Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 15.

The Agency mortgage sector has been buffeted this year by a number of shocks including high interest rate volatility, significant duration extension, market illiquidity, and the end of Fed buying. In this article, we take a look at the preferred securities of mortgage real estate investment trust (“REIT”) Two Harbors Investment Corp. (NYSE:TWO). TWO primarily allocates to the Agency MBS sector alongside mortgage servicing rights, which provide a natural interest rate hedge. More importantly, however, the company has been actively supporting their preferreds through various measures such as unexpected redemptions, buybacks, and common share issuance. In this article, we take a look at these actions and highlight the value in the preferreds suite.

A Recap Of The Agency MBS Sector

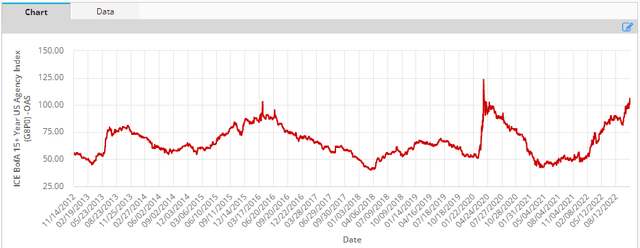

Agency MBS valuations have become very attractive by historical standards. The sector trades at a very elevated spread over Treasuries as the following chart shows – a level that has only been reached historically during periods of severe economic stress.

Secondly, the duration of the Agency MBS sector is as long as it has been this century, which suggests that there should be less additional selling pressure from institutional investors who manage their fixed-income portfolio on a duration basis.

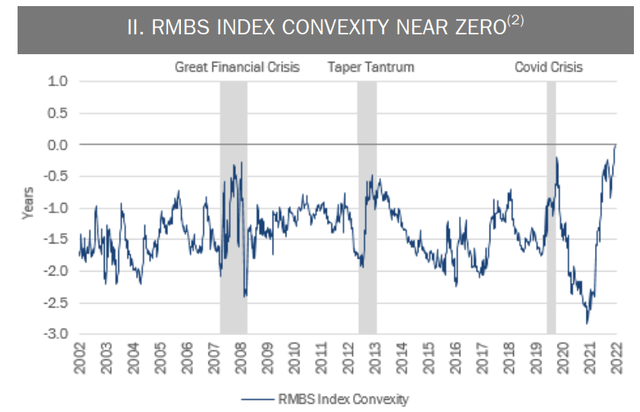

And third, Agency MBS convexity has moved to zero, which makes it much easier for mortgage REITs to hedge their interest rate exposure. This is for two reasons. First, changes in interest rates no longer require mREITs to significantly rebalance their interest rate hedges in response to changes in MBS duration. Doing so requires mREITs to pay high rates/receive low rates – a version of buying high and selling low – a process which leads to realized losses, particularly when interest rate volatility is high. When MBS convexity is zero, Agency MBS duration does not change very much and mREITs don’t have to reshuffle their hedges.

And two, mREITs don’t have to pay for expensive swaption positions, which can help offset the negative convexity of MBS. Swaptions are not only expensive when volatility is high (because mREITs have to “buy volatility” at high levels) but also create a so-called basis risk since swaptions reference interest rate swaps, whereas Agencies trade closer to Treasuries than swaps. With convexity near zero, mREITs can reduce their swaption holdings and forego having to buy volatility at expensive levels.

A Look At The TWO Profile

TWO has a relatively unusual profile in the mortgage REIT space, with a roughly 80/20 Agency MBS/Mortgage Servicing Rights portfolio. Most of the mREIT sector is composed of mREITs either primarily focused on Agency MBS or primarily focused on resi/commercial loans. TWO has an Agency allocation that is well below that of pure Agency mREITs like AGNC and DX but well above Hybrid mREITs like CIM or NYMT.

This kind of profile is not unheard of and makes a lot of sense. The two types of securities have different duration profiles – Agencies positive and MSR’s negative. The reason MSRs have negative duration is because when interest rates rise, mortgage maturities tend to extend because they are less likely to be refinanced. And because MSRs are basically fee annuities of mortgages, they rise in value because the period over which the servicing fees are paid increases.

A key reason why we like TWO in the Agency MBS space is that they have been willing to perform actions that are friendly to preferreds holders. These actions were clearly not motivated primarily by the interests of preferreds holders but the fact that they still happen does make TWO attractive.

Specifically, TWO has been willing to support their preferreds every time equity/preferred coverage approached a level of 3x (i.e., $3 of equity for each $1 of preferred liquidation preference), by either retiring preferreds (Series D and E in Q4-20 despite these stocks trading below “par”) or doing a large common issuance (Q3/Q4-21).

This time around they bought back 2.9m shares of their three existing preferreds or 10% of total outstanding shares – a significant move. This not only supported the prices of the preferreds and increased book value by around 1.5% but also allowed equity/preferred coverage to fall only modestly to 3.2x from 3.4x despite a much larger drop in book value over the quarter.

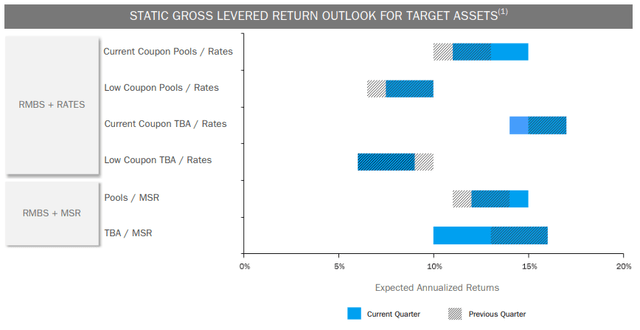

The company is not looking at it from an equity/preferreds coverage perspective but rather from a cost of equity/asset yield perspective. Preferreds yields hitting double-digit levels offered a much more enticing opportunity than Agencies/MSRs. Although the yield of the preferreds was below the leveraged yield of these asset classes, the preferreds have no risk to TWO unlike the other two asset classes, i.e., no credit risk, no negative convexity, no other kind of market risk at all. The chart below shows the leveraged yields available to TWO on various assets in its investment strategy.

So, given the choice of 10%+ on buying back their preferreds with no risk or 10-15% leveraged returns with a lot of risk, the 10% riskless return looks pretty good.

Another way to look at it is that TWO appears not to want preferreds to rise above a third of their total equity. This makes sense, since at some point preferreds would be siphoning off a big chunk of the company’s earnings, leaving less for common shareholders. And unlike common dividends, TWO cannot just cut preferreds dividends since these dividends are contractual. They can, of course, be suspended, but that has an obvious impact of also suspending common dividends and making TWO an uninvestable basket case for investors.

Overall, the fact that TWO has been happy to support their preferreds (through sheer economic logic or otherwise) is a nice feature of the company and makes the preferreds attractive outside of the sheer double-digit yield.

Stance And Takeaways

At the time of the management call a few days ago, TWO book value was already up 6-7% from quarter-end on the back of a downside surprise in inflation and a broad-based rally in fixed-income. If this trend continues, it will allow the Fed to pause early next year. This pause will likely reduce volatility in interest rates and improve the valuation profile of Agency securities. This would be a nice backdrop to have for allocating to the Agency MBS space.

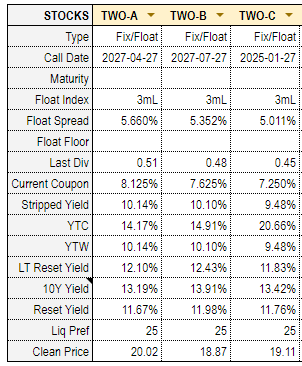

The TWO preferreds look like this. The three stocks are all Fix/Float and LIBOR-based with long-term first call dates.

Systematic Income Preferreds Tool

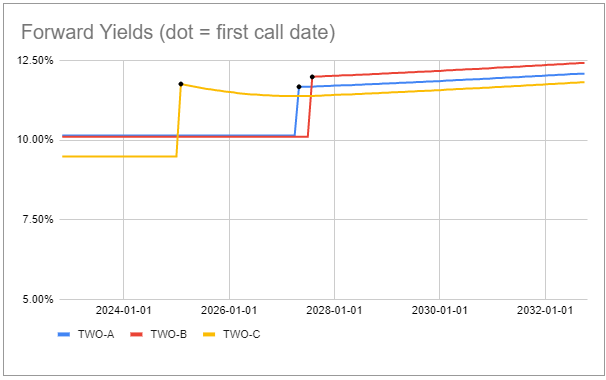

The yield profile based on LIBOR forwards looks like this.

Systematic Income Preferreds Tool

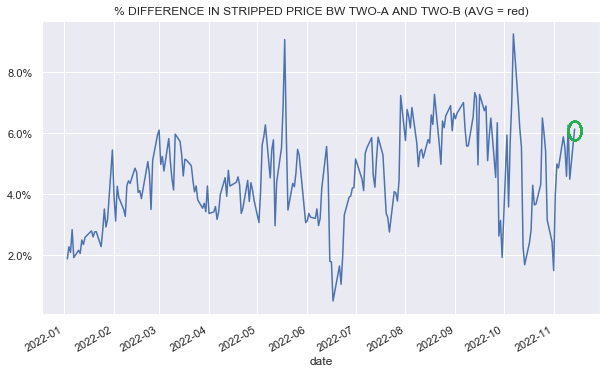

Historically, we have tended to favor TWO.PA. However, the stock has recently outperformed in the suite, and it is trading slightly rich to TWO.PB.

Systematic Income

TWO.PA has a very similar yield to TWO.PB but a lower yield after TWO.PB floats. For this reason, we find TWO.PB a more attractive option in the Two Harbors Investment Corp. suite at the moment.

Be the first to comment