Investment Thesis

Over the past decade, the share price of Johnson & Johnson (JNJ) has been in a persistent gradual uptrend in line with the company’s continuous progress and impressive fundamental growth. With a steadfast M&A activity, new product introductions and overall positive business developments, the company’s shares trade at their intrinsic value and already imply a positive expected rate of return, which may increase further extend as the market sell-off continues.

Corporate profile

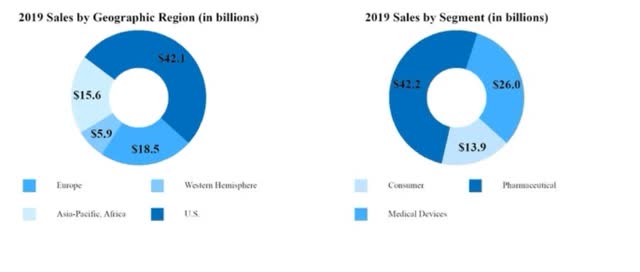

Johnson & Johnson is a multinational medical, pharmaceutical and consumer packaged goods holding company with its subsidiaries involved in research and development, manufacture and sale of a broad range of health care products, operating and conducting business virtually in all countries around the world. The company’s primary focus is human health and well-being related products and its credo is to put patients and people first. In 2019, the company had 132,000 employees and operated three distinct business segments: Consumer, Pharmaceutical and Medical Devices.

Source: 2019 10-K filing (Sales by segments and geography)

Source: 2019 10-K filing (Sales by segments and geography)

Key insights from the latest quarterly earnings call

Reading through the company’s latest quarterly earnings call transcript, the management recapped key financial statement changes, reported on performance of individual drugs and expressed confident outlook for the upcoming seasons.

“We reestablished our brand and purpose and made strategic decisions that over time will accelerate growth, reduce complexity and improve operating margins.” – Alex Gorsky, Chairman & CEO

In Q4 FY2019, the company managed to successfully complete integration of several new businesses such as Zarbee Inc. (a leading company in naturally based over-the-counter remedies) and the Dr. Ci Labo (successful dermo cosmetic skin care business) and divest no longer synergical units (Babycenter). Despite the Medical Devices business line experiencing single-digit growth, the management praised the performance of existing surgery platforms and provided details of other critical product market launches from one of the fastest growing health care categories and exciting transformative field of medicine – digital surgery.

“Now we also successfully launched critical products across each franchise throughout 2019, including the ATTUNE Cementless Knee system; our first-of-its-kind ACUVUE OASYS contact lens with TRANSITIONS LIGHT INTELLIGENT technology; the industry’s first powered circular stapler, ECHELON; and the VIZIGO steerable sheath in our market-leading electrophysiology business.” – Alex Gorsky, Chairman & CEO

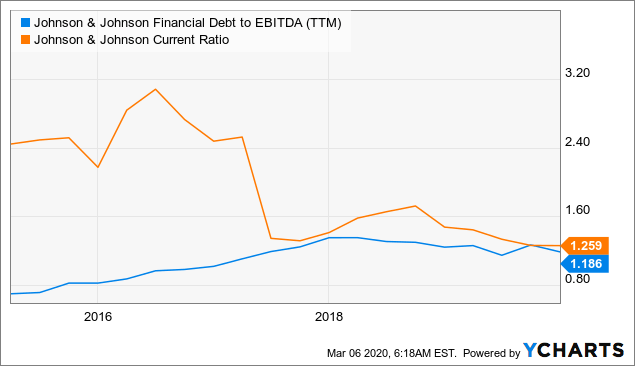

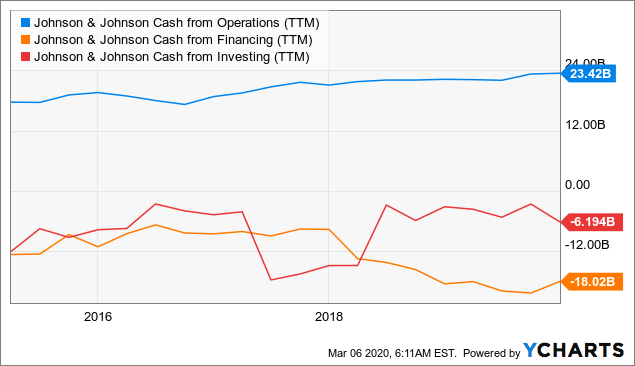

Strong financials

Looking at the company’s financial statements, the company has sufficiently liquid balance sheet with very little debt, robustly growing cash flow and income statements. For the last trailing twelve months, the company’s return on equity hovers around 25 percent, which is a noteworthy figure.

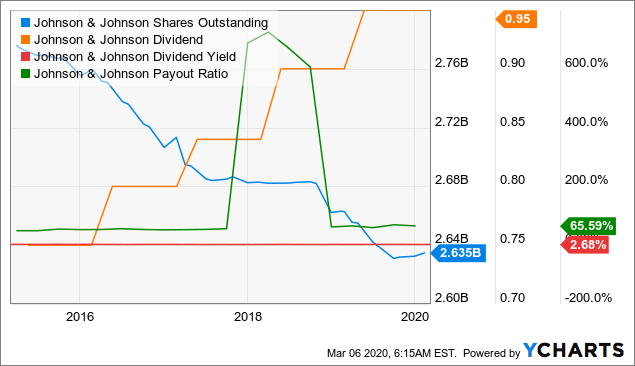

Shareholder-friendly policy

Over the past years, Johnson & Johnson has also built a strong shareholder-friendly policy with regular buybacks and growing dividend payments, forming a foundation of investor treatment. The current payout ratio sits at 42 percent and the company holds a track record of a 6 percent divided growth rate over the last five years.

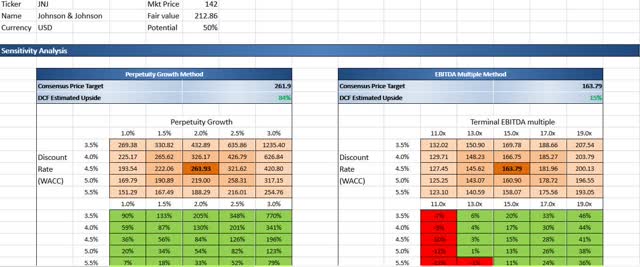

DCF valuation

Plugging in JNJ’s financial statement figures into my DCF template, the company’s shares show to have a solid upside. Under the perpetuity growth method with a terminal growth rate of 2 percent, 3 percent annual revenue growth over the next five years and stable operating income margin of 21 percent assumption, the model’s estimate of intrinsic value of the stock comes at $261.9. Under the EBITDA multiple approach of a discounted cash flow model, the intrinsic value per-share value of the company stands roughly at $163.79 if we assume that the appropriate exit EV/EBITDA multiple in five years’ time is around 15x.

Source: Author’s own model

Gordon’s dividend growth model

Using the dividend Gordon growth model and applying assumptions about the company’s next year dividend (~$4), the market’s required rate of return (~9 percent) and the expected growth rate in perpetuity (~6 percent), JNJ’s intrinsic value comes at $133. This is more or less in line with the current market price of JNJ’s shares.

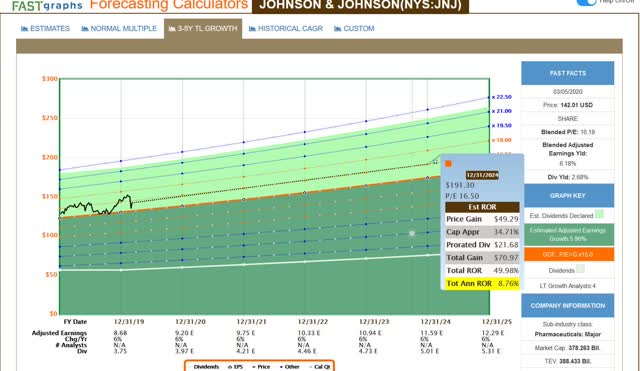

Positive valuation outlook

Through the lenses of F.A.S.T. Graphs forecasting calculator, the company’s long-term growth outlook appears positive. Should the company’s shares trade at more or less the same price-earnings multiple in five years from now and JNJ’s operating earnings expand at an annualized growth rate of around 6 percent, the shares’ fair price is going to be between $176 and $247 USD, implying 6.8 to 13.8 expected annualized share price growth rate.

Source: F.A.S.T. Graphs

The bottom line

To sum up, Johnson & Johnson is an exceptional company from a defensive industry with strong financials and positive valuation and prospects. With a dividend yield covering the current bond market’s yields more than three times, the company’s shares are more than attractive. Being among one of the top 10 global companies that invest the most in R&D and innovation and having ESG targets in place (reduction of carbon emissions by 20 percent and procurement of at least 35 percent of consumed electricity from renewable resources by the end of this year), Johnson & Johnson belongs to the top blue chips on the market.

Global Wealth Ideation, A new marketplace service focused on discovering ideas with wealth-building potential

Interested in finding out more investment decision making information? If you like access to in-depth articles, including discounted cash flow analysis, insights from equity analysis tools and prospectively much more, consider joining Global Wealth Ideation!

Join us today and get instant access to all articles and community of engaged investors aiming to benefit from growth opportunities all around the world.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Please note that this article has an informative purpose, expresses its author’s opinion, and does not constitute investment recommendation or advice. The author does not know individual investor’s circumstances, portfolio constraints, etc. Readers are expected to do their own analysis prior to making any investment decisions.

Be the first to comment