DKosig

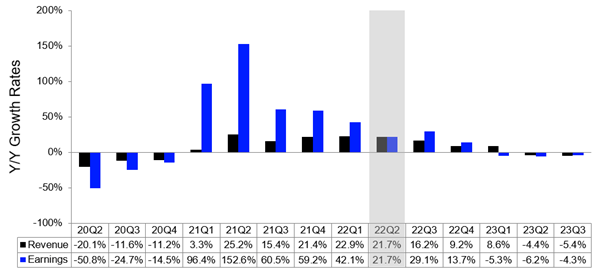

Earnings growth remained resilient last quarter in the face of higher inflation, higher interest rates, and a potential ‘hard landing’ as year-over-year earnings and revenue grew by 42.1% and 22.9%, respectively, along with above average earnings beat rates of 66.5% and a record-high 77.5% revenue beat rate.

As we enter 22Q2 earnings season, growth rates remain positive, but the rate of increase continues to decline after last year’s outsized pandemic impact as shown in Exhibit 1. 22Q2 earnings and revenue growth are currently forecasted at 21.7%.

Exhibit 1: STOXX 600 YoY Growth Rates

Refinitiv I/B/E/S

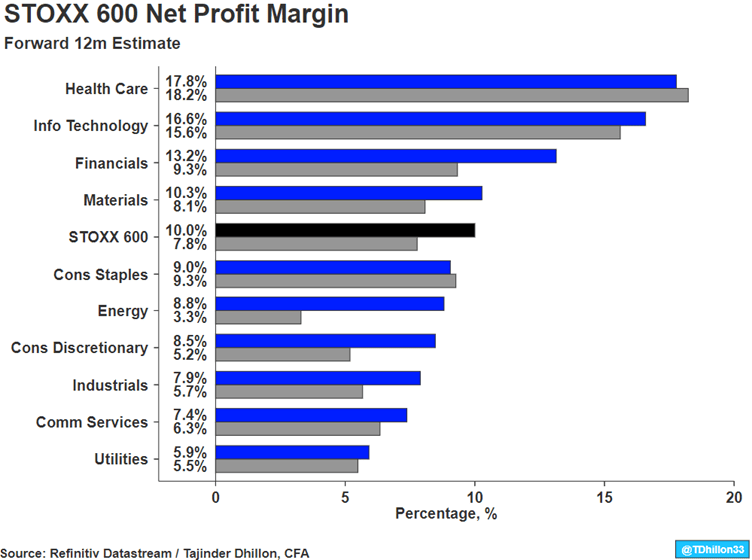

The forward 12-month net profit margin for the STOXX 600 is currently at an all-time high of 10.0% and has increased by 220 basis points (bps) over the last two years as shown in Exhibit 2. Every sector except for Health Care and Consumer Staples has seen a rise in profit margin over this period, with the largest gains seen from Energy (+550 bps), Financials (+390 bps), and Consumer Discretionary (+330 bps).

Certainly, this will be of critical importance as investors look to see if companies are still able to produce record level of margins in the face of higher inflation, wages, and commodity prices and whether companies are still able to pass on these costs to consumers.

Exhibit 2: STOXX 600 Net Profit Margin

Refinitiv Datastream/Tajinder Dhillon

Earnings growth when excluding energy

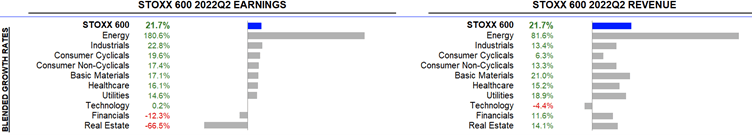

Exhibit 3 shows 22Q2 earnings and revenue growth rates at an index and sector level. The Energy sector earnings growth rate is currently forecast at 180.6%, which is by far the highest sector as the sector continues to benefit from the sharp rise in price of the underlying commodity.

Exhibit 3: STOXX 600 22Q2 Growth Rates

STOXX 600 Earnings Outlook, July 12, 2022

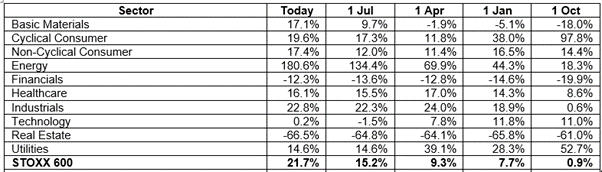

Looking at the change in growth expectations over the past year in Exhibit 4, half of the sectors have seen an increase in growth expectations, with Energy seeing the largest rise (180.6% vs. 18.3% on 01/10/21). The remaining sectors with higher growth expectations over this period include Basic Materials, Financials, Health Care, and Industrials.

Exhibit 4: STOXX 600 22Q2 Sector Growth Rate History

STOXX 600 Earnings Outlook, July 12, 2022

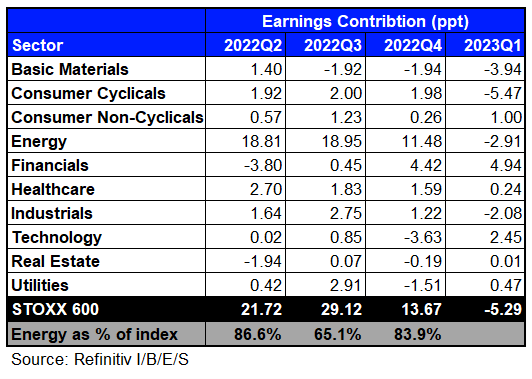

From an earnings contribution perspective, the energy sector is currently forecasted to contribute 18.8 percentage points (PPT) towards the index growth rate of 21.7%. Said differently, the energy sector is expected to contribute 85% of the total earnings growth this quarter. We note that ex-energy, STOXX 600 2Q22 earnings are expected to grow by only 3.2% year-over-year.

We can see the importance of the energy sector on 22Q2 earnings expectations, which leads us to emphasize the importance of looking at earnings growth by excluding the energy sector this quarter.

We display earnings contribution for 22Q2, 22Q3, 22Q4, and 23Q1 in Exhibit 5 which highlights that Energy will continue to play a significant role for the next three quarters. Energy will contribute 85.6%, 65.1% and 83.9% of total earnings in 22Q2, 22Q3 and 22Q4.

Exhibit 5: STOXX 600 Earnings Contribution

Forward 12-month estimates continue to rise

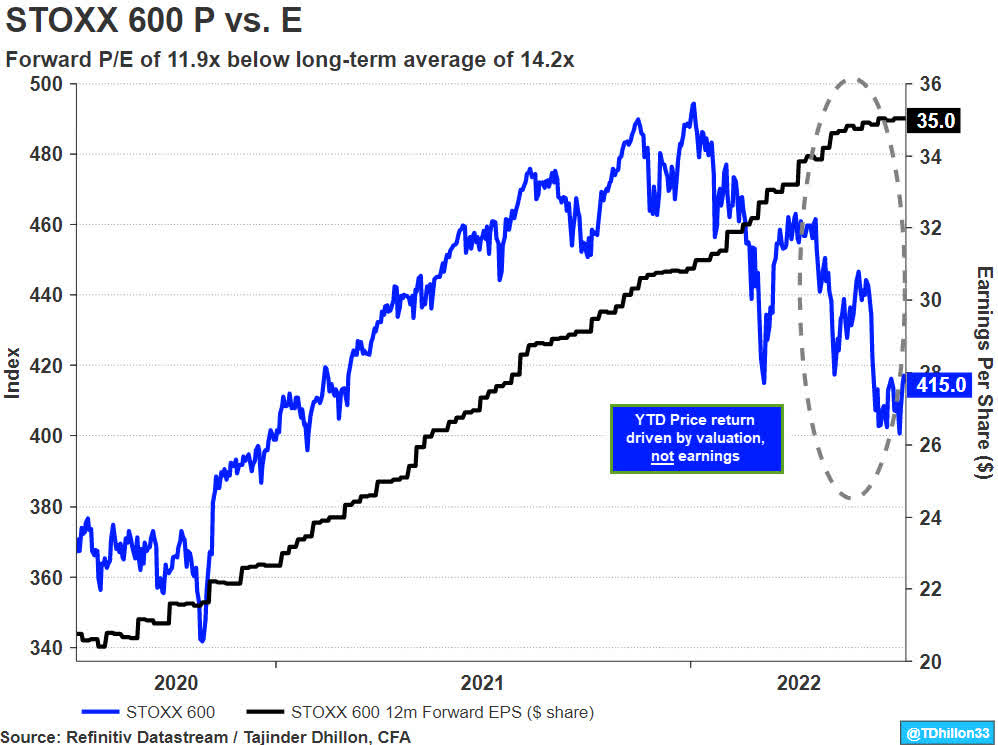

For most markets, year-to-date performance has been entirely driven by a decline in the P/E multiple, as opposed to any deterioration in earnings growth expectations. For example, the STOXX 600 has declined 14.9% YTD in comparison to an increase in 2022 earnings growth expectations from analysts (6.9% on Jan 1st to 16.6% on July 12th). This has led the forward P/E multiple to decline from 15.8x at the beginning of the year to a current reading of 11.9x, which is well below the long-term average of 14.2x (Exhibit 6).

As a result, there appears to be a significant disconnect between market pricing and analyst estimate revisions.

Exhibit 6: STOXX 600 P vs. E

22Q2 may turn to be a pivotal quarter, as the current decline in equities appears to be driven primarily by higher interest rates and less so by a potential weaker earnings outlook. If we see themes such as increased margin pressure, weaker guidance, a decline in pricing power, or weaker sales growth from companies, this may recalibrate the broken trend in the chart above.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment