Feverpitched

Thesis

MPLX LP (NYSE:MPLX) is a highly profitable midstream company that mainly supports Marathon Petroleum Corporation (MPC). It derives most of its adjusted EBITDA from its Logistics and Storage (L&S) segment, which accounted for 67% of MPLX’s Q2 adjusted EBITDA. L&S is also the more profitable segment, with an adjusted EBITDA margin of 41.8%. In addition, the company also has a Gathering and Processing (G&P) segment which has benefited from higher NGL prices and more robust volumes in Q2.

It’s important for investors not to understate the income visibility provided by its partnership with MPC. It has allowed MPLX to leverage a mutually beneficial relationship, providing strong visibility on contract rates. Therefore, it has afforded significant assurances to investors on the stability of its profitability. As a result, MPLX should be able to continue providing investors with a stable dividend payout that yielded more than 10% (on an NTM basis) after the recent pullback.

Notwithstanding, we would like to remind investors to consider potential demand destruction challenges that could affect the profitability of its G&P segment moving forward. Despite that, MPLX’s midstream assets are likely less vulnerable than its upstream and downstream players from underlying energy price volatility. Therefore, we believe that MPLX should be able to sustain its strong profitability profile moving ahead.

Furthermore, while MPLX has outperformed the broad market YTD, it has underperformed the SPDR Energy ETF (XLE) significantly, given its operating model.

Hence, we believe the market is unlikely to de-rate MPLX substantially unless energy prices collapse dramatically, leading to significant profitability issues. Also, we believe the structural constraints should keep prices relatively high. Accordingly, we view the probability of such a worst-case scenario as highly unlikely for now.

With a dividend yield that has improved to 10% from its recent pullback and robust profitability, we rate MPLX as a Buy.

MPLX Will Not Be Immune To A Recession

Despite the visibility in MPLX’s revenue and income model, MPLX is mindful of the impact of a recession that could impact its utilization. The company also accentuated in its Q2 earnings call that it would monitor the developments, even though management remains confident. CEO Mike Hennigan articulated:

The demand question is obviously one that we continue to monitor. And I guess at the end of the day, we’re still pretty bullish on what we’re seeing across the commodities. We’re still mostly at pre-pandemic levels across the system. So we think there’s still room to run on the demand side. Inventories are still constructive. So low cost, strong reliability and we’ll take what the market offers as far as margins. And right now, it’s hard not to still be constructive. Demand is looking good. Inventories are low. It’s still a pretty constructive environment for us.

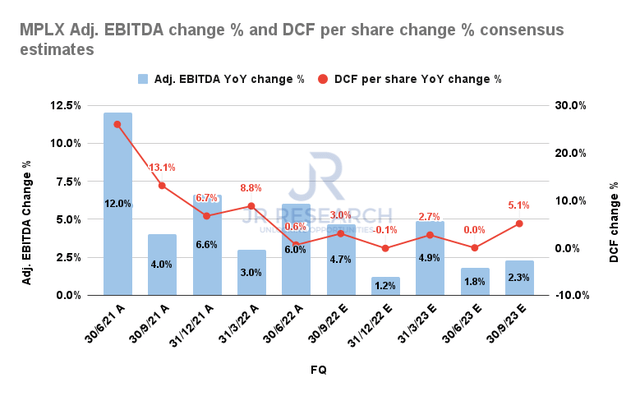

MPLX Adjusted EBITDA change % and Distributable cash flow change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that MPLX’s adjusted EBITDA growth metrics remain robust through FY23. Therefore, the Street is not modeling a marked impact on its profitability, even though growth is expected to slow from FY21’s recovery. Accordingly, investors should expect the increase in MPLX’s distributable cash flow (DCF) to remain stable, offering stability in their distribution.

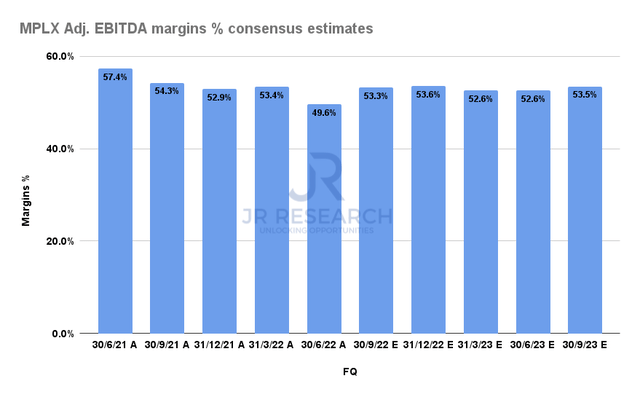

MPLX Adj. EBITDA margins % consensus estimates (S&P Cap IQ)

Accordingly, MPLX’s adjusted EBITDA margins are expected to remain stable through the cycle, lending credence to management’s confidence.

We are cautiously optimistic about management’s confidence and believe that MPLX’s long-term contracts should continue to provide stability in its profitability outlook.

Notwithstanding, MPLX is not immune to a severe downturn that could impact energy prices drastically. However, structural constraints are expected to continue supporting the pricing dynamics in the underlying markets. Therefore, we believe the consensus estimates are credible.

Is MPLX Stock A Buy, Sell, Or Hold?

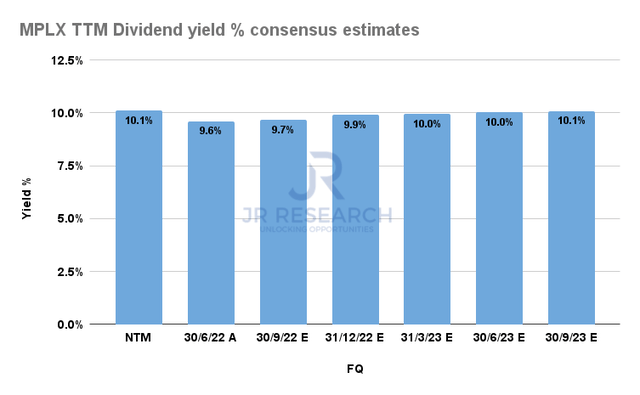

MPLX Forward Dividend yields % consensus estimates (S&P Cap IQ)

MPLX last traded at an NTM dividend yield of about 10%. Its payouts are expected to remain stable through the cycle, given its robust profitability. Therefore, it should continue to offer MPLX strong valuation support at its current levels.

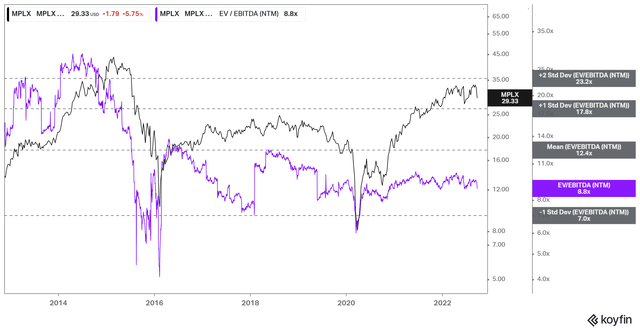

MPLX NTM EBITDA multiples valuation trend (koyfin)

MPLX’s NTM EBITDA multiple of 8.8x remains well below its 10Y mean of 12.4x. However, we deduce that the market has likely de-rated MPLX after the overvalued pre-COVID days.

We believe the market remains tentative over the cyclical performance of the energy market. Coupled with increasing odds of a recession, we postulate a near-term re-rating is highly unlikely.

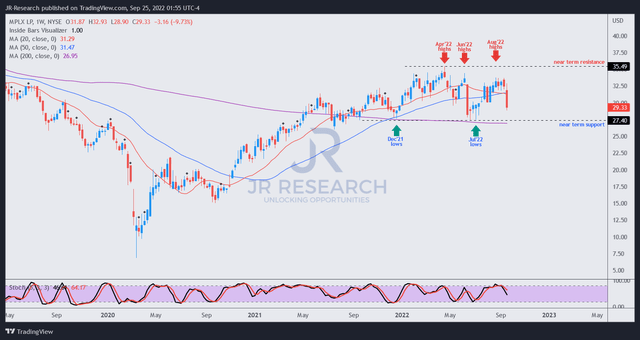

MPLX price chart (weekly) (TradingView)

We gleaned that MPLX has remained in a tight consolidation range since the start of 2022 after its remarkable recovery from its 2020 COVID lows. Therefore, it remains to be seen whether the consolidation indicates a distribution/accumulation zone.

Notwithstanding, investors should note that MPLX’s bullish momentum has weakened further, as it seems to be moving away from its medium-term uptrend bias. Therefore, more conservative investors should consider a successful re-test of its July lows before adding exposure.

However, we remain confident of MPLX’s operating profitability and robust revenue visibility. Coupled with a relatively well-balanced valuation supported by robust forward dividend yields, it should help mitigate downward volatility. Hence, investors are encouraged to consider their positions in MPLX from a total return framework.

We rate MPLX as a Buy. However, we urge investors to avoid adding close to its near-term resistance ($35).

Be the first to comment