da-kuk

It’s been about 6 ½ months since I wrote my cautious piece on Workiva Inc. (NYSE:WK) and in that time the shares are down about 27% against a loss of about 11.2% for the S&P 500. I want to review this name again for a few reasons. First, since shares trading at $78 are definitionally less risky an investment than the same shares when they’re trading at $106, I thought I’d check on the name again. Second, the company has reported earnings since, so I want to see if the problems I identified previously have been solved, which would make this a much more compelling investment. Finally, I recommended that investors who disagreed with me and insisted on staying long express that view via call options. The calls have just recently expired, and I’m absolutely champing at the bit to write about how that trade worked out. I think that even investors who are not interested in Workiva explicitly might find the risk reducing potential of call options interesting, particularly now.

My reader base is some of the most dynamic, attractive, intelligent, and insightful readers on this platform. They’re also a very busy crowd, and for that reason, each of my articles contains a convenient “thesis statement” paragraph near the beginning of the piece, which allows my readers to pop in, get the “gist” of my thinking, and then get back to working out which supermodel to date this weekend, or whether to travel across the Atlantic in a high altitude balloon or rowboat. You’re welcome. I’m of the view that Workiva remains un-investable. The company has continued its near decade tradition of selling dollar bills for 75 cents. The fact that they’re able to attract a market for this trade isn’t surprising in my view. What’s surprising is that some people insist on calling it a “growth” company. When you own a business, you’re compensated with whatever’s left over after the sales and marketing expenses, for instance, get paid. While sales have exploded higher, this company has produced losses throughout its history, and for that reason, it’s not a great investment in my view. In spite of all of this, the shares are hardly cheap. Finally, in my previous missive, I recommended people who insisted on staying long here express that view by buying call options. My thinking was that calls gave investors most of the “flavor” upside at a fraction of the “calories” risk. That trade has worked out relatively very well. I think this is further evidence of the fact that calls offer much better risk return potential as a way to speculate on “profit free” stocks. I think the April 2023 calls with a strike of $80 make the most sense for people who insist on staying long here. You get much of the upside at 13% of the risk.

Financial Update

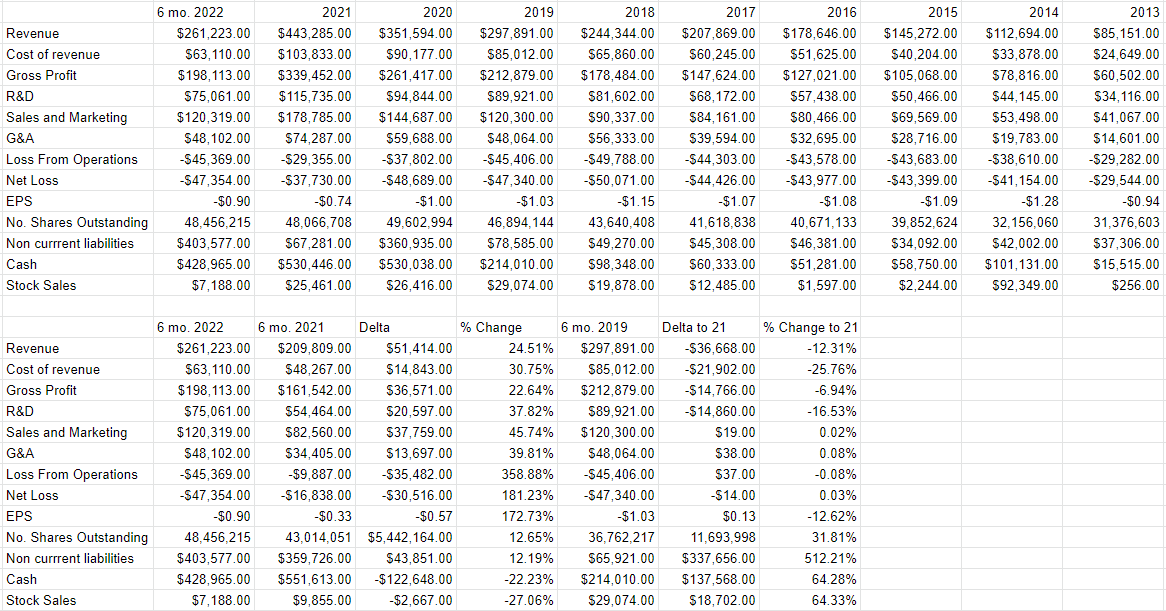

In case you don’t have my previous work on Workiva in front of you, I’ll remind you that I found some elements in the financial history to be optimistic about. For instance, I liked the fact that revenue and gross profit had jumped by 26% and 30%, and that the net loss had shrunk from $48.7 million to $37.7 million. Some of those positive trends remain intact. Specifically, the first six months of 2022 saw revenue and gross profit up by 24.5% and 22.6% respectively. The problem is that costs expanded at a much faster rate, resulting in a much higher net loss. To be precise, net loss ballooned from $16.8 million during the first six months of 2021 to $47.4 million most recently. The biggest single driver of this relative underperformance is sales and marketing expenses (up 45.75%), but other costs like G&A (up 39.8%), and sales and marketing (up 45.75%) also contributed substantially to losses. Most troubling of all in my view, the company lost as much money during the first six months of 2022 than it did during all of 2019. In my view, calling this a “growth” company would be a mischaracterization.

Additionally, the capital structure has deteriorated significantly from this time last year, with non-current liabilities up by about 12.2%, and cash down by 22%. A deterioration in the capital structure obviously increases risk. In fairness, though, the cash hoard of $429 million is sufficiently high to fund losses for a few more years.

Finally, in my previous missive, I went on about the fact that there’s a strong (r=-.87) negative correlation between revenue and net income here going back to 2013. It seems that the more this company sells, the more it loses. This prompts the very obvious question: if growing revenues can’t generate profits, what can? Given the current state of this business, I’d need to see the shares trading at a significant discount to both their own history and the overall market to get me excited about taking a position here.

Workiva Financials (Workiva investor relations)

The Stock

Welcome to the section of the article where I usually climb up on a virtual soapbox and drone on about the fact that the business and the stock are completely different things. The business brings together various inputs, adds value to them, and hopefully sells the results at a profit any year now. The stock, on the other hand, is the crowd’s aggregate view about the long term health of the business. The stock is buffeted by a host of forces, having more or less to do with the underlying business. The market obviously reacts to financial performance at the company. The stock may also be affected by the crowd’s changing views about “stocks” as an asset class. After all, some portion of Workiva’s recent underperformance can be blamed on the fact that investors are less enthusiastic about stocks this year than they were last year.

In my experience, the only way to make money trading stocks is to spot the difference between the market’s current expectations about a given company’s performance and subsequent reality. The more pessimistic the crowd is, the better, because dour expectations are relatively easy to overcome. Cheaper stocks are associated with a pessimistic crowd, which is why I insist on trying to buy stocks when they’re cheap. In particular, I want to find a stock that’s cheap relative to both the overall market and its own history.

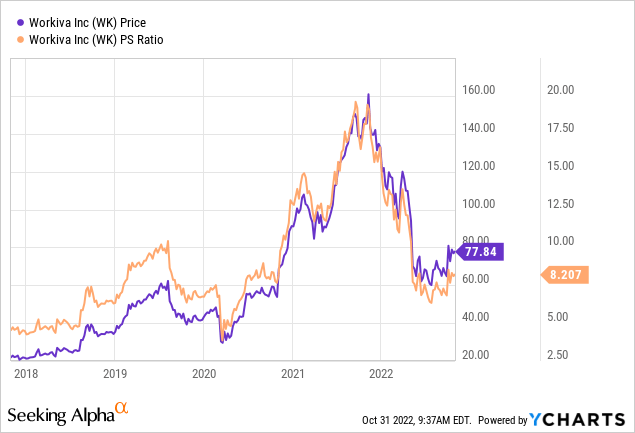

My regular readers know that I measure the cheapness, or not, of a stock in a few ways ranging from the simple to the more complex. On the simple side, I compare the price to some measure of economic value, like earnings, sales, free cash flow, and the like. Obviously it’s not possible to compare the price to earnings in this case, because this company is, shall we say, “earnings light.” On a price to sales basis, though, the shares are much cheaper than when I last reviewed the name, but still quite elevated in my view, per the following:

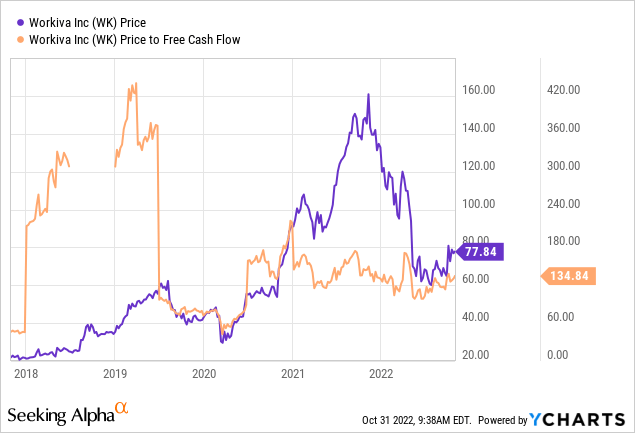

Additionally, while the shares are “cheaper” on a price to free cash flow basis, I don’t think it would be reasonable to characterize paying $134.84 for $1 of free cash flow here as “cheap.”

In addition to looking at ratios, I want to try to work out what the market is “assuming” about a given company’s future. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Applying this approach to Workiva at the moment suggests the market is assuming that this company will grow earnings at a rate of ~10% in perpetuity. I consider that to be a very optimistic forecast given the near decade of financial history we see above. Given all of this, I can’t recommend buying at current levels. The company is growing sales, but continues to bleed losses. Net income is the most relevant variable for owners of any business. There are a host of better risk adjusted investments available to investors, and for that reason I recommend continuing to avoid this name until the price comes down to match value.

Options Review

While I was skeptical of the stock in my previous missive, I also admitted that it was quite possible that the shares might spike in price. I recommended investors who insisted on disagreeing with me, and remaining long here, do so with the use of call options. Specifically, I recommended investors buy the October calls with a strike of $110 for $16.50. Since these calls have just recently expired, it’s time to perform an analysis of what happened. I’m going to do this by reviewing the relative performance of the stockholder and the call holder.

When I last splashed around some virtual ink about Workiva, the shares were trading at $106.66, and they last traded hands at $77.86, so the person who bought shares the day I published my article is down about $28.80 per share. The October calls with a strike of $110 that I recommended in lieu of shares have just expired, so the call holder is out $16.50. Losing $16.50 is better than losing $28.80, obviously, but I’d suggest that calls were a “less bad” solution even if the financial results were closer. This is because the call holder risked only about 15% of the capital that the shareholder did, which would allow them to put 85% of their capital in an alternative, safer investment.

I hope it’s plain by now that I don’t recommend this as an investment. That written, for those who insist on taking a long position in this stock, I think they would be wise to express this view via the April 2023 Workiva calls with a strike of $80. These are currently priced at $6-$10.70. So, worst case scenario, the speculator will expose 13.7% of the capital at risk, and will enjoy much of the upside investors might enjoy over the next six months.

Be the first to comment