mr.suphachai praserdumrongchai/iStock via Getty Images

Logo from the company website

ESSA Pharma (NASDAQ:EPIX) (TSXV:EPI:CA) is a clinical-stage oncology company focused on developing treatments against prostate cancer and is based in Vancouver, Canada.

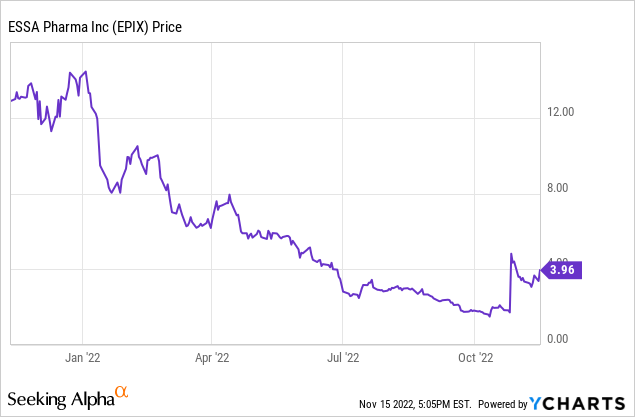

The company has been in the investor spotlight after the recently presented data for its product candidate EPI-7386 (in combination with Pfizer’s (PFE) approved drug Xtandi) in metastatic castration-resistant prostate cancer, mCRPC, showed an efficacy higher than the currently approved drugs (Xtandi or Erleada) alone. The stock has pulled back recently, thus presenting an attractive buying opportunity when I bought the stock.

In this note, I will present my bullish thesis for the company focusing on why EPI-7386 could be a blockbuster drug and why the company is very undervalued at its current negative enterprise value, where investors are assigning no value to its pipeline.

Background of the existing treatment approach to metastatic castration-resistant prostate cancer

Prostate cancer is the second most prevalent cancer in men. The estimated prevalence (existing) cases of prostate cancer in the U.S. is 3.2 million. The estimated number of new cases/year of prostate cancer in the U.S. (2022) is 268,490 cases (and 34,500 deaths in 2022). Out of these cases, approximately 1.1% of cases fall under mCRPC (the targeted population for EPI7386), with an estimated prevalence of 35,200 existing U.S. cases and approximately 3000 new U.S. cases/per year.

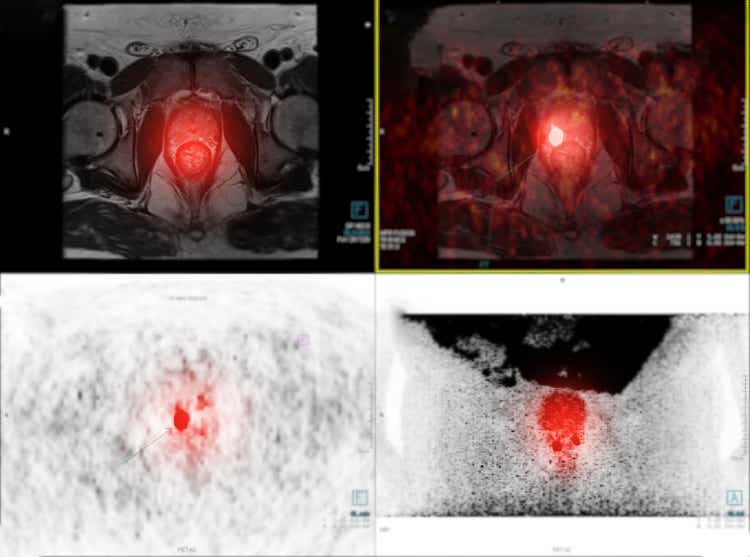

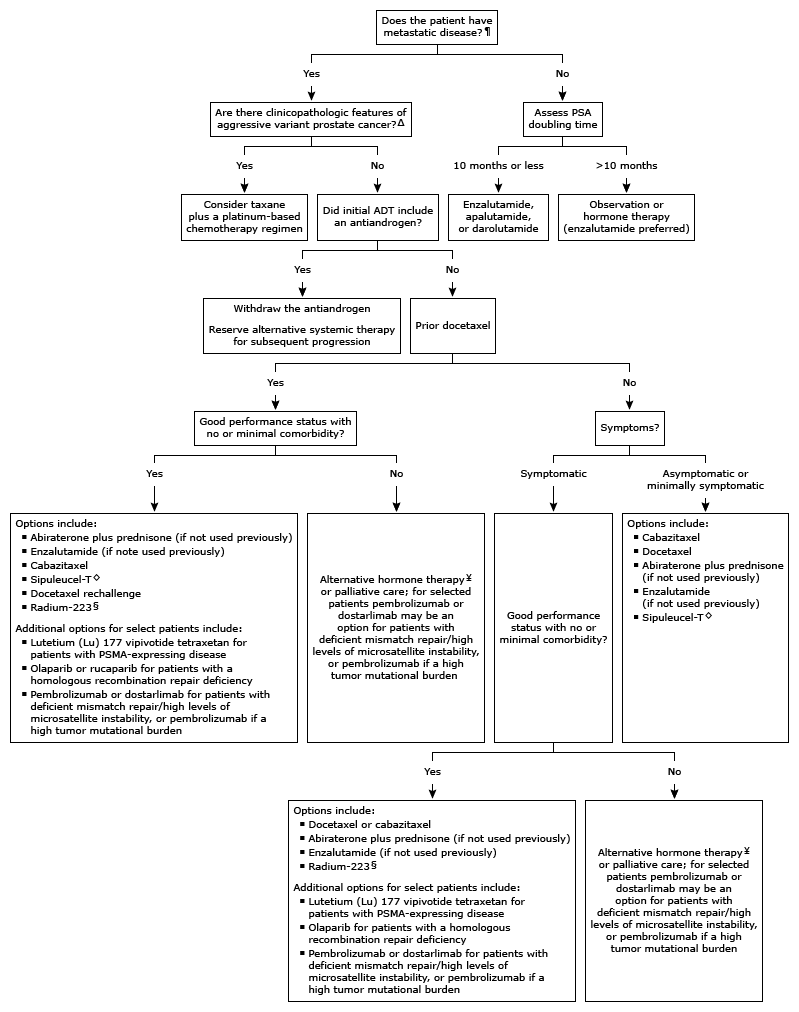

Prostate-specific antigen, PSA is a protein produced by the prostate gland. Its blood level is often increased in prostate cancer and is used to monitor the response to treatments like surgical resection, cancer therapies, radiation, etc. According to the American Urology Association, 2021 guidelines, all patients with mCRPC are treated with androgen deprivation therapy, ADT (luteinizing hormone-releasing hormone or surgical castration) plus abiraterone acetate plus prednisone, docetaxel or Xtandi (strong recommendation with grade A clinical trial evidence). Another evidence-based treatment algorithm for castration-resistant prostate cancer is given below.

(Treatment algorithm for castration-resistant prostate cancer, source: UpToDate)

EPI-7386 showed significantly higher efficacy in combination with Xtandi than currently approved treatments in mCRPC

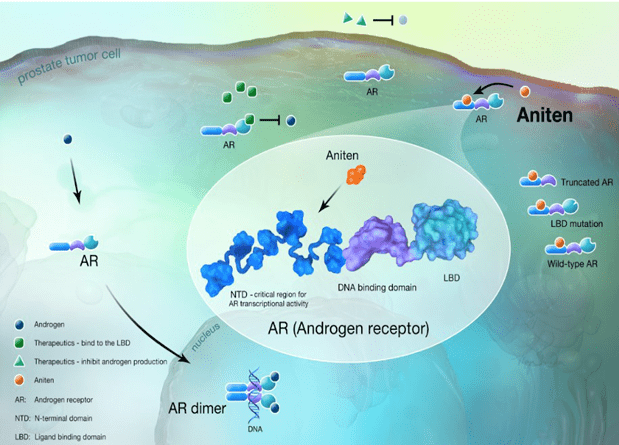

Essa Pharma has developed a new group of compounds called Anitens. EPI-7386 is a first-in-class N-terminal domain, NTD androgen receptor, AR inhibitor that blocks androgen receptor activity by a novel mechanism (binding to the AR NTD) that suppresses AR biology independent of mechanisms of currently approved antiandrogen treatments. This novel mechanism prevents the resistance that develops to currently approved antiandrogen treatments.

(Mechanism of action of EPI-7386, source: PCF 2022 poster presentation)

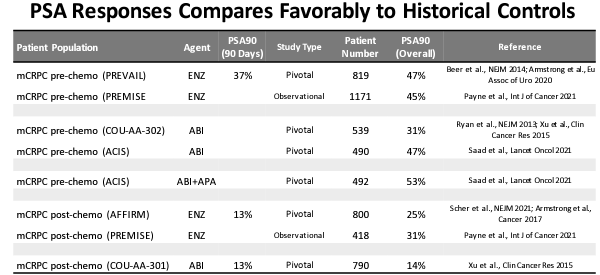

Data from an open-label Phase 1/ 2 multicenter dose-escalation study of EPI-7386 plus Xtandi in mCRPC showed that five out of six patients achieved PSA90 or 83% (a reduction in PSA level of 90% from the baseline), with 4/6 patients, 66% achieving PSA90 within 90 days. Notably, these were the patients who had received one prior round of chemotherapy and thus were resistant to it. In Phase 3 PREVAIL pivotal trial for Xtandi (leading to its approval), 47% of patients achieved PSA90 at 12 months (only 37% of patients attained PSA90 at 90 days). In the PREVAIL trial, the patients had not received prior chemotherapy, and thus had a lower bar to treatment. In the Phase 3 Xtandi trial in mCRPC patients receiving prior chemotherapy (AFFIRM trial), the PSA90 was just 25% at 12 months (and just 13% at 90 days: source: PCF poster 2022).

(PSA90 comparison with other trials of approved drugs including Xtandi, source: PCF poster 2022)

The initial clinical data for EPI-7386 + Xtandi combination is still in a small group of only six patients with a treatment duration of 90 days, however, the PSA90 of 66% is five times that shown by Xtandi monotherapy, a drug expected to have $3 billion/year in peak annual sales) in post-chemotherapy patients. The impressive efficacy data explains the doubling of the stock after the data release. While FDA approval of Essa Pharma’s combination will need more advanced data like the impact on survival, etc. in late-stage clinical trials, the initial data is promising and the significantly higher PSA90 response can be explained by the unique mechanism of action of EPI-7386 as explained above, which prevents the development of resistance to antiandrogen therapy.

The company is enrolling more patients in EPI-7386 600 mg BID + Xtandi 120 mg daily cohort. Based on the safety and pharmacokinetic data from this cohort, another cohort with a higher dose of Xtandi (160 mg daily) could be enrolled. I expect six and 12 months of follow-up data releases from this Phase 1/ 2 combination trial in 2023 as the next price-moving catalyst for the company.

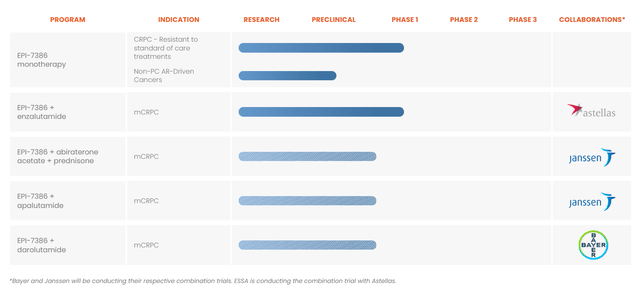

The stock’s drop last week was related to Janssen’s decision to stop the early clinical-stage combination trials of Essa Pharma’s EPI7386 with Janssen’s apalutamide (Erleada) due to operational recruitment challenges). The decision seems to be due to the non-prioritization of this combination by Janssen for business reasons and not related to the efficacy or safety of the combination. Xtandi is a more popular drug in treating mCRPC (estimated peak of $3 billion/year sales) and has found a place in the popular guidelines compared to Erleada (expected to have a peak of $1.2 billion in sales). I believe that the stock’s 20% fall on this news was irrational and presented a good opportunity to buy the dip in the stock.

Essa Pharma Pipeline: from the company website

The company has other product candidates in the pipeline as shown above, thus providing several shots at the goal. The preclinical data from EPI-8207, an Aniten-based Chimera NTD degrader (presented recently at a medical conference) showed high AR blocking potency.

Management with experience at big pharma like Biogen, Amgen, Novartis, etc.

President and CEO Parkinson held senior executive roles in big pharma companies like Biogen (BIIB), Amgen (AMGN), and Novartis (NVS). COO and Senior VP, Virsik was senior VP, of Corporate Development at Xenport (acquired by Arbor Pharmaceuticals for $467M). He also worked in corporate development at Gilead (GILD). Chief Medical Officer Cesano worked in senior management positions at Amgen, Biogen, and SmithKline Beecham Pharmaceuticals (now a part of GSK (GSK)).

The company appears highly undervalued considering the large target market opportunity

The company had $174.6M in cash reserves at June end. At the current operating cash use rate of $15M in the first half of 2023, and $28M for the last three quarters, the company expects to be well capitalized until 2024. The operating cash use rate is likely to increase as the company expands the cohort of its ongoing trial, however, I don’t expect a capital raise until mid-2023, when additional data from the above-mentioned trial is expected. Total liabilities were $4M at June end (no long-term debt).

The target U.S. market for EPI-7386 in mCRPC is 35,200 existing U.S. cases and approximately 3000 new U.S. cases/per year. At a wholesale price of $150K/year /patient and average selling price, ASP = 74% of wholesale price (average for biotech/pharma per the Pharmagellan guide of valuation), my expected price per patient/year for EPI7386 is $110,000. The total annual U.S. revenue opportunity for EPI-7386 is $3.8 billion/year (and growing per year due to new 3000 cases). (Xtandi has a peak annual revenue estimate of $3 billion/year). Biotech stocks typically are valued at EV/peak sales of seven in M&A scenarios (average for biotechs per NYU-Stern: Damodaran). Considering the peak annual sales opportunity, the stock appears highly undervalued at the current negative enterprise value, where investors are assigning no value to the pipeline. One of the reasons for the low valuation of the company is that it has not received much Wall Street analyst coverage. Also, sometimes investors are not convinced with the efficacy in combination trials and want to see the monotherapy data first. However, the recent combination data has shown promising signs of synergy with Xtandi.

Most recent sell-side analyst price targets are: from Piper Sandler (Buy, $20, on Oct. 31, 2022), and $23 from Bloom Burton (Nov. 2, 2022). The current stock price is $3.98.

Conclusion

In conclusion, I expect EPI-7386 to be a potential blockbuster oncology drug in mCRPC based on the high efficacy shown in combination with Xtandi and consider the stock highly undervalued at its current price with a timeframe of at least 2-3 years.

Risks

Investors should be aware of all the possible risks in investing in pre-revenue, developmental stage biotech/pharma companies. Risks in this investment include a possible reduction in the efficacy of EPI-7386 and Xtandi trials in mCRPC in longer-term readouts, or unexpected events like side effects, FDA clinical hold on trials or any stopping of the trials by the company of this combination, management changes, an unexpected capital raise before the above expected timeline, which may all lead to a fall in the stock price. This is a pre-revenue stage biotech company and is therefore highly risky. Investors may lose the entire capital invested in the company. Please diversify your portfolio appropriately based on your risk profile and investment objectives.

This note represents my own opinion and is not professional investment advice. Please do your own due diligence and research before making any investment decisions.

Be the first to comment