Ryan Fletcher

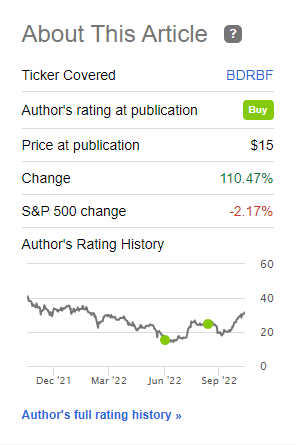

When I started covering Bombardier (TSX:BBD.B:CA) (OTCQX:BDRBF) years ago, it most certainly was not a company that had my preference for investment. It was a transportation company with a wide product portfolio, but with challenges in all segments most notably in the form of the C Series for which Bombardier had built up significant debt, but would never be able to reap the rewards of the investments made into that platform. In this report, I will analyze the Q3 2022 results, the 2020 guidance and the debt profile. I will also discuss how the current performance stacks against the 2025 targets.

Bombardier Stock Surges Leaving Its Past Behind

The Aerospace Forum

The company refocused itself as a business jet manufacturer, a move of which I first was skeptical but Bombardier has exceeded expectations, and as a result, I felt comfortably putting a buy tag on shares of Bombardier in June of this year and that has shown to be the right call so far with a 110% price change and up almost 35% with the broader market losing 3.4% since my September report. So, Bombardier’s improvement on operational level is also reflected in its share prices.

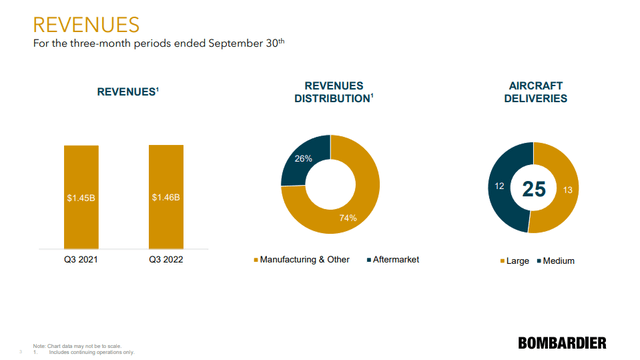

Stable Revenues, Higher Margins For Bombardier

Q3 2022 revenues Bombardier (Bombardier)

Compared to a year ago, revenues remained stable, increasing by $6 million. Manufacturing revenues came down by $50 million caused by the production end for the Learjet aircraft, which Bombardier is offsetting with higher medium jet production and lower large business jet deliveries. The reduction in manufacturing revenues was fully offset by the services segment with a $62 million increase in revenues as Bombardier is ramping up its services footprint and demand for services is increasing based on flight activity. Year-over-year, the share of after-market sales grew from 21% to 26%. This gives a $12 million increase for Bombardier’s core revenue streams which was partially offset by lower components sales of commercial aircraft programs.

Also interesting to note is that sequentially, manufacturing revenues decreased from $1.18 billion to $1.07 billion as deliveries tend to be light in the third quarter coming out of the summer. For after-market sales, revenues increased roughly four percent, which mostly reflects the continued ramp in services offering and demand for those services.

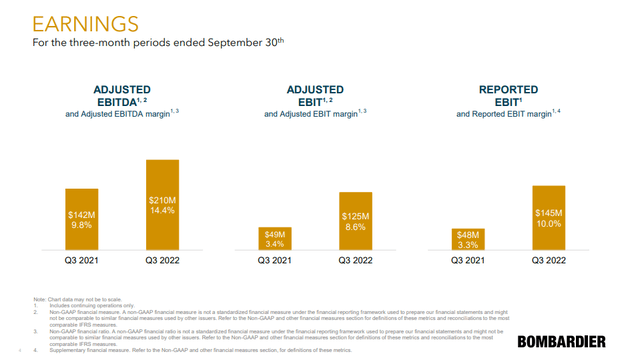

Q3 2022 earnings Bombardier (Bombardier)

The stable revenues in my view are not any reason for concern. There are some moving objects such as Learjet production termination that pressure revenues, but what we are seeing is that Bombardier is doing much better on its margins metric. So, out of the same dollar of revenue the company generates more earnings driven by its cost savings plan and incremental margin improvement on the Global 7500 as Bombardier progress in the learning curve.

Adjusted EBITDA (earnings before interest, taxes and depreciation and amortization) margin increased from 9.8% to 14.4% and adjusted EBIT (earnings before interest and taxes) margin showed a similar improvement. Sequentially EBITDA margin improved from 12.9% to 14.4% and EBIT margin improved from 6.6% to 8.6%. So, we continue to see momentum in the margin improvement. Bombardier is now focused on medium and large business jets, and in Q4, there will be some softening in the margins as the mix will lean more towards new aircraft for which margins have yet to reach a mature point.

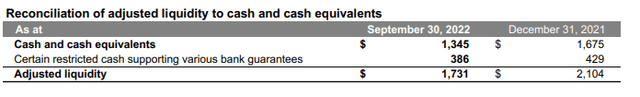

Liquidity Exceeds $2 Billion

The current adjusted liquidity stands at $1.7 billion and one will notice that this is down $373 million compared to the start of the year. There are a couple positives that factor into this. The first is that cash has been used to reduce debt. In Q1, there was $400 million in debt repayment followed by $373 million in Q2 and $100 million in Q3. That adds up to $873 million in debt retired generating annualized savings of $300 million. The other item is a $566 million increase in inventories as Bombardier is ramping up production and Q4 should be strong in terms of deliveries. So, we see two items with $1.4 billion in cash pressure that are indicative of longer term savings and value generation as well as more near-term performance.

As you can see it, the reduction does match the changes in retired debt and inventory increase, but they are I would say the two main items that result in liquidity being lower instead of higher as compared to the start of the year. Bombardier also secured a 5-year revolver of $300 million bringing the pro-forma liquidity to $2 billion. Going forward, the company aims to have around $1.2 billion in cash plus the $300 million revolver, giving it a $1.5 billion liquidity position excluding cash on hand. Previously the target was to have around $1.5 billion in cash on hand, but given better visibility it’s seen on the market as well as performance, the company feels comfortable with $1.2 billion which is a strong sign of confidence.

Additionally, with the $386 million in restricted cash to flow to Bombardier early next year, that gives the company space to use excess liquidity for further debt repayment, unlocking even more savings on interest.

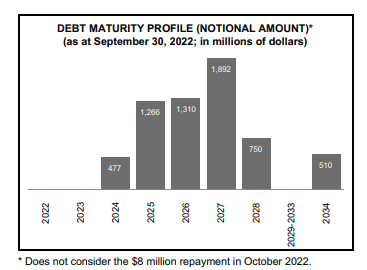

Debt Profile Is Looking More Manageable

Debt maturity profile Bombardier (Bombardier)

Previously, the main issue with Bombardier was that it had debt maturing in the near-term without it being able to really make the debt repayment in absence of selling some of its businesses. The company did that and that, in combination with operational performance, allowed it to have a clear runway for the coming two years. The first debt that will mature is $477 million in December 2024, giving the company a clear maturity runway for 26 months. As Bombardier feels comfortable with having $1.2 billion of cash and restricted cash flowing in early next year, the company already has what it takes to comfortably make the debt repayment for 2024. Furthermore, the $300 million in annualized savings cover half of the debt maturing by 2025 and the free cash flow objective of >$500 million by 2025 should be enough to make all debt repayments for 2025. With the current pro-forma liquidity of $2 billion, debt repayments until 2026 can be made, leaving around $1 billion of debt for 2026. What further supports confidence in Bombardier’s ability to service its debt is that the 2025 targets imply around $1 billion in cash flow to be put towards debt reduction.

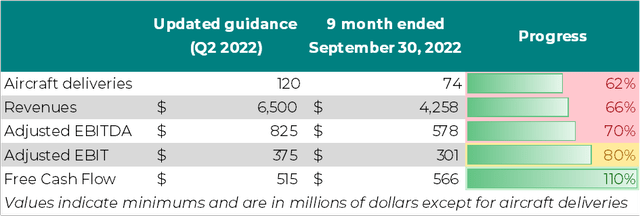

Guidance Maintained, 2025 Targets Achieved

Guidance progress Bombardier (The Aerospace Forum)

For the full year, Bombardier maintained the guidance issued in Q2 2022. I have provided a time-weighted progress on all metrics and what can be seen is that on aircraft deliveries, Bombardier is trailing that time-weighted progress. This, however, is mostly caused by the time-weighted progress not grasping the reality that deliveries in Q3 tend to be soft and pick up in Q4. If there was any concern that Bombardier would miss the delivery target, by the time of the Q3 earnings call, there should already be a strong indication for that which should have triggered an adjustment to the delivery guidance. Assuming that the delivery guidance still holds, the revenue guidance most likely will as well since Bombardier has the insights to forecast the revenues based on deliveries and service agreements. So, while colored red, I do not see an issue for the aircraft deliveries or revenues. For adjusted EBITDA and adjusted EBIT, the progress is 70% and 80% with the yellow color marking that Bombardier is marching ahead of the time-weighted progress.

For the fourth quarter, margins are going to contract a bit due to higher share of new lower margin aircraft in the delivery mix. Even when modeling a 2.5 percentage point decrease on the margins, which I think is excessive, Bombardier would meet its target on the adjusted EBITDA and adjusted EBIT. So, I believe that Bombardier should be able to achieve its 2022 targets. On free cash flow, the company already exceeded the free cash flow guidance and expects free cash flow to be positive, indicating that the target will be further exceeded.

For 2025, Bombardier is aiming for a $7.5 billion revenue and $1.5 billion EBITDA of which 55% will already be realized in 2022 and a $500 million in free cash flow which has already been exceeded in 2022. Important to note is that the free cash flow this year was heavily impacted by strong order bookings in the second quarter, but simultaneously Bombardier aims for free cash flow far higher than $500 million as demonstrated by the following back-of-the-envelope calculation:

And to be clear, the $500 million of free cash flow target that we set for ’25, the actual target is much higher than that. We highlighted this in our Investor Day in March of this year that when you think about a $1.5 billion of EBITDA less about $100 million of sustaining CapEx a year and I’ll call it $400 million of interest costs annualized, that leaves us with a $1 billion of cash flow that we can put to work.

Furthermore, a net leverage of 3x is targeted. Bombardier currently has a net leverage of 5.5x. The 3x leverage included an assumption of $4.5 billion in net debt and that is a figure that Bombardier already has exceeded. The EBITDA is not quite in the right ballpark yet because the top line and margins have yet to strengthen, but with the higher production expected in 2023 and continued strength in aftermarket sales Bombardier should be able to exceed its net leverage targets helped by strong debt retirement.

Conclusion: Shares Of Bombardier Remain Attractive On Spectacular Turnaround

Bombardier continues to execute well on its margin trajectory with margin expansion on new aircraft and services growth, all while retiring debt unlocking annualized savings adding to the deleveraging momentum. That snowball effect should positively aid the company in further retiring debt and unlock savings to achieve its 2025 objectives before 2025. One could say that the 2025 targets have been too conservative, but it should be kept in mind that a year ago the market did still look quite uncertain due to the pandemic and Bombardier had a history of overpromising and underdelivering and the current targets give the company a clear path on where to execute and it is doing that very well in its cost control both on manufacturing margins as well as debt retirement, coupled with higher manufacturing output next year and a growing services footprint.

As a result, I believe that Bombardier will continue outperforming the market. The company currently trades at a healthy EV/EBITDA of 10.49, and compared to its 11-year EV/EBITDA of 12.4, there still would be another 18% in upside compared to the historical average. One can argue that over the past 11 years, Bombardier has been a rather unhealthy company trading at an elevated EV/EBITDA, but I would say that given the strong execution path, Bombardier might actually have to trade at a higher current EV/EBITDA. As a result, I continue to believe Bombardier is a buy with a $37 price target and could actually be worth even more.

Be the first to comment