Matthew Troke/iStock Editorial via Getty Images

John Maynard Keynes once warned, “the inevitable never happens and the unexpected constantly occurs”.

In recent years it seemed inevitable that the US shale gas revolution and vast volumes from countries like Russia would drive down natural gas prices for ever and then the unexpected occurred – Putin invaded Ukraine and changed the world map.

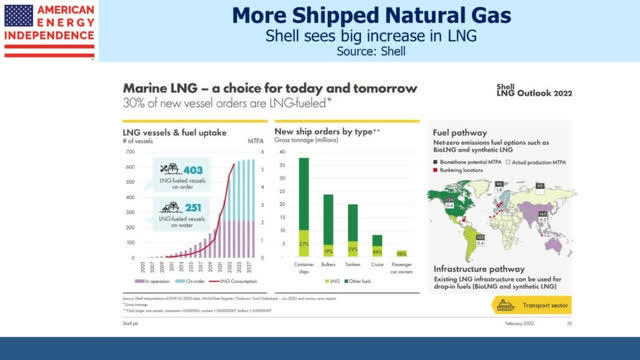

Changes were already happening with LNG unexpectedly replacing filthy oils to fuel ships like the cruise ship in the photo and cargo ships too. The shipping industry is responsible for a significant proportion of the global climate change problem. More than three percent of global carbon dioxide emissions can be attributed to ocean-going ships. In addition to that is the pollution of the seas from their oil waste released into the sea, accidentally or otherwise.

There are many other global happenings related to pollution like that plus increasing energy needs. For example, around 1 billion people still have no electricity.

Many investors have relied on having broad assets exposures but those many happenings mean successful investing today calls for more granular views by focusing on sectors, regions, and specific companies within those. I have been doing that now for several years and the results show. For example, my portfolio of 30 companies focused on 4 main sectors – home rentals, natural gas including LNG, hydrogen and infrastructure building – have given me a gain of 15% this year compared with the 15% fall of the S&P 500.

My biggest sector gainer has been natural gas with Antero Resources being the star within that and my overall portfolio. Many investors would have taken profits but I have let greed overcome fear and will continue to let things run as the demand for natural gas will be insatiable for several years yet.

I will expand later on those huge demand sources but will first go into some detail on Antero Resources as my pick to be an investor winner in 2023…

Antero Resources

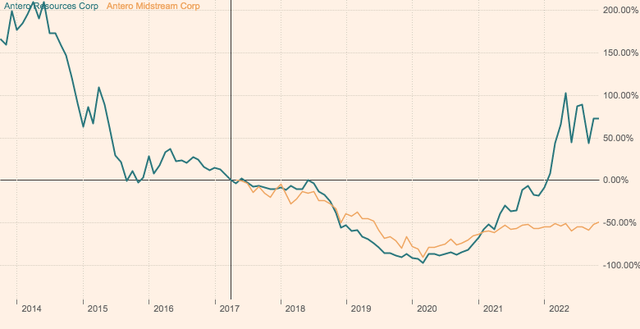

Already an investor winner in 2022 Antero Resources (NYSE:AR) stock price has gained 108% while the S&P 500 has lost around 15%! And it has sound foundations that will ensure it stays ahead of the pack in 2023 and beyond.

AR is one of the largest natural gas and natural gas liquids producers in the US with a large portfolio of repeatable, low cost, liquids-rich drilling opportunities in two of the premier North American shale plays, the Marcellus and the Utica shales. It has been estimated there are sufficient reserves in those plays to last 50-80 years at the current rate of depletion.

AR is also a major shareholder in Antero Midstream (AM) with a holding of 29%.

That is of vital importance because AM gives it the transportation pipelines out to LNG export hubs and US LNG exports are set to grow dramatically as many EU countries wean themselves off Russian supplied natural gas. Putin’s invasion of Ukraine has been a rude awakening for many countries, like Germany, who trusted him to the point that Russia accounts for 25 to 40% of gas supplies.

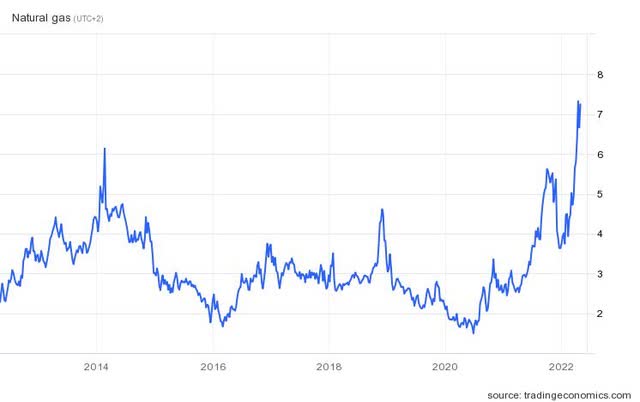

Even prior to that invasion world demand and insufficient supply had driven natural gas prices outside the US much higher than those inside, but now a combination of those things has driven US NYMEX Henry Hub prices close to long term highs that were also achieved this year:

tradingeconomics.com

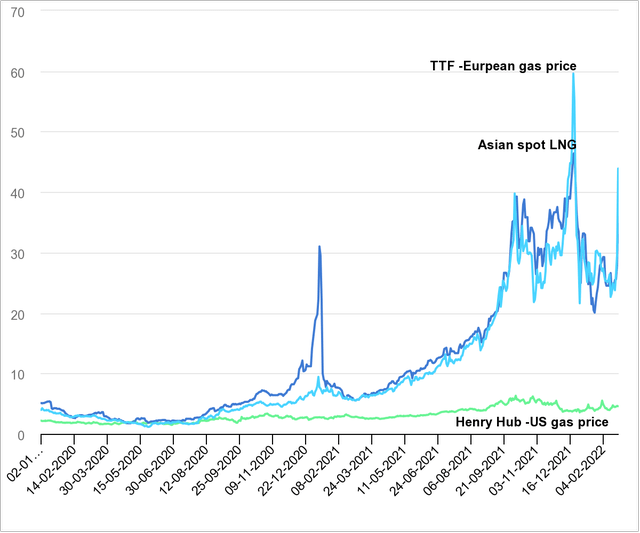

Even so they remain well below European and Asian prices as the following chart shows:

Reuters

Things have not changed significantly since that last date on the chart. Foreign demand is bound to push US prices higher as more US LNG export facilities come online.

Today’s price is anyway benefiting AR, and the trend up will continue as AR leaves its past hedging policy. It is also interesting to note that the NYMEX price is higher today than the peak in 2014 yet AR’s price is 47% lower than then – at $34.42 as I write – compared to $65.67 in early June 2014.

Finances are better today as well and the following is from the latest results released in October:

Third Quarter 2022 Highlights Include:

- Net production averaged 3.2 Bcfe/d, including 171 MBbl/d of liquids

- Realized pre-hedge natural gas price of $8.69 per Mcf, a $0.49 per Mcf premium to NYMEX pricing

- Realized C3+ NGL price of $50.61 per barrel, or 55% of WTI

- Net income was $560 million, Adjusted Net Income was $531 million (Non-GAAP)

- Adjusted EBITDAX was $878 million (Non-GAAP); net cash provided by operating activities was $1.1 billion

- Free Cash Flow was $797 million (Non-GAAP)

- Reduced total debt by $404 million during the quarter

- Purchased $382 million of shares during the quarter

- Net Debt at quarter end was $1.17 billion (Non-GAAP)

- Net Debt to trailing last twelve month Adjusted EBITDAX declined to 0.4x (Non-GAAP)

Given today’s high interest environment I especially like the ongoing debt reduction programme that can be afforded together with share buy-backs.

Full results details can be found here

Other points I like are these:

| Gross margin | 79.88% |

|---|---|

| Net profit margin | 29.40% |

| Operating margin | 38.02% |

Return on assets:15.71%

Return on equity: 37.42%

Return on investment: 19.91%

AR beats most other big US natural gas producers on those points including EQT Corp (EQT).

Another plus for AR is its 29% stake in AM that gives it a market leading firm transportation portfolio and midstream ownership, making it the most integrated NGL and natural gas business in the U.S….

Antero Midstream

Like its “mother” company AR, AM has gained nicely – but not so hugely – in 2022 being up 17% YTD compared to that S&P 500 fall of 14.9%. Plus it is a dividend winner paying one of 7.9% on top of that capital gain.

Antero Midstream was formed by AR to service its rapidly increasing natural gas and NGL production in the Appalachian Basin. AM provides gathering and compression services to AR under long-term fixed-fee service agreements and provides processing and fractionation services through its 50% / 50% Joint Venture with MPLX, LP.

AM is expanding and Paul Rady, Chairman and CEO of AR and AM, said recently:

we closed the $205 million bolt-on acquisition of gathering and compression assets in the Marcellus Shale. This complementary acquisition with highly visible throughput in the core of the Marcellus Shale is a strategic fit with Antero Midstream’s assets.

AM also owns and operates an integrated closed-loop system of fresh water pipelines and storage facilities to support the completions operations for AR. This is important because many shale gas producers have earned a reputation for ruining clean water.

The recent results presentation tells the full story.

Especially important are the pipelines that take AR’s output directly to the Cove Point LNG export facility and to the Gulf Coast LNG fairway.

Paul Rady said:

This quarter marked an important inflection point as we generated $30 million of Free Cash Flow after dividends. This was driven by a reduction in capital expenditures as we completed milestone projects supporting the expected growth from the drilling partnership. This transition to generating consistent Free Cash Flow after dividends significantly de-risks our business model over the next several years and positions us well to achieve our leverage target of 3.0x or less by year end 2024.

AM pays a nice, safe dividend of 7.9%

I can confidently state that dividend is safe due to the huge world demand for natural gas that will also ensure ongoing, profitable growth for both AR and AM. Plus AR likes the mountain of cash that dividend gives it on its 29% shareholding.

More on that demand…

Demand

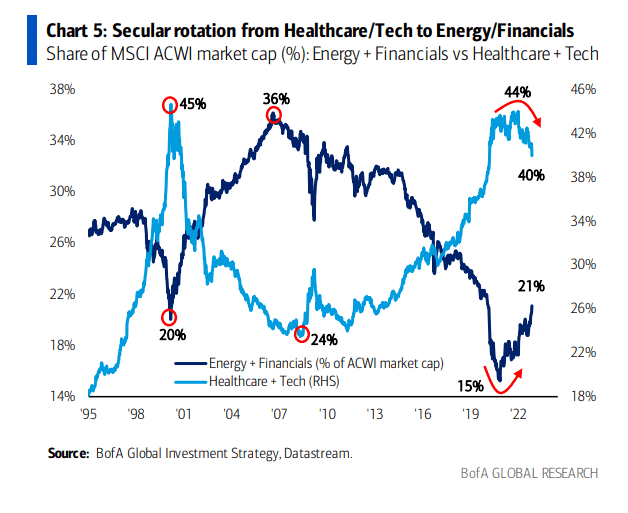

Generally, AR will benefit from sector rotation as shown in this chart…

BofA Global Investment Strategy, Datastream

More specifically, a bit of history about US shale gas is worth reviewing as it is also one key to the future. A company called Mitchell Energy managed to successfully adapt and apply hydraulic fracturing techniques – fracking – developed in the late 1940s. That company was bought by Devon Energy (DVN) in 2002 who soon after melded horizontal drilling with fracking and used that with success in the Barnett shale region of North Texas. That started a race joined by others who took the technology to other parts of the US and into the Marcellus that is now one of the largest gas plays in the world and maybe the largest. And that gas is among the world’s cheapest to produce.

Thus the shale gas revolution of 2008 was spawned when US natural gas output went up instead of down and expensive LNG imports soon after ended.

US New Industrial Age Demand

The past 40 years of steady growth – known as the period of Great Moderation – is over. Today’s world is shaped by production constraints.

President Biden is putting $2 trillion into a “modern American industrial strategy”. That will benefit many sectors including US shale gas producers already on the road to doing nicely.

Coal started the first Industrial Age late in the 1700s. In 2007 coal generated half of US electricity. By 2019 that was down to 24% and natural gas had risen to 38% and is still growing.

Over many years industrial investment flowed out of the US mostly due to lower labour costs elsewhere but low-cost gas has upturned that equation and over $200 billion is being spent on new and expanded US chemical related factories that use gas as a raw material for making chemicals, more than offsetting higher labour costs. Tens of billions more are going into steel making and other manufacturing plants seeking lower cost electricity.

Some specifics on new factory building in the US are:

– BAE Systems (OTCPK:BAESF) has opened a new $150M Austin, Texas facility.

– Micron (MU) will invest up to $100B in a massive New York chipmaking plant

– Samsung (OTCPK:SSNLF) is currently building an advanced chip making plant in Taylor, Texas that will be open in 2024. The company has reportedly been considering sites for as many as 11 different factories in Texas in an investment that could be worth as much as $200B.

– John Deere (DE) is investing $29.8m to shift production from China to Louisiana.

Every major car maker is spending billions in the US to build EV factories.

– Samsung is building a $2.5 billion EV battery factory in Indiana.

– General Motors (GM) is spending $7bn to convert an existing factory to make EVs.

– Ford (F) has begun construction of $5.6B EV-focused facility in Haywood County, Tennessee. Another similar sized one is being built in Kentucky.

– Hyundai (OTCPK:HYMLF) will break ground in Georgia later this month on its first EV dedicated US plant worth $5.5bn.

– BMW (OTCPK:BMWYY) is making a $1.7B investment for electric vehicle production in South Carolina. BMW Group Chairman Oliver Zipse called the South Caroline EV commitment the biggest single investment the German automaker has made.

– Volkswagen (OTCPK:VWAGY) is spending $7.1B to boost EV production in the US.

– Stellantis (STLA) and Samsung have a JV to build a $2.5 billion battery factory in Indiana.

AR can supply plenty of natural gas for those too plus they want clean gas fired electricity to power their clean EV car building factories! If they have lobbying power too, they will not want those EV batteries recharged with coal power so may lobby for faster change from that.

Worldwide

Those US prices are so low that Europe and Asia want more, so big investments are being made in building LNG export facilities on US coasts and the pipelines to feed them. AR and AM are at the forefront to supply those LNG plants directly right now.

In Europe prices remain incredibly high, particularly for early next year, and when the cold weather finally hits there remain concerns Europe could quickly burn through its gas reserves, potentially still leading to extreme tightness in supplies after Christmas. Gas at around €115 per megawatt hour is still equivalent to almost $180 a barrel in oil terms. Contracts for January are above $230 a barrel equivalent.

Europe has already tapped almost every available source of gas, from increased LNG imports to asking Norway to maximise production for months. There is little in the way of supply additions expected globally until the middle of this decade. The EU will boost its ability to import LNG through floating terminals in Germany and the Netherlands but they’ll be competing for the same limited pool of supply. And without Russian gas, the EU will need even more LNG over the next 12 months.

US company Venture Global has said it would expand a 20-year contract with German utility EnBW by 500,000 tonnes of LNG a year, to 2mn tonnes. US companies have executed about 47mn annual tonnes of sale and purchase agreements with various countries this year, according to Webber Research and Advisory.

Politics will help! Two Texas reps have introduced a bipartisan “LNG for Allies” bill, which would expedite licensing for exports of U.S. LNG.

The EU is investing $2 trillion in its “economic recovery and transformation plan”. Similar investments are being made from Japan to Latin America.

Natural gas for heating in cold weather is one thing. In Germany – the EU’s economic czar – the manufacturing sector’s scope for further natural gas savings is dwindling with only ~39% of companies saying they would be able to reduce their consumption without decreasing production.

Germany has finished construction of its first import terminal for liquefied natural gas, a crucial milestone in its efforts to end its energy dependency on Russia. The completion of the terminal, at Wilhelmshaven on the North Sea, will ease fears that Europe’s largest economy might face gas rationing this winter.

Germany has been striving to build new import infrastructure for gas since Moscow’s full-scale invasion of Ukraine on February 24, which led to a sharp decline in Russian gas supplies to Europe.

Financial Times

Earlier this year, it chartered five floating storage and regasification units (FSRUs), one of which will be installed at Wilhelmshaven and the other at nearby Brunsbüttel by the end of the year. The first LNG tankers are due to dock at the two sites early next year.

However, Europe could still face a 30bn cubic-metre shortfall during next summer’s key storage refilling period if Russia halts all pipeline deliveries and Chinese demand for liquefied natural gas increases as it lifts more coronavirus restrictions, according to the International Energy Agency.

The US will supply some of that LNG when more export facilities are built. One important happening in March 2023 will be the reopening of the Freeport LNG terminal that has been closed for several months due to an accident there. In normal times that terminal handles around 15% of US LNG exports!

Shipping needs. I mentioned in my opening words above that ships are getting out of filthy oils for fuel and into LNG. Some 30% of all new ship orders today are for those…

Shell

The above covers the demand potential for natural gas in Europe and the US.

Asia’s needs are massive too led by China and Japan with India’s needs growing fast too – it will soon oust the UK as the 5th largest economy in the world. Indian authorities plan to announce a $2.5B proposal by fiscal year-end to set up FSRUs at all major ports.

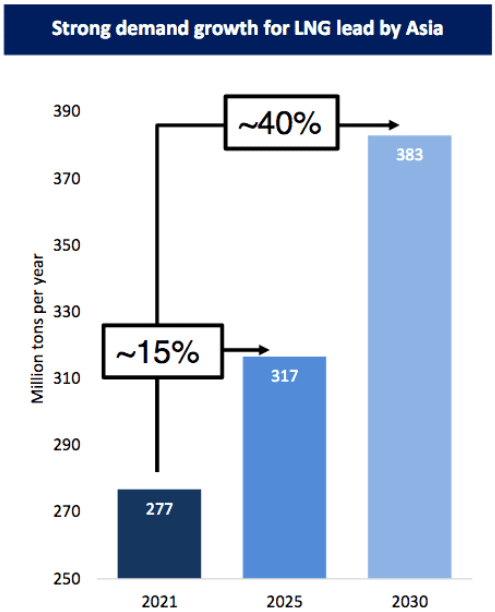

The following chart summarises Asian demand forecasts better than I can do with words…

Golar LNG

China has been written off by many but the dictators there are backing away from Covid lockdowns due to people power. Its demand for LNG will soar again soon. Some US companies have been leaving for political or other reasons but foreign investment is still high even if not from the US. French world leading electrical equipment maker Schneider Electric (OTCPK:SBGSF) is expanding its existing large presence there. German chemicals giant, Bayer (OTCPK:BAYRY) is expanding its plants in China. Chemical making needs gas.

Risks/Threats

No business is without these and – putting aside the risk of Putin causing a world war – the main one that I see for AR and AM is a glut of natural gas hitting the market. Qatar is a huge supplier and is investing heavily to produce more. Bloomberg has this report on a big contract it has signed to supply Germany with LNG. Since that gas only starts to flow in 2026 it is no threat in the near term and is only a small part of German and global needs. Australia is another major producer but environmental protestors and very high costs of labour are restricting new production growth there.

Under the doorstep, there is plenty gas in Europe but fracking is banned. The UK government recently tried again to get things started but people power stopped that.

Natural gas producers and related companies must clean up their act and prevent dangerous happenings such as methane leaks otherwise the Green movement will stop their growth. AR has a good track record on ESG matters so far.

Longer term the biggest threat to all natural gas producers is hydrogen. Many scorn that but costs are coming down fast at the same time oil and gas prices have gone up. By 2030 its use will be widespread.

Other opportunities

One day US Nymex natural gas pricing might stop being based on weather forecasts for Boston and get closer the world pricing. That would hugely increase AR’s profits.

One other opportunity – that is in AR’s management hands – also stands out and that is the addition of LNG export facilities. I have long been wrong by being long on Tellurian (TELL) and it must make it a potentially ideal acquisition at a low price. It has everything in place – except management – to get AR’s gas liquefied and off into the world by getting the Driftwood LNG terminal finished fast. Plus TELL would also give it more natural gas resources and pipelines.

Even if that or similar does not happen I see plenty of reasons why AR will be a…

T’Winner For 2023 And Beyond

PEs alone tell a story of mispricing/underpricing by the markets.

AR has a trailing PE of 5.73 and a forward PE of 5.18. If I pluck a name from the tech stocks – that would be part of that secular rotation chart above and choose Amazon (AMZN) – I get these numbers:

P/E (TTM) 89.09. Fwd P/E (NTM) 86.12.

Other numbers stand out too:

AMZN:

| Return on assets | 2.80% |

|---|---|

| Return on equity | 8.78% |

| Return on investment | 4.15% |

AR:

Return on assets:15.71%

Return on equity: 37.42%

Return on investment: 19.91%

Amazon – a supposed growth stock – is floundering for growth, is getting rid of 10,000 employees and seeks rescue by moving into new things while AR – a value stock – has growth prospects in abundance even if they just keep doing what they are doing.

I do not suggest that anything will close those gaps, neither a huge price increase for AR nor a price plunge for AMZN but that gap is striking and highlights the opportunity now for investors.

Seeking Alpha has this opinion on AR:

Financial Times analysts price targets are:

High: $ 61.00. Med: $49.00. Low: $34.00

First Call’s current Price Target for AR is $49.67. That and the FT’s mid-range target gives a gain of 42% from today.

This chart tells the past story nicely…

Financial Times

AR hit that high of $65.67 in June 2014. As I write it is $34.42.

I look at but do not follow those as I do my own analysis and I strongly believe AR will hit that 2014 high again in 2023 meaning a gain of 90%, if I am right.

If one takes into account that observation by Keynes “the inevitable never happens and the unexpected constantly occurs” one could assume that the inevitable gain forecasted by analysts will not happen and the unexpected will and maybe I will be proved right.

In short: AR’s capital gain and AM’s dividend makes AR a prime candidate to be a big double winner in 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment