DuxX/iStock via Getty Images

Coca-Cola Consolidated, Inc. (NASDAQ:COKE) is the largest Coca Cola bottler in the US, with 10 manufacturing plants and 60 distribution centers, serving an area of 14 states. Around 83% of their volume are Coca Cola products. Their main retail customers are Walmart (WMT) and Kroger (KR).

One of the keys to Coca Cola’s successful business model is the fact that they don’t do their own bottling. They supply syrups and concentrates to bottlers like COKE. Comparing COKE to KO isn’t the main point of this article but I ‘d like to point out some key differences a bit later.

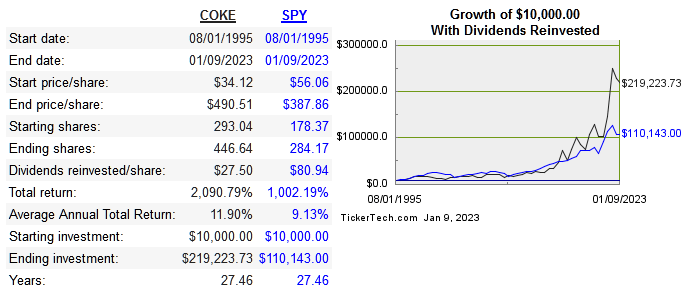

The company has been public since 1972, and below is the share price performance of the past 27 years.

dividendchannel

Next is the return on capital and earnings metrics compared to peers:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

13.5% |

14.3% |

4% |

20.6% |

21.5% |

|

|

6.3% |

15.9% |

8% |

0.4% |

7.7% |

|

|

6.2% |

7.1% |

4.3% |

19.9%0 |

12.9% |

|

|

0.4% |

9.1% |

5.7% |

-1.5% |

-11% |

Source: Quickfs

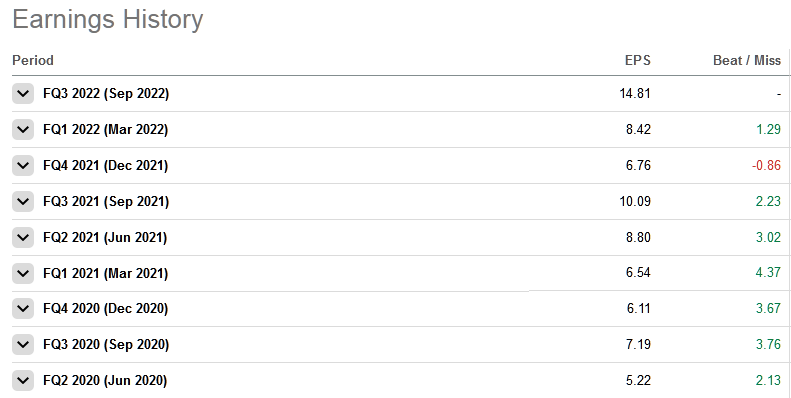

While many companies suffered greatly during the pandemic, COKE had a series of impressive earnings beats which boosted the share price accordingly. The price has declined since the peak last year like many others did, but the decline was nothing like what happened to so many growth names.

Seeking Alpha

Capital Allocation

Usually I’m more critical of companies paying a dividend when buybacks or debt reduction should take higher priority. This isn’t the case here. The issue is that the dividend has historically never been raised.

This is a key difference between COKE and KO, the capital allocation. KO has consecutively grown its dividend for over 50 years, whereas COKE paid a constant dividend until recently, hiking the common dividend by double in addition to paying a special dividend of $3/share. KO also reduces share count regularly, unlike COKE which keeps share count the same year after year.

The only downside to a rising share price has been a dwindling dividend yield. Income seekers might not find the dividend aspect to this stock very appealing. In spite of the recent dividend hike, I don’t expect this to be recurring every year.

Risk

There’s not a ton of risk as far as permanent losses of capital. The same secular trends of consumers moving away from sugary drinks affects both KO and COKE. I don’t argue this trend in the long term but for now KO has adapted reasonably well to the shift in consumer preferences. KO simply has too much financial power to let their brand be eroded due to change in consumer’s taste. They have and will continue to alter their products and acquire younger brands in order to keep up with this change.

The ownership issue is important for potential investors to understand. The Harrison family through various trusts owns 86% of the voting power of the shares. So it’s not possible for any activist to shake things up and make changes. Any potential investor needs to be aware of this, don’t expect any change from the status quo. KO also owns 5% of the voting power of COKE.

There is very little risk on the debt side of the equation, with TTM long term debt at $727 million versus $331 million in TTM net income.

Valuation

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

COKE |

0.8 |

7 |

19.5 |

4.6 |

0.3% |

|

CCEP |

2 |

11.6 |

13.3 |

3.2 |

6% |

|

FMX |

5 |

54.7 |

46.4 |

24.5 |

2.1% |

|

KOF |

11.6 |

11.7 |

11.6 |

2.4 |

4% |

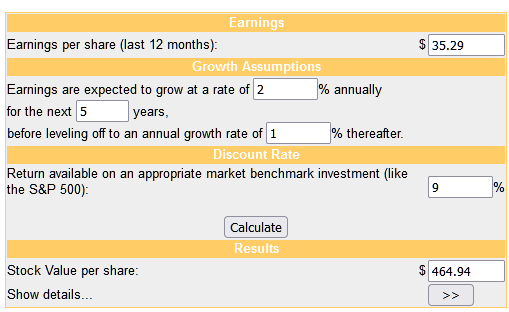

They had a very impressive growth in EPS since 2020, but I don’t expect this trend to continue as mean reversion will kick in. This is why my forecast in the DCF model below is so low:

money chimp

While I do consider the stock overvalued, my reasoning for not buying has more to do with capital allocation. The lack of dividend growth and total absence of share reduction aren’t things I like to see with a mature business. That being said, if EPS and ROIC can continue at the rate they have the past two years, the capital appreciation would nullify my issues with shareholder yield. I don’t have the confidence that this is the likely scenario, so I will give this stock a hold at current prices.

Conclusion

While closely connected, there are some key differences between COKE and KO that investors should be aware of. KO has a very long history of dividend growth and share repurchases, COKE on the other hand has held the dividend and share count constant. At the current price, there isn’t enough upside through share price appreciation, and the current yield is too low to satisfy virtually any dividend seeker. The business quality is definitely good, and downside is relatively low. The issues of an intrinsically high share price and lack of shareholder yield force me to pass on this stock right now.

Be the first to comment