Natali_Mis/iStock via Getty Images

What stocks to buy now that inflation cools faster than expected? Growth stocks’ outlook improves immediately as everyone can adjust their DCF models with lower WACC rates. I provide a selection of four stocks I deem buyable today.

A relief rally spurred by a 7.7% YoY increase in consumer prices sounds absurd. As usual, the market looks ahead to slower price increases and, more importantly, lower peak interest rates.

I’m not one to follow the whim of the day but follow macroeconomic news out of interest. These stocks were ‘buys’ before the inflation news and can now profit from a potential market rally.

Selection Method And Common Ground

- Substantial revenue per share growth.

- A sturdy balance sheet with low leverage.

- Reasonable valuation based on FCF and PE ratios relative to their growth.

- Stocks that return cash to shareholders with buybacks and/or dividends are often run by shareholder-friendly management. I look for regular returns.

This list can be seen as an addition to recent articles that used the same selection criteria:

Accenture (ACN)

Accenture delivers strategy, consulting, and professional IT services to companies. It’s a way to invest across the technology stack without picking a single provider.

Accenture focuses on five crucial forces in the evolution of companies:

- Total enterprise reinvention

- Talent

- Sustainability

- The metaverse continuum

- The ongoing technological revolution

These are fast-growing areas in most businesses where a lot of advice and insights are needed.

Growth

It creates value for every stakeholder with its 360° strategy. The company gets rewarded by outpacing industry growth organically.

Accenture continuously acquires small service providers with its free cash flow. It grows revenue an additional 2-3% annually with acquisitions without using debt.

It expects 8% to 11% local currency growth in FY2023 (ending 8/31/2023).

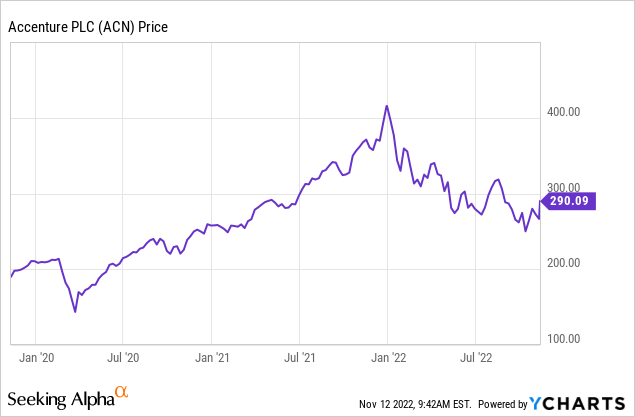

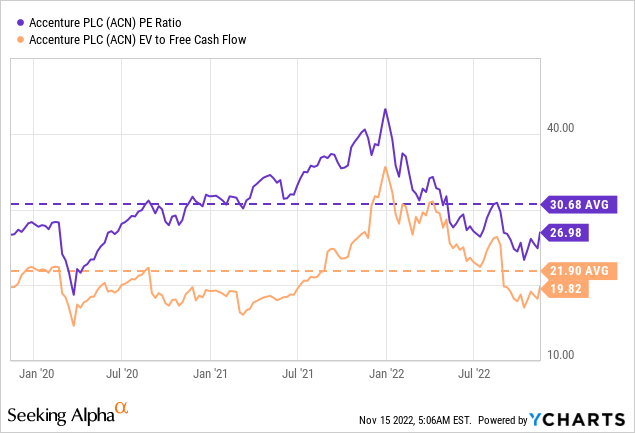

Valuation

Accenture is reasonably valued in comparison to its recent history. Current valuation levels are below the three-year average. It still expects strong growth and frequently rewards shareholders with dividends and buybacks.

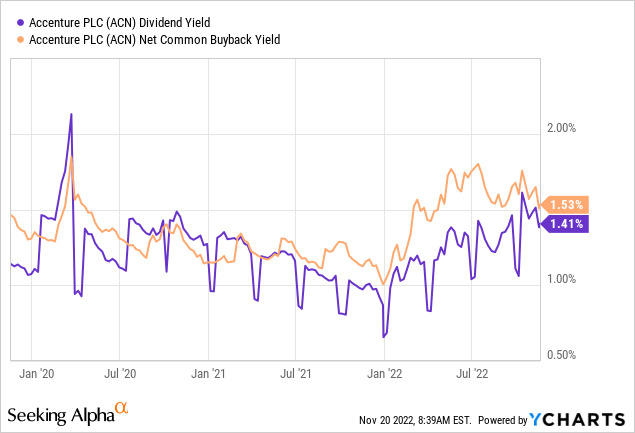

Accenture’s dividend increased by 15.46% over the past year. An increase slightly above its 5-year average. Its buybacks continuously support the share price.

Please read my full article about Accenture for more details.

Abbott Laboratories (ABT)

Abbott is a major healthcare company with four business areas: medical devices, diagnostics, established pharmaceuticals, and nutrition. It innovates with new products and chases strong organic growth.

It’s a leader in many of its technologies, such as continuous glucose monitoring, remote heart failure monitoring, heart pumps, stents, and infectious disease testing.

Abbott was a pandemic winner with a lot of revenue from covid testing. It did grow its other business as well during the past two years.

Growth

Abbott’s latest EPS guidance was in line with last year’s $5.21 EPS, pointing towards zero near-term growth. It makes sense as the amount of covid tests reduces.

Longer-term growth looks optimistic, with analysts expecting above 5% growth rates over the next five years. I believe Abbott should beat these estimates with its continuous innovations.

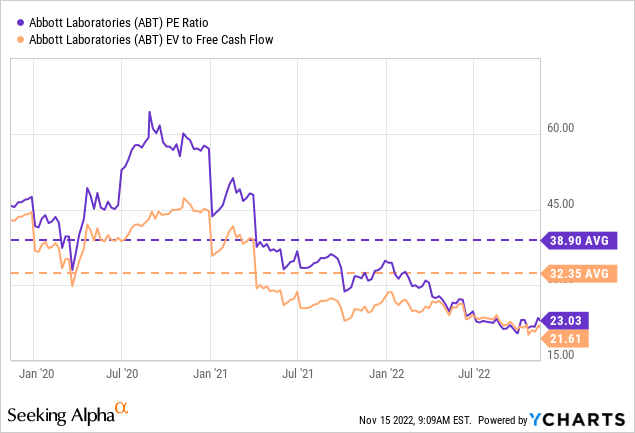

Valuation

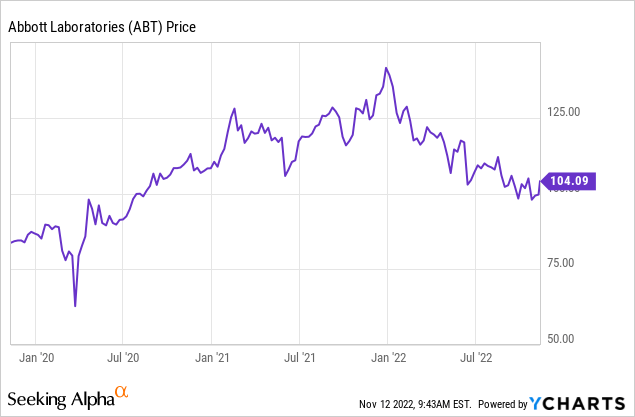

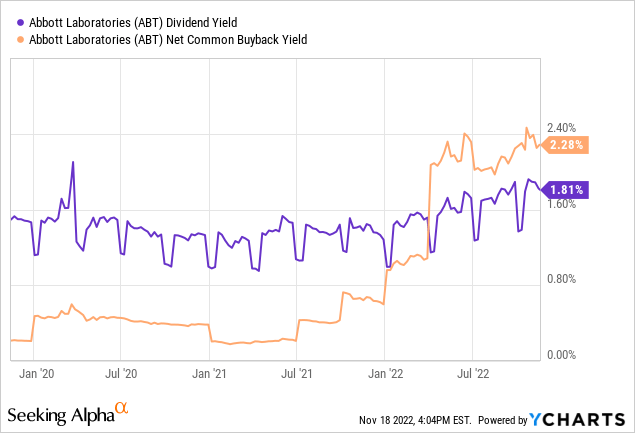

Abbott looks cheaply valued in comparison to its recent history. It seems like a steal for a company with a strong growth track record and stable shareholder returns.

The fading of covid tailwinds made the share price drop while its results are still strong due to current testing. Abbott seems to guide prudently as it beat its expectations over the past few quarters.

Abbott’s dividend only grew 4.44% this year as opposed to its 12.14% 5-year dividend CAGR. It makes sense, as the previous annual increase was 25%. Buybacks increased heavily recently as Abbott didn’t find M&A opportunities.

I found Gen Alpha’s overview of Abbott interesting.

Microsoft (MSFT)

Microsoft was also on my initial list of companies to buy and hold forever. It’s a sensible choice with a very diversified business in strong growth areas. Microsoft innovates with new solutions in gaming, the metaverse, and IoT.

It has a lot of established products like MS Office, Windows, and Xbox, … Despite the long existence of these products, it keeps growing them and launching new products.

Growth

Microsoft remains on a solid growth path. In its first quarter of FY2023, it managed 11% revenue growth and 16% constant currency revenue growth. Impressive after a couple of robust years due to the pandemic. Growth slowed a bit now that the pandemic tailwind fades, but it remains strong over the long run.

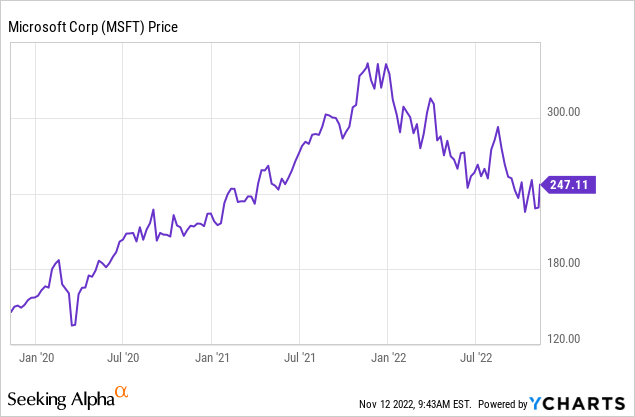

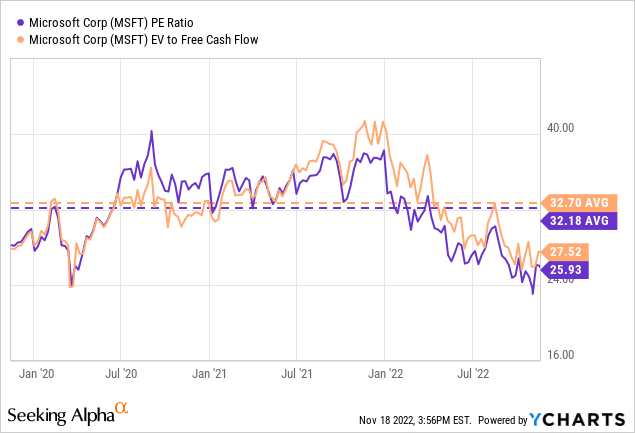

Valuation

Microsoft’s PE recently dipped below its March 2020 bottom and is still rather low compared to its three-year average. It doesn’t get enough credit for its growth potential.

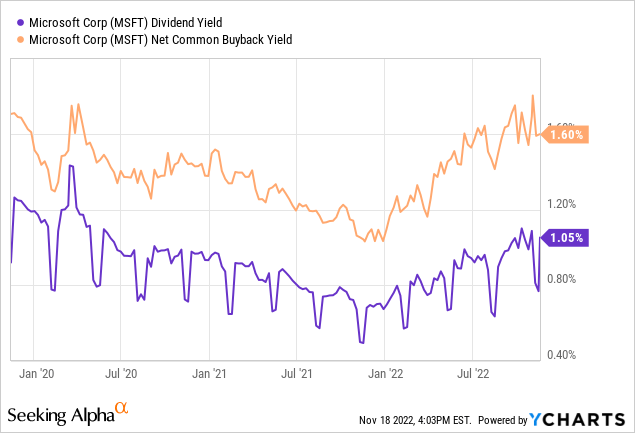

Microsoft pays a growing dividend that just increased by 9.67%, in line with the 5-year average. It also regularly repurchases shares with large buyback programs.

Brett Ashcroft Green offers an excellent view of Microsoft’s value.

UnitedHealth Group (UNH)

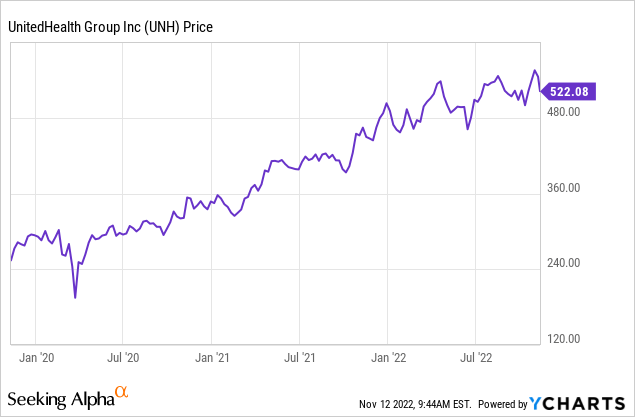

UnitedHealth is a large insurer with a significant moat. Its size ensures good deals with healthcare providers for its customers. The competitive advantage led to fast growth in the past and provided a bright outlook.

The current environment of rising interest rates is positive for insurance companies. They can reinvest their excess cash more profitably. Inflation doesn’t hurt its business as it can easily increase its prices without much churn.

Growth

UnitedHealth expects 15.4% EPS growth in 2022.

Membership growth and new products support its long-term 13% to 16% earnings per share growth goal.

Valuation

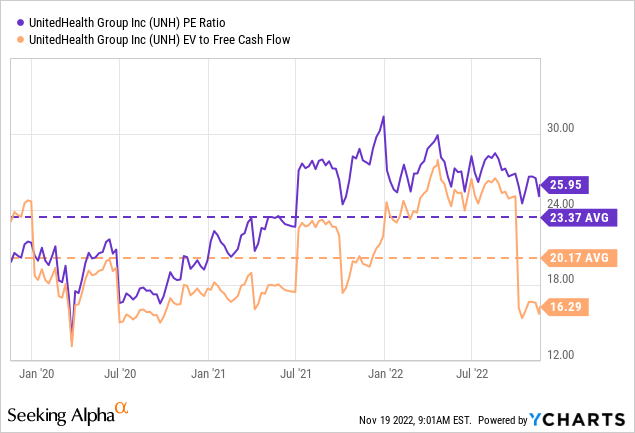

UnitedHealth is the only stock on the list that trades above its 3-year average valuation levels. Its EV/FCF rating skewed downwards due to October payments received in September. Corrected for this one-off, the EV/FCF would be 23.7. It could be slightly overvalued at this point, but still an acceptable price for a stable long-term grower.

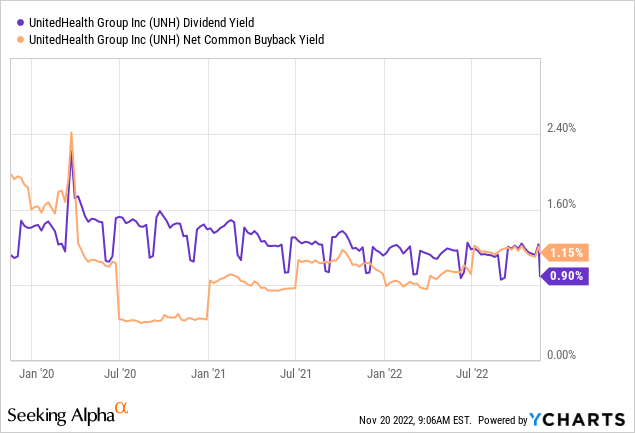

UnitedHealth’s dividend increased by 13.79% over the past year, slightly below its 5-year average. It regularly repurchases shares with some fluctuation depending on the available cash.

I like Yannick Frey’s overview of UnitedHealth.

Conclusion

I believe these stocks offer a long-term opportunity today. The risk-on spurred by inflation could be a short-term catalyst for their share price. In the long run, they will grow on their strength as they did in the past. Patient investors get rewarded with a growing dividend and buybacks.

I look forward to reading your additional ideas in the comment section!

Be the first to comment