JJ Gouin

Investment Thesis

The Andersons (NASDAQ:ANDE) deals with agricultural-based products and operates its business in Trade, Renewables, and Plant Nutrient segment. It is experiencing strong demand and higher product prices. The company has recently entered into an agreement with Mote Farm Service to purchase assets in Union City and Harrisville locations. I believe this acquisition can accelerate the company’s growth in the coming period.

About ANDE

ANDE is an agricultural commodity-based company that deals in three business segments: Trade, Renewables, and Plant Nutrients. The trade segment deals in logistics and merchandising of a wide variety of commodities such as feed ingredients, whole grains, grain products, fuel products, and other agricultural commodities. This segment also deals in operating grain elevators in the regions of the US and Canada, where income is generated on commodities traded through the elevators. It also generates revenue by offering various services, such as grain marketing, risk management, origination services, and affiliated ethanol facilities. The company earns 74% of its revenue from the Trade segment. The Renewables segment focuses on producing, purchasing, and selling ethanol and co-products. It also offers various services to the ethanol plants, such as risk management, facility operations, and marketing services. These ethanol plants are located in Michigan, Ohio, Kansas, Indiana, and Iowa. The Renewables segment contributes 19% to the total revenue. The Plant Nutrient segment mainly deals in manufacturing, distributing, and retailing agricultural plant nutrients, pelleted lime, corncob-based products, and gypsum. This segment generates revenue by providing services such as warehousing, packaging, and manufacturing services to the producers and distributors of essential nutrients. It also produces and distributes nitrogen reagents used in coal-fired power plants and water treatment. The company earns 7% of its revenue from the Plant Nutrient segment. The company pays out a dividend yield of 2.08%.

Financial Trend

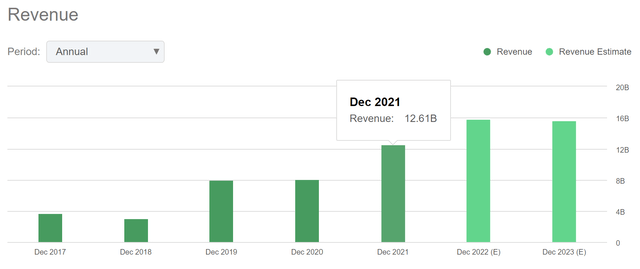

The company has experienced robust revenue growth in the last five years. The revenue has grown from $3.68 billion in FY2017 to $12.61 billion in FY2022 resulting in a solid 5-year CAGR of 27.86%. ANDE has experienced substantial growth in FY2021. The company has reported revenue growth of 56.45% YoY compared to the revenue of FY2020. I think the revenue growth might continue in the coming years as the company is experiencing strong demand for the distillers corn oil, renewable diesel feedstock, and ethanol. The company has acquired Mote Farm Service to cater to the rising demand for plant nutrients and create a strong dominance in the Midwest, which can be a significant contributor to the company’s revenue growth in the coming years.

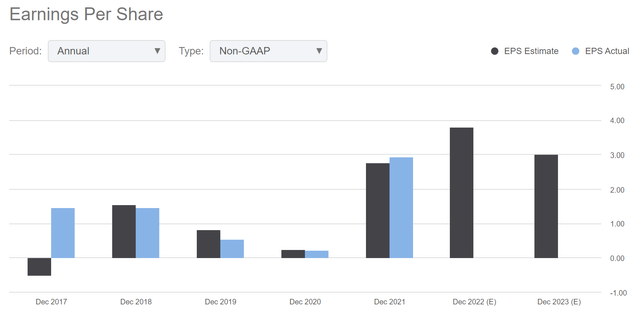

Also, the company has experienced strong EPS growth in the past five years. The EPS has grown from $1.46 in FY2017 to $2.94 in FY2022 resulting in a 5-year CAGR of 15.03%. The EPS growth of the company has been significantly lower than the revenue growth. I think the reason behind the low EPS growth is the company’s low gross margin and net income margin. However, I believe ANDE might experience margin expansion in the coming years as the company is experiencing strong demand and higher product prices. According to Seeking Alpha, the company can achieve an EPS of $3.81 in FY2022. After considering the company’s strong demand and potential margin expansions, I believe Seeking Alpha’s estimates are accurate.

Acquisition of Mote Farm Service

ANDE has recently announced that it has signed an agreement to purchase the assets of Mote Farm Service, Inc. This agreement will include locations of Union City, and Harrisville. As this sector is highly competitive with regional and local wholesalers, retailers, manufacturers, and importers, it becomes essential to compete in the market based on factors such as product offerings, services, and location. I believe this purchase deal can significantly help the company to be the leading provider of plant nutrient and agronomic services in eastern Indiana & western Ohio and further create its strong dominance in the Midwest. Though the competition is intense in the market, the strong entry barriers of the plant nutrient industry can sustain the company’s growth for a longer period as it requires huge capital investment to enter the market. I believe the rising demand for plant nutrients and expansion of the ANDE’s retail farm center network can accelerate the company’s growth by acquiring more market share in the Midwest, which can further increase the company’s revenue and profit margins in the coming years.

What is the Main Risk Faced by ANDE?

Uncertainty of Supply and Demand of Raw Materials

All three segments of the company deal in inventories of agricultural input and output commodities, some of which are traded on commodity exchanges. The supply and demand of these commodities are impacted mainly by unfavorable weather conditions and other external factors beyond the company’s control. These conditions expose it to liquidity pressures to finance hedges in the rising market scenario. The plant nutrient segment gets highly affected due to the changes in supply and demand of the commodities, which further affects the value of inventories that the company holds and also leads to high raw material prices. If the cost of inventory and prices of raw materials increase, it can affect the company’s operations, further putting pressure on the profit margins.

Valuation

ANDE is experiencing strong demand for the distillers corn oil, renewable diesel feedstock, and ethanol. The product prices of the company are also higher than the historical average prices of the company. It has recently announced that it has signed an agreement to purchase the assets of Mote Farm Services, which I believe can create a strong presence in the Midwest. I think all these factors can drive the company’s growth in the coming years. After considering all these factors, I believe Seeking Alpha’s EPS estimate for FY2022 is accurate. According to Seeking Alpha, the company’s EPS for FY2022 might be $3.81, giving the forward P/E ratio of 8.57x. According to my analysis, the company is undervalued as its forward P/E ratio is significantly lower than the sector median of 17.69x. I believe the company can counter the effects of uncertainty of supply & demand of raw materials with high product prices. Hence, I estimate the company might trade at a sector median P/E ratio of 17.69x. The EPS of $3.81 and P/E ratio of 17.69x gives the target price of $67.4, which is a 106.4% upside compared to the current share price of $32.65.

Conclusion

ANDE is experiencing strong demand for the distillers corn oil, renewable diesel feedstock, and ethanol. The product prices of the company are also higher than the historical average prices of the company. The company has recently announced the purchase of assets of Mote Farm Services, which can significantly make the company stronger in the Midwest and increase its market share in the coming years by acquiring more customers. It is exposed to the risk of changes in supply and demand factors which can affect the company’s performance negatively, but I think the company can mitigate the effect of this risk with high product prices. After analyzing all the above factors, I assign a buy rating to Andersons.

Be the first to comment