Torsten Asmus/iStock via Getty Images

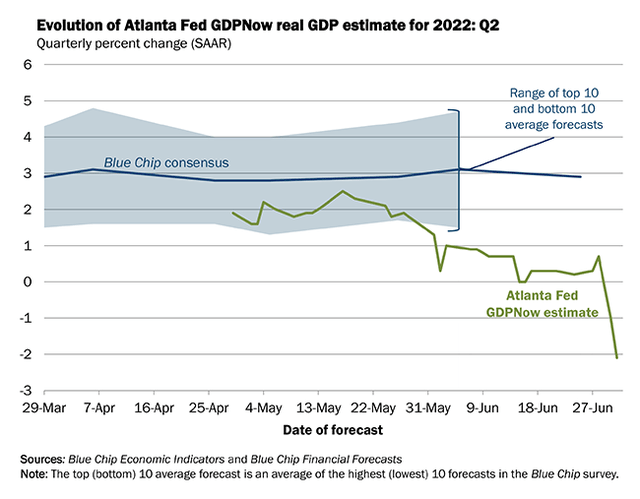

With more evidence appearing daily that a recession has begun in 2022 (given a second straight quarter of real U.S. GDP contraction is all but certain to be reported in July, tracking the Atlanta Fed’s GDPNow indicator), I am getting very worried the largest sector of market gains this year, centered around energy and commodities, could be close to an abrupt cycle turn lower.

Atlanta Fed GDPNow Q2 Forecast

And, if we are entering a “deep” recession, which is entirely possible, a total collapse in commodities the rest of the year could be next, which would be a near carbon-copy repeat of 2008’s Great Recession pattern. Assuming a similar horrific economic demand scenario comes to pass, you will not want to be anywhere near the Invesco DB Commodity Tracking Index ETF (NYSEARCA:DBC).

I have written several stories since the spring that major oil/gas names are likely peaking, perhaps for a number of years. I have specifically mentioned selling Warren Buffett’s favorites of Chevron (CVX) here and Occidental Petroleum (OXY) here. The Berkshire Hathaway (BRK.A) (BRK.B) acquisition spree of these oil/gas names carries huge risk, if a deep recession is beginning. Given my downside projection of $70 a barrel for crude oil comes to pass by early 2023, both would likely be cut in half for price.

What gets me after trading stocks and commodity names for 35 years is investors always believe supply/demand forces no longer work at tops and bottoms, despite higher prices being the “cure” for supply/demand shortages and low prices curtailing surpluses. I am going to tell you this straight – free market forces will work again to lower commodity prices into 2023, like they always have. Things are not different this time – wars in Europe have happened before, economic booms/busts globally are not new, and record money printing by the Federal Reserve in the U.S. is quickly turning into a massive tightening posture. Demand destruction for commodities is already taking place and will worsen, as a lag of 3-6 months on macroeconomic numbers is typical of events like today’s record retail gasoline prices.

To be completely honest, the 2008 boom/bust cycle in commodities, especially oil/gas and the industrial metals, is starting to look like the best comparable (almost mirror) period vs. 2022’s economic turmoil. The very rise in commodities in the first half of 2008 helped to change profitability at regular businesses and consumer buying behaviors on the ground. Then overly tight Fed policy to fight the commodity price spike, on top of an imploding real estate sector, utterly demolished commodity demand and business confidence holding inventories of such. The 2008-09 bust in commodity pricing entirely wiped out gains from the beginning of the year plus 2007, which could mean a 30% or greater dump in DBC may be next for overly bullish investors.

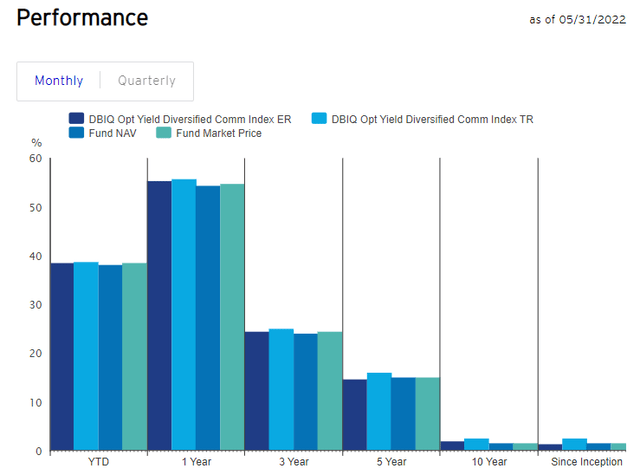

Invesco DBC Product

The Invesco DBC ETF uses futures contracts to invest in commodities like Light Sweet Crude Oil (WTIC), Heating Oil, RBOB Gasoline, Natural Gas, Brent Crude, Gold, Silver, Aluminum, Zinc, Copper Grade A, Corn, Wheat, Soybeans, and Sugar. It seeks to replicate the performance of the DBIQ Optimum Yield Diversified Commodity Index Excess Return. Currently, crude oil, natural gas, and refined petroleum products make up about 62% of notational net assets. Annual management fees of at least 0.85% are charged, and K-1 tax forms are sent out for trust holders every year. For me, DBC is a great vehicle to play fossil fuel energy price swings both up and down vs. other ETF products.

Unfortunately, if you review long-term returns from this ETF, taking futures position contango rollover effects and its high management fee under consideration, buy-and-hold returns have not been great for investors. With no dividend being paid, selling or shorting DBC is logically backed by a whole lot of common sense right now, especially if we are close to a commodity cycle peak.

Invesco Website

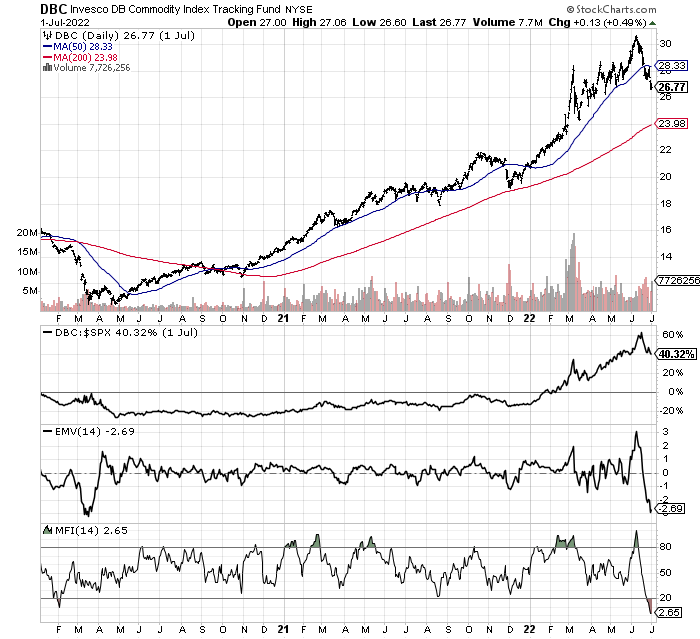

Of further worry for commodity/crude oil bulls, the latest June selloff in DBC is showing the same rotten 14-day Ease of Movement and Money Flow Index readings as the early 2020 pandemic implosion. I have drawn a 30-month chart of daily price and volume changes below, alongside some momentum indicators flashing red in early July.

In addition, after a period of terrific and steady outperformance of the S&P 500 index, DBC has quickly underperformed by roughly 20%, its worst showing since April 2020 (over a month of trading). A final warning signal is price has dropped under the important 50-day moving average. If it cannot be recaptured on the upside in coming weeks, the odds favor a serious reversal is underway.

StockCharts.com

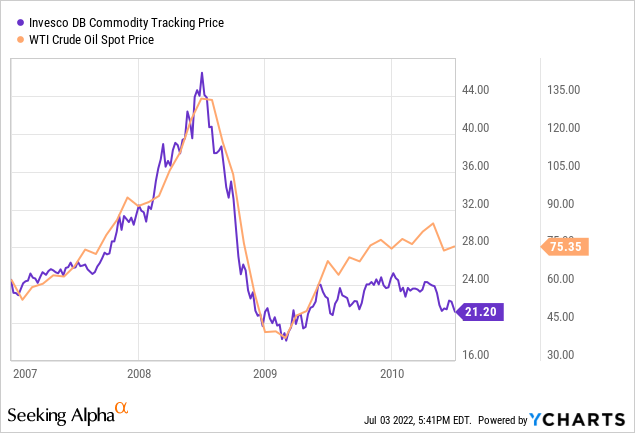

2008 History Lesson – Recession

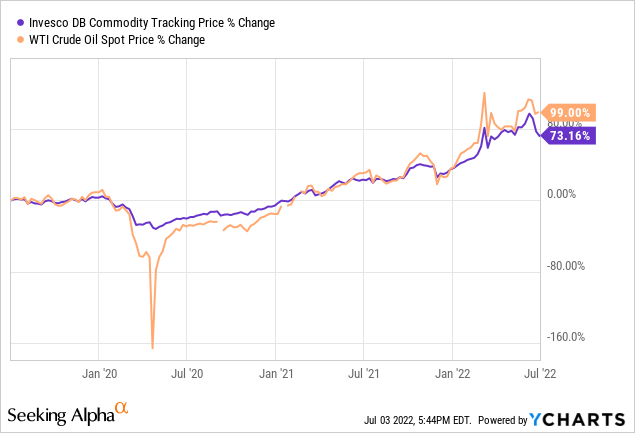

So how bad did DBC decline during the last half of the Great Recession? A deep and lingering recession (unlike the short-term economic lockdowns during the pandemic spring and summer of 2020) had a devastating impact on commodity demand and pricing, especially for crude oil. From an all-time high $140 a barrel price for crude oil, this important energy source for the economy tumbled all the way back to $40. DBC fell from $46 to $18, ouch if you owned it all the way down -60%.

YCharts

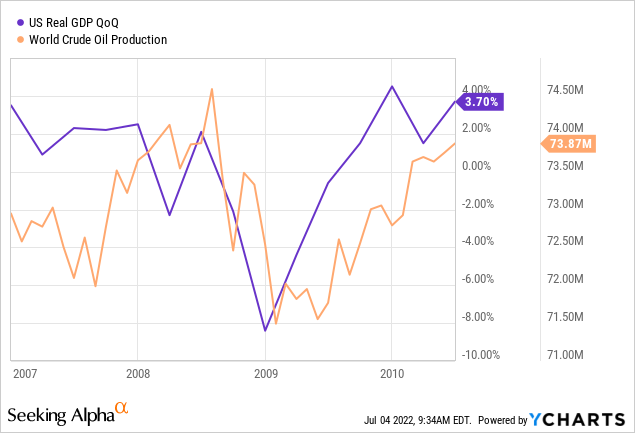

As real GDP contracted in 2008-09, crude oil demand and production fell roughly -5%. This idea is graphed below.

YCharts

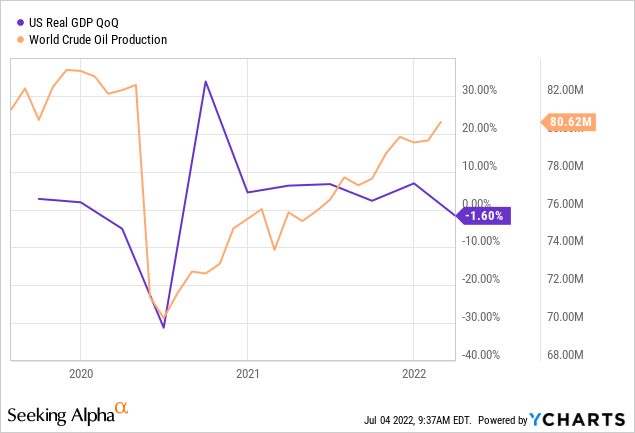

Current Setup

I have graphed some equivalent charts reviewing the past three years of data. Again, DBC is strongly correlated with crude oil price movements. The $125 crude oil spike on the Russian invasion of Ukraine and record refined petroleum pricing are today’s reality. Already, global oil production is rising to capture unusually high profit margins, and extended prices themselves have begun to change consumption trends. If the Federal Reserve and other central banks around the globe continue raising rates, chasing inflation, disposable incomes for workers at the bottom of the pay scale will decline rapidly. Demand destruction is all but guaranteed the rest of 2022, allowing crude oil supply/demand to rebalance or even morph into a surplus situation. That’s how free market forces work, as a function of price.

YCharts

YCharts

Final Thoughts

If we get a severe recession that lasts into 2023, crude oil will almost surely tank in price. I know perma-bulls believe such is impossible, with amazing levels of optimism and positive sentiment now the conventional wisdom of the day. Even Warren Buffett has been seduced by the strong advance in energy pricing over 27 months. It’s now fashionable to think market cycles have been repealed in 2022 for energy supply/demand dynamics.

I disagree and suggest DBC holders lighten up or sell their positions. Assuming the Fed is intent on raising rates aggressively, all I can see is wicked downside in industrial commodities like crude oil. My view is the economy is nowhere near as strong as mainstream economists would like to believe. Record debts in aggregate (sovereign + business + consumer) for the U.S. economy as a percentage of GDP are built on low interest costs. Spiking interest rates to catch 40-year high CPI gains is fraught with serious risk. The stock market’s 25-30% slide in the first half of 2022 is clear evidence of looming economic trouble. After the summer COVID-reopening travel spurt is over, and the seasonal buying peak for housing is reached in coming weeks, I fully expect a sizable downturn in consumer demand will hit.

Hopefully, a substantial drop in industrial commodity pricing will allow the Fed to quit its tightening bent that is sucking all liquidity out of the financial system. My fear, growing every day in June, is once it is clear a steep contraction in GDP is underway, it will be too late for the Fed to slow the worst effects of the recession into the end of 2022. I fully expect a huge jump in layoffs and the ranks of the unemployed is upon us. And, because of the labor participation mess caused by the pandemic and built-up inflation costs in the system, CPI rates may only fall back to 4% or 5% annually in 2023. So, yes “stagflation” is now reality in July 2022.

What could keep commodities high? That’s a great question. If the Fed reversed course and announced new money printing measures to fight a slowing economy, demand for commodities would remain high. However, outside of this scenario, I struggle to model an optimistic take on commodity pricing (the exact opposite of my bullish 2020-21 articles on commodities). An expanded Russia invasion into NATO nations might produce a short-term blip higher on fear-related buying, but also send the global economy into a steep dive, not good for commodity demand long term.

I have a 12-month price target of $20 for DBC, with a crude oil forecast low of $70 a barrel by early next year. Of course, a deep recession could send both far lower. I rate ownership in the trust a Sell at $26, and an Avoid for new investment capital.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment