blackdovfx/E+ via Getty Images

Elevator Pitch

I rate Ambarella, Inc.’s (NASDAQ:AMBA) shares as a Hold. In fiscal 2025 (YE January 31), I see AMBA achieving a key revenue milestone with its sales exceeding $500 million; and the company is also expected to generate positive GAAP earnings in that year. But this isn’t the time to buy AMBA’s stock. Ambarella currently trades at a huge premium to its peers, and the stock is at risk of valuation de-rating given its inferior EBITDA margins on a relative basis. In a nutshell, I think a Hold rating is the most appropriate for AMBA.

Who Are Ambarella’s Competitors?

Ambarella calls itself “an artificial intelligence semiconductor company” in its June 2022 investor presentation slides. In its media releases, AMBA highlights that its “products are used in a wide variety of human and computer vision applications.”

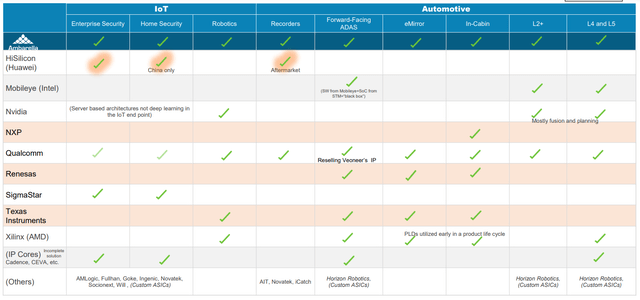

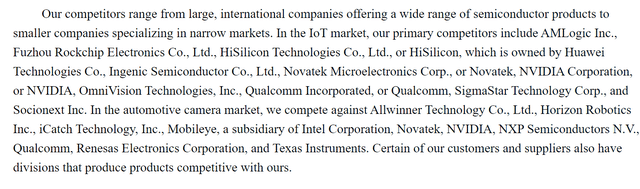

AMBA provides a long list of its competitors in the company’s FY 2022 10-K filing, which is highlighted below.

Ambarella’s Competitors As Listed In Its 10-K Filing

As per its June 2022 investor presentation slides, the company has also mapped out its competitive landscape as shown in the chart below.

AMBA’s Competitive Landscape As Per Investor Presentation

AMBA’s June 2022 Investor Presentation

To narrow down the list of AMBA’s competitors to those that really pose strong competitive threats, it is necessary to review Ambarella’s recent investor calls to see which companies are mentioned by AMBA’s management.

At the Bank of America (BAC) Global Technology Conference on June 8, 2022, Ambarella mentioned that “we compete with the TIs or Texas Instruments (TXN) and the Renesas Electronics (OTCPK:RNECF) (OTCPK:RNECY) [6723:JP] type of suppliers” for certain “automotive applications” such as “recorders.” AMBA also shared at the recent Bank of America Global Technology Conference that we are competing with NVIDIA (NVDA), QUALCOMM (QCOM) and Mobileye” in the area of “ADAS and Level 2+ cars.” Notably, Ambarella also previously referred to NVDA and QCOM as competitors at the Q1 FY 2023 earnings call on May 31, 2022 and its 2022 Capital Markets Day on January 4, 2022.

With a clear idea of who are AMBA’s key rivals, it is worth doing a peer comparison to see how Ambarella matches up to its listed competitors, which is covered in the next section of this article.

AMBA Stock Key Metrics

AMBA is valued by the market at a premium to its peers based on the forward EV/EBITDA and normalized P/E valuation metrics as per the peer comparison table presented below.

Ambarella’s Peer Valuation Comparison

| Stock | Consensus Forward Next Twelve Months’ EV/EBITDA Multiple | Consensus Forward Next Twelve Months’ Normalized P/E Multiple | Consensus Current Fiscal Year Revenue Growth Rate | Consensus Forward One Fiscal Year Revenue Growth Rate | Consensus Current Fiscal Year EBITDA Margin | Consensus Forward One Fiscal Year EBITDA Margin |

| Ambarella | 38.8 | 57.8 | +5.8% | +24.2% | 18.1% | 21.8% |

| NVIDIA | 24.4 | 28.3 | +26.0% | +16.8% | 43.6% | 45.8% |

| Texas Instruments | 12.9 | 17.4 | +5.5% | +2.0% | 56.0% | 56.6% |

| QUALCOMM | 7.0 | 9.3 | +33.1% | +7.4% | 42.7% | 40.5% |

| Renesas Electronics | 5.6 | 6.0 | +88.1% | -1.3% | 40.4% | 40.2% |

Source: S&P Capital IQ

Ambarella has the weakest profitability among its peers as evidenced by its consensus forward EBITDA margins. On the flip side, AMBA boasts the fastest expected revenue growth rate in the peer group in the next fiscal year.

In recent times, investors are placing a strong emphasis on profitability (instead of topline expansion), as seen with the sharp pullback in the share prices of many unprofitable listed companies. In that respect, AMBA might not be able to sustain its valuation premium relative to its peers, considering its relatively lower EBITDA margins notwithstanding stronger revenue growth.

Where Will Ambarella’s Stock Be By 2025?

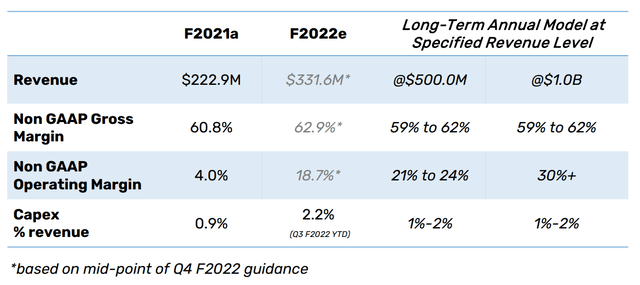

At the company’s Capital Markets Day in early-January 2022, Ambarella outlined the company’s long-term financial targets, including key revenue milestones, like $500 billion and $1 billion without specifying a specific timeline.

AMBA’s Long-Term Financial Targets

AMBA’s Capital Markets Day Presentation

Based on the Wall Street’s consensus financial projections obtained from S&P Capital IQ, Ambarella is forecasted to meet the company’s first key sales milestone ($500 million) in fiscal 2025. The sell-side’s consensus estimates point to AMBA achieving a topline of $556 million in FY 2025, while delivering a gross margin of 62.3% and an EBIT margin of 23.4% in the same year. The consensus profitability expectations are in line with the company management’s profit margin guidance (21%-24% operating margin; 59%-62% gross margin) corresponding to a revenue of half a billion dollars as highlighted in the chart above.

More significantly, fiscal 2025 is the year that the sell-side analysts see Ambarella achieving profitability on a GAAP basis.

It seems realistic for Ambarella’s revenue to exceed $500 million in fiscal 2025. AMBA’s consensus FY 2025 revenue of $556 million translates into an FY 2023-2025 topline CAGR of +18.8%. This is aligned with the company’s 2022 Capital Markets Day guidance of its Serviceable Addressable Market or SAM growing by a “high-teens” CAGR for the FY 2023-2028 period. Assuming Ambarella can gain market share from competitors, it might be able to beat the industry’s growth rate in the “high-teens” percentage level. In other words, Ambarella’s consensus sales projection for FY 2025 is achievable.

Separately, AMBA’s margin expansion appears to be reasonable. Ambarella noted at its January 2022 Capital Markets Day that the expected improvement in its profitability with a larger revenue base is driven by the company’s expectations that its “computer vision revenue will continue to rise” and enable it to “achieve a positive operating leverage.”

Is Ambarella A Good Long-Term Investment?

A company has to be evaluated based on the growth and valuation criteria to determine if it is a good investment for the long term.

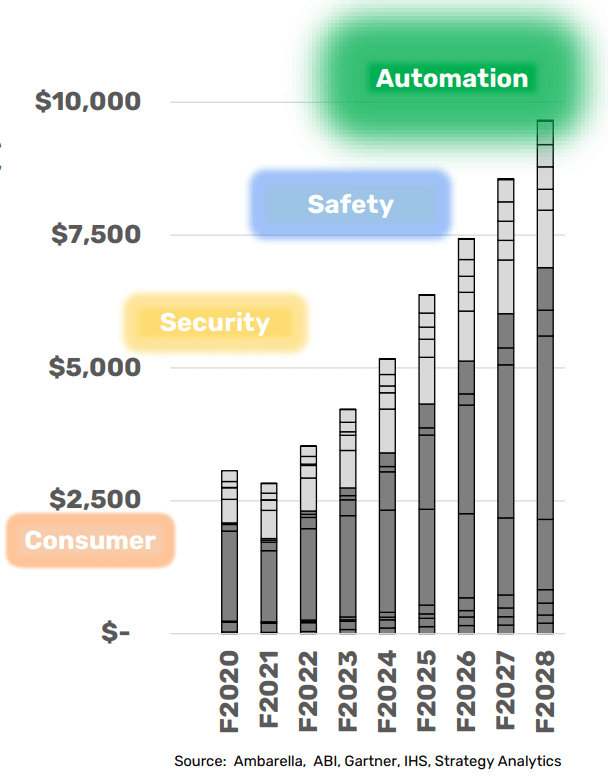

In terms of growth potential, Ambarella’s long-term revenue goal of $1 billion is only around 10% of the company’s estimated FY 2028 Serviceable Addressable Market or SAM of close to $10 billion as per the chart below.

Ambarella’s Estimated SAM

AMBA’s Capital Markets Day Presentation

Moreover, Ambarella’s current trailing twelve months’ revenue of $352 million (as per S&P Capital IQ) is less than 4% of its $10 billion SAM. This gives the company the confidence to guide at its Capital Markets Day that its FY 2023-2028 topline CAGR will be better than a high-teens percentage growth rate.

On the flip side, AMBA’s valuations are expensive on both an absolute and relative basis, as discussed in an earlier section of this article. In other words, Ambarella’s robust revenue growth outlook has already been priced into valuations. More importantly, there is downside risk to Ambarella’s valuations in the current environment where valuation multiples are compressing and investors are not favoring loss-making companies (AMBA is still unprofitable on a GAAP basis).

Is AMBA Stock A Buy, Sell, Or Hold?

AMBA stock is a Hold. I like the company’s growth outlook, but I find its valuations unattractive. Ambarella will only achieve positive GAAP profits and meet its revenue goal of $500 million in FY 2025, so it seems too early to be bullish on the stock now.

Be the first to comment