fstop123/iStock via Getty Images

Investment Thesis

Marathon Oil (NYSE:MRO) is the only company I know in the oil space that is so intent on returning capital to shareholders that its capital return framework starts on its cash flows from operations line.

Put another way, even before there’s any consideration of investing in capex, shareholders are going to get paid. A discussion of how many barrels will be produced in 2022. Sure, that’s important, too. But haven’t you been listening? That’s not where the focus is. Marathon Oil is fully focused on returning capital to shareholders.

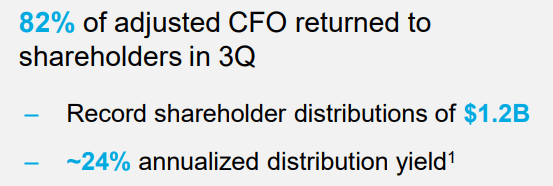

More specifically, at least 40% of cash flows from operations are coming back to shareholders. But this is a low bar. In actuality, Q3 2022 saw Marathon Oil return 82% of its cash flows to shareholders.

That being said, this narrative is now likely to take a back burner, as Marathon Oil makes its large acquisition. How to think about this?

This is my point, it’s unambiguous. Shareholders will get paid. The only question is how much.

What’s Happening Right Now?

The biggest concern facing oil companies is that we are about to enter a global recession. This could see a very weak oil market, as the market becomes flooded with excess oil. Or so that’s what the shorts would have you believe. Yes, can you imagine that even now Marathon Oil is 3% shorted?

I mean, I understand someone not wanting to invest in Marathon Oil. I even understand people not investing in energy. But to go out and purposely short Marathon Oil? Seriously? On what basis?

For my part, I stubbornly believe that even if we go into a global recession, oil demand will not be meaningfully curtailed. Firstly, remember that in 2020, when flights were grounded, plus the global economy shut down, oil demand was only down 10% from 2019.

Secondly, going into 2023, we are highly unlikely to see a similar drop in oil demand. Furthermore, the other two noticeable heads that investors have had to contend with in 2022, China’s lockdown and the Strategic Petroleum Reserve will become tailwinds next year.

Thirdly, less tangible but still true, outside of major shocks, oil demand isn’t ”that sensitive” to the economy. We remain an oil economy.

Fourthly, given all the volatility in the oil market, who is really drilling for oil? Shareholders across the sector will simply not support any oil company that is talking about dramatically increasing capex to drill for oil.

With that backdrop in mind, let us now discuss Marathon Oil’s capital return program.

Capital Returns Program, 24% Annualized Return

MRO Q3 2022

Before getting stuck into it, allow me to momentarily digress. Let me remind readers of what you get when a company substantially repurchases shares.

In the first instance, that means that your ownership of the future earnings increases without you having to invest any further capital. Secondly, the company can spend the same amount in dividends, and the dividends per share increase.

With that in mind, consider this. During Q3 2022, MRO returned to shareholders $1.2 billion. This annualizes at approximately $4.7 billion. Or a 24% return annualized.

Indeed, as we headed into Q3 earnings, I wrote a bullish article on Marathon Oil arguing that shareholders should get at least a 10% annualized return. But that figure was simply too conservative.

So, as we look ahead, what should we expect to see? As we look ahead to Q4, Marathon Oil will dial back its capital returns program. Marathon Oil states that Q4 buybacks will be reduced from $1.2 billion in Q3 to $300 million in Q4. Why such a drop?

Because Marathon Oil believes that it needs to increase the cash on its balance sheet to buy up the Eagle Ford assets. Does this dramatically change the bull case?

I don’t believe it does. It means that these highly astute capital allocators are also playing the long game. And that’s something that investors also want.

MRO Stock Valuation — Approximately 4x Free Cash Flow

Marathon Oil is priced at very approximately 4x next year’s free cash flows. This multiple could go up or down depending on oil prices in 2023.

Investors may be concerned that Marathon Oil is going to leverage its balance sheet to acquire the Eagle Ford assets.

But on this matter, this is what Marathon Oil stated,

The acquisition itself is 17% accretive, so the — to our CFO. So the quantum of cash available to return to shareholders is greater. Think about it as pre-Ensign 50% return equals a post-Ensign 40% return. So it’s a significant increase the quantum of cash that we can allocate to shareholders.

Again, as you can see, Marathon Oil reaffirms its commitment to return capital to shareholders.

The Bottom Line

Marathon Oil is a cheaply valued oil company. The stock is valued at approximately 4x next year’s free cash flows.

It is making an acquisition that will leverage its balance sheet. But the amount of cash it will make in 2023, assuming similar oil prices, will lead to higher cash flows from operations in absolute terms.

Meanwhile, Marathon Oil remains resolute on its priority to return capital to shareholders.

But what about the vicissitudes of the oil market? Couldn’t we see oil prices dip below $70 WTI, particularly if we enter a global recession?

Yes, that’s certainly a possibility. But for my part, I believe that we are an oil economy. And paying low single digits free cash flows for oil companies is something that I believe is very attractive.

Be the first to comment