The shares of Air Products and Chemicals Inc. (APD) are down about 2% since I last wrote about the company 56 days ago, against a loss of 10.5% for the S&P 500 during the same period. Since the company has since released financial statements, I thought it would be worth looking in on the company again, in an effort to answer the question whether shares make sense to buy at these levels. For those who are too impatient to either read the title of this article, or read to the end, I’ll make the point in a sentence. The shares remain overpriced in my view, and for that reason I recommend continuing to avoid the name. That said, the put options I recommended selling in my previous article are much more attractive and I’ll be selling more of them. The premia are much higher, given general market jitters, in spite of the fact that the shares have barely budged, and there are 56 fewer days of time value. So, in sum, no to buying shares, yes to selling puts.

Financial Update

Over the past several years, Air Products has grown reasonably well in my view. Specifically, revenue has grown at a CAGR of 2.65%, and net income has grown at a CAGR of just over 6.5%.

I’m quite comfortable with the capital structure, in spite of the fact that about 65% of debt is due before 2024. First, the company has a large cash hoard on hand relative to the long-term debt which represents about 74% of total debt outstanding. Second, the interest rate on the debt is relatively low (~3.5%).

Management has treated shareholders reasonably well over the past several years, having returned just over $4.3 billion to owners in ever growing dividends. At the same time, the company has generated just under $481 million in share sales since 2015. Interestingly for a so-called “dividend aristocrat”, the payout ratio has generally declined over the past five years, from ~75% in 2015 to just over 54% as of the latest quarter.

The first quarter of FY 2020 was solid in my estimation in light of the fact that revenue was only about 1.4% higher than the same period a year ago, while operating income was 23% higher, and net income was up about 37%. Dividends per share were up about 5.5%.

As before, I think there’s little to fret about from the updated financials. Thus, if the shares are reasonably priced, I think Air Products would be a great buy.

Source: Company filings

The Stock

As I’ve written now approximately 400 times on this forum, and preached about in person more times than I can count, a great company like Air Products can be a terrible investment if the investor overpays for it. This is such an obvious point to make that I’m almost embarrassed making it, but some of the comments I receive on articles remind me that I need to reiterate the point frequently. This point is driven home easily enough by looking at the price history of Air Products over the past six months. As of this writing, an investor who bought this company mid-February would be sitting on an 11% loss. Someone who bought the stock at a much lower valuation only four months prior would be sitting on a 6% gain. The price we pay really matters. In particular, I think the more optimistically priced the company is, the more risky are the shares and the lower will be the subsequent returns. I judge the optimism or pessimism surrounding a given name in a couple of ways, ranging from the more simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value. Obviously the more an investor is willing to pay for $1 of future earnings, the more optimistic is that investor. For that reason, I like paying as little as possible for future benefits, as I set myself apart from the optimist in investing and life. In particular, I want to find companies that are trading for low valuations relative to the overall market and to their own history.

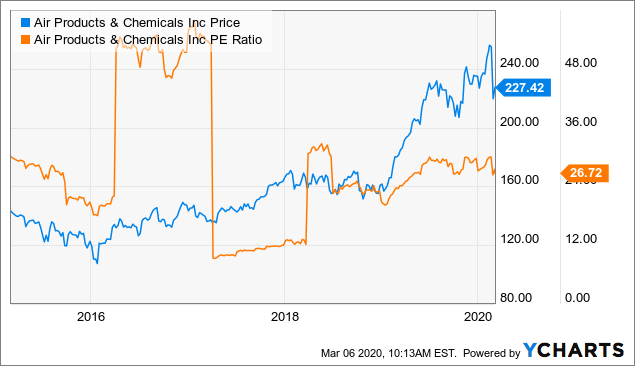

In my previous review of this company, I recommended eschewing the shares because they were trading at a PE multiple of about 29. At the moment, that ratio has come down only slightly to 26.7, so the shares remain excessively priced in my view. Within the context of a reasonably priced market, this valuation is troublesome. In the midst of current market jitters, it’s dangerous.

Data by YCharts

Data by YCharts

Options Update

The puts I recommended in my previous article (June expiry with a strike of $190) were at the time bid-asked at $1.80-$2.05, and I recommended selling them. Something is happening in the options market that on the face of it doesn’t make sense. With 55 fewer days of time value, and the shares basically flat since I wrote the last piece, those same puts are bid-asked at $4.00-$6.90. The market is obviously jittery, which is understandable under the circumstances, and I want to take advantage of that nervousness. In my view, investors with a long-term perspective need to look past the current market turmoil and exploit current sentiment in an effort to acquire quality assets at favorable prices.

For that reason, I recommend selling the same puts I did earlier. The stock would have to drop about 19% from these levels for the puts to be exercised. That price represents a more palatable forward PE of ~20 times, and a dividend yield of ~2.8%. It’s possible for the shares to get back down to that level, as they traded in that range back in April of last year.

Conclusion

Air Products and Chemicals Inc. is a great company serving a growing market, with a rock solid balance sheet. The dividend history here is obviously superb, and that dividend seems to be even more well covered now than it was any time over the past five years. In my view, there is nothing wrong with the business. The problem I had with this investment in my previous article is the same problem I have now. The shares are overpriced in my view. No matter how successful the business, overpaying for future is the definition of risk in my view, and so I must continue to avoid the shares. That said, I obviously think there’s value here, and I’d be willing to buy the business at the right price. Rather than sit around and wait for shares to maybe some day return to a more reasonable price, I will sell other investors the right to sell me Air Products at a price I’d be willing to pay. As I’ve written many times, I think this represents a win-win trade. If the shares rally from these levels, I’ll pocket some very nice premiums. If the shares fall more than 19% from these levels, I’ll be obliged to buy this dividend grower at a 2.8% yield. In my view, investing well involves keeping our heads while others panic, and having the fortitude to buy great assets at great prices. Unfortunately, Air Products isn’t trading for anything like a great price at the moment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I will be selling more of the puts described in this article.

Be the first to comment