DenisTangneyJr/iStock via Getty Images

What Stock Will Benefit The Most From Inflation?

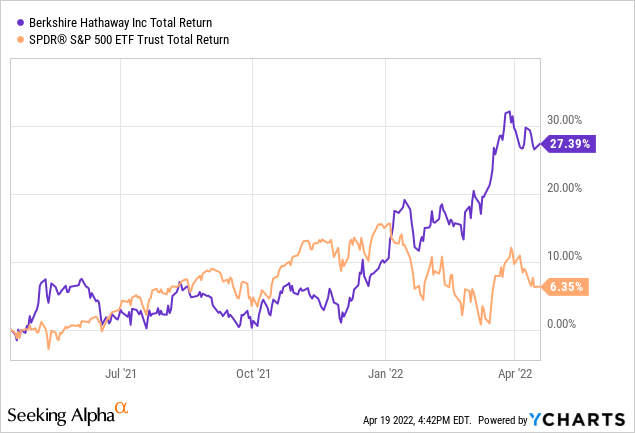

I believe Berkshire Hathaway (NYSE:BRK.B) is the best single stock you can buy to outpace inflation. I’m not the only one to recently think this, but the case practically makes itself for buying Berkshire. Berkshire has a high degree of pricing power throughout its businesses, a low cost of capital, and a P/E ratio lower than the market when you account for the value of its investments. These traits mirror Buffett’s own thoughts from the early 1980s on the best investments to make in an inflationary environment.

I became increasingly concerned about inflation early last year when Texas started to get wracked by shortages of goods, which were compounded by the 2021 freeze. I warned my readers that the massive amount of stimulus injected into the economy made an inflation spike inevitable (this actually wasn’t hard to see coming for anyone who has ever taken an intermediate-level econ class and doesn’t have a conflict of interest).

In my quest to understand which investments did best in inflationary environments, I found myself reading the work of Warren Buffett from his experiences investing in the inflationary 1970s. Interested readers can read the collected thoughts of Buffett on inflation here for guidance in these crazy times.

In the fullness of time, inflation doesn’t necessarily make stocks go up in real terms. The problem is that inflation is quite good at increasing revenue, but it does not make companies inherently more profitable. Stimulus made everyone cash rich for a bit and drove the market up, but now the bill is coming due. Low-quality stocks will provide no shelter from inflation, and investors will be hit with the double whammy of nominal losses and a loss of purchasing power due to inflation on top of it.

Buffett noted in his pieces in the 1970s that even when stocks do go up in nominal terms, federal and state capital gains taxes mean that investors tend to get crushed on “gains” that are in reality simply keeping pace with the pace of price increases. The investor experience in 2022 drives this point home – inflation continues unabated, while stocks are down, meaning that investors are losing purchasing power in nominal terms, and losing even more in real terms.

In Buffett’s 1977 Fortune article on investing in inflation:

The central problem in the stock market is that the return on capital hasn’t risen with inflation… It is no longer a secret that stocks, like bonds, do poorly in an inflationary environment.

Buffett also shared a few nuggets of wisdom on the best stocks for inflation in his 1981 annual letter, referring to it as a “tapeworm” that forces companies to retain earnings and/or sell stock to continue to operate, which drags down valuations over time.

I’ve found that a lot of things that seem like good investments in inflationary environments actually may not be. The gist from studying the 1970s and Buffett’s work from that period is that companies with lots of inventory and physical assets counterintuitively do not perform well in inflationary environments. Neither do companies that are heavily indebted, as when rates inevitably rise to combat inflation, their debt gets much more expensive, while their return on equity generally does not improve.

What Buffett said the best stocks were in the inflationary 1970s:

The first involves companies that, through design or accident, have purchased only businesses that are particularly well adapted to an inflationary environment. Such favored business must have two characteristics: (1) An ability to increase prices rather easily (even when product demand is flat and capacity is not fully utilized) without fear of significant loss of either market share or unit volume, and (2) an ability to accommodate large dollar volume increases in business (often produced more by inflation than by real growth) with only minor additional investment of capital.

When looking for individual stocks that can do well in an inflationary environment, this gives us a clear mandate. The ideal stock in an inflationary environment is a business that has pricing power and that’s not very capital/ financing intensive.

Why Berkshire Hathaway Is The Right Stock For An Inflationary Environment

Relative to the market, I feel that it’s never really a bad time to buy Berkshire. Investors tend to agree, as Berkshire’s short interest is among the lowest in the entire stock market. Today’s Berkshire is positioned to fulfill Buffett’s advice on how to succeed in an inflationary environment, roughly 40 years later.

1. Pricing power

Berkshire Hathaway invests in high-quality businesses and has a disproportionate number of investments in companies with good pricing power. Roughly 25% of the market cap of Berkshire is its shares of Apple (AAPL), which through its services business and iPhone duopoly has loads of pricing power. I’m not a big fan of Apple based on valuation concerns and exuberant earnings estimates, but buying Berkshire essentially gets you Apple for free. The correlation between Apple and Berkshire is a fairly well-known relative value trade, and one featured regularly by some of the brighter minds on Seeking Alpha (“the backdoor way to own Apple“). I think almost everyone can agree that Apple is a good business to own for the long run despite the valuation being way ahead of itself, which the backdoor trade solves.

Other large holdings include American Express (AXP) and Bank of America (BAC), which are great businesses for inflation and rising rates, respectively. The pricing power story isn’t so different for Coca-Cola (KO), which has a similar issue to Apple in that the valuation is a little high compared to the business, a problem that buying Berkshire stock instead solves.

Similarly, Berkshire’s private holdings have good pricing power and high quality as well, such as Burlington Northern Santa Fe, Berkshire Energy, and Berkshire’s sprawling insurance businesses. And lastly, Berkshire’s investment arm has good pricing power, as seen by its clever preferred and warrant deal with Occidental Petroleum (OXY), another inflationary winner.

2. Low cost of capital

One of the famous “secrets” of Berkshire Hathaway is that its cost of capital is unusually low. The key reason for this is because of Berkshire Hathaway’s insurance float, where the company constantly takes in cash in the form of insurance premiums, which they can invest until they have to pay out claims. One famous study on Buffett found that Berkshire achieves about 1.7x leverage (with no potential for margin calls) mainly using its insurance float, at a cost of roughly 3.6% less per year than the average LIBOR over the time period studied. The study also finds that Buffett has profited over time from another asset pricing anomaly known as quality minus junk, which could be a very useful hedge with the Nasdaq (QQQ) reeling.

Berkshire is unique in that it has the ability to vacuum up capital for rates far below the rate of inflation and then subsequently invest them. This means that Berkshire’s operations can benefit from a rising rate environment, a falling stock market, and inflationary pressures due to the genius design of the company.

If rates continue their rapid rise, Berkshire can invest the capital in the money markets and/or in bonds at a rate higher than they’ll likely have to pay out in insurance claims (and if they can’t, then Berkshire has always been willing to stop writing insurance in unprofitable markets, a key difference with its competitors). If rates stay behind inflation, Berkshire benefits from its ownership of companies with strong pricing power. Either way, you won’t come out too badly by investing in BRK.B stock.

3. Reasonable valuation

On paper, Berkshire trades for about 26x earnings at its current price. However, in reality, Berkshire likely trades for about half this – somewhere between 10x and 20x earnings, depending on how you count its investment portfolio and cash balances (full explanation here). There are some incredibly deep analyses you can do on this topic and Berkshire’s book value and intrinsic value, but the key point is that Berkshire’s P/E ratio is not apples to apples with other companies due to the unique nature of its business, and is in fact lower than it looks. Also, note that there’s little practical difference between Berkshire’s B-class shares and A-class shares, this is easily confirmed by running a backtest. The main reason Buffett introduced the B shares in the 1990s was to thwart Wall Street from making funds that did nothing but track Berkshire and selling them at a markup to investors who couldn’t afford the high share price.

Risks Are Moderate

1. Key man risk

No investment discussion about Berkshire is complete without discussing the inevitable. Warren Buffett is 91, while Charlie Munger is 98 at the time of writing this. They won’t live forever. Like the Queen, they’ve managed to outlive most of their critics, but their succession will be of great interest to the public. In some ways, Berkshire isn’t too different than a monarchy, because they’ve managed to institutionalize their culture around work ethic, responsible risk-taking, and investing for the long term. Berkshire has always been run as a fairly decentralized company – decisions are delegated to managers to a much higher degree than seems to be the case at other large corporations. Otherwise, it would literally be impossible to run. I can’t ignore this risk, but I think it’s quite manageable, and Buffett’s longevity has made this easier to plan for the company.

2. Macro risk

Berkshire is an exceedingly well-run company, but it isn’t immune to macro risk. I would expect Berkshire to outperform the market, but the macro backdrop isn’t great right now, so if we enter a full-on recession and bear market, then it’s unlikely that BRK.B stock will be up while the market is down big. In the long run, however, Berkshire has shown through the years that its strong financial position brings opportunities to buy back stock or make acquisitions, creating value in the long run.

Best Investments For Inflation: Honorable Mentions

1. I-Bonds. You only get $10,000 per taxpayer per year, but it’s the closest thing to a free lunch you can get as a risk-free inflation hedge, currently paying about 8% annualized. Buy through the U.S. Treasury itself. You’re required to hold them for one year. Our article series focuses on individual stocks, but if you aren’t aware of these bonds, they’re worth knowing about.

2. Vanguard Commodity Fund (VCMDX). Vanguard’s quantitative equity group has a really thoughtful commodity fund that combines commodity futures, awareness of contango/backwardation, and TIPs into one product with a 20 basis point annual fee. This is the other best inflation hedge around besides I bonds. The downside is that they have a $50,000 minimum as far as I know, so you’d need about 10 to 20x that in assets for it to be a useful hedge and have it not dominate your portfolio.

Bottom Line

There are stocks that can do better in a certain kind of inflationary environment than BRK.B (for example if you in advance knew oil was about to skyrocket you could buy something exposed to that). But I don’t think you can find a better all-around stock for an inflationary environment than Berkshire Hathaway, and as a bonus, owning the stock doesn’t require you to correctly forecast the macro environment to profit.

Be the first to comment