Alex Wong

REITs are down 30% year-to-date, which is far more than the rest of the market.

This is of course in large part because of fears caused by rising interest rates.

However, I think that most investors are misunderstanding this risk, and as a result, they’re also selecting the wrong REITs for their portfolios.

Most investors appear to make the mistake of focusing solely on the impact of rising interest rates on the profitability of REITs as they make their selections.

But that’s not actually the main risk that they should worry about.

What they should worry about is the impact of rising interest rates on asset values, not profitability. This would lead to much better investment decision-making and likely superior returns in the recovery.

Below, I explain why that is:

The Impact On Profitability Is Not Material In Most Cases

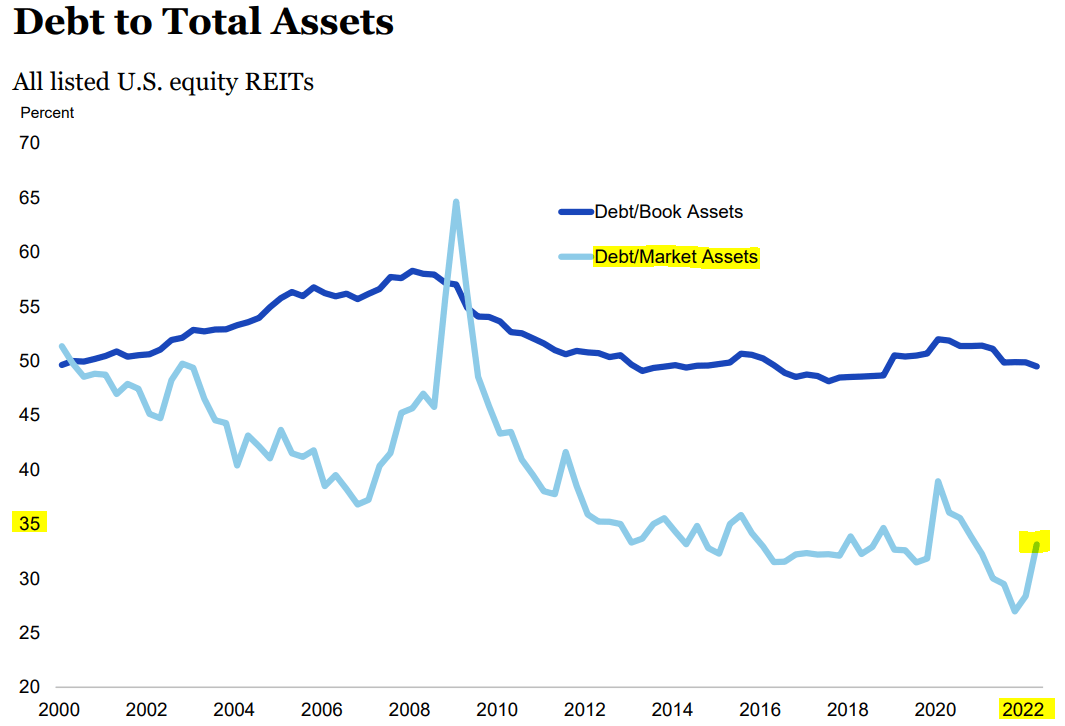

Today, the leverage in the REIT sector is at a historic low. The average LTV is only about 35%, which means that REITs use 65% equity and 35% debt on average.

NAREIT

This is very little debt when you consider that most people buy their homes with 80%-90% LTVs. Private equity players like Blackstone (BX) and Brookfield (BAM) also commonly buy commercial real estate with 60-70% LTV, which is twice as much as what REITs are using.

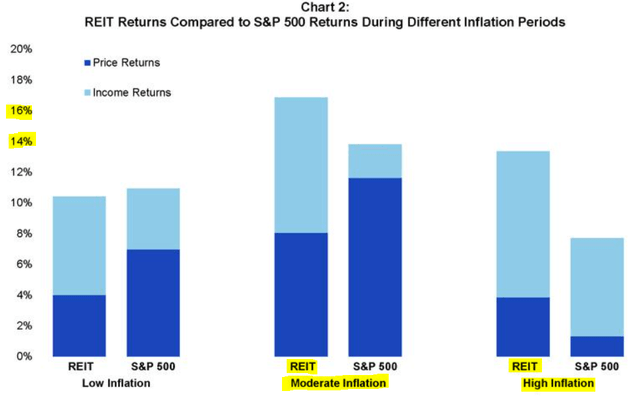

So the debt itself is not high, which naturally, also limits the impact of rising interest rates, and importantly, interest rates are today only rising because inflation is at a multi-decade high.

This is important because the rising interest rates only impact 35% of the balance sheet. Meanwhile, inflation is impacting 100% of the assets because rents are rising. So it’s clear that the positive impact of inflation is in most cases more significant than the negative impact of rising interest rates.

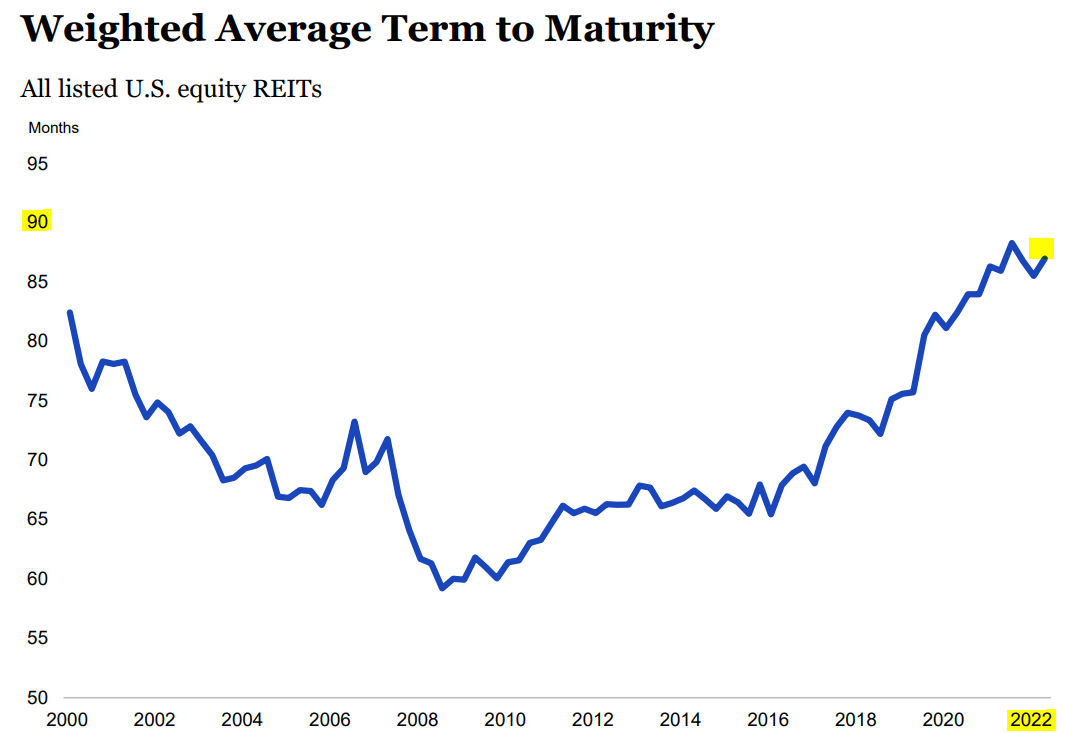

Finally, REITs also are structuring their debt in a conservative way that mitigates the impact of rising interest rates even further. Most of the debt is fixed rate and debt maturities are historically long at eight years:

NAREIT

So REITs use little debt to start with, and only a small portion of this little debt is expiring each year. Often REITs have no maturities for many years to come and retain enough cash flow after paying their dividend to pay off their debt maturities with existing liquidity.

Prologis (PLD), Camden (CPT), and Extra Space (EXR) are all good examples. They have no significant maturities for years to come and retain a lot of cash flow and have the ability to sell assets at low cap rates to pay off debt maturities if desired. Meanwhile, their rents also keep growing at a rapid pace, which more than makes up for any increase in interest expense.

So again, the impact of rising interest rates on profitability is not significant in most cases and therefore, this shouldn’t be your primary focus. In fact, even the REITs that use leverage more heavily aren’t heavily impacted in most cases because of how their debt is structured (fixed rate, long term).

More important is how the rising rates could impact cap rates and property values. This is what we discuss next.

The Impact Of Rising Interest Rates On Asset Values Could Be More Significant And This Is What You Should Worry About

Commercial real estate is valued based on two main factors:

The net operating income, or NOI in short.

And a capitalization rate, or cap rate in short.

The higher the NOI, the higher the property value, of course. And the lower the cap rate, the higher the property value, and vice-versa.

Here’s an example: If a property generated $100,000 of NOI, it will be worth $2,000,000 at a 5% cap rate, but only $1,666,667 at a 6% cap rate.

So if cap rates expand because investors suddenly demand a higher return from real estate, that would lower property values and hurt investors.

So are cap rates about to expand?

This is the primary risk today, and this should be your primary concern as you invest in REITs in 2022.

Cap rates dropped to historically low levels in recent years, and this was at least in part because of the low interest rates. Now that rates are rising again, you would expect cap rates to expand if all else is held equal.

I think that this is very probable for some property sectors, but not for others, and this is why being selective is so important right now.

The whole REIT sector has sold off heavily as if cap rates would expand across the board, but this is highly unlikely because different property sectors offer different levels of income, have different risk profiles, and cater to different groups of investors.

Here is an example:

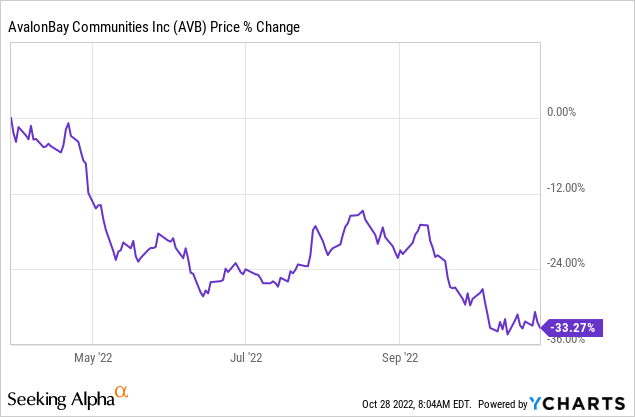

Cap rates have compressed to new historic lows in the apartment sector in the past years. AvalonBay (AVB) and other similar apartment REITs have been able to sell older properties in the high 3s and low 4s. That’s very low in today’s interest rate environment because there is no spread. The 10-year treasuries now offer a higher yield, and therefore, some cap rate expansion may be expected, and you could argue that the drop in the share prices of apartment REITs is at least partly justified (more on this later):

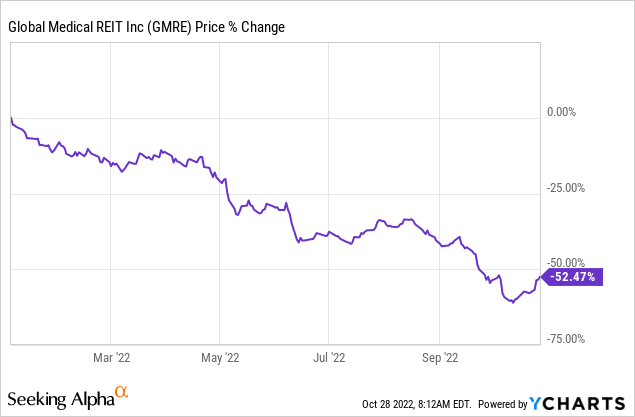

But then you have other property sectors that still offer high cap rates, especially relative to their risk profile. Global Medical REIT (GMRE) has been buying medical office buildings at a ~7.5% cap rate. That’s a large spread, even relative to today’s interest rates. The spread was temporarily abnormally high in the wake of the pandemic, but it is now near historic norms again.

I wouldn’t expect cap rates to change materially. In fact, they may even compress a bit as investors from other lower-yielding property sectors start competing with GMRE to buy its properties in an attempt to earn a spread in today’s higher-rate environment.

Despite that, GMRE is down even more than most apartment REITs in 2022:

It appears that the market sold off GMRE so heavily because it focuses on the impact of rising interest rates on profitability instead of asset values. To be fair, it has more debt than the apartment REITs at a 45% LTV.

But as we discussed earlier, the impact of rising rates still won’t be very material on its profitability.

What matters is the impact on asset values, and from this perspective, GMRE is likely to be less impacted, and yet, it has sold off much more.

We think that this is an opportunity.

Currently, GMRE is priced at a 40% discount relative to its consensus NAV, and it’s buying high-cap rate properties to start with. We believe that its NAV per share is sustainable and even headed higher in the coming year, and this will ultimately lead to a rapid recovery in its share price.

Just to recover its NAV, GMRE would need to almost double its share price. While you wait for the upside, you earn a 10% dividend yield.

In comparison, the apartment REITs trade at a smaller discount to NAV, and this NAV may decline a bit as cap rates expand. As a result, they have less upside potential, and they also pay a much smaller yield at just 3.5% since they are buying lower-cap rate properties.

This does not mean that the apartment REITs are poor investments. In fact, we buy a lot of them as well.

But if I had to pick one, it would be GMRE. It appears to me that the market has mispriced GMRE at an excessively large discount because it focuses too much on the impact of rising rates on the profitability of REITs instead of asset values.

Bottom Line

The bottom line is that you should focus more on property values rather than profitability as you assess the impact of rising interest rates.

Most investors are focusing on the wrong things, and it has led to lots of opportunities for more sophisticated real estate investors who now get to buy good real estate at steep discounts to NAV.

Be the first to comment