bjdlzx

(Note: This article appeared in the newsletter on June 7, 2022 and has been updated as needed. Note: Baytex Energy is a Canadian company that reports in Canadian dollars unless otherwise stated)

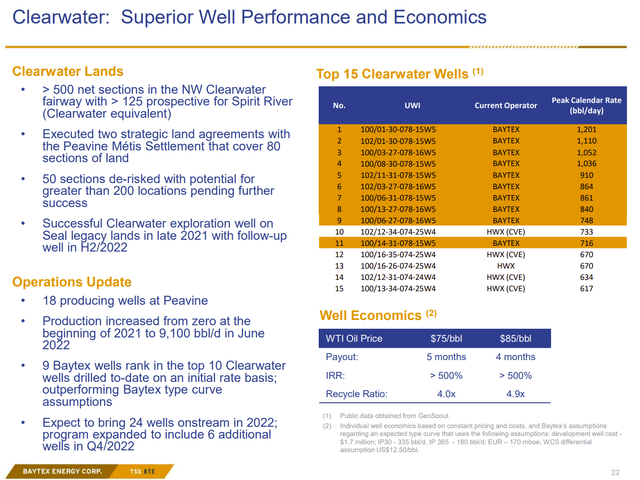

Baytex Energy Corp. (OTCPK:BTEGF) sought for years to have a reasonable cash flow when prices weakened during periodic industry downturns. Several times, I mentioned how Canadian profits basically disappeared because the heavy oil discount widened to the point that the company began shutting in production. Now the Clearwater Play is changing that calculation because the cost to produce that heavy oil is so low that even under trying circumstances, that project is likely to cash flow when the legacy production clearly will not. Light oil production will remain important for downturns. But the Clearwater Play is likely to lead to increasing profitability whether or not production grows for a few years as this production is substituted for less profitable heavy oil production.

That means that the cyclical peak will be a very different story for those investors trying to figure out stock price valuations. Heavy oil traditionally commanded a less valuable valuation than light oil due to the larger losses during cyclical downturns (and eventually lack of cash flow). But a far more profitable project will command better market valuations than in the past because the promises of cash flow during downturns from a very low-cost operation is a game changer for a company that began as a producer of only heavy oil. Mr. Market appears to be noticing this enough as the stock is getting more attention than would be expected for a heavy oil producer.

Baytex Energy Presents The Superior Aspects Of The Clearwater Pla (Baytex Energy August 2022, Investor Presentation)

Management has clearly shifted the capital budget as a result of the fantastic IRRs and the great recycle ratio shown above. It is so easy to hedge these wells to lock in a minimum profit when you have the paybacks shown above.

Keep in mind that today’s top wells are likely to be an everyday occurrence as technology continues to move forward. In this industry, new techniques tend to spread fast “all over the place” with varying degrees of success. This project was already very profitable without new well production records. The results above mean that this play is likely to remain a low-cost leader for some time to come.

The big deal is that this particular interval has gone from nothing to approaching 9,500 BOED in short order. That is going to be taking capital away from some legacy plays that now cannot compete for capital. This is how bigger players like Baytex increase profitability without having to raise production.

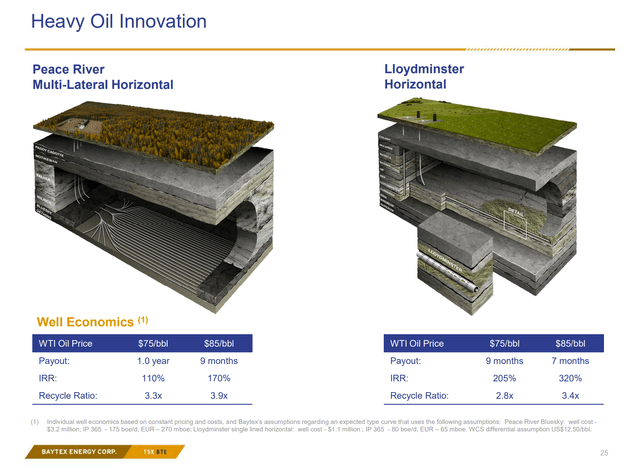

Baytex Energy Summary Of Legacy Heavy Oil Performance Measures And Profitability (Baytex Energy August 2022, Investor Presentation)

The comparison to the legacy production shown above is stark. Even though the two heavy oil slides show decent profitability, the wells cost more on legacy acreage and the initial flow rates are lower. Most companies in this situation will maintain the acreage because a technology improvement can overnight change the priority calculations. In the current environment of fairly rapid operational advances, it is really hard to know if acreage will be permanently noncompetitive in the future. Therefore, many managements take a “wait and see” attitude. While those managements are waiting, they will produce this acreage to keep the leases, and as long as cash flow remains positive no matter the accounting profit report.

The superior rate of return leads to a far lower breakeven point for the Clearwater Play. This accounts for the interest in the play from much of the Canadian industry.

The superior returns will lead to a faster cash flow build at nearly any pricing point. Management can drill between two and three wells per year in Clearwater with the same capital. Therefore, shareholders should expect continuing guidance production improvements throughout the year. Both flow rates and production are better than expected so that should lead to more cash flow to not only return to shareholders, but also to increase production “accidently” so as not to arouse a market focused upon shareholder returns.

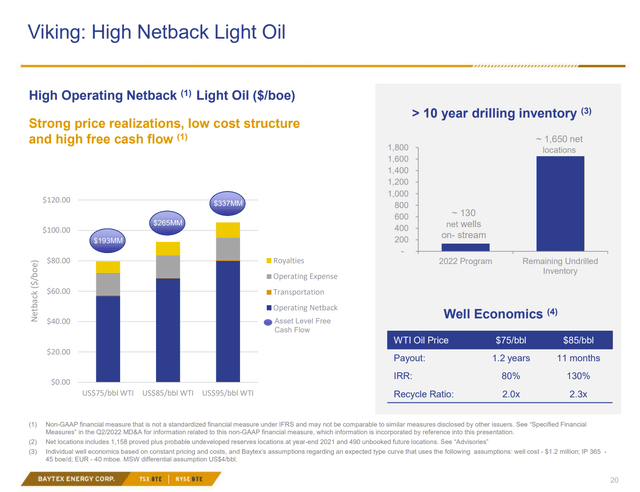

Baytex Presentation Of Viking Light Oil Advantages (Baytex Energy August 2022, Investor Presentation)

It is not at all unusual for light oil to be less profitable than heavy oil during times of strong commodity prices. In fact, Baytex management used to present graphs that I had in previous articles showing this very point.

However, light oil is the premium product with stronger prices during an industry downturn. This product is generally the cash flow machine when commodity prices remain weak. In the past, the light oil from here and the Eagle Ford produced all the cash flow at times of really weak pricing.

So, the question remains to what extent has the Clearwater play shifted the need for the light oil production. Management does have the option of repaying more debt than currently planned to allow for a larger than anticipated amount of Clearwater production. Investors need to decide if the lower breakeven of Clearwater production makes this a safer play than was the case in the past.

Clearwater is likely to cash flow in all but the most extreme downturns. That provides some “breathing room” to consider a higher percentage of heavy oil production during a time of fantastic profitability. However, there remains the risk of a larger discount to light oil prices during any downturn than is currently in the projections. So how management balances the current cash flow bonanza compared to getting ready for the next cyclical downturn by having adequate cash flow is something investors need to watch with this issue.

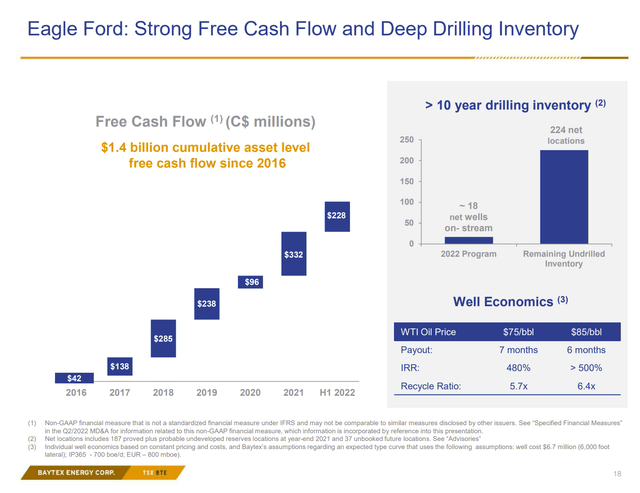

Baytex Energy Presentation Of Eagle Ford Profitability Characteristics. (Baytex Energy August 2022, Investor Presentation)

The only play that has comparable profitability to the Clearwater Play is the Eagle Ford. This property is operated by Marathon Oil (MRO). So Baytex does not control the pace of development. Obviously in the current atmosphere of strong commodity prices, there is likely to be quite a bit of development (probably sooner rather than later). Furthermore, this light oil play will generally have superior profitability to the Clearwater Play during industry downturns. The superior cash flow during times of weak commodity prices is often self-evident.

Therefore, the Eagle Ford will likely retain “first call” on any capital spent. Just as clearly, the Clearwater Play will be right behind this one. But that means that shareholders will need to determine the cyclical action from a company that essentially has a new very profitable play. It may turn out that the downturn will not have the share price decline that has plagued this company in the past (along with some real tight cash flow).

Hedging will also become a risk factor as this company is likely to move towards opportunistic hedging now that the debt is materially lower and expected to decline fast. In the past, heavy oil producers often had no debt because of the lack of cash flow at industry cyclical bottoms. That may not be necessary anymore with a play like Clearwater.

It also means that the current rally will allow this company to boost profitability from the addition of a more profitable play as well as from stronger commodity prices. Therefore, this common stock is likely to continue to outperform the industry. Cash flow has taken on a lot of importance. But earnings before unrealized hedging losses could easily top the $2 per share mark for a quarter (when annualized). That would be a number that this company has not even thought about in a very long time. It also augurs well for continued stock price appreciation.

Be the first to comment