alphaspirit/iStock via Getty Images

Investment Thesis

The Rise Of Conventional Energy Stocks

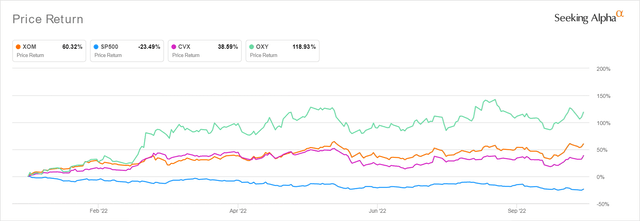

It is evident by now that most conventional energy stocks, including Exxon Mobil Corporation (NYSE:XOM), Chevron Corporation (NYSE:CVX), and Occidental Petroleum Corporation (NYSE:OXY) are trading at premium levels, due to the robust support levels enjoyed by oil/gas prices. The XOM stock has reported a massive 60.32% rally YTD in contrast to the S&P 500 Index, which had plunged below its previous June lows twice in the past two weeks.

The unnatural market-wide rally experienced on 13 October also temporarily boosted XOM’s stock prices by 3.49%, attributed to the persistently elevated September CPI rates. The latest report indicated a sequential increase of 0.4% and a YoY increase of 6.6% in core inflation, against consensus estimates of moderation. Nonetheless, this is not surprising, given the overwhelmingly robust US labor market and sticky PPI index for the month, to the Fed’s chagrin.

These macroeconomic events have naturally triggered Mr. Market’s worsening fears of the Fed’s raised terminal rate to potentially 5% in 2023 (or more), against the previous projection of 4.6%. This points to more pain in the stock market, with 99.4% of analysts projecting another 75 basis point hike for the Fed’s November and, potentially, January meeting (if not December). Therefore, indicating the short-lived nature of 13th October’s rally for the stock market in general, since the S&P 500 Index has also plunged by -23.49% YTD. More uncertainty will be here, once it is clear that the Feds will persist in its hawkish stance through 2023.

In addition, the XOM stock is also trading at a premium, way above its 50, 100, and 200-day moving averages, leaving a minimal margin of safety for long-term investing and portfolio growth. As a result, existing investors should sit back and enjoy the dividends, as we expect the stock to continue holding at these elevated levels due to the hyper-inflated energy prices. Definitely, not the time to add guys.

XOM Is Literally Swimming In Cash

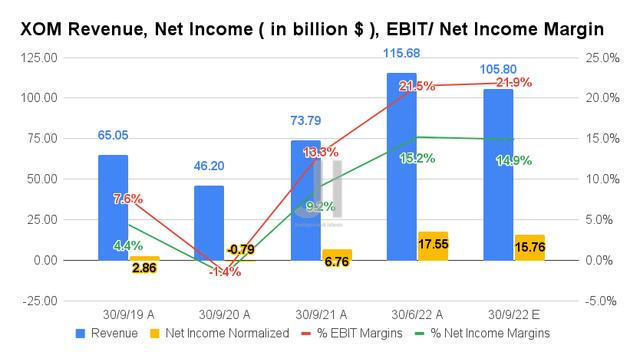

For its upcoming FQ3’22 earnings call, XOM is expected to report revenues of $105.8B and EBIT margins of 21.9%, representing a notable QoQ decline of -8.54% though an improvement of 0.4 percentage points, respectively. This is attributed to the lower oil prices and refining margins compared to the previous quarter, despite the higher gas prices. Otherwise, massive growth of 43.37% and 8.6 percentage points YoY, respectively.

Consequently, XOM is expected to still report impressive profitability with net incomes of $15.76B and net income margins of 14.9% for the next quarter, indicating YoY growth of 233.13% and 5.7 percentage points, respectively. The company is also expected to report FQ3’22 adj. EPS of $3.72, representing a moderation of -10.14% QoQ though a massive improvement of 235.44% YoY.

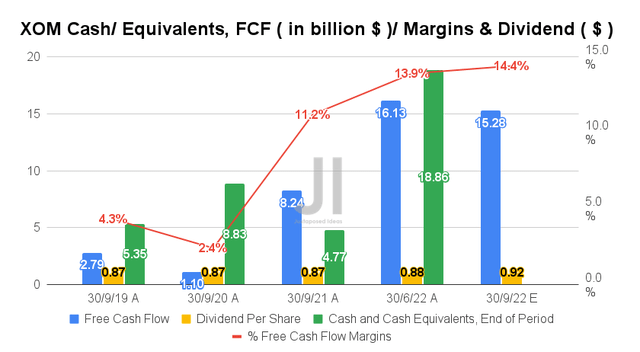

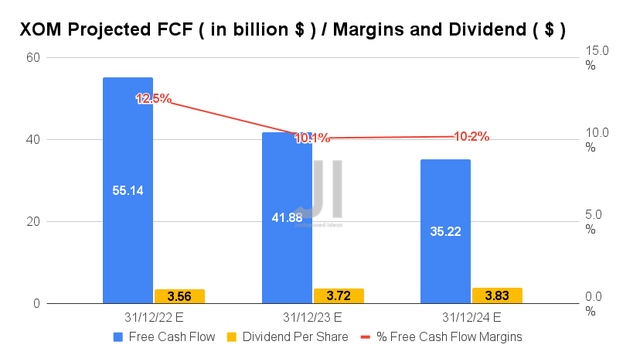

Naturally, XOM is projected to report excellent Free Cash Flow (FCF) generation of $15.28B and an FCF margin of 14.4% in FQ3’22, indicating a tremendous increase of 85.43% and 3.2 percentage points YoY, respectively. Its massive war chest of $18.86B on its balance sheet in FQ2’22 would also well-position the company in weathering the enormous volatility in oil/gas prices ahead.

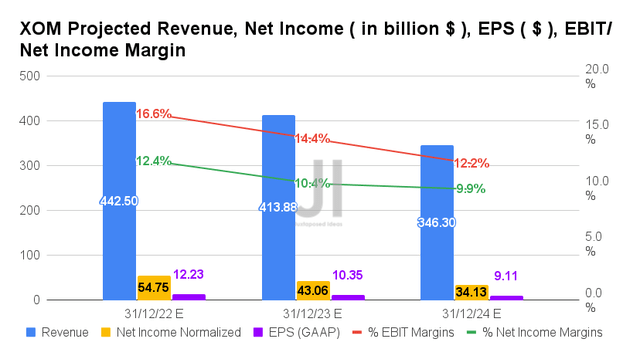

XOM is expected to report an adj. revenue and adj. net income growth at a CAGR of 5.94% and 18.94%, respectively, between FY2019 and FY2024. It is evident that Mr. Market expects a smashing year indeed, given the estimates’ upgrades in its top and bottom line growth by 9.54% and 26.44% since our analysis in June 2022, significantly boosted by the stubbornly sticky PPI/ CPI rates and the Ukraine war. Furthermore, consensus estimates remain very confident about the company’s forward execution, with the massive improvement in its profitability from EBIT/ net income margins from 6%/4.7% in FY2019, 9.6%/7.1% in FY2021, and finally to 12.2%/9.9% by FY2024.

In the meantime, XOM is expected to report revenues of $442.50B, net income of $54.75B, and EPS of $12.23 in FY2022, indicating an impressive YoY growth of 58.61%, 237.63%, and 227.32%, respectively. It is no wonder that the stock continued to rally, with Hurricane Ian and the OPEC+ production cuts putting a floor on current crude oil prices at $89.04 per barrel at the time of writing. Gas prices will also be persistently elevated due to the brutal winter ahead in the EU.

These will naturally boost XOM’s FCF generation to $55.14B with an FCF margin of 12.5% in FY2022, indicating a massive increase of 52.95% YoY or a gargantuan growth of 1030.65% from FY2019 levels. It is no wonder, then, that its shareholders have been calling for raised dividend payouts, given the record windfall thus far. We shall see, since analysts are expecting a $0.92 dividend per share ahead, indicating a 4.54% increase. Although these numbers may not quite satisfy serious dividend hunters.

Meanwhile, we encourage you to read our previous article on XOM, which would help you better understand its position and market opportunities.

- Exxon Mobil Crashed – Will It Rally Again?

So, Is XOM Stock A Buy, Sell, or Hold?

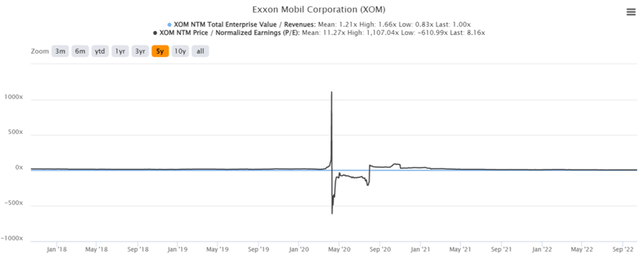

XOM 5Y EV/Revenue and P/E Valuations

XOM is currently trading at an EV/NTM Revenue of 1.00x and NTM P/E of 8.16x, lower than its 5Y mean of 1.21x and 11.27x, respectively. The stock is also trading at $101.87, nearing its 52 weeks high of $105.57, though at a premium of 75.75% from its 52 weeks low of $57.96. Its premium is also reflected in the consensus estimates price target of $108.86 and the minimal 6.86% upside from current prices.

Given the factors discussed above, we rate XOM stock as a Hold for now, due to the massive volatility ahead. Stay safe, all.

Be the first to comment