SHansche

Intro

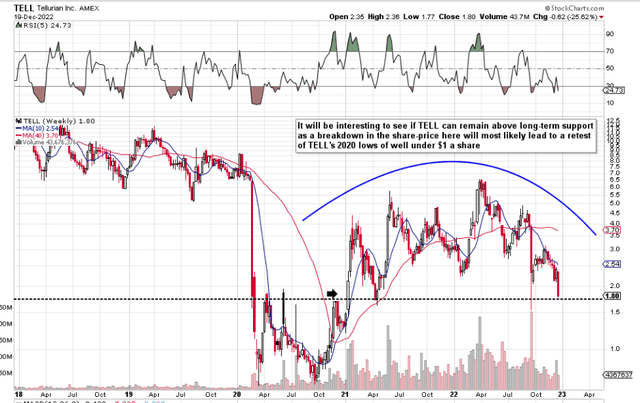

If we pull up a long-term chart of Tellurian Inc. (NYSE:TELL), we see that shares have pulled back to their breakout zone which they recorded back at the start of calendar 2021. We actually wrote a bullish piece on Tellurian Inc. at the time due to the thrust in the share price out of its bottoming pattern as well as the strong fundamentals in the company at the time. After the breakout, shares managed to rally well above $6 a share (March 2022), but as we see below, shares are once more testing that breakout zone (where lower lows have become the norm over the past 9 months), which is worrying from a bullish standpoint.

Tellurian Technical Chart (Stockcharts.com)

Many fundamentalists may totally disregard TELL’s share-price action on the technical chart and we understand this line of thinking. In TELL’s case, for example, the construction of the now $13+ billion Driftwood LNG project in Louisiana appears to be more like a pipe dream (unless a sizable backer can come on the scene sooner rather than later) with every passing day. Suffice it to say, the fundamentalist will state that the technical chart would change in a heartbeat if indeed a rich backer can ultimately save the day.

This may be true, but the technician or chartist will counter by saying that the probability of fresh capital coming on the scene in the near term has decreased significantly since TELL shares began to make sustained lower lows in March of this year. In short, the market (due to its bullish technicals), believed TELL was a much better bet 24 months ago than now. Here are some reasons for the change of heart among the investing public in recent times.

Global Gas Dislocation

Firstly, when looking at the project through the eyes of a backer, the attraction of Driftwood is the ability to sell gas at the spot price instead of tying up the product in long-term deals. The benefit here for a functioning Driftwood is two-fold. Firstly, the world desperately needs more LNG, with the global market estimated to double in value to almost $70 billion over the next five years. Furthermore, on the back of this demand, you have the significant dislocation which has taken place in recent times between U.S. & global gas prices. Selling cheap U.S. gas into these markets at spot prices is obviously a no-brainer at present. However, if one retraces back to pre-2021, European, Asian & U.S. LNG prices were very much on an even keel. Suffice it to say, there is every possibility that international gas prices will once more come back into alignment with Henry Hub: something our backer will most certainly not want to happen anytime soon.

Inflation

Moreover, the risk of lower margins is also tied to the very real risk of sustained high inflation, which is not good for Driftwood on two fronts. Firstly, the multi-billion dollar project has already seen its build-cost increase to $13.6 billion (14%+ increase) due to hefty advances in raw material pricing since inflation reared its ugly head. Furthermore, nobody would have suspected that Europe would have been able to reduce its natural gas demand in October by 25% and by a further 19% in November, both of which were higher percentages than the Union expected. Suffice it to say, with inflation expected to be with us for some time to come, Driftwood is facing higher costs on the front end for its facility as well as lower demand in Europe primarily due to behavioral changes to keep those energy bills depressed as much as possible.

The crux of the matter is the following. Prior to March of this year, when shares were consistently making those higher highs, the justification for a fully functioning Driftwood made every sense in the world for the backer. However, with TTF European prices having collapsed since March and with inflation continuing at elevated levels, a present deal would have to be very sweet indeed (meaning Tellurian would have to give up far more than originally envisioned) for a serious backer to come on board here.

Conclusion

Therefore, to sum up, the world badly needs projects such as Driftwood to take place from an LNG global supply perspective. However, the window of opportunity seems to have faded somewhat due to Europe cutting back aggressively on its energy needs and inflation remaining elevated. Tellurian Inc.’s natural gas sales from the Haynesville basin plus sustained share dilution continue to keep the dream alive. The question is for how long. We look forward to continued coverage.

Be the first to comment