cagkansayin

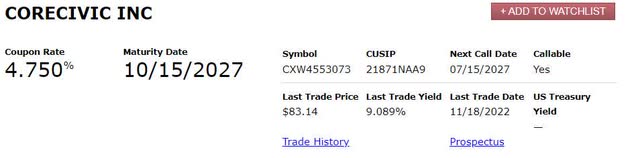

CoreCivic, Inc. (NYSE:CXW) is a former REIT turned C-Corp that owns private prisons throughout the United States. While the sector has been under political pressure for making money from incarceration, the company has taken defensive moves by eliminating its dividend and selling assets. Nonetheless, the company’s 2027 maturing debt is priced at 83 cents on the dollar with a yield to maturity of over 9%, nearly 200 basis points higher than the BB corporate yield index. While the company faces unique challenges, I believe the 9% is a good investment.

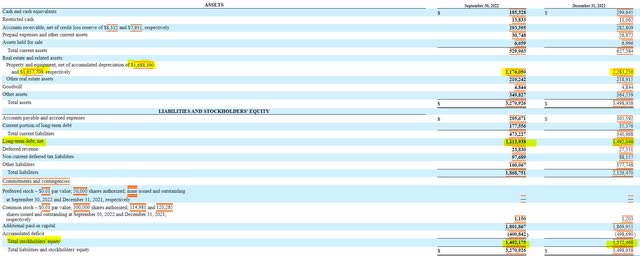

CoreCivic’s balance sheet indicates there were asset sales during 2022. The company used the proceeds of the sales to pay down long-term debt, which has declined noticeably this year. CoreCivic has managed to preserve shareholder equity despite the challenges in 2022, and the trend of downsize and deleverage seems to be working.

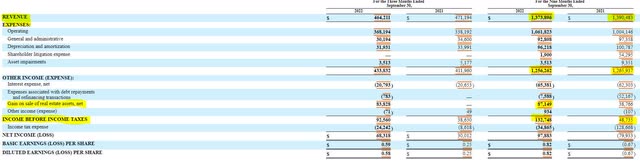

As for profit and loss, the company has been surprisingly resilient despite selling assets. Year-to-date revenue and third quarter revenue is only 1-2% lower than the same period a year ago. CoreCivic saw an $85 million increase in income before taxes year to date compared to last year, but that was mostly influenced by the gain on the sale of assets. Nonetheless, CoreCivic’s profitability continues to remain intact.

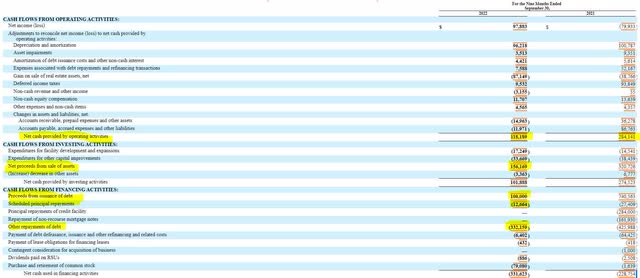

In terms of cash flow, the company’s operating cash flow is facing the strongest headwind, but it is mainly due to the timing/changes in receivables and payables. CoreCivic still has nearly $70 million in free cash flow remaining after capital expenditures, a measure that should make debt investors confident that the company can reduce debt. Free cash flow combined with the $156 million sale of assets contributed to the $234 million reduction of debt.

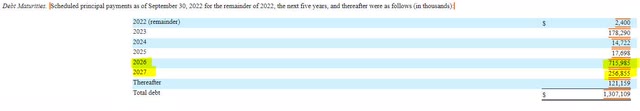

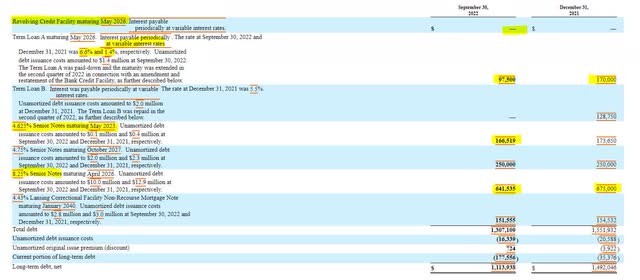

When it comes to debt maturities, CoreCivic is facing a $1 billion wall in 2026 and 2027, accounting for 75-80% of the total debt load. CoreCivic should be able to wait for interest rates to normalize before attempting to address refinancing these maturities. As for next year, the company has $178 million in notes maturing. While the company has $185 million in cash, it also has an untapped revolving line of credit that it can draw up to $800 million from. The revolving line does have a variable interest rate, but it can be a good source of liquidity should the debt markets turn unfriendly towards CoreCivic’s refinancing efforts.

CoreCivic has some large risks it has to address other than the interest rate environment. The first is the political environment. In 2021, President Biden signed an Executive Order forbidding the Department of Justice to engage in contracts with private prisons. CoreCivic disclosed in its 10-Q filing that this impacted its business with the United States Marshalls Service (USMS), and 22% of the company’s revenue. The Executive Order does not affect its relationship with Immigration and Customs Enforcement (ICE). While some may believe ICE traffic could increase to cover the losses of USMS, it is better for CoreCivic to negotiate asset sales with public entities, a move they are currently doing. The company has until September 2025 before its contract with USMS expires.

The second risk the company faces is the allocation of capital towards the repurchase of shares. Earlier this year, the Board of Directors authorized the repurchase of up to $225 million worth of shares. Repurchasing shares may buoy the share price, to the advantage of the shareholders, but it also sends capital out of the corporation. CoreCivic could buy back some of its debt at a discount or repay its variable interest rate term loan to help further stabilize its debt situation.

Overall, I trust that CoreCivic is working diligently to soften the impact of the Private Prison EO and deleverage its balance sheet. The company continues to generate free cash flow, which can be applied towards future debt reduction. The large amount of liquidity available under its revolving credit facility should give debt investors confidence in seeing their investment succeed.

CUSIP: 21871NAA9

Price: $83.14

Coupon: 4.75%

Yield to Maturity: 9.089%

Maturity Date: 10/15/2027

Credit Rating (Moody’s/S&P): Ba2/BB-

Be the first to comment