Sundry Photography/iStock via Getty Images

The market has punished the most speculative parts of the market, from cryptocurrencies to former SPACs. One of the former SPACs that I have been keeping an eye on is Latch (NASDAQ:LTCH), a small-cap company focused on real estate technology. I bought a small position in the warrants as the selloff has continued with no sign of stopping. I am considering adding to my tiny position in the warrants as I think the risk/reward profile is favorable at current prices.

Investment Thesis

Latch is a risky proposition for investors, as the company continues to burn a significant amount of cash in pursuit of growth. That is why it is prudent to keep any long position small, but I think the long-term future of the company is bright. They continue to show impressive revenue growth, which is the central pillar of the bullish thesis. While a small portion of the company’s revenue comes from software, the margin profile on the software segment means that the company could have an impressive margin profile at scale. I own a small chunk of warrants and I’m considering adding another small piece to the position at current prices.

Rapid Revenue Growth

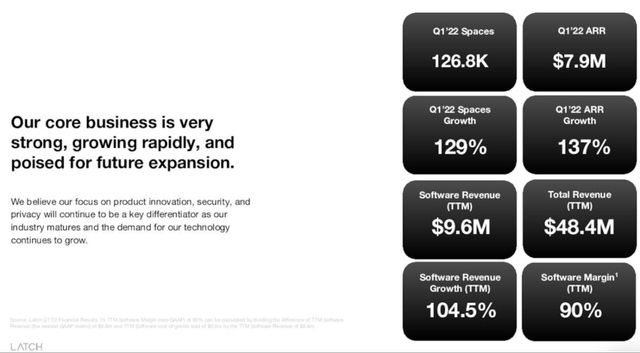

Latch is growing revenue rapidly, albeit from a small base. They have shown triple-digit revenue growth, which is bound to slow down at some point, but I think they will continue to post impressive revenue growth for years to come. I’m most excited about the software revenue growth because that segment has the potential to be a cash cow at scale.

The company is a small-cap company now, which comes with risks, but I think they have the potential to be a much larger company in 3 to 5 years. As they continue to roll out their products and increase their building count, revenue should continue to grow rapidly. While the margin profile is what has me excited about the long-term future of the company, the current valuation is why I’m considering adding to my small position today.

Valuation

Latch currently has a market cap of $165M, which is down around 80% from my last article on the company. My last article talked more in depth about the business, margins, and insider ownership, but the revenue growth continued with the Q1 results reported in May. I typically avoid using price to sales as a valuation metric, but since Latch doesn’t have earnings yet, I will make an exception. The company had $48.4M in sales over the last 12 months, giving us a price/sales just a smidge over 3x. However, I think a look at the balance sheet is more informative for investors at the current stage.

The company had $264M in cash and short-term investments on the balance sheet, versus $62M in long-term debt at the end of Q1. While I expect the cash burn to continue, that is a pretty hefty cash position for a company with a $165M market cap. Because the company is burning large amounts of cash, I think investors should keep any position small. It will take some time for the cash burn to slow down, but the biggest future change that I see will be as the software segment makes up a larger portion of future revenues. The margins are much better and have the potential to be a long-term recurring cash cow for the company. One of the ways to increase the upside on a small investment is to buy the warrants (NASDAQ:LTCHW).

Why I Chose The Warrants

Latch has warrants as a part of the SPAC deal. The warrants have a strike of $11.50 and expire in June of 2026. If the business continues to grow revenue rapidly and turns profitable before expiration, the warrants could have even more upside than the shares. To be perfectly transparent, my position in the warrants is very tiny (worth less than $100). It certainly won’t be a portfolio buster if things don’t pan out, but I’m considering adding another small chunk at current prices.

Conclusion

Latch is a company whose share price has suffered along with the other unprofitable tech companies on the market. The company has continued to grow revenue at a rapid clip, and I will be watching the next quarterly report to see how much revenue grows versus the cash burn of the company. The company has a lot of cash on the balance sheet compared to debt levels and the market cap despite the current cash burning nature of the business. I’m looking at adding to my warrant position, and investors looking for a small intelligent speculation might consider taking a closer look at Latch.

Be the first to comment