sanfel/iStock Editorial via Getty Images

Things have not been going particularly well for companies that are dedicated to the trucking and logistics industry. But then again, things have not been going particularly well for most companies and most industries because of general market malaise. One of the players in the trucking and logistics space that has been hit rather hard lately even though fundamental performance remains robust is Schneider National (NYSE:SNDR). It would be one thing if shares of the company were trading at lofty levels. But the fact of the matter is that the stock looks rather cheap, both on an absolute basis and relative to similar firms. Given this low price and how strong the company is fundamentally, I do believe the market is overreacting. Yes, it is true that fundamental performance probably will deteriorate to some degree because of general market conditions. But even if financial performance reverses and matches what we saw in the 2020 fiscal year, shares would still look attractively priced.

A great prospect for value investors

Near the end of March of this year, I wrote a bullish article about Schneider National. In that article, I detailed that the company had been performing exceptionally well over the prior few months, with fundamental performance driving shares higher. Even though I thought that the easy money that was available at that time had already been made, leading the company to be more or less fairly valued relative to peers, I felt as though it still offered some upside moving forward. At the end of the day, these findings led me to rate the company a ‘buy’, reflecting my belief that it would likely still outperform the broader market for the foreseeable future. Unfortunately, the market has had other plans. With the S&P 500 plunging by 18.7%, shares of Schneider National followed it lower, declining in value by 19.7% in all.

Although we can take solace in the fact that shares did not perform materially worse than what the broader market did, that performance is still worse than what I would have expected. What’s interesting is that the performance the company did experience was completely unwarranted from a fundamental perspective. To see what I mean, we need only look at how the company performed from a revenue and profitability perspective over the past two quarters. These are the two quarters for which data is now available that was not available when I last wrote about the enterprise.

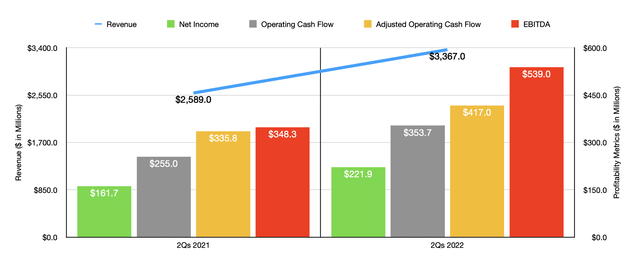

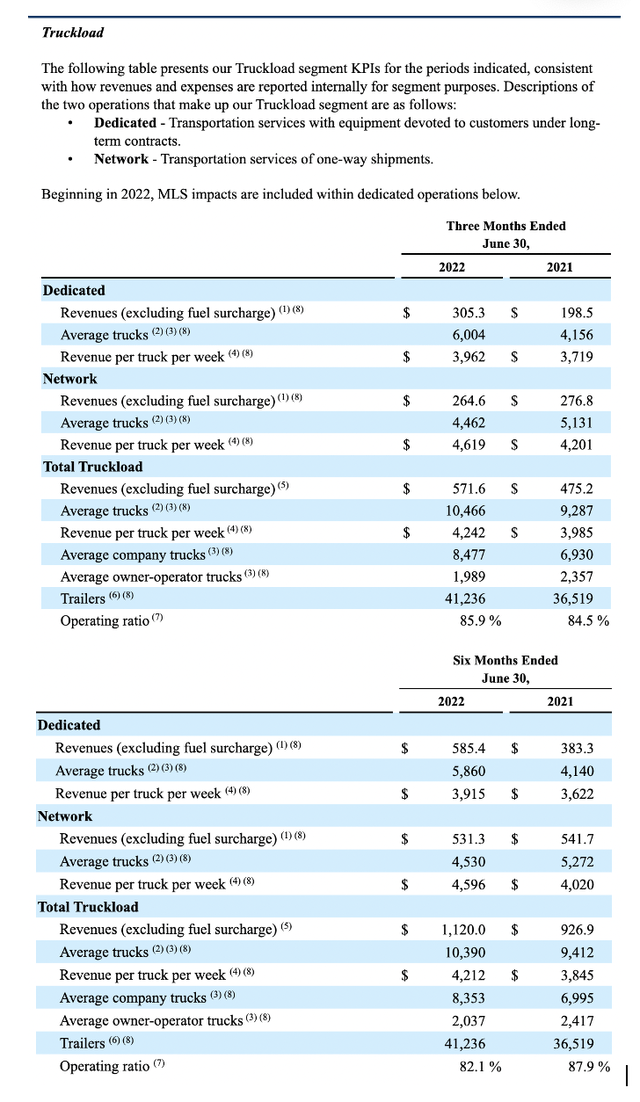

Take revenue for starters. In the first half of the 2022 fiscal year, sales came in strong at $3.37 billion. That represents a sizable improvement over the $2.59 billion generated the same time one year earlier. There were a couple of key drivers behind this increase. For instance, the average number of trucks at the company’s disposal managed to rise from 9,412 to 10,390. In addition to that, the revenue per truck per week also increased, rising from $3,845 to $4,212. On the intermodal side of things, the company also benefited from an increase in orders from 222,679 to 229,790. At the same time, we also saw a meaningful rise in revenue per order from $2,351 to $2,735. That represents a year-over-year increase of 16.3%.

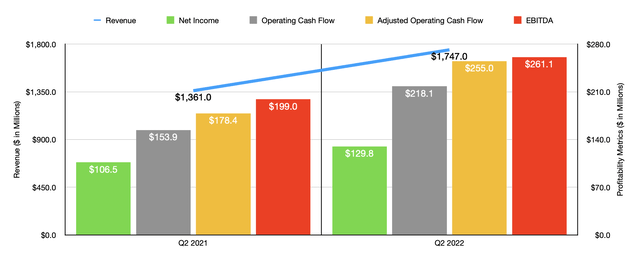

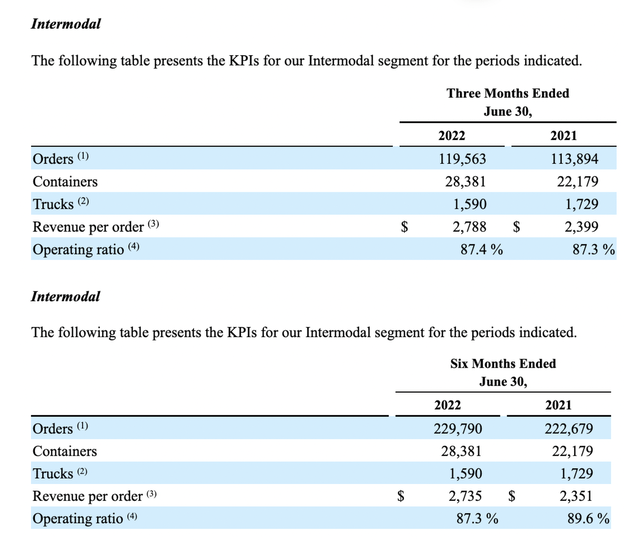

For investors worried about the most recent data, we do have the option to focus on figures covering just the second quarter of this year. During that time, revenue came in at $1.75 billion. That’s 28.4% above the $1.36 billion generated one year earlier. Once again, the company benefited from an increase in the number of trucks from 9,287 to 10,466. However, it also saw revenue per truck per week climb from $3,985 to $4,242. And on the intermodal side of things, the number of orders rose from 113,894 to 119,563, while revenue per order grew from $2,399 to $2,788.

With revenue rising, profitability has followed suit. Net income in the first half of the 2022 fiscal year came in strong at $221.9 million. That’s quite a bit higher than the $161.3 million generated the same time one year earlier. Operating cash flow followed suit, rising from $255 million to $353.7 million. Even if we adjust for changes in working capital, it would have risen, climbing from $335.8 million to $417 million. And over that same window of time, we also saw EBITDA increase, climbing from $348.3 million to $539 million. As was the case with revenue, we also saw profitability rise across the board for the second quarter of this year. This can be seen in the chart above.

For the 2022 fiscal year as a whole, management has even gone so far as to increase the company’s guidance. Their current expectation is for earnings per share of between $2.60 and $2.70. This compares to the prior expected range of between $2.55 and $2.70. At the midpoint, this would translate to net income of $473 million. No guidance was given when it came to other profitability metrics. But if we were to annualize the data coming from the first half of the year, we should expect adjusted operating cash flow of $887.3 million and EBITDA of roughly $1.32 billion.

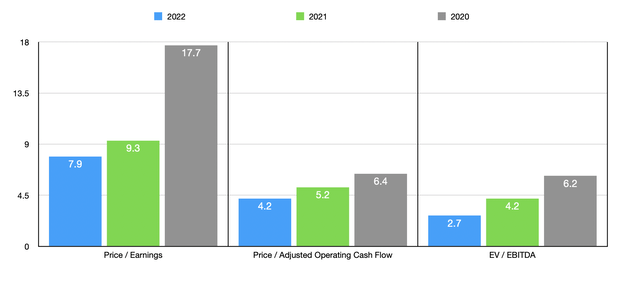

Using these figures, we can easily value the company. On a price-to-earnings basis, the company is trading at a forward multiple of 7.9. The price to adjusted operating cash flow multiple is even lower at 4.2, while the EV to EBITDA for the company should come in at 2.7. If financial performance instead eventually reverts back to what we saw in 2021, these multiples would be 9.3, 5.2, and 4.2, respectively. And even if they were to revert back to the levels seen one year earlier than that, they would still be reasonably attractive at 17.7, 6.4, and 6.2, respectively. As part of my analysis, I also compared the company to five similar firms. For the purpose of this analysis, I compared those companies based on their pricing for the 2021 fiscal year to our prospect for that same time. On a price-to-earnings basis, these companies ranged from a low of 8.6 to a high of 35.6. Using the price to operating cash flow approach, the range was between 2 and 24.7. And when it comes to the EV to EBITDA approach, the range was between 4 and 18.3. In all three scenarios, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Schneider National | 9.3 | 5.2 | 4.2 |

| Ryder System (R) | 8.6 | 2.0 | 4.0 |

| Saia Inc. (SAIA) | 35.6 | 23.5 | 18.3 |

| XPO Logistics (XPO) | 26.3 | 12.2 | 11.1 |

| Werner Enterprises (WERN) | 12.4 | 9.7 | 5.7 |

| Landstar System (LSTR) | 17.9 | 24.7 | 12.1 |

Takeaway

What data we have before us right now says to me that the fundamental strength of Schneider National is impressive. Clearly, management has high expectations for the 2022 fiscal year as a whole. But even if financial performance does revert back to what it was in prior years, shares would still be attractively priced. The stock is also cheap relative to similar players and I see no reason why we should anticipate a massive deterioration in fundamentals to the point that it would make the entire space overvalued. Due to these factors, I must once again view the company as a solid ‘buy’ opportunity right now.

Be the first to comment