sturti/E+ via Getty Images

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Telecommunication Services? Download my research for free here.

The Fed appears to have lost control of inflation, and is ratcheting up rates pushing the economy closer and closer toward a recession. This has driven government bond yields to their highest since 2007 on the eve of the great recession and growth stocks with huge P/Es have plunged as investors become weary of highly-leveraged stocks.

This chaos and uncertainty have also had an impact on firms with good valuations and profitable histories, creating opportunities for savvy investors prepared to take a contrarian view, and can see deep value where others can’t.

One industry where value has begun to emerge is the Telecommunications industry, which has been dragged down by the Communications Sector due to overvalued software and entertainment companies being shunned by investors in the rout.

Unfortunately, this market will also expose firms that deserve a discount from premium valuations that can’t be justified.

Today’s analysis will be looking at BCE Inc. (NYSE:BCE), a Canadian telecommunications and media company, providing wireless, wireline, Internet, and television services to residential, business, and wholesale customers.

For those unfamiliar with my analysis methodology, you’ll find in-depth explanations for my research in an earlier piece relating to AT&T (T).

(Data & prices correct as of pre-market 20th September, 2022)

(Top Integrated, Wireless & Alternative Telecommunication Services Stocks referred to can be found on this Seeking Alpha screener)

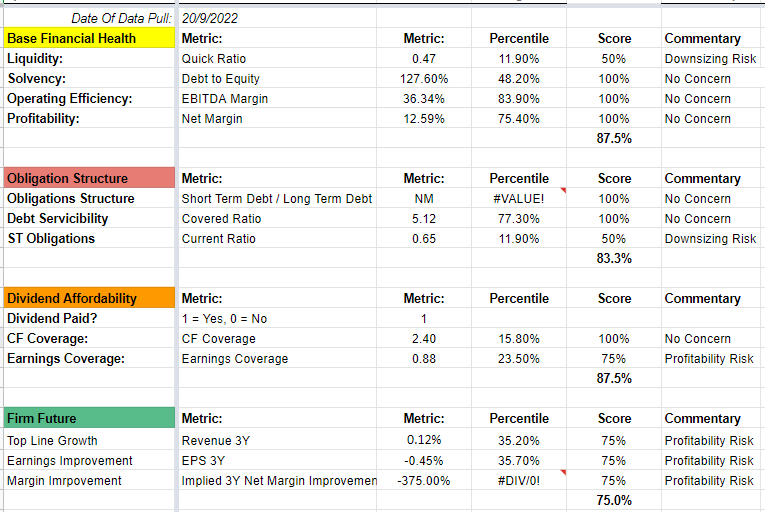

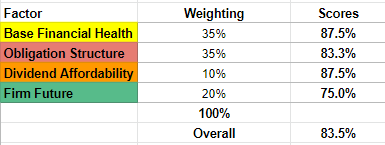

BCE Inc.’s Base Financial Health

Kicking off our analysis is a look at the firm’s overall financial health. Immediately we see liquidity is an issue in the event of a worst case scenario, and further along we see concerns around the balance of short terms assets & obligations, earnings coverage of dividends and the firm’s future profitability.

Author

These combined metrics give us a number of concerns, not immediately grave, however this creates a difficult operating environment for the firm to trade its way out of any difficulties it may face as the economy tightens.

Author

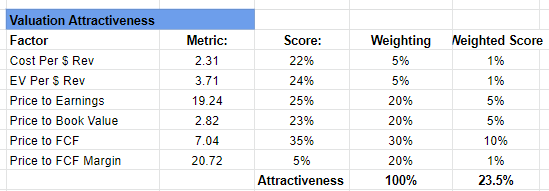

Assessing BCE Inc.’s Pricing Attractiveness

Next, we look at the broad valuation attractiveness of BCE by scoring its valuation metrics and comparing them to the industry peer group.

Unfortunately for BCE, there’s not a great deal of value here compared to other telecommunications firms, with price to free cash flow margins showing the greatest weakness, and no metrics scoring better than 35%, leading us to a weighted overall score of 23.5%.

Author

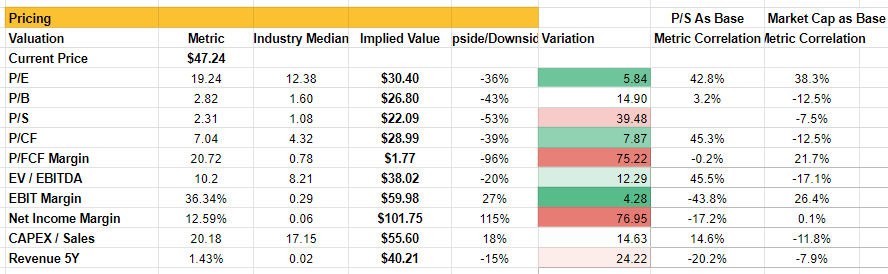

Finding An Appropriate Valuation Method For BCE Inc.

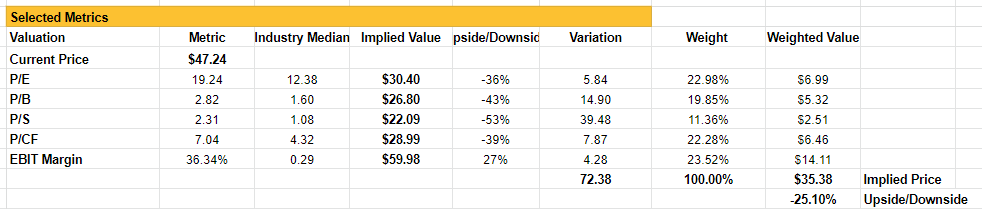

Our final task is to try to find an appropriate pricing mechanism for the industry according to the market, and then calculate what the market believes is a fair valuation for BCE. Thankfully we can rely on our previous estimations of the industry’s pricing mechanism and shortcut the work required here.

Author

Finally, we arrive at a bearish outlook for BCE, with an implied price of $35.38, representing a 25.1% downside risk, driven mostly by an overvaluation by P/E.

Author

Closing Remarks

Given the troubles facing the financial health of the firm, it’s hard to see how the market will justify its current valuation as the risk-reward profile is skewed more towards the risk side.

While the market pricing mechanism might imply a $35.38 price target, I imagine investors will require a further discount as recession fears drive more uncertainty around firms carrying large debts and unsustainable financials.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firms financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the industry as a whole but does not consider the market as a whole (i.e., the S&P 500) and does not break down a near-peer comparison. Investors should use this analysis as perhaps a base-line for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

(If you would like a more detailed analysis of BCE’s financials and operations, I recommend reading “BCE Inc.: Get Out Now”)

Be the first to comment