vldmit/E+ via Getty Images

In Tuesday’s issue of the 1-Minute Market Report, I focus on three key items. Tuesday was an extremely rare 56:1 down day, we wiped out all of the gains we made over the prior four days, and we are setting up for a 25% rally over the next 12 months.

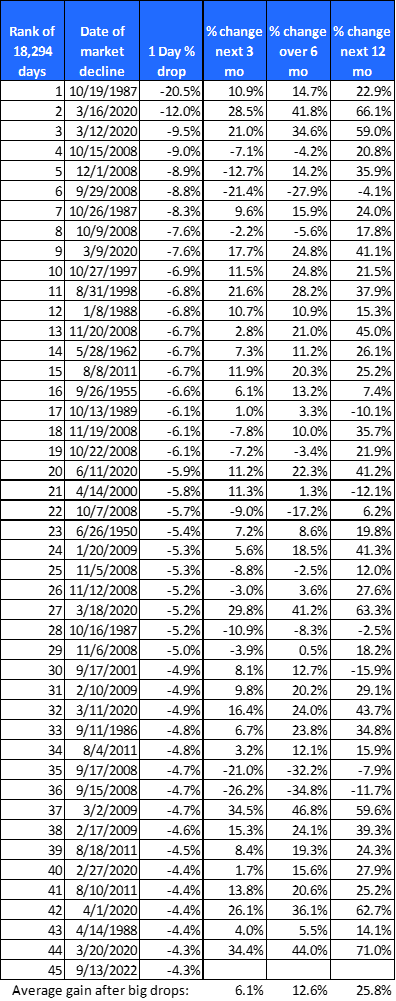

As I’ve been saying for a couple of months, these big down days tend to cluster near the end of a bear market, albeit with a few exceptions. The table below shows the 45 worst one-day market declines, and what the market did over the next 3, 6, and 12 months. (Tuesday was the 45th worst day for stocks out of the 18,294 trading days since 1950.)

You will see that in 40 of the 45 instances, the market was higher by an average of 25% twelve months later. The 5 exceptions resulted in an average 12-month loss of 8.4%, and 3 of the 5 exceptions came in 2008.

Table 1. The 45 worst 1-day market declines and what came next.

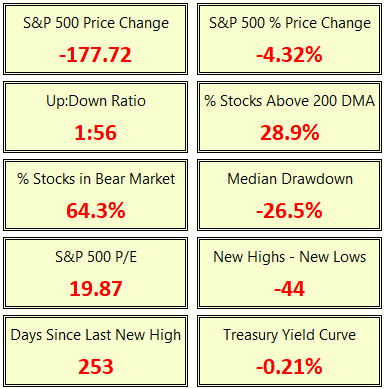

Tuesday’s Stats

Here is a look at the stats for Tuesday’s big decline. For every stock that was up, there were 56 that were down. This is close to an all-time record.

Nearly two-thirds of all stocks in the S&P 1500 Composite Index are now in a bear market, with the median stock down -26.5% from its 52-week high. More than 70% of all stocks in the index are trading below their 200-day moving average.

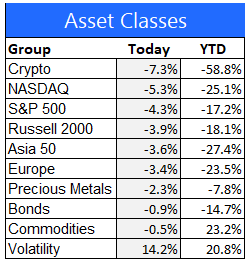

Asset Class performance

Here is a look at the performance of the major asset classes, September 13 and year-to-date. Crypto, and blockchain in general, continue to struggle this year. The only asset classes showing positive year-to-date performance are commodities and volatility.

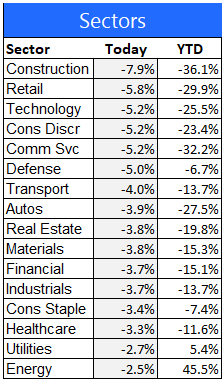

Equity sector performance

For this report, I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. I find that using all 16 gives a fuller picture of which areas of the market are attracting the most buying and selling interest from investors.

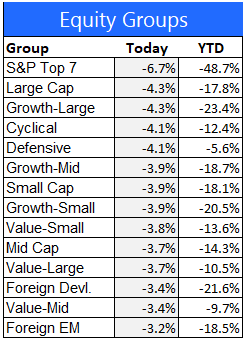

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

The top 7 stocks by market cap (big tech names, like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG, GOOGL)) are by far the worst performing equity group year-to-date.

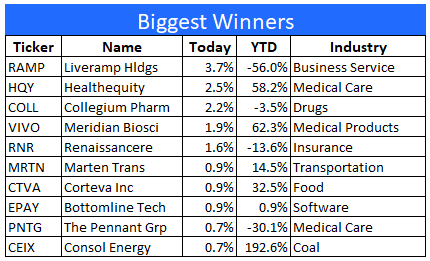

The 10 best-performing stocks

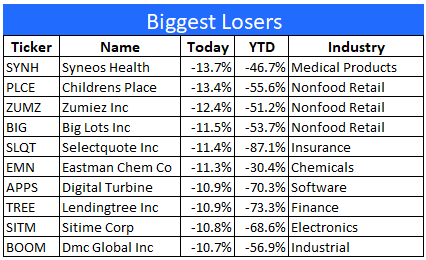

The 10 worst performing stocks on Tuesday

Final thoughts

The market had put together an impressive, four-day rally before the wheels came off on Tuesday. The proximate cause was obvious – the surprise uptick in inflation killed the narrative that the Fed was winning the inflation battle and would soon begin to pivot to a more supportive policy stance.

It now looks very likely that the Fed will do another 75-basis point hike next week. That will increase the fears about a Fed-induced recession later this year or early next year. Investors had been looking past what they assumed would be a short and mild recession, but now those assumptions are being called into question.

Where do we go from here? Probably lower for a while, but I don’t think we have much more downside to cover before we make the final bottom for this cycle. History is on the side of the optimists, even though they were handed a significant setback on Tuesday. Odds are that one year from September 13, the market will be higher by 20% or more.

Are you looking for more high quality ideas? Consider joining The ZenInvestor Top 7, my Marketplace service. The Top 7 is a factor-based trading strategy. Its screening algorithm prioritizes reasonable price first, then the momentum, and finally projected earnings growth. The strategy produces 5-7 names, and rebalances every 4 weeks (13 times per year). The goal is to catch healthy companies that have gone through a rough period, and are now showing signs of making a strong comeback. Join now with a two-week free trial.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment