naphtalina/iStock via Getty Images

Coloplast A/S (OTCPK:CLPBF) is without much doubt a company and stock that doesn’t get much interest on Seeking Alpha. Therefore, I called it a hidden stock market gem in my last article, which was published in June 2020 and remained the only article until today. But as I have pointed out in my last article, we are dealing with a great business and Coloplast flying under the radar of investors is unjustified.

While we are clearly talking about a great business, we also saw an extremely expensive stock when my last article was published. Back then, the stock was trading around DKK 1,100 and today it is trading around DKK 800 and raising the question if Coloplast is fairly valued (or even a bargain). And not only did Coloplast report quarterly results on Monday, but we are also looking at a rather recession-resilient business, which justified a closer look at the business. But as I assume that many of you won’t be familiar with the business although Coloplast is the 6th largest company in Denmark by market capitalization, we will start with a small description again.

Business Description

(You can skip this part if you are already familiar with the business)

Coloplast was founded in 1954 as Aage Louis-Hansen, a civil engineer and plastics manufacturer and his wife Johanne Louis-Hansen, a trained nurse, created the ostomy bag, after Elise Sørensen, a nurse, conceived the idea of the world’s first adhesive ostomy bag as her sister had an operation and was afraid to go out in the public. Today, Coloplast is a business with 13,650 employees, is generating DKK 22.5 billion in annual sales and treated more than 2 million chronic users in 140 countries around the world.

Coloplast is operating in the so-called intimate healthcare space and is designing, manufacturing, and marketing ostomy-care-systems, disposable containment devices, paste, powder, seals, and wipes. Additionally, Coloplast is present in the urology and wound-care market and markets penile implants, slings for incontinence and prolapse, and wound dressings. Coloplast often acts as a direct supplier to its customers. And Coloplast is now reporting in five different business segments due to the acquisition of Atos Medical (we will get back to this), which led to the new business segment “Voice & Respiratory Care”.

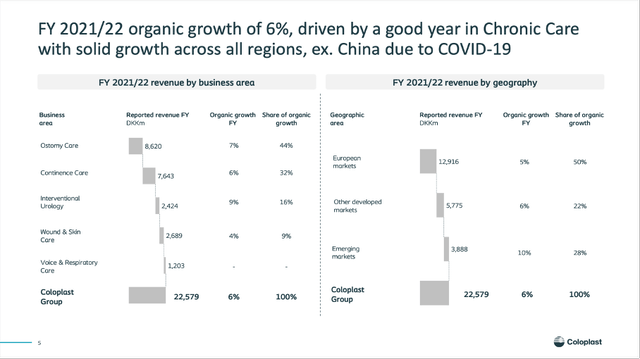

Annual Results

And when looking at these five business segments, the two major business segments are Ostomy Care (which generated DKK 8,620 million in revenue in fiscal 2021/22) as well as Continence Care (which generated DKK 7,643 million in revenue in fiscal 2021/22). The other three segments – Interventional Urology, Wound & Skin Care and Voice & Respiratory Care – generated between DKK 1.2 billion and about DKK 2.4 billion in revenue. And all four segments are contributing to growth in the mid-to-high single digits.

Coloplast Conference Call Presentation

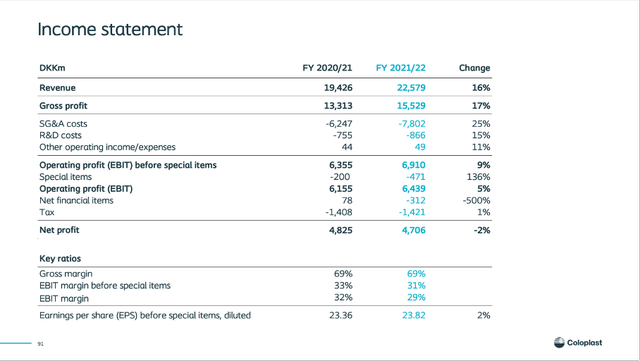

When looking at the annual results for the business, the company demonstrated once again it is rather recession-resilient and reported high growth rates for the top line. In fiscal 2021/22 Coloplast generated DKK 22,579 million in sales and compared to the previous fiscal year (in which Coloplast generated DKK 19,426 million in sales) this is resulting in 16.2% year-over-year growth. Of course, Coloplast profited from currency effects as well as the acquisition, but organic revenue growth was still 6%.

Coloplast Roadshow Presentation Fiscal 2021/22

While revenue could increase in the double digits, operating profit (EBIT) increased only 4.7% year-over-year from DKK 6,150 million in the previous fiscal year to DKK 6,439 million this year. And diluted earnings per share declined even 2.3% from DKK 22.63 in fiscal 2020/21 to DKK 22.11 in fiscal 2021/22. The reason were higher distribution costs as well as increased administrative expenses. But Coloplast also had higher financial expenses than in the previous year – especially interest expenses for bonds increased (due to the acquisition).

Coloplast Conference Call Presentation

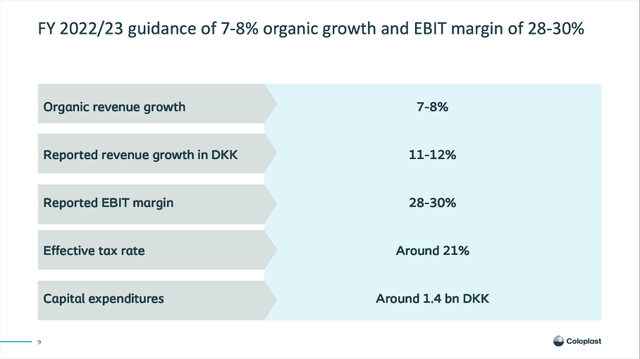

And Coloplast also issued a solid guidance for fiscal 2022/23. While EBIT margin is expected to be similar to this year’s margin, organic revenue growth is expected to be about 7-8% and reported revenue growth (in DKK) will be between 11% and 12%.

Recession-Resilient

The guidance for fiscal 2022/23 is also a strong sign that we are dealing with a rather recession-resilient business. Several other companies are cautious for the next year as the risk for a global recession is high, but Coloplast is quite optimistic.

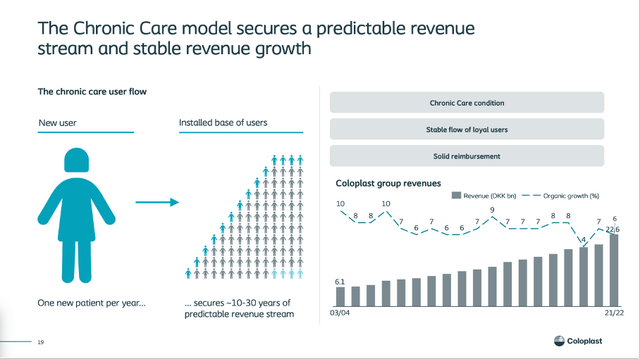

When considering that Coloplast is dealing with chronic users in the healthcare space (see business description above), being rather recession-resilient is not surprising. The products and services provided by Coloplast are highly important for the patients and relevant for the daily lives. It seems highly unlikely and often even impossible to stop using these products – even when the economic situation is difficult and disposable income declining.

Coloplast Roadshow Presentation Fiscal 2021/22

We can also look at the performance of Coloplast during the last three and a half decades – we have data since 1988 and see an impressive performance of 34 years of revenue growth in a row. This is including four recessions – and Coloplast could increase revenue every single time.

Economic Moat

And Coloplast is not only recession resilient, but it has also a wide economic moat around its business. In my last article I described the economic moat, which is based on patents as well as switching costs, in detail:

And while being recession-proof and addressing the chronic care market are two great qualities for a business operating in the healthcare market, both are not the source of a wide economic moat. Both don’t tell us anything about aspects like competition, gaining market share, or keeping customers from switching to a competitor. When thinking about economic moats, a first important aspects is the patents Coloplast has. Patents are making it difficult for new competitors to enter the market with similar products and patents will also ensure a stable revenue flow for a certain amount of years for Coloplast. Patens are blocking competition in a very effective way and can, therefore, be the source of a wide economic moat.

A second – even more important aspect is the switching costs, the patients of Coloplast are facing. Once patients have chosen a certain medical product it is rather unlikely, they will switch to the product of a competitor: these medical devices are often extremely important for the patients in their daily lives and they get accustomed to these products, know how to use them. And to switch to the product of a competitor is rather unlikely. When considering the different types of switching costs, there are learning costs (as the patients often have to learn how to use the medical devices) and maybe some kind of economic risk costs (as one doesn’t know if the new product will be as good as the old one and having a mediocre product can be a problem).

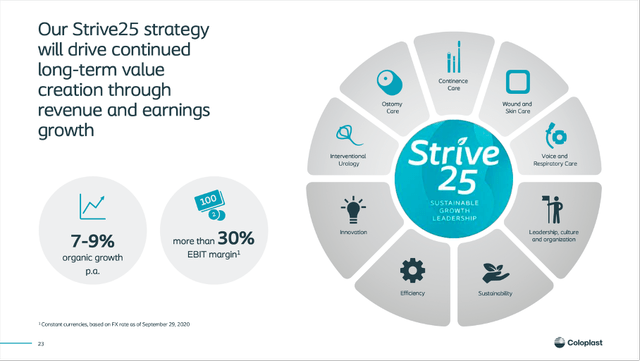

And thanks to its wide economic moat, Coloplast’s long-term growth targets of 7% to 9% organic growth per annum according to its Strive25 strategy seem realistic.

Coloplast Conference Call Presentation

Atos Medical Acquisition

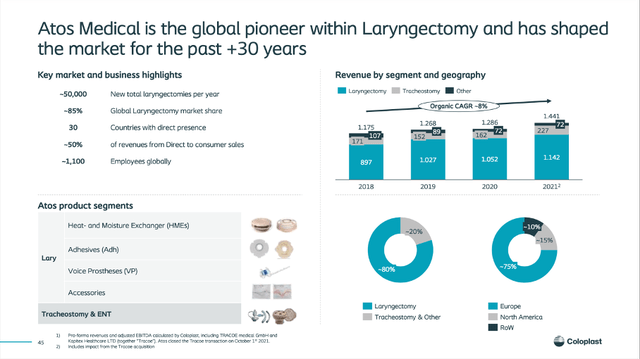

We already mentioned above that Coloplast acquired Atos Medical for DKK 10,622 million and the acquisition was completed on January 31, 2022. Atos Medical is the global market leader in laryngectomy and serves customers in around 90 countries and has a direct presence in 30 countries around the world with about 1,200 employees.

Coloplast Roadshow Presentation Fiscal 2021/22

The acquisition generated a new business segment for Coloplast – Voice & Respiratory Care, which is expected to grow 8-10% organically for the years to come with an EBITDA margin in the mid-30s.

The acquisition also had an impact on the balance sheet. On September 30, 2022, the company had DKK 16,359 million in long-term debt (bonds). When comparing the amount to DKK 8,292 million in equity we get a D/E ratio of 1.97 which is higher than I usually like to see. Additionally, we can compare the total debt to the operating income (EBIT) Coloplast can generate annually (in fiscal 2021/22 it was DKK 6,439) and it would therefore take about 2.5 years of operating income to repay the outstanding debt, which is acceptable. The balance sheet is certainly not perfect, but it is no reason to worry.

Long-term growth

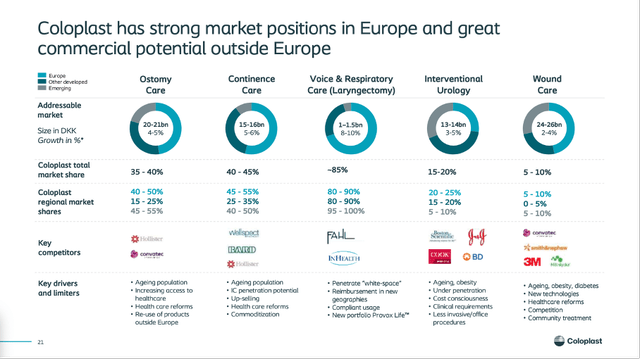

However, Coloplast can not only grow by acquisitions. It is now operating in five business segments and aside from wound care (with a market share of only 5-10%), Coloplast has a solid market share in each business segment. In Ostomy Care and Continence Care it has a market share around 40% and the Voice & Respiratory market is clearly dominated by the company (market share around 85%).

Coloplast Roadshow Presentation Fiscal 2021/22

And all of these markets are expected to grow, with Voice & Respiratory Care promising almost double digit returns and Ostomy Care and Continence Care promising growth rates in the mid-single digits.

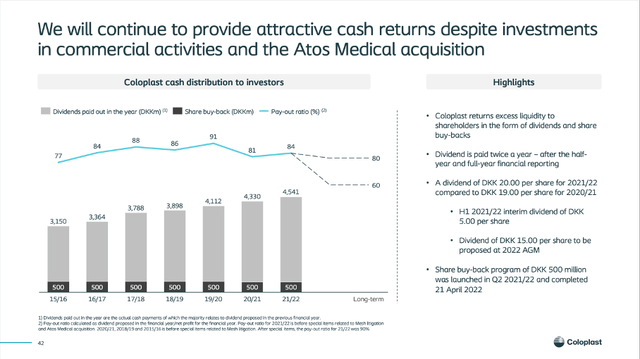

Dividend

In the past, Coloplast has paid out most of its profits as dividend resulting in rather high payout ratios between 80% and 90% in the last few years. For fiscal 2021/22, the company will pay an annual dividend of DKK 20.00 (compared to DKK 19.00 in dividends in the previous fiscal year). The dividend is paid twice a year – for this fiscal year it was an interim dividend of DKK 5.00 and a final dividend of DKK 15.00. This is resulting in a dividend yield around 2.4% for Coloplast which is making the stock not really interesting for dividend investors. We also must expect dividend growth to slow down in the next few years, as management is now targeting a payout ratio between 60% and 80%.

Coloplast Roadshow Presentation Fiscal 2021/22

Additionally, Coloplast is also spending money on share buybacks – DKK 500 million every single year. I don’t know if this strategy makes sense. Of course, if Coloplast is finding no better ways to spend its free cash flow, it can pay a dividend to investors. But paying out almost the entire profits seems a bit extreme and Coloplast will reduce the payout ratio in the next few years.

Intrinsic Value Calculation

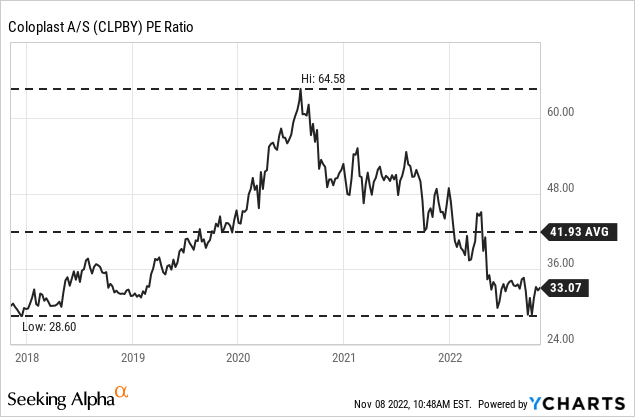

And while Coloplast is a great business, rather recession-resilient and with growth potential in the years to come, the stock is still trading for a huge premium and is certainly not a bargain. We can argue that Coloplast is trading for one of the lowest P/E ratios in the last five years: Right now, Coloplast is trading for 33 times earnings, which is below the high of 65 and below the 5-year average of 42 and close to the five-year low of 29.

But a P/E ratio of 33 is still high for any business and we need high and consistent growth rates to justify such a valuation. And when trying to calculate an intrinsic value for Coloplast by using a discount cash flow calculation Coloplast still seems overvalued. Let’s be optimistic and assume 10% growth annually for the next ten years (Coloplast is aiming for 7-9% organic growth and might also be able to improve its EBIT margin a bit) followed by 6% growth till perpetuity.

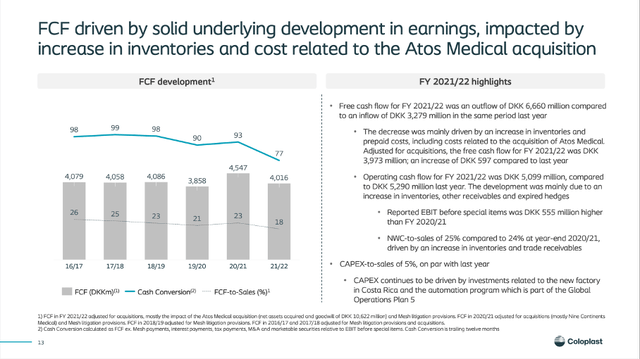

Coloplast Conference Call Presentation

And as basis for our calculation, we assume a free cash flow of DKK 4,500 as cash conversion will probably improve again in the years to come (in the past it was above 90%). When calculating with these assumptions (and 10% discount rate as well as 212.3 million outstanding shares) we get an intrinsic value of DKK 703 for Coloplast, and the stock remains overvalued. And in my opinion, there is no reason to calculate with even more optimistic assumptions.

Conclusion

Coloplast could be interesting right now as the business is pretty recession resilient and will most likely perform stable in the years to come (and even during a potential recession). However, the stock is still not a good investment as it is too expensive. It is trading above its intrinsic value and with a P/E ratio of 33 the risk for the stock declining rather steep in case of a global bear market is high. Stocks trading for high premiums often get punished in such market environments.

Be the first to comment