CHUNYIP WONG/E+ via Getty Images

A turbulent history has taught Chinese leaders that not every problem has a solution and that too great an emphasis on total mastery over specific events could upset the harmony of the universe. – Henry Kissinger

Introduction

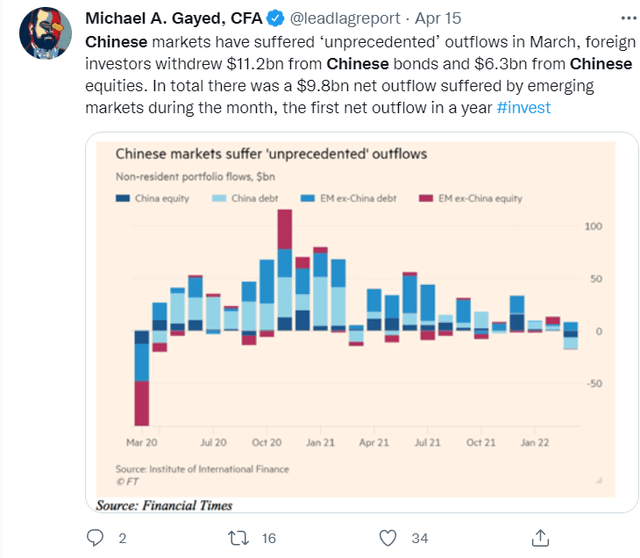

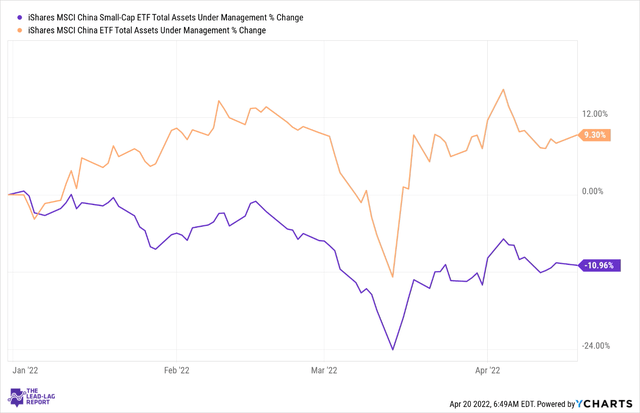

Last week, followers of The Lead-Lag Report would note that I had put out some data highlighting the degree of fund outflows that the Chinese markets witnessed recently; well, the ETF, I’ll be reviewing today – the iShares MSCI China Small-Cap ETF (NYSEARCA:ECNS), has been one of the investment products that has had to take it on the chin, as evidenced by the double-digit decline in AUM (conversely on a YTD basis, the flagship iShares MSCI China ETF) has held up relatively well, with the AUM actually growing by 9%.

Coming back to ECNS, if it wasn’t obvious from the title, the ETF provides exposure to small-cap Chinese equities (around 277 in total).

The Chinese landscape

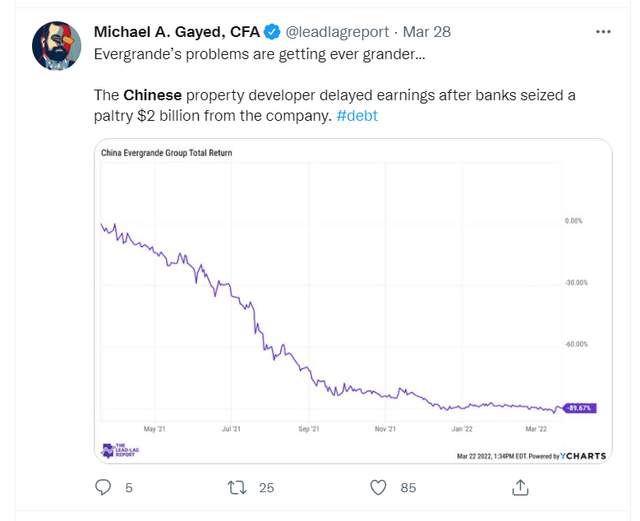

I believe there are a couple of reasons why ECNS has come under some heavy onslaught, and I do wonder if there’s ample optimism to reverse course. Firstly, note that the sector with the largest weight in ECNS is the real estate sector, and this has proven to be a terrain where things are in a real slump. You can’t dismiss the impact this has had on the broader economy, as it typically accounts for one-fourth of Chinese GDP.

Official data, which came out a couple of days back, showed that the sector contracted for the third straight quarter, with March’s 29% decline in new home sales proving to be the worst decline in 7 months (sales have also been sliding for all seven months). Sadly, the recent zero-COVID policy and the associated lockdowns have made things only worse in recent weeks. According to property consultant – Tospur, an important housing market such as Shanghai has been badly hit with a dozen new-home projects that were due to go on sale being postponed. As noted in The Lead-Lag Report, major property developers in China have been facing liquidity crunches even as banks tighten the noose around their necks.

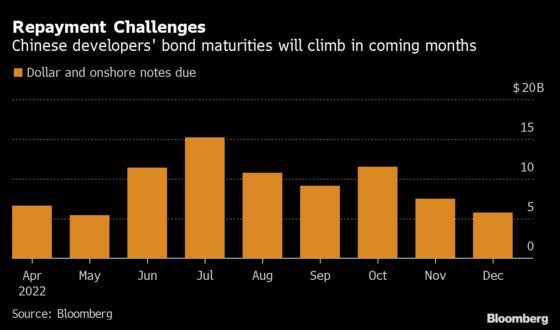

Last month, we saw a lot of these distressed players delay earnings, but if you thought things are likely to ease off, think again as the months of June and July will put even more pressure on the liquidity situation with potentially $25-$30bn of dollar and offshore notes due then.

Bloomberg

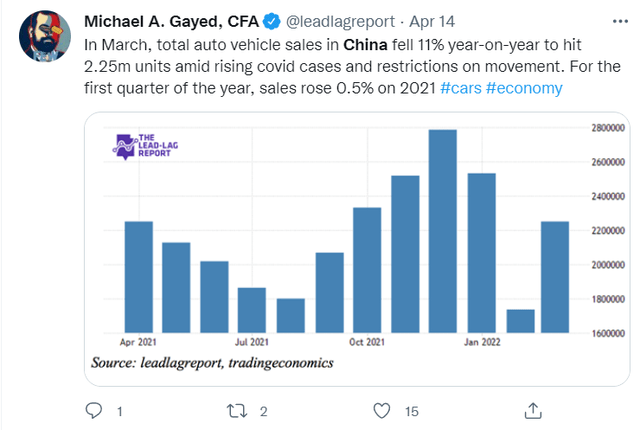

It isn’t just the real estate sector, these recent lockdowns have also had a pronounced impact on auto sales which fell by 11% there. Members of China’s automobile association expect a similar trend to persist in April as well.

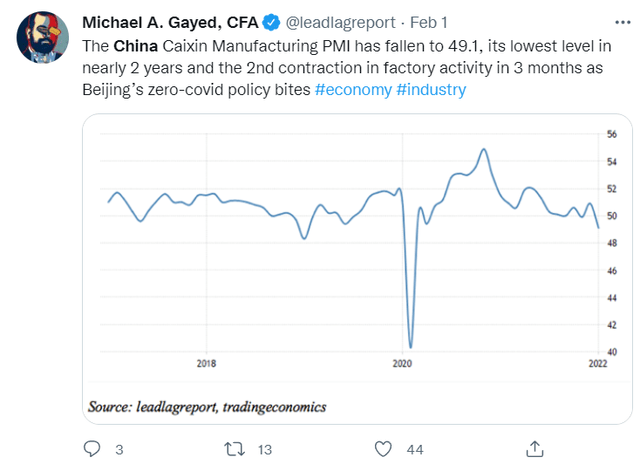

Beyond autos, the malaise has spread to broad manufacturing. A couple of months back, I had highlighted how the Caixin manufacturing PMI looked bad enough at 49.1, even as the zero-covid policy had just begun to kick in. Well, the latest reading in March was a lot worse at 48.1 and points to some difficult times ahead.

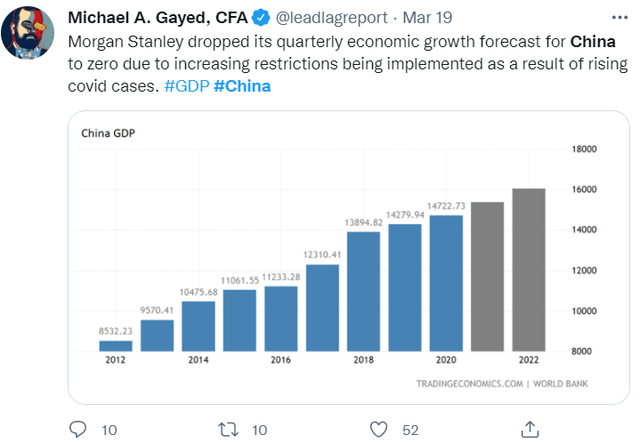

All this has prompted, leading fund houses to slash their GDP forecasts and when the growth runway tails off, you can’t expect skittish global fund flows to stay wedged in China. Morgan Stanley has scaled down its FY growth rate from 5.1% to 4.6%, whilst Citigroup thinks that the Q2 impact alone could be as much as 0.9%.

Besides all these macro-economic factors, one theme that hasn’t been publicized an awful lot is the growing risk of China invading Taiwan. This is something I’ve been highlighting off late. In fact, if you keep abreast of developments on the timeline of The Lead-Lag Report, you’d note that I recently held a long discussion with Chris Fenton who’s well versed with the ground-level conditions in China.

The recent Russian invasion of Ukraine would have likely emboldened China to take similar steps with Taiwan and it’s no coincidence that we’re seeing China also cozying up with Russia, even as it ruffles the feathers of the US. This is something of an underappreciated risk, but I believe it has the potential to cause further havoc in stimulating volatility levels across the global markets.

Conclusion

As you may have gleaned from the commentary provided above, there are a lot of risks circulating around ECNS, but what I can say in favor of this ETF is that valuations are remarkably cheap and if you’re a value-conscious investor who has the appetite and wherewithal to ride through strong bouts of volatility, this product ought to be on your watchlist. Just for some perspective, this ETF currently trades at a remarkably low forward P/E of just 5.2x! In contrast, something like the iShares MSCI China ETF (MCHI) trades at almost twice that figure at 10.3x. You also have to consider that the Chinese authorities are unlikely to lie still and let the economy rot. Recently, the central bank unveiled a slew of measures to boost the economy, and I would imagine there would be more in store to stave off the impact of the recent lockdowns.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment