JHVEPhoto

Thesis

Bayer (OTCPK:BAYRY) delivered a better than expected September quarter, beating analyst consensus with regards to both sales and earnings. The above-consensus results highlight once again that market sentiment towards Bayer’s business initiatives – most notably the agriculture segment – is lagging. While litigations relating to Monsanto are still weighting on BAYRY share price, a continued strong performance from herbicide sales could catalyse higher valuation multiples.

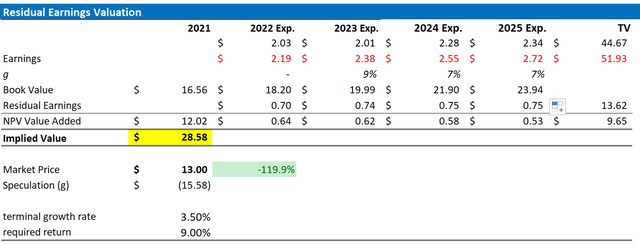

On the backdrop of EPS updates following Q3 2022, I now calculate a fair implied share price of $28.58. I reiterate ‘Buy’ rating.

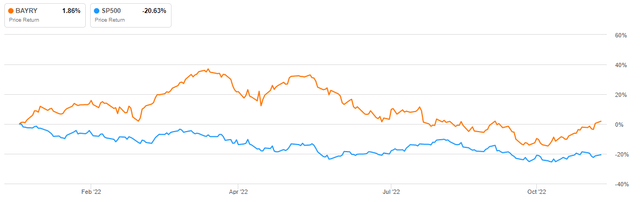

For reference, Bayer stock has outperformed the broad market YTD, being up about 1.9% versus a loss of approximately 21.5% for the S&P 500 (SPY)

Bayer’s Q3 Results

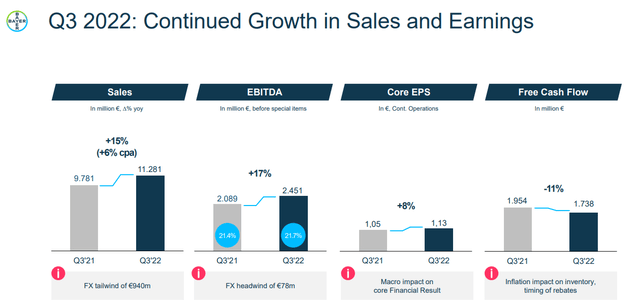

Bayer’s Q3 results topped analyst consensus estimates as the life sciences company reported stronger a stronger than expected performance from the agriculture business, as well as solid performance from pharma and consumer health.

From July to end of September, Bayer generated total group sales of €11.3 billion, which compares to €9.78 billion for the same period one year earlier (15.5% year over year growth) and to consensus estimates for the period of €10.9 billion (€400 million beat).

EBITDA jumped by about 17.3% respectively, to €2.5 billion, as all of Bayer’s divisions managed to report expanding profitability. Net income came in at €0.5 billion (or €1.13/share), representing an increase of about 7.6% year over year.

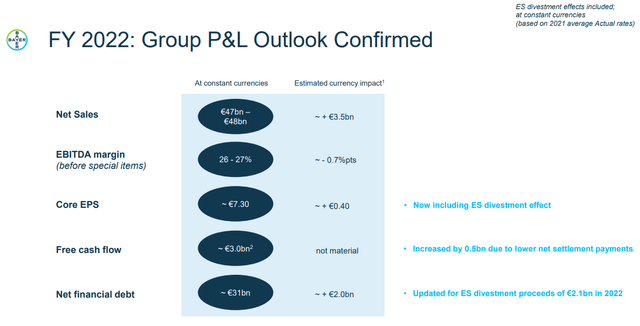

FY 2022 Guidance Confirmed

While other international businesses (most notably the tech giants) are cutting sales and profitability expectations, Bayer confirmed that 2022 is on track for an exceptionally strong performance. Net sales for 2022 are expected to be around €47 billion and €48 billion, and core EPS is expected to be €7.4/share.

If Bayer would indeed manage to deliver on the guidance – which I do not doubt – then the company’s stock would effectively be trading at a P/S multiple close to x1 and a P/E multiple of x7. Such multiples would indicate a 60% to 70% discount to the sector median (Health Care).

Narrative Is Improving

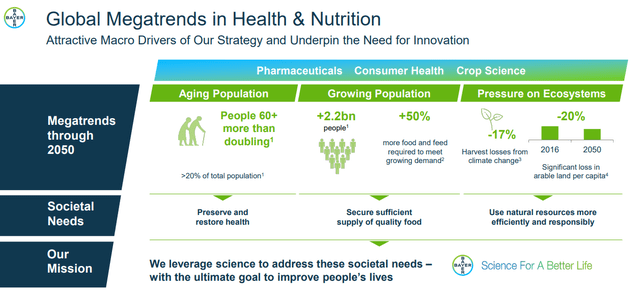

I am confident to believe that Bayer’s strong performance in 2022 so far is not a function of short-term business cycles, but more a reflection of a sustainable long-term trend.

Consumer health and pharma will undoubtedly continue to play a key role in people’s wallet share. But the agriculture business is poised for further expansion.

Investors should consider that food price inflation is not only caused by the Russia-Ukraine conflict, but also supported by structural trends such as climate change and population growth. Notably, in 2022, more than 800 million people do not have enough to eat. And as the planet is expecting an additional two billion people expected to be born by 2050, the World Resources Institute estimates a 56% food gap between the crop calories produced in 2010 and the crop calories needed in 2050. The resulting potential tailwind for Bayer’s agriculture / crop-science business is obvious.

For reference, in Q3 Bayer’s crop science division delivered a 33.5% year over year expansion on EBITDA, growing to €629 million, as a strong herbicides business (+53% year over year) outpaced analyst consensus expectations.

Valuation: Update

Following another very strong quarter from Bayer, I update my residual earnings model for BAYRY to account for preliminary consensus EPS upgrades. But I continue to anchor on a 9% cost of equity and a 3.5% terminal growth rate, which I regard as very reasonable – if not conservative.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $28.58, versus $22.03 prior.

Analyst Consensus; Author’s Calculation

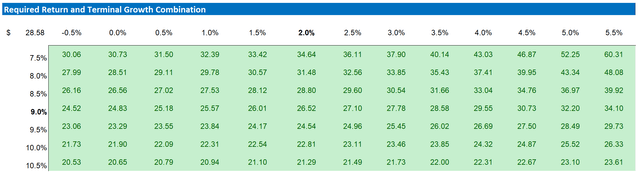

Below is also the updated sensitivity table.

Analyst Consensus; Author’s Calculation

Risks

As I see it, there has been no major risk update since I initiated coverage on Bayer stock. Thus, I would like to highlight what I have written before:

… the major headwind for the company is and will likely remain the Monsanto litigation. While the lawsuits should be manageable, and Bayer has set aside adequate funds for potential liabilities, the costs are still open-ended and uncertainty persists. However, one could argue that Monsanto is the opportunity, not the risk, as without the litigation investors would never be able to buy Bayer at such a cheap valuation. At this point I see the risk/reward skewed to the upside.

Conclusion

Bayer stock is trading super cheap. And Q3 has highlighted that a 50% to 70% discount to the sector median with regards to key valuation multiples is hard to justify – even considering the omnipresent Monsanto arguments.

In my opinion, Bayer’s strong 2022 performance so far is only the beginning of a long-term business expansion on the backdrop of an expanding agriculture segment.

I reiterate my ‘Buy’ rating. And on the backdrop of EPS updates following Q3 2022, I now calculate a fair implied share price of $ 28.58.

Be the first to comment