Shutter2U

There is a short thesis on Silvergate Capital (NYSE:SI) by Marc Cohodes. Cohodes is well known as a determined short seller. Grant Williams interviewed him in a beautiful production for Real Vision. It’s a few years old, but it provides a view into Cohodes personality and background. There’s a lot of pressure on Silvergate Capital its share price that I suspect is, at least partly, due to an interview with Cohodes by Keith McCullough of HedgeEye. I understand the short case as I initially found myself on that side. After digging in deeper I now see the long side as a superior long term opportunity.

In this interview, Cohodes says he’s short Silvergate Capital and insinuates several things are wrong at this bank. Because this interview seems to have a profound effect on the stock price and is widely cited in the comments on my previous articles, I’ll review the issues Cohodes brings up.

My “reading” of Cohodes case is that he identifies the following problems:

Cohodes: Know your customer and anti-money laundering at Silvergate Capital is potentially not in order

He provides no evidence for this claim, except that Silvergate held $1 billion of FTX in deposits and he seems to believe FTX is a criminal organization.

Silvergate deals with a limited number of institutional grade customers. These are trading firms, mining firms, exchanges, hedge funds, etc. It is easier to do extensive customer diligence on business customers. However, your customers can still lie on the forms you provide them. If they’re a total fraud, they’re not going to announce this during a KYC or AML process. At this time, I don’t see a reason why Silvergate should be considered especially lax. Silvergate was one of the first banks to provide services to crypto-related customers, and if they weren’t under intense scrutiny they likely were prepared to be pioneers in this field.

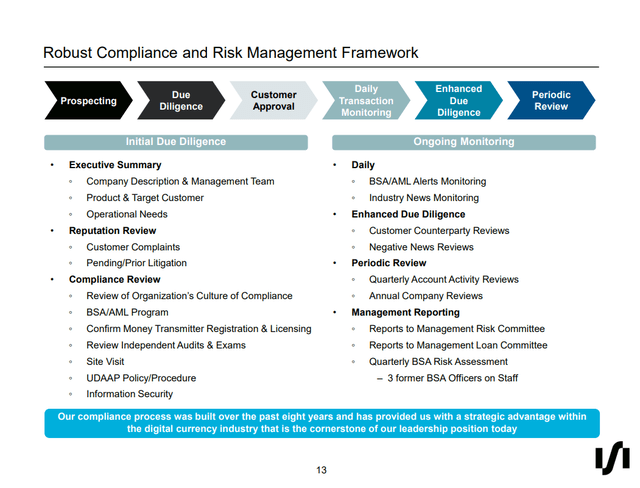

The most recent investor presentation has this slide clearly showing the presence of KYC and AML procedures:

Silvergate Capital Compliance and Risk framework (Silvergate Capital Investor Presentation)

Cohodes: Silvergate processes an abnormal volume of USD transactions, given its deposit base

Silvergate pays no interest on deposits. It encourages clients to take the deposits they are not engaging in trades elsewhere to earn yield. The network they have developed is very valuable to trading firms and exchanges in the ecosystem because they can do dollar trades with other Silvergate customers at no cost. They can send each other crypto elsewhere and settle the corresponding dollar amounts on Silvergate, for example. Silvergate is popular with hedge and arb funds that can easily send money between exchanges or go in and out of crypto exposure. What customers are looking for is an efficient use of their capital base, and Silvergate is seeking to provide that platform. Efficient use of capital means high trading volumes. It makes sense that there is a lot of volume at Silvergate on a relatively modest deposit base. These are not your run-of-the-mill bank deposits. It is effectively day trading capital.

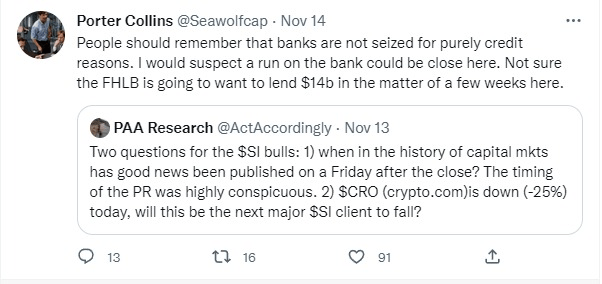

A bank analyst Cohodes knows says there is a run on the bank going on. Cohodes is likely referring to Porter Collins or @Seawolfcap on Twitter. Porter Collins posted the following on Twitter:

Porter Collins tweet (Twitter)

Cohodes states it is a deposit story implying it is not a solvability story (although he doesn’t say that outright). A deposit story isn’t as interesting at a bank like Silvergate as it would be at your run-of-the-mill sleepy town bank. At most banks deposits are hard to win and if you lose them, they’re hard to get back. There isn’t much difference between most banks. But Silvergate’s services are deeply differentiated and customized around the needs of their crypto industry clientele. It seems much likely to me that deposits that are temporarily scared off, will return. Deposits have historically been quite volatile because of their specific nature (mostly crypto firms and crypto trading firms).

In turn, Silvergate its assets are highly liquid and designed to meet a high number of rapid withdrawals 24/7. Deposits seem extra likely to return because the environment to capture spreads in crypto markets is good (high volatility). Silvergate provides valuable infrastructure advantages if you trade in that arena. It doesn’t mean they aren’t losing deposits right now, but naturally, it should be a temporary headwind as funds will want to pursue opportunities.

Deposit base

I find some solace in the fact that Silvergate’s deposit base is highly institutional-based with clients with a lot of knowledge about this space. In addition, the deposits are not based on any yield differential. They deposit with Silvergate DESPITE the zero yield on deposits. This confirms customers are attracted to the platform for other reasons.

One of these things is the trading advantages, and it is exactly in this type of environment that trading is very lucrative. Do you want to pull back from trading just as the going is very, very good? That doesn’t seem very likely to me.

I believe historically deposits at Silvergate tended to RISE as volatility in crypto goes up.

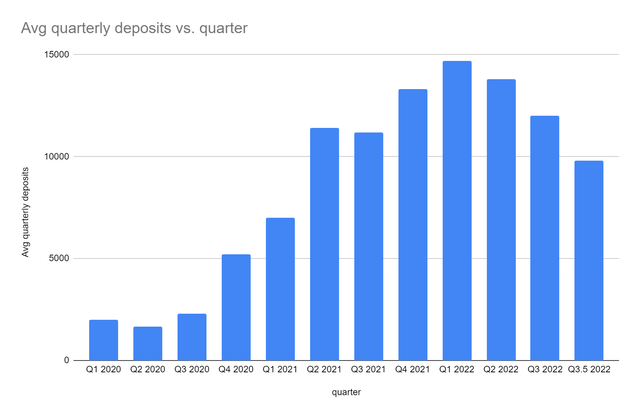

Deposit history Silvergate (Special Situations Report )

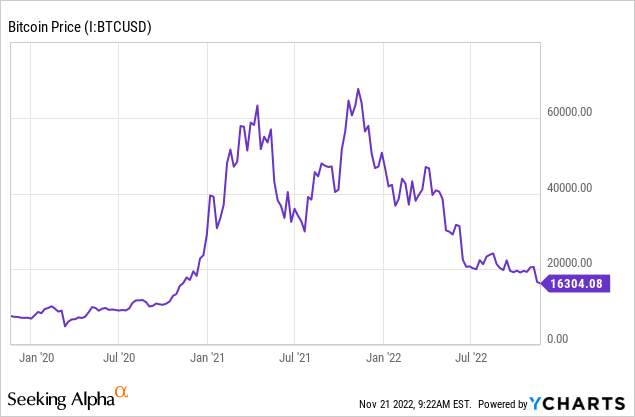

But the deposits also rise with the price of Bitcoin (BTC-USD) as trading the same number of Bitcoins requires an increasing number of dollars when its price is rising sharply:

Silvergate is generally reporting an AVERAGE quarterly deposit number (which has been its practice for many quarters now). They believe this is more informative because the firm sometimes experiences multi-billion dollar swings of deposits within days.

As an investor, the average is hard to read because there are different ways the number may have come together. One of the worst-case scenarios is where crypto firms fled to safety in the FTX crisis (i.e. parked at Silvergate), and after Cohodes started throwing shade at the bank there may have been a stampede away (as this is only a few days ago). The average could still be holding up very well while deposits could theoretically be much lower.

The opposite is also possible where everyone initially battened down the hatches and are now returning to do a lot of trading as the opportunities to do arbitrage and scalping are likely really good amidst the chaos.

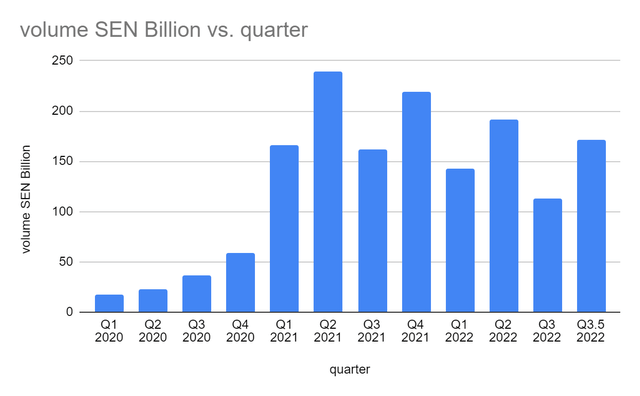

I’ve also charted the trading volume over SEN going back to Q1 2020 and a picture like this emerges (based on the Q3.5 update as of yesterday):

SEN Volume history (Special Situations Report)

There is a lot of trading volume, but it is not entirely exceptional. There have been quite a few peaks of the trading volume. Likely the volume is easier to achieve with much higher Bitcoin and crypto prices so it could still be exceptional if adjusted for that.

My understanding from going through years of earnings calls is that there is a relationship where deposits tend to be high when volumes are high, BUT this relationship doesn’t hold 1:1 and last week’s deposit update suggests it doesn’t hold true right now.

Conclusion

I can’t say I’m not worried about the short-selling campaign that’s casting doubt on the company and potentially driving some deposit outflows. However, I think there are three important mitigating factors:

1) The deposit base is professional in nature

2) Trading opportunities are likely really good and to traders, Silvergate is a huge help

3) To a “normal bank” deposit outflows are long-term damaging. I don’t think that’s the case here. Silvergate’s SEN network has a lot of utility to its customers (that’s why they go along with receiving no yield) and they will come back if they are no longer scared.

Be the first to comment