Andrii Yalanskyi

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on September 15th, 2022.

The Clough Global Opportunities Fund (NYSE:GLO) has been on a downward spiral. The fund is highly leveraged and could put them in a situation where deleveraging could occur to stay within regulations. This will cause permanent damage, not to mention the permanent damage being done by the excessive distribution. The fund pays a managed 10% distribution plan that is reset annually.

Despite the collapse in the fund and the significant headwinds with little to no chance to rebound, investors bid this fund up to near parity with the fund’s NAV. A reason for this could be that mouth-watering distribution yield of almost 17%.

We’ve seen this time and again, though. A high yield that eventually gets cut has the discount/premium drop substantially. In this case, it is known when the distribution will be adjusted, which could make the drop a bit less painful as it should be on the minds of every investor already in this fund and its sister funds.

The Basics

- 1-Year Z-score: -1.24

- Discount: -1.46%

- Distribution Yield: 16.71%

- Expense Ratio: 2.43%

- Leverage: 39.30%

- Managed Assets: $655.573 million

- Structure: Perpetual

GLO’s investment objective is “to provide a high level of total return.” The fund attempts to achieve this by “applying a fundamental research-driven investment process and will invest in equity and equity-related securities as well as fixed-income securities, including both corporate and sovereign debt.” They also include that the fund will “invest in both U.S. and non-U.S. markets.”

The fund’s expense ratio comes to 2.43% and climbs to 3.49% when including leverage expenses. The interest expenses will climb based on three-month LIBOR plus 0.70%.

The fund last reported borrowings of $257 million at the end of April 30th, 2022. Given the latest fact sheet still shows a leverage ratio of 39.29%, it is likely that the fund will have to deleverage.

As noted above, they have limits that they need to stay under. For debt/borrowings, the limit is 33.3% (50% if it is preferred leverage) of the overall fund’s assets. They are still paying a distribution, so this seems to be taken care of one way or another.

Earlier this year, Virtus Convertible & Income Fund II (NCZ) ran into its own leverage issue where this mattered. They had to suspend the distribution until their leverage was corrected. Steven Bavaria discussed that saga more in-depth previously.

With this amount of leverage, they have a lot more to worry about than just higher interest expenses that they’ll see. The funds’ expense ratio is already quite high. I invest in some CEFs and BDCs with 10%+ expense ratios. If the results are still there, I can look past a high expense ratio. However, GLO has performed poorly in most years since it launched.

GLO Fund Performance – Look Out Below

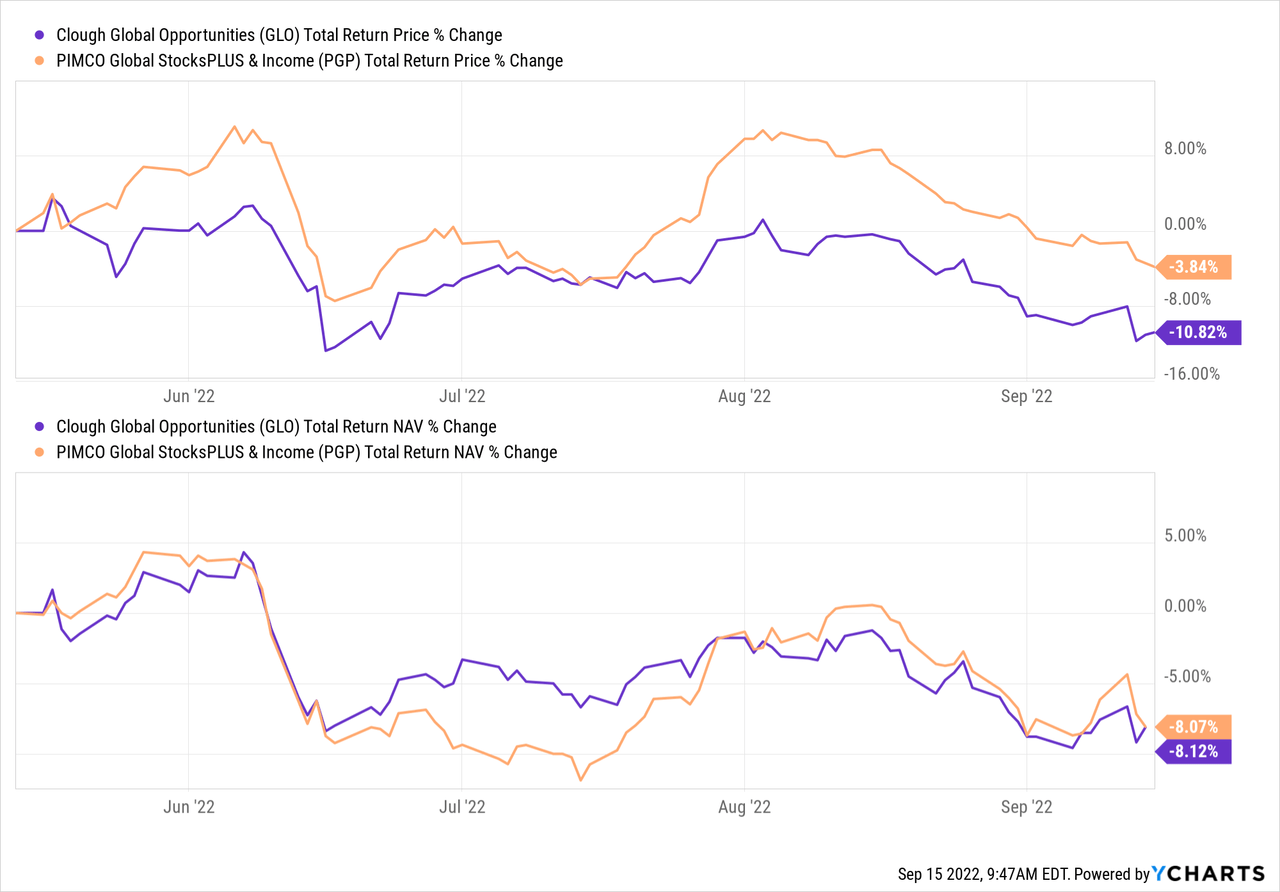

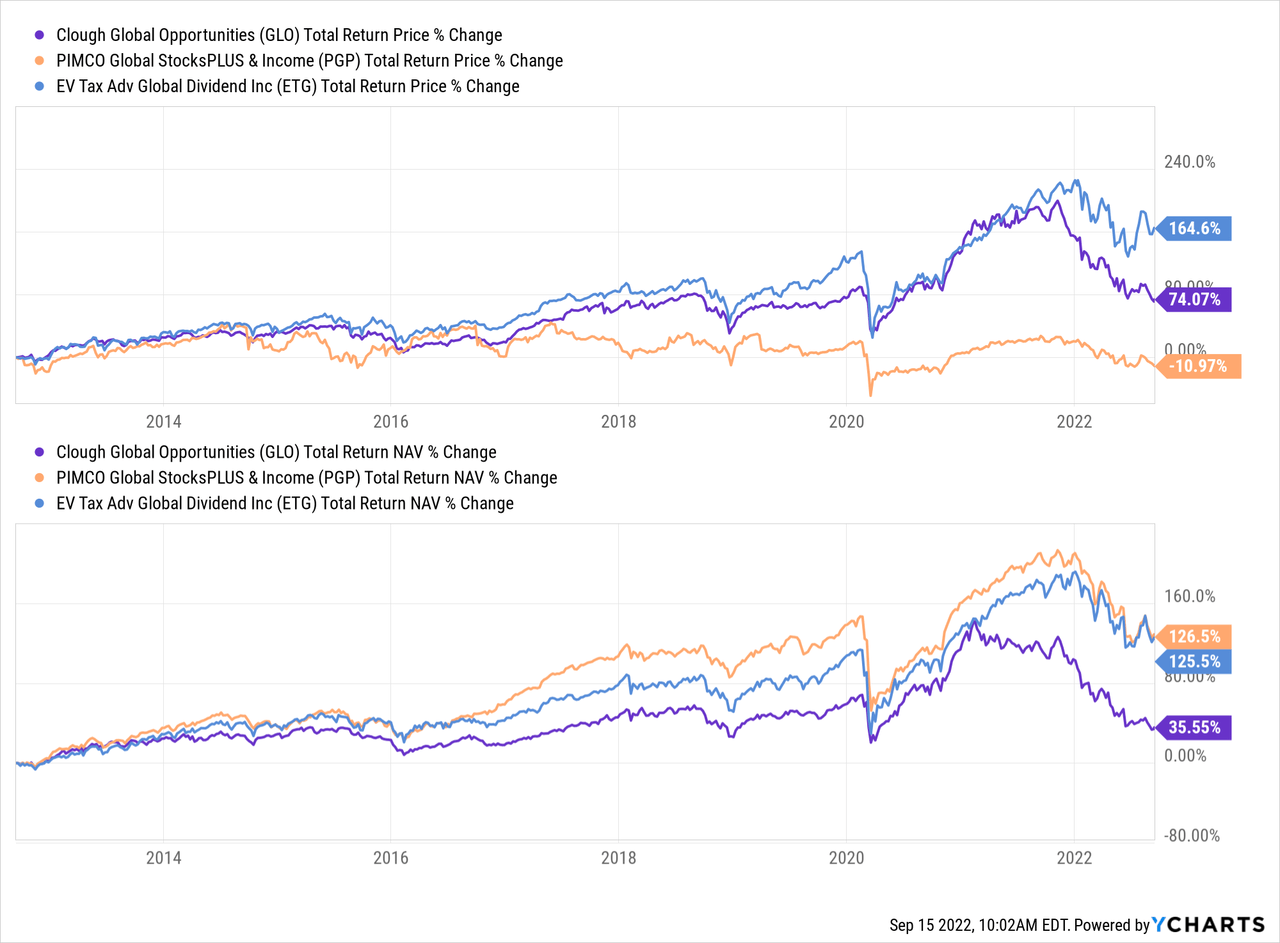

The last time I touched on GLO, I compared the fund with PIMCO Global StocksPLUS & Income (PGP). I believed that PGP would be the better performer going forward. On a total share price return basis, I was correct. However, I’m not taking any victory lap here, as both funds performed poorly on a total NAV return basis.

YCharts

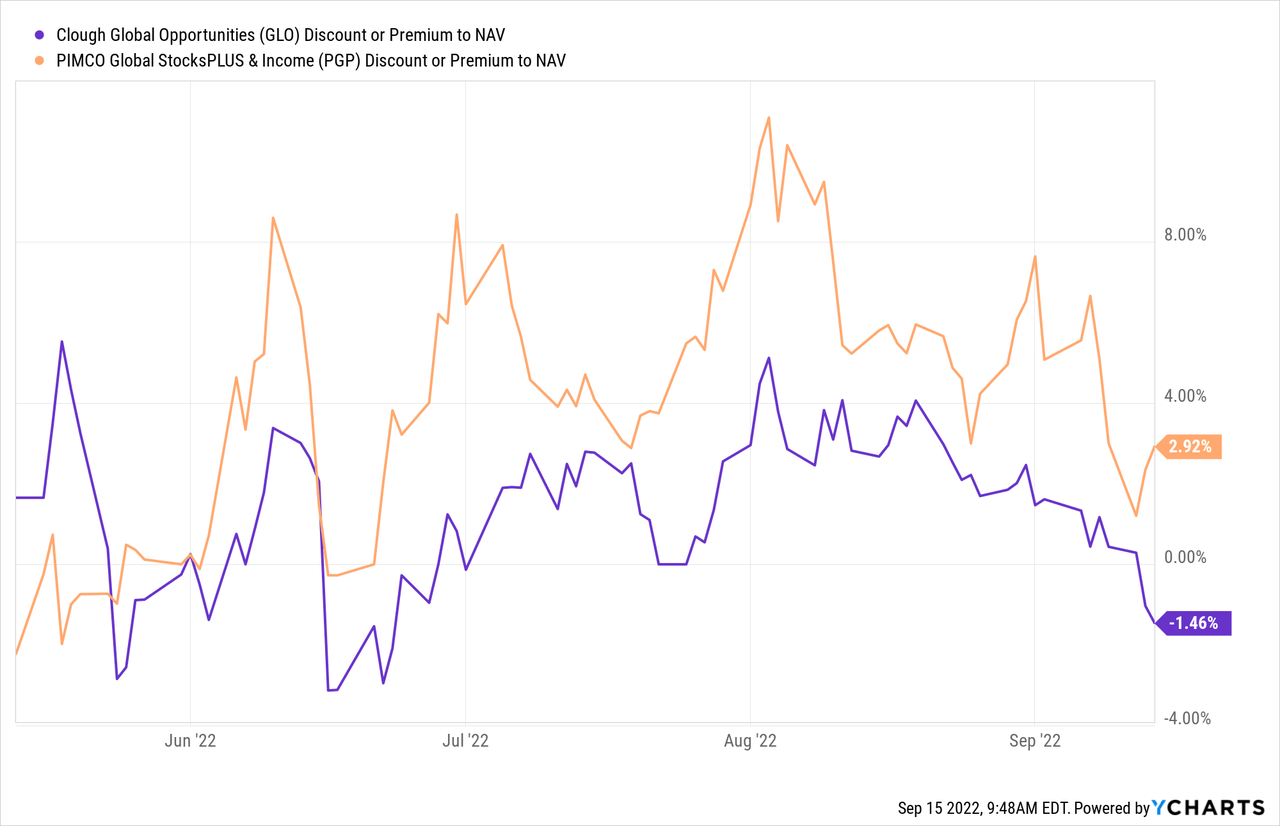

Some of this outperformance was merely PGP running up to a slight premium while GLO has dropped slightly to a narrow discount.

YCharts

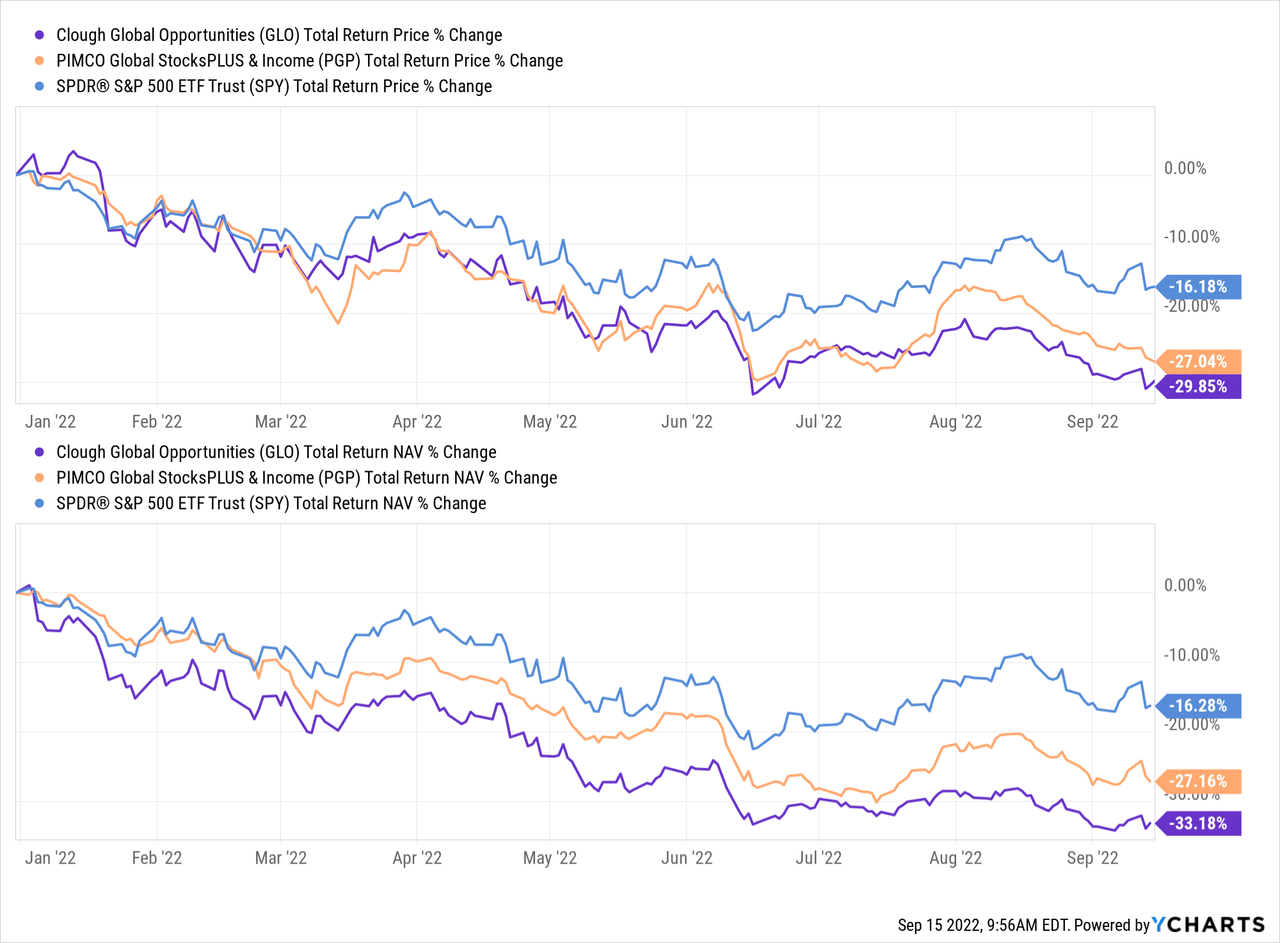

Both funds have done terribly relative to the market, as measured by the SPDR S&P 500 (SPY), on a YTD basis. These hybrid funds have a great deal of flexibility in their approach. SPY isn’t a direct benchmark, but it can give us some context on how badly these funds are off this year.

YCharts

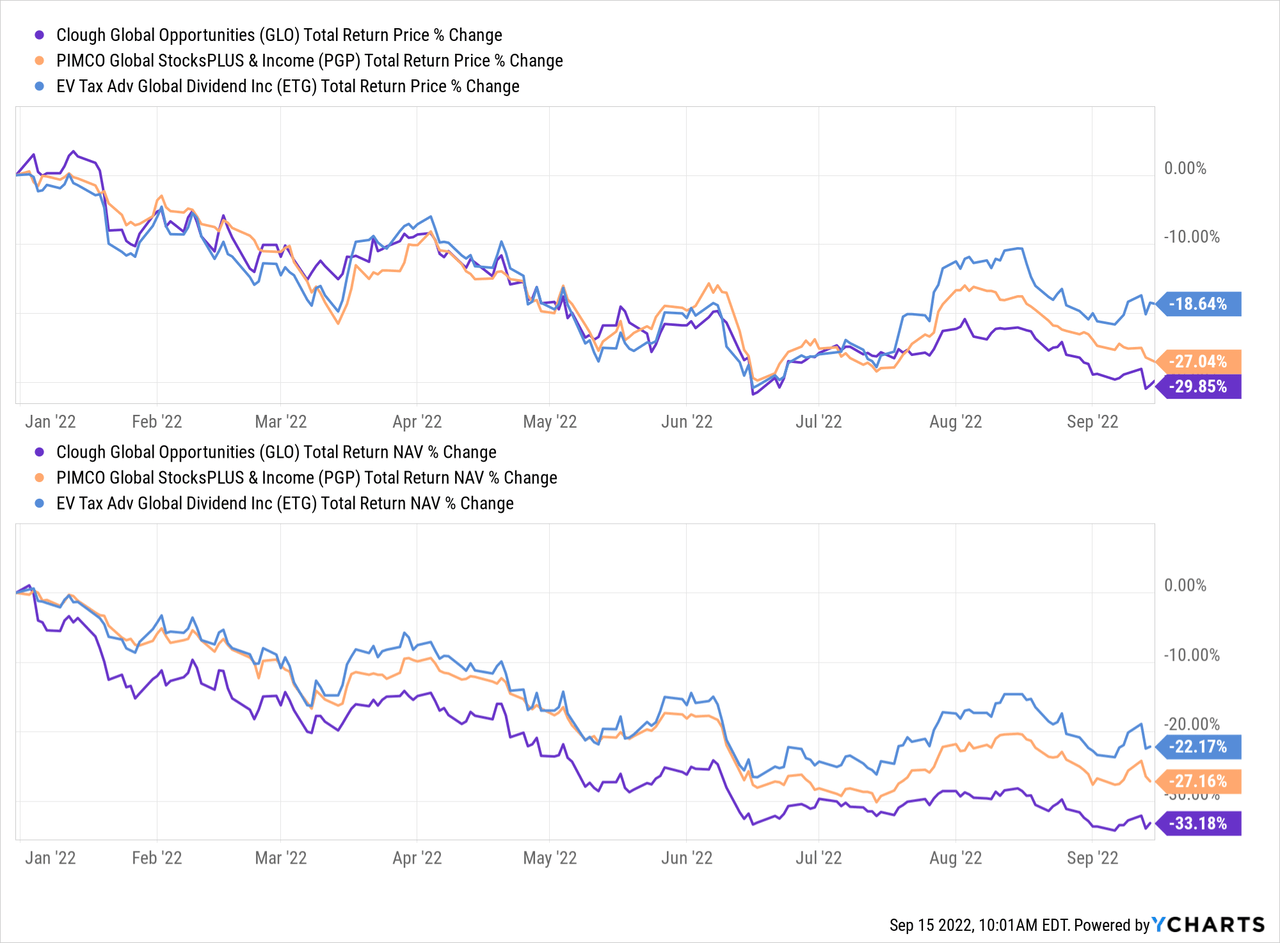

While I suspect that PGP will perform better going forward, going with a more basic fund could be a logical approach. Eaton Vance Tax-Advantaged Global Dividend Income (ETG) is also an option. They invest primarily in equity positions but have some preferred and bond holdings too. They are leveraged, but not overwhelmingly so. They won’t drown in leverage when things start going bad.

That being said, ETG is still slightly elevated in terms of its valuation. It sits at a premium when it has a long history of trading at a discount. So waiting for a better opportunity to switch to such a fund could be appropriate too.

Here’s a YTD comparison of the performance of the funds with ETG included.

YCharts

Here is the longer-term historical performance of this trio of funds. As we can see, ETG has provided similar returns to PGP. GLO has been the serial underperformer.

YCharts

Going forward, things could change, of course. However, I would be skeptical because GLO emphasizes a long/short strategy. Even during good times, the short positions require management to get the calls right. A poorly run company can still show positive share price gains when a rising tide lifts all boats. Over time, the market has tended to rise so long that only funds such as ETG tend to benefit more.

GLO’s short positions might be paying off this year, but it isn’t enough to compensate for the losses generated elsewhere with a hefty amount of leverage. Thus, the fund is hit with these massive losses.

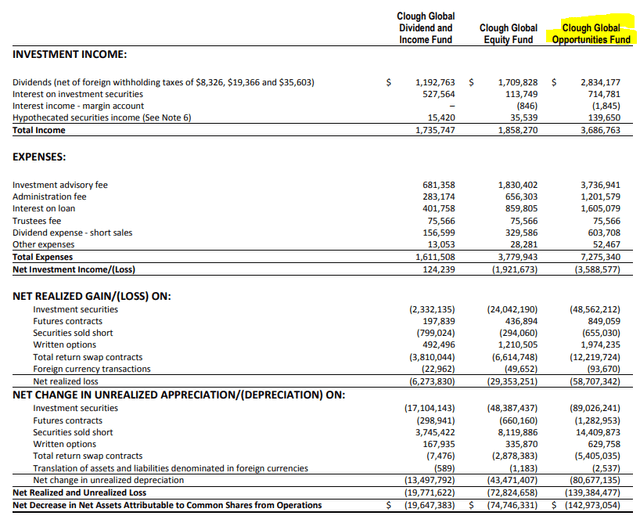

GLO’s only realized gains came from future contracts and written options. This was similar to its sister funds. Here is a look at the semi-annual report for the period ending April 30th, 2022. Since then, the fund has only continued to create losses, so these figures are presumably worse now.

Unfortunately, all this flexibility and levers that they can pull just aren’t working out to GLO’s benefit. Even their short positions contributed to a loss of $655k in a year where short positions should be contributing to gains.

Consolidated Clough Semi-Annual Report (Clough (highlight from author))

Distribution – 10% Managed

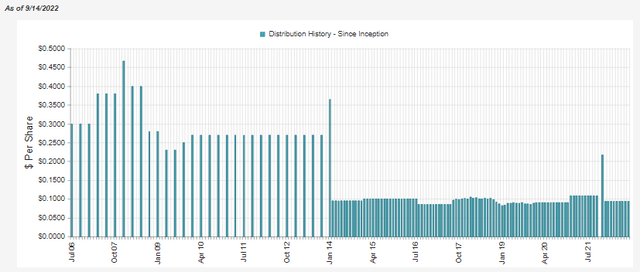

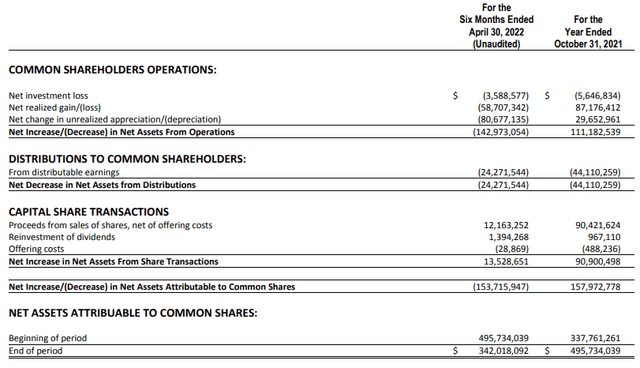

A predictable distribution can be a great thing. At 10%, that’s a high enough payout rate to get investors excited. However, it is only damaging the fund further now. If the fund calculated its payout for the following year today, investors would see quite a sharp distribution cut.

GLO Distribution History (CEFConnect)

The current monthly distribution comes to $0.0943. Based on the last NAV, it would be cut down to $0.05725 for next year. That would be a nearly 40% slashing for the distribution. Quite honestly, while I don’t like to predict short-term moves, I don’t see the fund making up enough ground coming into the final quarter to avoid this.

Above, we showed how the losses came about in more detail under the “net realized gain/(loss)” section. Since it is a hybrid fund with significant exposure to equities, it will rely on capital gains to earn its distribution.

For this fund, due to an elevated expense ratio, the fund doesn’t earn any net investment income at all. So the entire distribution should be earned via capital gains.

GLO Semi-Annual Report (Clough)

In a sharp recovery fiscal year of 2021, this was achieved. Unfortunately, based on poor historical performance, the fund often does not achieve the 10% managed distribution that they target.

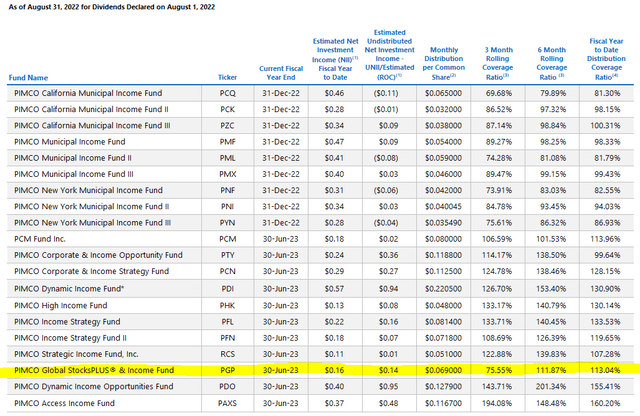

This is a place where PGP shines. While they are mostly a fixed-income fund with derivatives to simulate equity exposure, the NII coverage is significant. In fact, it is over 100% on a rolling 6-month basis. That would mean any capital gains would be a bonus. Some of the capital losses can even be offset by the higher generation of NII.

PIMCO UNII Report (PIMCO (highlight from author))

GLO’s Portfolio

When looking at GLO’s portfolio, there isn’t anything necessarily that stands out as truly atrocious. It is more underlying fund-specific issues such as the fund’s high utilization of leverage, high expense ratio and managed distribution plan are hurting the fund more so than the actual portfolio.

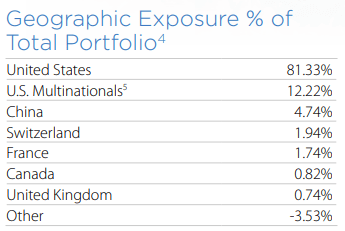

They are primarily invested in U.S. investments. That’s where things have been holding up relatively well, given the Russian invasion of Ukraine. This is as of June 30th, 2022.

GLO Geographic Allocation (Clough)

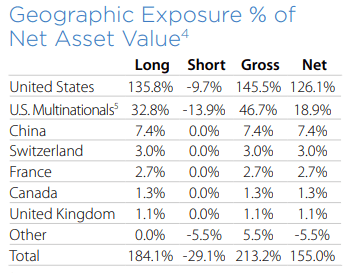

Since we last looked at the fund, they have started to short U.S. multinationals a bit more.

GLO Geographic Breakdown (Clough)

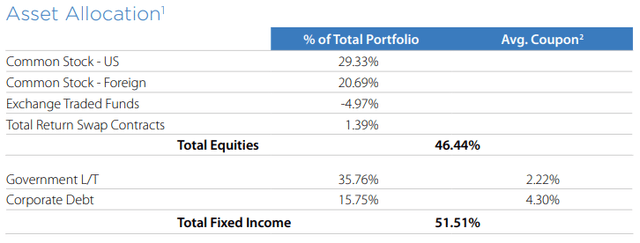

The fund is even split between equity and fixed-income positions fairly evenly. This was a significant shift from the 69.68%/23.35% allocations previously.

Over 70% is in AAA rated debt. That should mean it is fairly safe, but the fact is that it carries the highest interest rate risk too. That would be due to the fund’s duration being elevated. They don’t share a duration stat, meaning we don’t know exactly what it is. Generally, the higher the credit quality, the higher the interest rate sensitivity.

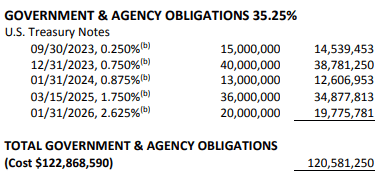

So what is supposed to make the fund safer is hurting the fund at this time. That is despite the rather short maturity of these. Here is a look at their government positions listed in the semi-annual report for the period ending April 30th, 2022.

GLO U.S. Treasury Holdings (Clough)

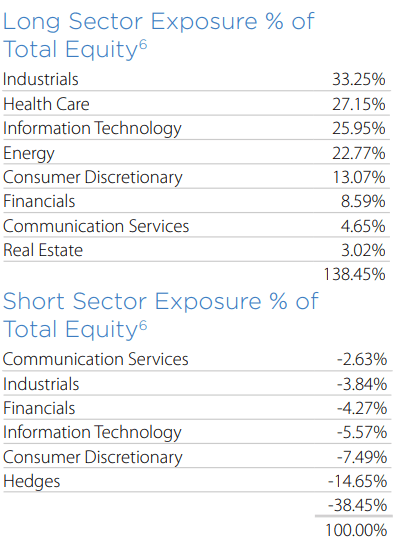

The fund’s sector exposure could be seen as somewhat of a red flag. This would be because they are fairly heavily weighted towards industrials, tech and energy.

GLO Long/Short Breakdown (Clough)

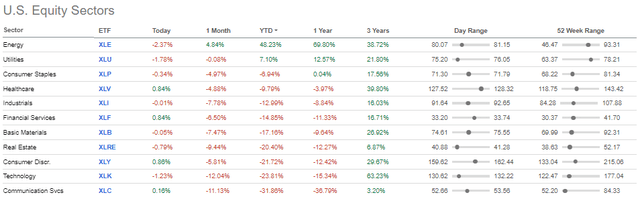

Energy is working out this year very well. That being said, it is a cyclical and volatile sector, nonetheless. Tech has been on a breakneck speed tearing lower. It was only topped by the weakness in the communication services sector. Industrials have just been floating in the middle of the pack.

Healthcare is seen as a defensive space, but even those results have been more mediocre in this challenging year.

Sector Performance (Seeking Alpha)

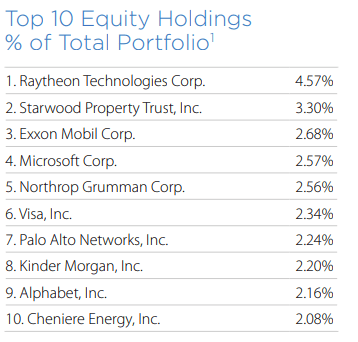

When looking at the top ten, again, I don’t see anything that has been really terrible. There is nothing that I would absolutely never want to own in any circumstance. Though there are a few names, I’m not overly familiar with too.

GLO Top Ten (Clough)

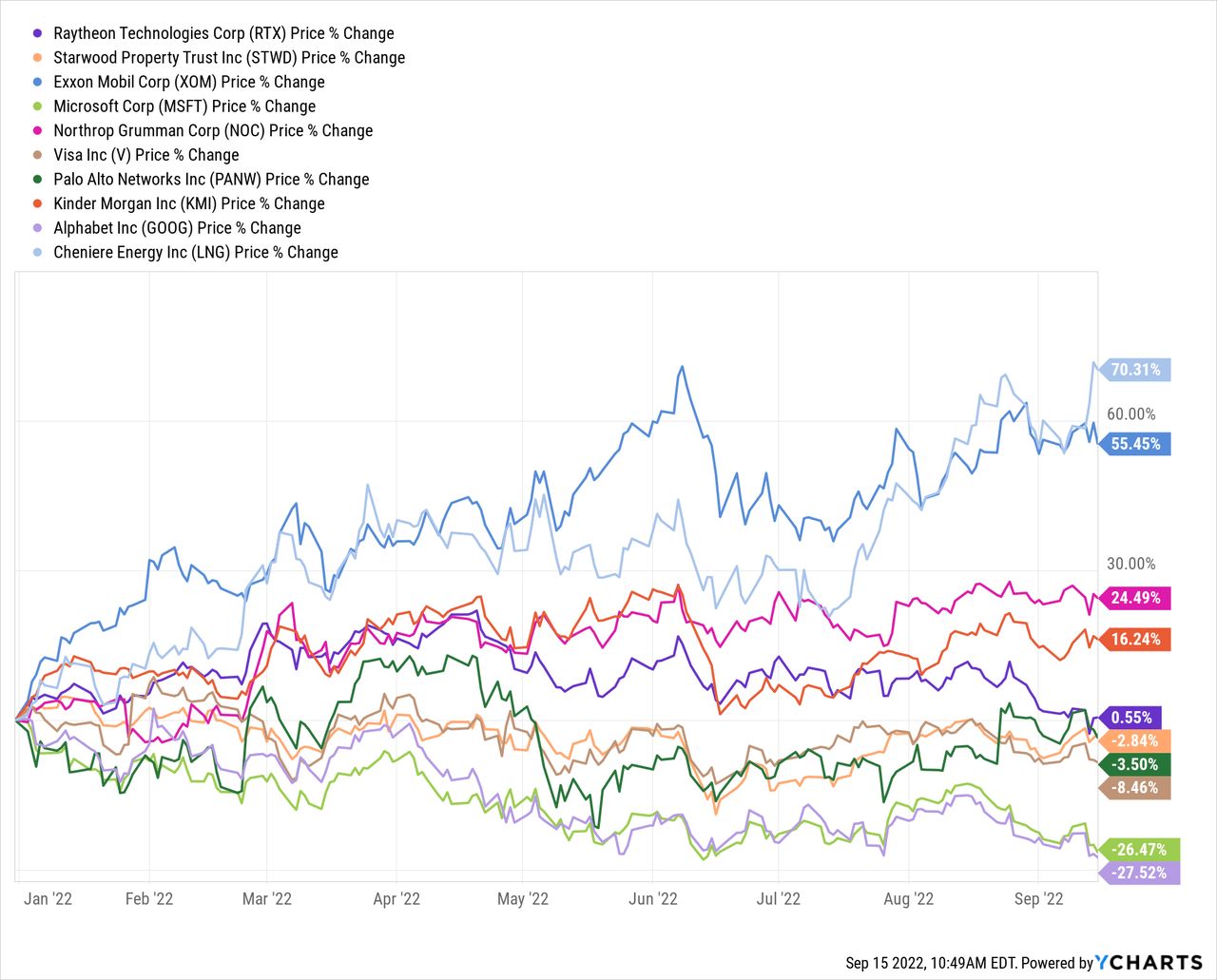

The two worst performers here were Alphabet (GOOG) and Microsoft (MSFT) on a YTD basis. Those are probably two of the more recognizable names too. They also weren’t performing as terribly as the overall fund itself. Again, it highlights that leverage can play a negative role.

YCharts

Additionally, the fund’s turnover ratio is incredibly high. It was last reported at 140% in the last six months. For 2021, it was 209%, then 261% in 2020 and a whopping 306% in 2019. Therefore, some of these positions could be coming and going rapidly.

Conclusion

I’ve been pretty tough on GLO for this article. There are some positives here, though. First, I think the flexibility and fairly unique approach means it is a worthwhile fund if you are looking for diversification. Secondly, the fund has a high managed distribution yield. It is also a predictable payout since it is simply a 10% managed distribution based on the average NAV of the last five trading days of the year.

That being said, if you want to get something flexible and more unique, PGP could be a great alternative that shows some strong distribution coverage. GLO is already showing weak distribution coverage, so deleveraging will only hurt the fund more. With deleveraging on the table, a recovery for GLO doesn’t seem likely.

Alternatively, if you want something a bit more basic, ETG is also an option that has provided similar results as PGP. All three funds are trading at what I believe to be elevated levels, but if you must invest, then I’d be leaning towards PGP and ETG.

Be the first to comment