Justin Sullivan

By The Valuentum Team

Shares of Intel Corporation (NASDAQ:INTC) have gotten crushed in recent years as the company has fallen far behind its peers in terms of its semiconductor manufacturing prowess. It will take tens of billions of dollars and many years for Intel to catch up, though management has set out a roadmap to eventually become a relevant player in the “chip” industry once again. The company will benefit from the recently passed CHIPS Act in the US, which includes substantial subsidies for enterprises seeking to build semiconductor fabrication sites (chip manufacturing facilities) located in the US. We are staying on the sidelines for now until Intel can prove its broad corporate revamp strategy will bear fruit and turn things around.

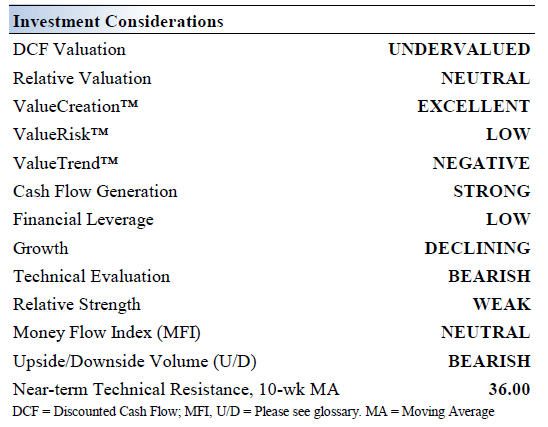

Intel’s Key Investment Considerations

Image Source: Valuentum

Intel designs and manufactures advanced integrated digital technology platforms, which are used in PCs, servers, tablets, smartphones, automobiles, automated factory systems, and medical devices. Intel is in the process of selling its NAND flash memory business to SK Hynix Inc (OTC:HXSCL) for ~$9.0 billion in cash. The first phase of this deal was completed in December 2021.

Over the long haul, Intel aims to capitalize on secular growth tailwinds in the realms of cloud-computing, 5G, Internet of Things [‘IoT’] trend, and the future of mobility (autonomous and semiautonomous vehicles). As the company intends to spend heavily improving its semiconductor fabrication operations, its free cash flows (defined as net operating cash flows less capital expenditures) will come under significant pressure over the coming years due to its surging capital expenditure expectations (we’ll cover that in a moment).

Intel’s purchase of Mobileye in August 2017 positioned it as a leader in the provision of end-to-end solutions in the automated driving market, expanding the reach of its virtuous cycle of growth. The firm also acquired Moovit in March 2020 to accelerate its push into the Mobility-as-a-Service space. These deals broadened Intel’s total addressable market [‘TAM’].

Intel’s Problems

Over the past decade, Intel has fallen far behind its peers and the firm plans to spend aggressively to catch up. For instance, Intel intends to spend up to 80 billion euros on R&D and manufacturing activities in Europe over the next decade. This plan includes a new semiconductor fabrication facility in Germany, a new R&D hub in France, and additional semiconductor-related facilities in Italy, Poland, and Portugal. Additionally, Intel is spending $20 billion building two new semiconductor fabrication facilities in Ohio and another $20 billion building two new semiconductor fabrication facilities in Arizona.

These major investments are part of Intel’s IDM 2.0 strategy which includes building out a vast manufacturing presence which can be used to meet internal and external needs. Stepping up its R&D investments is another part of this strategy, and these efforts are in response to Intel’s 7-nm chip production process not going as planned. Intel’s first 7nm chips for PCs are expected in 2023, years behind the competition, largely due to its inability to internally produce 7nm chips at scale. Management is largely justifying Intel’s major manufacturing capacity expansion by noting that the firm’s future revenues will benefit its ability to manufacture chips for third-parties, while also enabling Intel to better meet its own needs.

Competition is fierce in the markets Intel operates in, with many of its competitors moving or already selling 5nm chips. Taiwan Semiconductor Manufacturing Co Ltd (TSM) and Samsung Electronics Co Ltd (OTCPK:SSNLF) are both capable of manufacturing 5nm chips, while firms like Qualcomm Inc (QCOM) and Advanced Micro Devices Inc (AMD) are capable of designing 5nm chips that are produced by Taiwan Semi and Samsung.

Earnings Update

On July 28, Intel reported second quarter earnings for fiscal 2022 (period ended July 2, 2022) that missed both consensus top- and bottom-line estimates. The firm’s GAAP revenues fell by 22% year-over-year last fiscal quarter to hit $15.3 billion as Intel lost market share to its peers, and its GAAP operating income flipped to an operating loss of $0.7 billion due to surging operating expenses (R&D expenses were up 18% year-over-year). Intel reported -$0.11 (negative $0.11) in GAAP diluted EPS last fiscal quarter versus (a profit of) $1.24 in the same period last fiscal year.

As of July 2, 2022, Intel had a net debt load of $8.4 billion (inclusive of short-term debt). Its $27.0 billion in cash-like assets on hand at the end of the fiscal second quarter provides Intel with ample liquidity to meet its near term funding needs, but we caution that the company is entering a period of major capital investments with limited financial firepower.

During the first half of fiscal 2022, Intel generated negative $5.4 billion in free cash flows as its capital expenditures surged higher (removing capital expenditures relating to Intel’s NAND business that’s being sold, Intel’s capital investments rose by 56% year-over-year). The company spent $3.0 billion covering its dividend obligations during the first half of fiscal 2022, which was funded by its balance sheet.

Here is what Intel’s management team had to say regarding Intel’s longer term strategy and recent performance during its latest earnings call:

The sudden and rapid decline in economic activity was the largest driver of the shortfall, but Q2 also reflected our own execution issues in areas like product design, DCAI, and the ramp of AXG offerings.

We have an obligation to remain vigilant and to respond to the changing business conditions while not losing sight of our long-term goals and opportunities. We will look to do both by adjusting and refocusing our spending levels in the near term, at the same time, as we accelerate the deployment of our smart capital strategy and improve product execution. Collectively, these actions will begin to show dividends in the second half of the year, allowing us to return gross margins to our target range by Q4 and maintain our initial free cash flow outlook for 2022.

While still early in our journey, we remain laser-focused on executing to our strategy to deliver leadership products anchored on open and secure platforms, powered by at scale manufacturing and supercharged by our people. The current economic backdrop only strengthens our result and we are embracing this environment to accelerate our transformation. — Pat Gelsinger, CEO of Intel

Intel has its work cut out for it to right the ship, and this process will take a long time. We appreciate that Intel’s revamped management team (its new CEO Pat Gelsinger took over in February 2021) has laid out a roadmap to turn things around, but this plan is quite expensive.

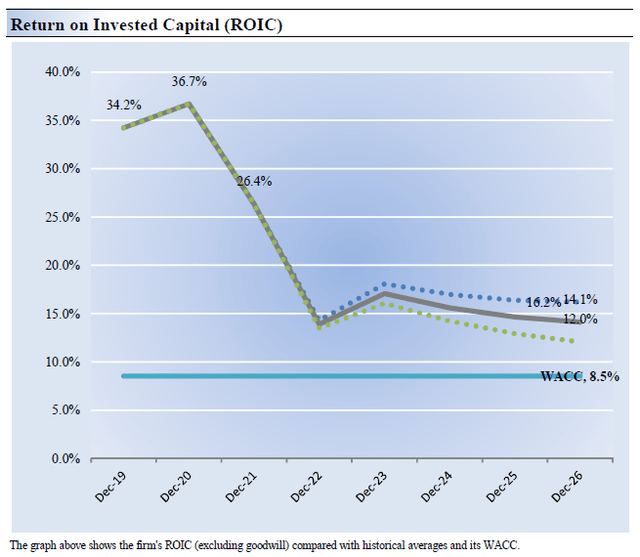

Intel’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Intel’s 3-year historical return on invested capital (without goodwill) is 32.4%, which is above the estimate of its cost of capital of 8.5%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

Image Source: Valuentum

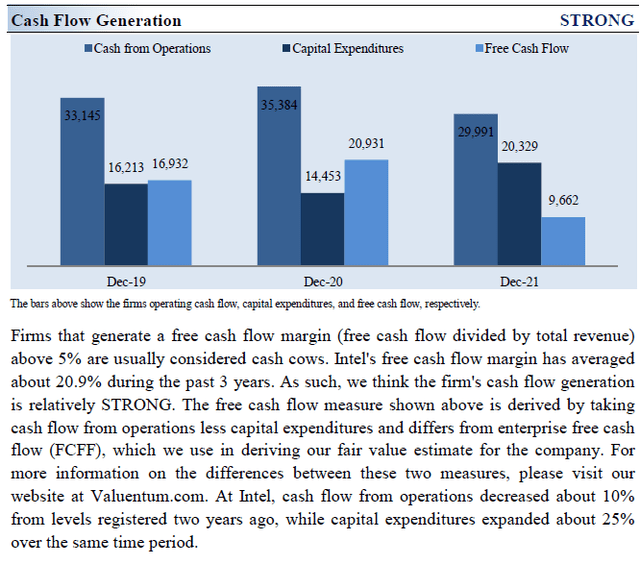

Intel’s Cash Flow Valuation Analysis

Image Source: Valuentum

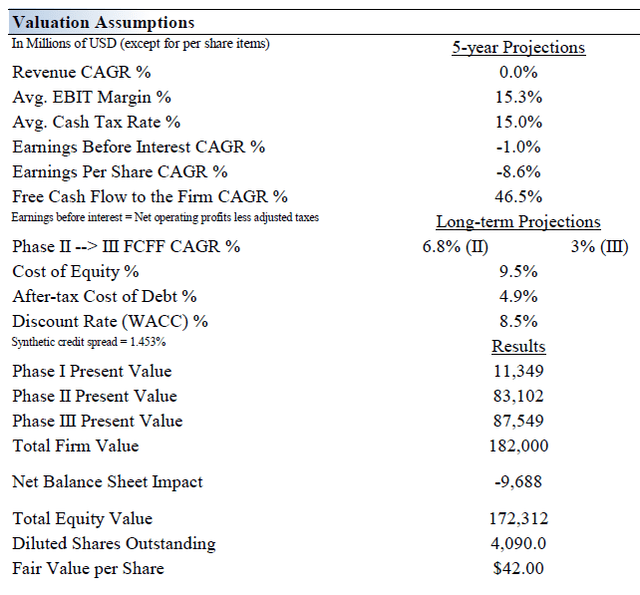

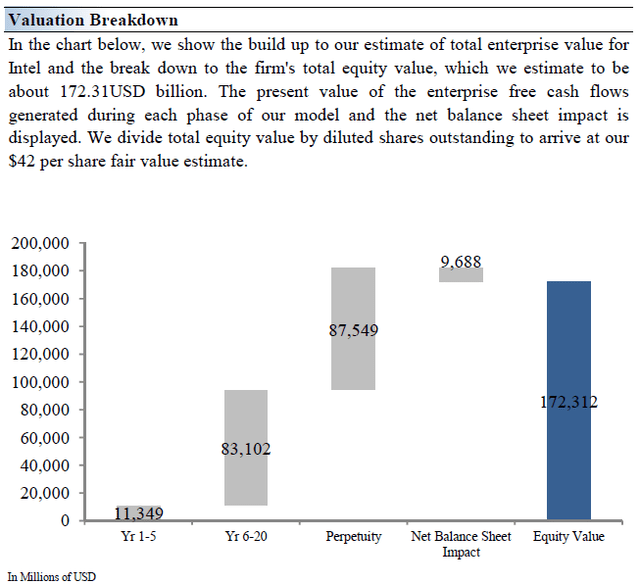

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think Intel is worth $42 per share with a fair value range of $34.00 – $50.00. Shares of Intel are trading below the bottom up end of our fair value estimate range as of this writing, though we are still staying away from Intel for now given its weak technical performance of late (investors are apparently not convinced Intel’s strategy will pan out favorably and as such have sold off shares of INTC accordingly).

The near-term operating forecasts used in our enterprise cash flow models, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 0% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 3.7%. Our model reflects a 5-year projected average operating margin of 15.3%, which is below Intel’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 6.8% for the next 15 years and 3% in perpetuity. For Intel, we use an 8.5% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum

Image Source: Valuentum

Intel’s Margin of Safety Analysis

Image Source: Valuentum

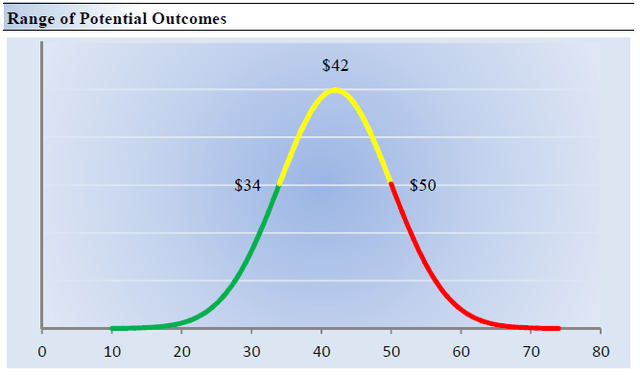

Although we estimate Intel’s fair value at about $42 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graph up above, we show this probable range of fair values for Intel. We think the firm is attractive below $34 per share (the green line), but quite expensive above $50 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Intel’s outlook is stressed by rising competitive threats and the company intends to aggressively scale up its capital expenditure expectations over the coming years to bolster its chip manufacturing capabilities. The firm’s free cash flow generating abilities will face headwinds during this expansion phase due to the hefty capital expenditure requirements involved with building advanced chip making facilities. Increases in its R&D investments will also pressure Intel’s financial performance in the near term, as will its large net debt load. We are steering clear of Intel for now, though we are closely watching its turnaround ambitions.

Be the first to comment