donfiore/iStock via Getty Images

Investment Thesis

With Politico reporting the potential approval of NVX-CoV2373 by the US FDA on 13 July 2022, this is a friendly reminder for those looking to cash out the Novavax, Inc (NASDAQ:NVAX) stock. The time is finally near, though admittedly much slower than expected since NVAX had submitted for US regulatory approval since 31 January 2022. The approval process for its vaccine has been oddly drawn out, given the swift approvals granted to its competitors, such as Pfizer (PFE) and Moderna (MRNA), for the youngest age group. Nonetheless, we are not here to speculate on the US FDA’s reasons, since there are more significant problems here.

Though we still believe in the NVAX vaccine’s efficacy and its traditional protein subunit technology, its management has proven to be slower than expected in getting any of its products approved by the US FDA. In addition, there is no further news from its global supply chain/ manufacturing plants, potentially due to the “destruction of demand” for most COVID-19 vaccines, with PFE already feeling the heat.

As the NVAX bulls continue to say, some could be holding out for its more traditional vaccine and/or its combined COVID/ Flu shot. However, we are less hopeful for now. We believe that these vaccines need to be approved first, before we can glean any real-life data and global demand, before justifying NVAX’s current premium.

Still, Minimal Novavax Vaccine Deliveries

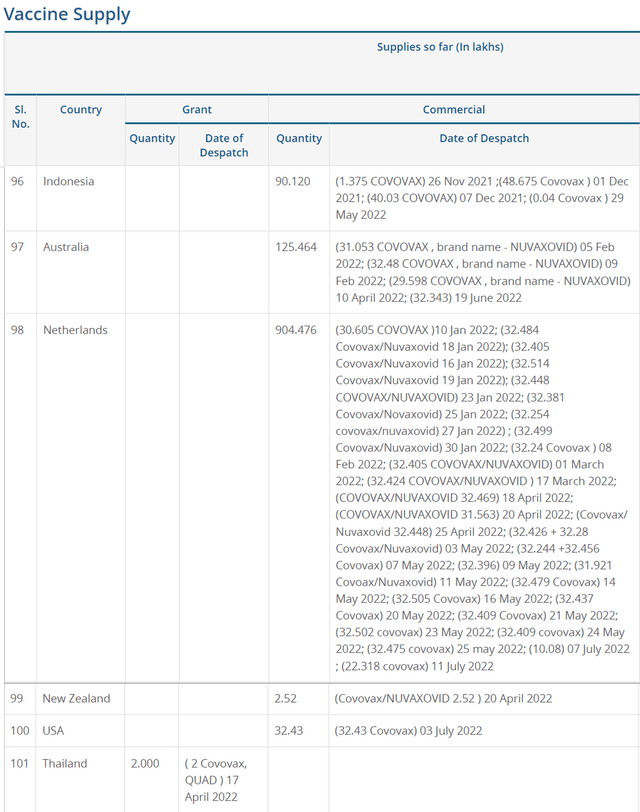

Ministry of External Affairs in India

By now, NVAX has only shipped 157.01M vaccines out from its manufacturing partner’s facility in India, Serum Institute of India. Though the US government had also ordered 3.2M doses contingent on the US FDA approval, these numbers are far lower than the original APA of 110M doses as part of its $1.8B funding commitment. Now that is somewhat underwhelming, since a similar “demand destruction” was reported in the EU with only 90.4M doses of NVX-CoV2373 delivered out of 400M APAs.

With the US FDA requesting Omicron-specific vaccines, NVAX would be late again, with its clinical trials/ results only released by the end of Q3’22. In the meantime, Moderna had released satisfactory results for its Omicron-specific vaccines by 22 June 2022, with Pfizer also announcing its findings on 25 June 2022. Therefore, given the historical speed of the US FDA’s approval and their manufacturing prowess, we expect Pfizer and Moderna to win the upcoming race as well, potentially leaving NVAX in the dust.

As for the combined COVID-19/ Flu shot, NVAX may potentially stand on the global stage, since Pfizer’s and Moderna’s pipelines are either still in the pre-clinical stage or Phase 1. However, it also remains to be seen when its NanoFlu will be approved, despite the excellent clinical trial results since March 2020 and the appointment of a new leadership team specific to NanoFlu in October 2020. Frustrating, to say the least, given the annual global demand for Influenza shots worth $6.59B in 2021.

NVAX Underperformed In The Show-Me-The-Money Game

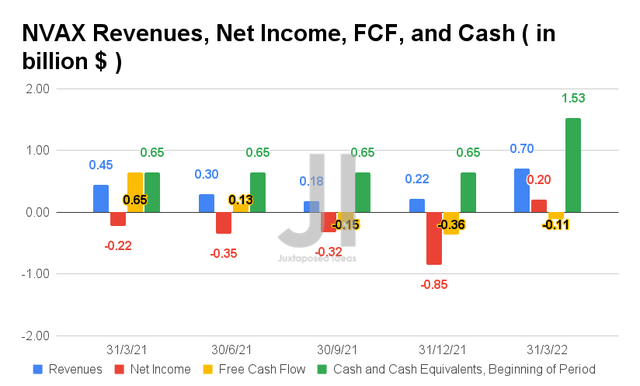

NVAX has been underperforming in its financial segment in the past few quarters, despite the previous hype. However, it is also essential to note that the company finally reported positive net income profitability of $0.2B from revenues of $1.53B in FQ1’22, indicating a net income margin of 13% then. Not too bad for starters, indeed.

Nonetheless, it is also apparent that NVAX has yet to generate positive Free Cash Flows (FCF), with -$0.11B of FCF and -15% of FCF margins in its latest quarter, a vital point for its future expansion, pipeline research, and R&D efforts. As a result, the company could potentially rely on more debt and share dilution for its future capital, as highlighted in our previous analysis.

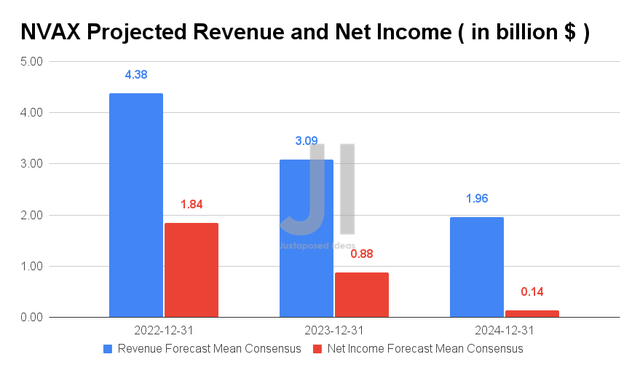

Since our previous analysis, NVAX’s projected revenue and net incomes have fortunately remained broadly in line, with a similar tapering by FY2024. Analysts will also be closely watching its FQ2’22 performance on 4 August 2022, with consensus revenue estimates of $1.02B and EPS of $5.54, indicating a YoY improvement of 241.2% and 85.7%, respectively. Given NVAX’s deliveries of approximately 58M doses in FQ2’22, there might be a chance for stock recovery post the FQ2’22 earnings call, since it represents a 41.4% increase in delivery QoQ. We shall see.

In the meantime, we encourage you to read our previous article on NVAX, which would help you better understand its position and market opportunities.

So, Is NVAX Stock A Buy, Sell, Or Hold?

NVAX 5Y EV/Revenue and P/E Valuations

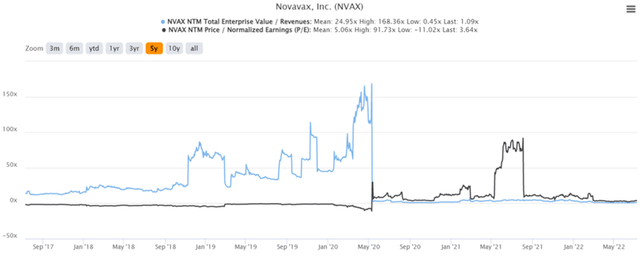

NVAX is currently trading at an EV/NTM Revenue of 1.09x and NTM P/E of 3.64x, lower than its 5Y mean of 24.95x and 5.06x, respectively. However, who are we kidding? The stock’s valuation was never really in the picture, since it moves mostly on investors’ sentiment and news. As of 12 July 2022, the stock is trading at $69.76, down 74.8% from its 52 weeks high of $277.8, though at a premium of 200% from its 52 weeks low of $34.88. The stock has also rallied by 33.36% from our previous analysis, from $52.31 on 8 June 2022 to $69.76 on 12 July 2022, making all NVAX investors happy, especially those looking for a higher exit point.

NVAX 5Y Stock Price

Therefore, given the multitude of reasons above, we are not convinced of the consensus estimates’ attractive buy rating with a price target of $126.50 with an 81.34% upside. We will be lucky to see the stock reach $100 in the next few weeks ( post US FDA approval and FQ2’22 earnings call ), providing a comfortable cushion for those looking to cash out. As for the bulls, I love your enthusiasm, really, since I was a believer too before the management disappoints. It might be interesting to see how NVAX performs in FQ2’22, since we might be feeling a little hopeful again. Good luck to all!

Nonetheless, we still reiterate our sell rating for the NVAX stock, upon the upcoming rally post US FDA approval.

Be the first to comment