Pgiam/iStock via Getty Images

John Hancock Premium Dividend Fund (NYSE:PDT) is a closed-end equity mutual fund (“CEF”) that primarily invests in high-dividend stocks and bonds of utilities, financials and energy companies. The fund invests in equity and preferred stocks of mainly those companies which have rated or investment grade senior debt securities. The fund has consistently paid monthly dividends for the past 28 years, and has generated a yield between 7 to 11 percent during the past 10 years. However, the price performance has consistently remained flat. Still, the fund has a positive total return over the long run.

High Expense Ratio Acting as a Bane for John Hancock’s Dividend Fund

PDT benchmarks the performance of its portfolio against a composite benchmark comprised of 70 percent of Bank of America Merrill Lynch Preferred Stock DRD Eligible Index and 30 percent of S&P 500 Utilities Index. The fund was formed as John Hancock Patriot Premium Dividend Fund II on December 21, 1989. It was launched and managed by John Hancock Investment Management LLC and is co-managed by John Hancock Asset Management. The fund seeks to generate strong income for its investors and has delivered positive long term total returns over the past 10 years.

PDT has an extremely high expense ratio of 1.82 percent. A probable reason might be its smaller asset base that gets stretched while investing in such a variety of assets. The fund also invests a very small proportion of funds in each of its selected stocks. Its top 16 equity investments consist of only 35 percent of the entire portfolio. In only three stocks, the fund has invested in excess of 3 percent. These stocks are NiSource Inc. (NI), The Williams Companies, Inc. (WMB), and NextEra Energy, Inc. (NEE). Research and management cost also increases due to its focus on equity and preferred stocks of only those companies that have investment grade senior debt.

Also, selecting and managing assets in the utilities sector requires more expertise, because these stocks are not among the most popular stocks. Almost half of its entire portfolio is invested in stocks and bonds belonging to the utility sector. This high expense ratio technically generates an income of a little more than 5 percent, when the yield is 7 percent. This might be a major reason behind investors shying away from this stock, which gets reflected in its poor price performance. PDT’s price growth has been negative over the past 3 to 5 years. Over the long run, it has managed to generate positive price return, but that’s exceptionally low.

A Portfolio of Utilities & Financial Stocks Aimed at Generating High Yield

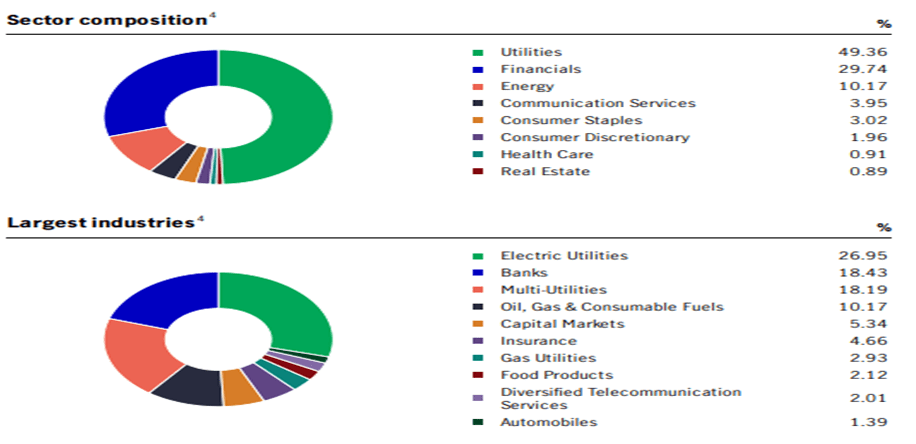

Almost 80 percent of PDT’s investments are in the utilities and financial sectors. Within utilities also, investments are spread over electricity companies, gas suppliers, and other multi-utility providers. In the financial sector, the fund has invested in banking companies, capital market advisors, and a few insurance companies. The fund has made half of its investments in stocks, while the remaining half has been invested in fixed income generating securities. Investments in corporate bonds of financial giants, such as Citizens Financial Group, Inc. (CFG) and Bank of America Corporation (BAC), typically generate a yield in excess of 6 percent, whereas its investments in government bonds have a yield of less than 3 percent.

Composition (PDT website)

Source: Investor fact sheet | John Hancock Premium Dividend Fund

The best thing about PDT’s equity portfolio is that 12 out of its top 16 investments have generated double-digit returns during the past one year. These companies are WMB, NI, Duke Energy Corporation (DUK), Dominion Energy, Inc. (D), OGE Energy Corp. (OGE), BP p.l.c. (BP), FirstEnergy Corp. (FE), Kinder Morgan, Inc. (KMI), Black Hills Corporation (BKH), Public Service Enterprise Group Incorporated (PEG), Spire Inc. (SR), and DTE Energy Company (DTP). However, unlike many other funds, only four stocks – WMB, OGE, BP and NI – have been able to generate returns in excess of 20 percent. Moreover, the proportion of funds invested in a particular stock is quite low. This implies that, though most stocks are generating good returns, none of the stocks has the ability to single-handedly pull up or pull down the fund’s return.

Advantages and Disadvantages of High Yielding Funds

Investment legends like Benjamin Graham and John Bogle have advocated buying stocks that pay high dividends. The same principle can be applied to CEFs, exchange-traded funds (“ETFs”), or any other funds. A CEF pays dividends out of its profits. Thus, higher dividend paying funds can be assumed to be better performing ones. Investors can add stability to their portfolio by buying established funds with a history of consistent and frequent dividends with high yield. Dividends also provide cushion in case the fund loses its market value, and also creates an opportunity for stock price to appreciate. These are the prime rationale behind investing in high dividend paying stocks.

However, dividends are never guaranteed and are fully dependent on overall economic conditions as well as the company’s performance. Historically, high yield generating stocks have failed to become growth leaders. Barring a few exceptions, high growth stocks usually do not pay high yields even if they have generated sufficient income and outperformed the market. Instead, those high-growth stocks invest more on capital expansion, research and development, human resource development and mergers and acquisitions. In case of high-growth funds, they invest in acquiring more and better performing stocks in order to generate higher growth.

Investment Thesis

The individual investments within the portfolio of John Hancock Premium Dividend Fund have been able to generate steady growth in their values, and thus the fund has been able to generate high yield. The fund primarily invests in stocks and bonds of various types of utilities and financial firms. It invests a very small proportion of funds in a particular security, and thus enjoys the benefit of diversification. However, its investment strategy involves a high expense ratio. An excessively high expense ratio is partially eating out the return delivered to its investors, and thus the firm has consistently failed to generate strong price growth. The fund may probably be falling into the group of high yielding funds unable to become a growth leader. Though I don’t doubt PDT’s capability of generating high yield in the future, I don’t foresee investors buying this fund in volume, unless it is able to curb down its expense ratio.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website feature a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment