FG Trade

August 4th proved to be a rather bad day for shareholders of Warner Bros. Discovery (NASDAQ:WBD). After the company announced financial results covering the second quarter of its 2022 fiscal year, which is the first quarter in which both WarnerMedia and Discovery have been merged into one, shares of the business plunged after hours because of the direction the company seems to be taking. Moving forward, management still maintains that they have high expectations for the enterprise. They are most definitely taking some transformative steps aimed at achieving their goals. But at the same time, there is a tremendous amount of uncertainty about what the future holds. Add on top of this the fact that shares of the enterprise are not precisely cheap compared to similar players and there just seems to be no real reason to place a vote of confidence in the company at this time.

Streaming uncertainty

Leading up to the company’s earnings release, I wrote an article detailing what things investors should keep an eye out for. The primary emphasis was on the streaming side of the business. I was interested in how both HBO Max (inclusive of legacy HBO) and discovery+ would grow at a time of tremendous uncertainty in the streaming space. I was also concerned about other aspects that I would get to shortly. First and foremost, we should address the elephant in the room. And that is that Warner Bros. Discovery did report an increase in the number of subscribers… kind of.

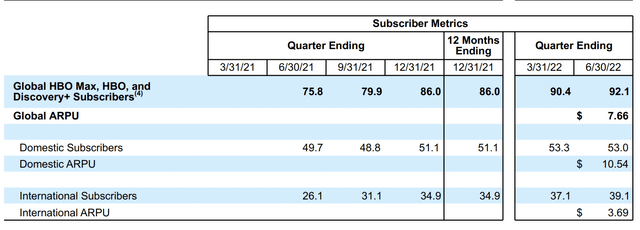

During the second quarter, the company tallied 92.1 million subscribers across its streaming services. This represented an increase of 1.7 million over the 90.4 million the company had one year earlier on a pro forma basis. And it was also up 16.3 million, or 21.5%, compared to the 75.8 million reported for the second quarter of the company’s 2021 fiscal year on a pro forma basis. For those who follow these numbers closely, something should immediately seem off. At the end of the first quarter of this year, AT&T (T) reported that HBO Max had 76.8 million subscribers, while Discovery reported that discovery+ had 24 million. Added together, this comes out to 100.8 million. The big disparity here lies with how Warner Bros. Discovery has decided to define subscribers moving forward. This new definition resulted in the exclusion of around 10 million legacy Discovery non-core subscribers and unactivated AT&T mobility subscribers.

Digging deeper, there is another issue that investors should pay attention to. And that would be the composition of the subscriber base. Total domestic subscribers in the latest quarter across its ecosystem came out to 53 million. This is actually down from the 53.3 million reported one quarter earlier. Internationally, its subscriber base rose from 37.1 million to 39.1 million. This matters because it confirms weakness in the domestic market. That is problematic because of the difference in profitability between a domestic subscriber and an international one. Domestic subscribers in the latest quarter resulted in average revenue per month for the company of $10.54. By comparison, international subscribers resulted in average revenue per month of just $3.69. To put this in perspective, to make up for a decline of 0.3 million subscribers in the domestic market, the company must add nearly triple that number internationally.

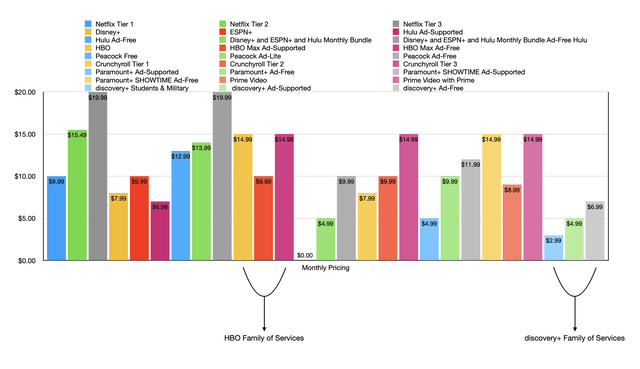

Management also had another interesting development to share with investors. And that relates to their plans for the future. Previously, it had been hinted at that the company might combine their two main streaming platforms. I warned against that because I saw the platforms as being significantly different from one another. Even management recognize that in their second earnings call, saying that HBO Max has a ‘competitive feature set’ while being hit because of performance and customer issues. And when it comes to discovery+, they described the platform as a best-in-class performance with strong consumer ratings but limited features for its user base. My own concern is a little more fundamental. Namely, discovery+ is positioned as a low-cost value platform with a smaller amount of niche content, while HBO Max has built its business around being a premium platform that has a hodgepodge of largely quality offerings.

Regardless of my concerns, management believes that this is the best course of action moving forward. Their current goal is to roll out their new combined offering under a single brand, starting with its launch in the US next summer. This will be followed by its launch in Latin America later that year, followed by its expansion into European markets where HBO Max is already present in early 2024. The platform will eventually launch in key Asia Pacific territories and some new European markets later that year. This does not mean that the company is starting from scratch. Rather, they will transition customers from their existing offerings onto this new service, with the goal of hitting 130 million global subscribers by 2025. Their target school for the platform to break even by 2024, with EBITDA eventually hitting $1 billion by 2025. To put this in perspective, EBITDA in the latest quarter was negative to the tune of $560 million. That implies an annualized rate of negative $2.24 billion.

There are other warning signs that investors should be cognizant of. Management stressed that they would be focused on producing quality over quantity content. That alone is fine, but to have to make that distinction when other streaming services are producing both is disconcerting and further illustrates the company’s unsavory position as a second-rate or third-rate platform provider. They also expressed concern about the existing streaming space, complaining that collapsing all windows into streaming, overpaying for and over-investing in content, and offering it all at the same time for a low price, is not the way to go. Although some may take umbrage with this description, this seems to further solidify the company’s goal of remaining a premium platform, which could ultimately come at the cost of many of the current discovery+ subscribers that it has. There’s also the fact that, as the chart above illustrates, Warner Bros. Discovery already has pricing for its services that could be considered near the very top end of what other non-bundled services charge. So it remains to be seen what will transpire if the company tries to push the envelope further through price increases.

Not everything was bad from Warner Bros. Discovery

Outside of streaming, there were some other interesting developments for investors. For starters, the company reported net debt of $49.91 billion. This translates to a net leverage ratio of 5, which matches with the company said it would have immediately following the merger. Having said that, the company has been paying down debt, with $3.5 billion associated with its outstanding term loans due in 2023 and 2025 being paid down during the quarter. The company’s ultimate goal is to pay down debt by $6 billion by the end of August. The firm is also setting the goal of achieving $1 billion in annual cost savings over the next 12 months. This plays into the $3 billion in synergies the company said they would eventually capture. But it looks like $2 billion to this will take place after this 12-month window comes to pass.

| Company | EV / EBITDA |

| Warner Bros. Discovery | 8.4 |

| Netflix | 18.0 |

| Paramount Global | 8.2 |

| The Walt Disney Company | 23.3 |

| Comcast | 7.3 |

Another thing to also consider about the company is that shares are not exactly pricey at this time. Using 2021 pro forma figures, the company is trading at an EV to EBITDA multiple of 8.4. If we assume that shares will drop by about 12% in response to this earnings release, as after-hours data shows, this multiple comes in at 7.9. As you can see in the table above, major platforms like Netflix and The Walt Disney Company (DIS) are trading materially higher right now. But the pricing for Warner Bros. Discovery it’s not all that different from other second-string players like Comcast (CMCSA) and Paramount Global (PARA). So although shares look affordable at this time, it does look as though you can find similarly priced competitors that don’t have as much uncertainty about the future as Warner Bros. Discovery does.

Takeaway

Based on all the data provided, I will say that I remain intrigued about the potential prospects of Warner Bros. Discovery. Having said that, I have no interest in investing in it at this time. The company is going through a significant transition and it’s unclear how everything will shape out. Revelations regarding the streaming side of the equation are particularly worrisome to me. And if investors want a cheap streaming provider, there are alternatives out there.

Be the first to comment