Hispanolistic/E+ via Getty Images

Shares of Advance Auto Parts (NYSE:AAP) have fallen about 20% as the business has proven not to be entirely recession resistant. Still, the business is far less cyclical than the retail industry as a whole. With a strong balance sheet, solid free cash flow generation, and secular tailwinds, AAP has positive fundamental dynamics. At just 13x earnings with a 3.5% yield, this is an attractive, relatively defensive stock with meaningful upside.

In the company’s second quarter, it reported record adjusted EPS of $3.74, up 10% from last year. While earnings rose solidly, net sales rose just 0.6% to $2.7 billion, and same-store sales growth was -0.6%. Part of this was due to a strategic shift to sell more of its own brands, which are lower-priced but keep customers coming to Advance Auto Parts vs other auto parts retailers. The company’s margin performance was excellent given the stagnant revenue. Adjusted gross profit was up 4.2% to $1.3 billion with 166bp of margin expansion to 48%. Adjusted operating margin came in at 11.7% and was the highest in seven years. During the quarter, AAP returned $291 million to shareholders, buying back $200 million with $1.1 billion remaining under its authorization.

That said, the company is seeing some pressure from the softening economy. On the professional side of the business, AAP continues to register growth and as a result is holding price, willing to sacrifice some volume to maintain margins. There has been some weakness in the do-it-yourself (DIY) side of the business as declining real incomes amid high inflation cause consumers to defer some discretionary projects. There are some DIY car projects that have to be done (i.e. replacing a battery), and AAP is seeing no impact here. However, there are some “fun” projects, like repainting a car or adding an accessory, and sales here have fallen.

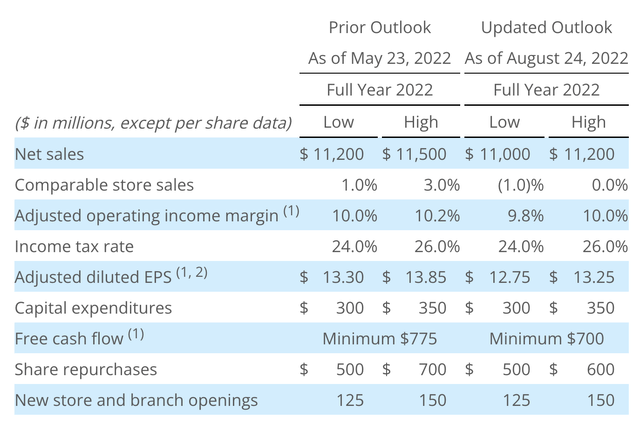

As a consequence, management has taken down guidance, reducing the midpoint of sales by about $250 million (2%) with same-store sales expected to be slightly negative. Adjusted EPS is now expected to be about $13, and the company expects to generate over $700 million in free cash flow from $775 previously. Given its conservative balance sheet policies, share buybacks will be slightly lower, at about $550 million.

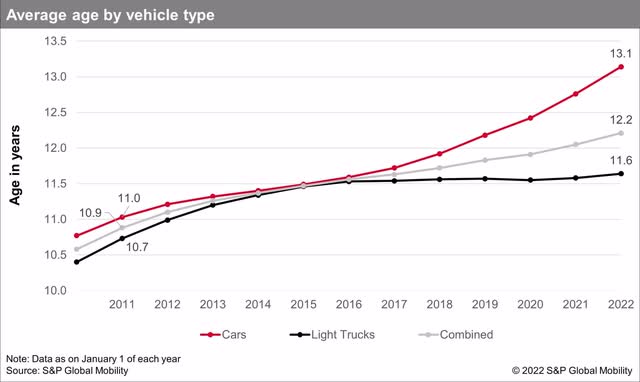

Compared to other retailers, like Target (TGT) or Nordstrom (JWN), AAP’s guidance reduction is relatively small, reflecting the fact there is a significant nondiscretionary aspect to auto parts as sometimes cars break down and simply need to be fixed. In fact, there can be a counter-cyclical aspect to this business. In general, older cars are more likely to run into issues than new ones. With new cars more expensive and production constrained by semiconductor issues, the age of cars on the road has continued to extend, now at a record 12.2 years. An older fleet is likely to support demand for parts.

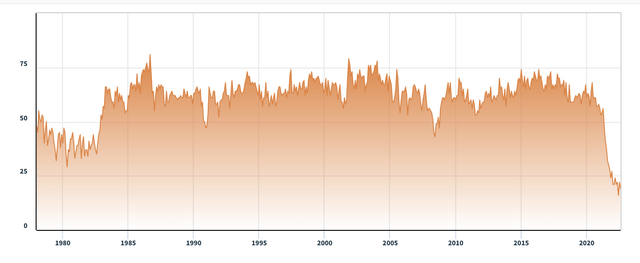

At some point, individuals can be confronted with a decision: do they keep fixing up the car they have or do they a buy a new one. According to the University of Michigan consumer sentiment survey, consumers have never felt it is a worse time to buy a car. Lingering supply chain issues have increased new car prices and limited choice. Combine that with uncertainty about the future, and many consumers would rather than spend $300 fixing their car than spending $30,000 on a new one.

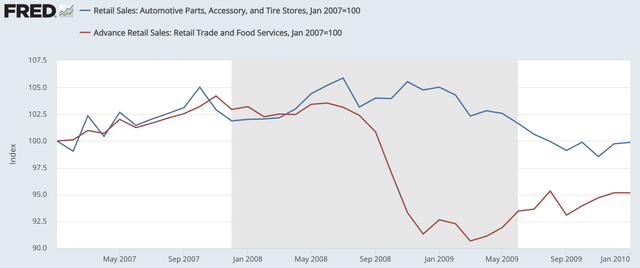

This theoretical argument for why the auto parts business can hold up well in a recession may sound convincing, but more importantly, it has played out. During the 2008 recession, retail sales fell over 8% from January 2007 levels while auto parts sales remained within 1% of that level.

Since the start of COVID, auto parts sales have continued to rise and are not showing the same headwinds as in more discretionary parts of retail. With consumers in no rush to buy new cars and the fleet of cars older than ever, the outlook is fairly bight in my view.

Many of these DIY projects are deferrable more than they are purely discretionary and will occur at some point. Management expects it will get DIY transaction growth in 2023 after the current patch of softness, and I would agree. As evidenced by this quarter, the company is also holding margins up well. It has deployed new tools and is already seeing progress matching labor hours with transaction volumes to increase productivity. Unlike other retailers who over-ordered, its inventories are up just 4% year to date. It does not have to push out product and is positioned to maintain prices.

So far this year, the company has generated $97 million in free cash flow, but it has faced $175 million of working capital headwinds, and most of its cap-ex was spent in H1. As these normalize in H2, I view the $700 million FCF target as very achievable this year.

AAP just carries $1.3 billion in debt, less than 2x free cash flow, and its cash flow-funded buyback program has been able to reduce the share count 6.8% to 60.8 million. Advance Auto Parts is well positioned to pursue moderate buybacks on top of its 3.5% dividend, which it has been growing aggressively since 2020.

Even at its reduced guidance, AAP is trading just 13x earnings. Given the nature of the business, I do not expect AAP to be entering a series of downward earnings revisions. An aging auto fleet should provide secular support for the auto parts business, and auto parts sales tend to hold up well during recessions. As deferred DIY projects materialize next year, I expect sales to be up low-single digits, which should support 2023 EPS of $13.25-$13.75. As investors grow comfortable with AAP’s limited cyclical exposure and the favorable secular environment, I believe shares can move back to at least a 15x multiple, which would push shares back over $200, or up about 20%. For investors who worry about the economy, AAP is a good investment that offers upside with limited macroeconomic sensitivity.

Be the first to comment