Joe Raedle

Thesis

Moderna, Inc. (NASDAQ:MRNA) stock has given back all its gains from July and August after surging to its August highs, post-Q2 earnings. Therefore, we believe the market used Moderna’s July recovery to draw investors into its recent highs before digesting those gains rapidly. As a result, MRNA has fallen nearly 30% from its August highs.

We also urged investors to be cautious in our early July article (Hold rating), as we suggested investors who followed our June update (Buy rating) cut exposure and take profit, as the rapid surge is likely unsustainable. Given the uncertainty in Moderna’s revenue visibility post-FY22, we urge investors to be nimble with their MRNA exposure, leveraging appropriate opportunities to Buy and Sell.

Despite the recent deep pullback, we reiterate our conviction that MRNA has staged its long-term bottom in May/June. As MRNA closes in on its June support zone, we believe it has proffered patient investors another opportunity to add speculative exposure, capitalizing on the near-term pessimism.

Accordingly, we revise our rating from Hold to Speculative Buy.

Moderna – Prepare For A Marked Slowdown In Growth

Post-Q2 earnings, Moderna has had success with its Omicron bivalent booster, receiving an additional 15M doses from the European Commission. Furthermore, the US CDC also has greenlit Moderna’s Omicron bivalent booster, mRNA 1273.222, based on the BA.4/5 strain. Therefore, it’s setting up Moderna well into the fall as it gears up for a strong H2’22, with management highlighting more robust sales in Q4.

Despite that, Moderna maintained the delivery for its advanced purchase agreements (APAs) guidance at $21B for FY22. Given the deteriorating outlook for COVID vaccine growth, we believe it’s a prudent move as the world enters an endemic phase.

Therefore, Moderna has also been preparing for the private commercial market moving forward while focusing on four of its development candidates in Phase III trials. CEO Stéphane Bancel remains confident in Moderna’s ability to drive rapid development through its superior platform, with 31 programs in active clinical trials, as of Q2. He accentuated:

It’s kind of remarkable that we already have 4 vaccines in Phase III right now. We have shown the ability to go from starting a clinical study in vaccine to starting a Phase III in around 12 months time frame, which I think really speaks about the platform capabilities and, of course, how we really build a very strong late-stage development team. As you know, one of the really good things about messenger RNA and how we build the company with a lot of robotics, a lot of digitalization is the ability to scale very quickly. (Moderna FQ2’22 earnings call)

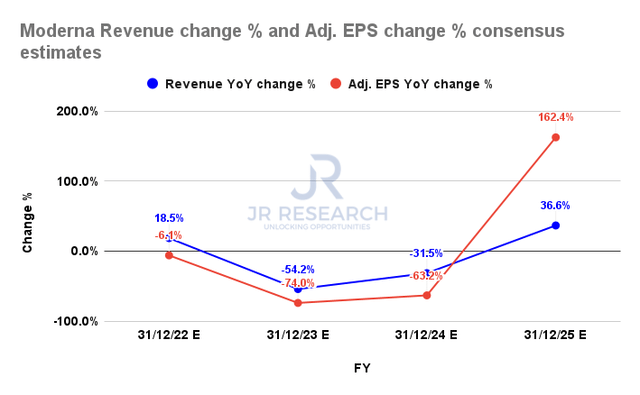

Moderna revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) continue to point to a worrying decline in Moderna’s revenue growth through FY24, despite the optimism from its four potential candidates in the Phase III stage. Therefore, the battering seen in MRNA over the past year justifiably reflects these worries, as it’s also expected to impact Moderna’s adjusted EPS growth.

Moderna also highlighted in its 10-Q that we believe suggested the company also sees potential risks to its growth cadence. It added:

Evolving dynamics in the market for COVID-19 vaccines are likely to impact our results. For example, we anticipate that our product mix will shift from a two-dose 100 µg primary series to 50 µg booster doses as COVID-19 evolves to an endemic phase. This change in product mix and evolving market dynamics will require us to purchase fewer raw materials and scale back our manufacturing operations with contract manufacturers. (Moderna 10-Q)

Hence, we surmise that the consensus estimates are credible, as the company also didn’t telegraph much confidence in its FY23 APAs updates. Management articulated:

In terms of 2023 orders, we have already signed deals with 5 countries that we’ve previously announced, the United Kingdom, Canada, Australia, Kuwait and Taiwan. We have also signed options with Canada, Switzerland, Taiwan as well. And we are actively having dialogue with countries around the world for additional orders in 2023. (Moderna earnings)

Therefore, we urge investors to temper their growth expectations for Moderna. While we believe that much of the long-term downside in MRNA has been reflected, given its pummeling from 2021, there could still be tremendous volatility in the near term.

Therefore, we deduce investors must remain nimble with their positions, as Moderna’s revenue visibility remains highly speculative. We believe the Street has modeled its inflection from FY25, predicated on the success of its current Phase III programs. Still, those estimates are likely to remain highly uncertain.

MRNA’s Valuation Remains Well-Balanced

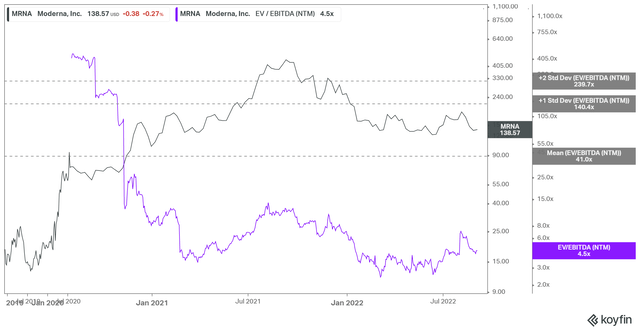

MRNA EV/NTM EBITDA valuation trend (koyfin)

MRNA last traded at an NTM EBITDA of 4.46x, well above its May/June lows of 2.4x. Therefore, we urge investors to consider the falling EBITDA estimates, as it could impact the market’s perception of MRNA’s valuation moving ahead.

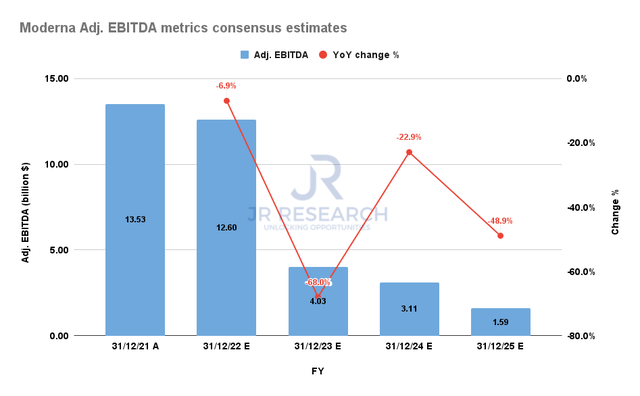

Moderna adjusted EBITDA consensus estimates (S&P Cap IQ)

As seen above, Moderna’s adjusted EBITDA is projected to fall through FY25 as its Spikevax-driven growth slows down, with no other successful commercial candidate in place.

As a result, MRNA FY25’s EBITDA multiple would rise to 23.3x. While still lower than its all-time mean, we believe the opportunity for a medium-term re-rating remains uncertain if the market is not confident of its execution.

Is MRNA Stock A Buy, Sell, Or Hold?

MRNA price chart (weekly) (TradingView)

As seen above, the $200 resistance level has rejected MRNA’s buying upside robustly since April 2022, as it formed two notable bull traps, including at the highs in August 2022. Therefore, we urge investors to avoid adding close to that level while using the opportunity to take profits smartly and cutting exposure.

However, we view the pullback in MRNA as healthy, despite declining revenue and profitability estimates, as the market awaits Moderna to prove its commercial capability beyond Spikevax.

We view the opportunity to add exposure to MRNA as appropriate, given our conviction of a long-term bottom predicated on May/June lows. Therefore, we revise our rating on MRNA from Hold to Cautious Buy.

However, we highlight the potential for near-term downside volatility and encourage investors to consider using a dollar-cost averaging strategy.

Be the first to comment