AleksandarGeorgiev/iStock via Getty Images

Well, I woke up Tuesday mornin’

It was supposed to be the latest bit of good news in an encouraging narrative. On Tuesday morning, The U.S. Bureau of Labor Statistics was scheduled to release its latest monthly Consumer Price Index (CPI) reading for August, and the report was widely expected to show that recently blistering inflationary pressures were increasingly cooling. Maybe, just maybe, the Fed’s job of raising interest rates might soon be done. But the official announcement that came at 8:30 AM ET told a decidedly different story. Inflation for the month of August came in hot. It was a narrative buster to say the least, as investors quickly came to terms with the fact that the Fed likely has more rate hiking work to do and for longer. What are implications for financial markets coming out of Tuesday morning and the trading day that followed?

Something that we’ve lost

Before we go any further in dissecting the implications of Tuesday’s inflation report, it is worthwhile to bring some perspective to the discussion. I remember when I first started out in the industry, I was frequently reminded of the importance of not putting too much emphasis on a single data point. This discipline is particularly important when considering the most recent periodic economic data releases, as many of these readings are derived using models that require varying degrees of estimation and are subject to frequent and sometimes meaningful revisions in future months.

For years, investment market participants recognized this reality and typically would have a more measured response to a single economic data release. But since the Great Financial Crisis, I have noticed an increasing propensity of financial markets and the policy makers that guide it to place undue emphasis on a single data release. Perhaps this increased reactivity is due to the premium valuations that exist across so many asset classes. Nonetheless, it shows a troubling lack of discipline that remains prevalent in capital markets today. Of course, such lack of discipline also brings opportunity.

What stood out to me most about today’s CPI report is how much of an outlier it was versus not only consensus expectations but also other pricing readings such as PriceStats. For these reasons alone, it is important for investors and policy makers to take a beat before overreacting to a single data point.

Again, don’t fight the Fed

The latest CPI reading and the subsequent market reaction did provide an important reminder for upside semivariance addicted investors. For years when the Fed had interest rates pinned at the zero bound and increased their balance sheet when the sun didn’t fully come out on any given trading day, we were constantly reminded to not fight the Fed. If the Fed wants to support capital markets going higher, investors should get on board for the ride.

Why then are investors suddenly ignoring this priority now that the tables have turned. The Fed has made no secrets about their explicitly stated intention to raise the hell out of interest rates in the months ahead to completely extinguish the inflation problem. In short, don’t fight the Fed if it implicitly wants the stock market to go controllably lower to take away a few more dollars from chasing too few goods. Yet investors spent an entire summer largely ignoring this reality. The Fed keeps saying it, but they don’t really mean it right? Um, no. They mean it, and they are still going to raise rates through the rest of 2022 and into 2023 even if inflationary pressures subside in the coming months. Sure, Tuesday’s CPI reading for August didn’t help, but investors should have known this reality already, because the Fed has been repeatedly telling them as much.

The disappearin’ dreams of yesterday

With these two important points out of the way, let’s now get into the market implications of what took place on Tuesday.

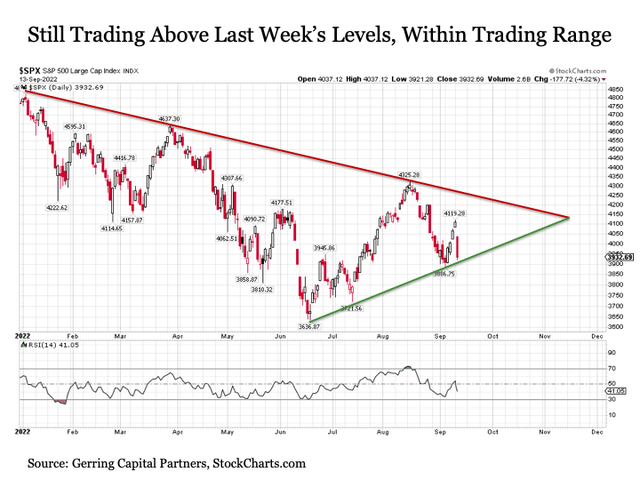

First, it is important to keep what took place on Tuesday in broader perspective. Indeed, the magnitude of the stock market losses on Tuesday were staggering. The tech heavy NASDAQ dropped by 5.5%, and the broader market S&P 500 was also off by a sizeable 4.3%. Moreover, 99% of stocks in the S&P 500, or 496 out of 503, moved lower on the day, which is notable downside breadth. But despite these massive trading day declines, both the NASDAQ and the S&P 500 are still trading about 1% higher than they were just five trading days ago on Wednesday, September 7. In short, the markets did nothing more than give back most (but not all) of the trading gains they had registered during the rally over the previous four trading days. Hardly a disaster.

StockCharts.com

Next, it should also be noted that the S&P 500 is continuing to trade within its narrowing wedge pattern that began roughly three months ago in June. While stocks have shifted from the middle toward the low-end support in this trading range, stocks are still behaving in an orderly way even with Tuesday’s sharp decline.

Lastly, it also remains worth noting that the S&P 500 even after Tuesday’s drop to 3932 is still trading more than +8% above its mid-June lows of 3636. And this has taken place despite increasing signs of slowing economic growth, deteriorating corporate earnings, and increasingly aggressive monetary policy from the Federal Reserve. If anything, investors should arguably be surprised that stocks have held up so well over the past few months despite the accumulating headwinds.

With all of this being said, I remain bearish on stocks between now and Thanksgiving. It remains my view that the S&P 500 will eventually break below the bottom trendline support in its narrowing wedge pattern. In the process, I believe it is likely that at a minimum the S&P 500 will need to retest its 3636 lows if not break further to the downside. And the implications from Tuesday’s inflation report is that the Fed is all the more likely to continue to raise interest rates even further and for longer than the market had been previously expecting. Of course, none of this takes into consideration the implications of the Fed’s increasingly shrinking balance sheet, which is the subject of an article for another day.

Tuesday mornin’ comin’ down

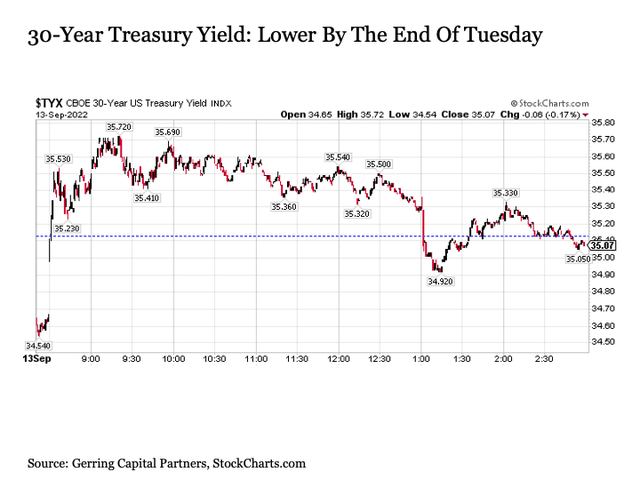

What was more notable in my view coming out of Tuesday’s trading was not the reaction of the stock market, but instead the response from the Treasury market.

Without a doubt, the market reaction on the short end of the Treasury curve was significant, as 2-Year U.S. Treasury yields spiked by 17 basis points to their highest levels since before the Great Financial Crisis.

But it was on the longer end of the Treasury curve where the reaction was far more revealing. For example, the 10-Year U.S. Treasury yield initially jumped by double-digit basis points on the inflation news, but quickly settled down and ended the day only 6 basis points higher. Still a big move to be sure, but notably still below the peaks from mid-June.

StockCharts.com

The 30-Year U.S. Treasury yield was even more notable. After jumping by as much as 6 basis points after the inflation news, long bond yields were lower on the day by 1PM ET on Tuesday afternoon. And the 30-Year U.S. Treasury yield ended the day lower by less than 1 basis point, which is remarkable given the intensity of the inflation chatter throughout the trading day. Equally notable was that long-term U.S. Treasuries as measured by the iShares 20+ Year Treasury Bond ETF (TLT) ended Tuesday +0.23% higher despite the hot inflation news for August.

‘Cause there’s somethin’ in a Tuesday

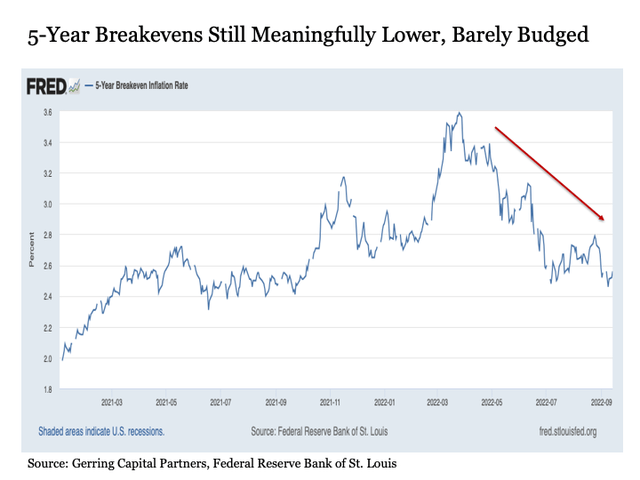

Of course, this long bond resilience tells an important story that stock investors should heed.

Federal Reserve Bank of St. Louis

First, consider the following associated data from Tuesday’s trading. The Bureau of Labor Statistics releases a scorching hot inflation report that sparks financial market handwringing that high inflation may be tougher to get rid of than previously thought. Yet when one looks at the 5-Year Breakeven Inflation Rate coming out of Tuesday’s trading, it creeped higher by a mere 4 basis points. Moreover, this reading at 2.56% remains more than 100 basis points below the peak of 3.59% back on March 25 and is back to levels from the summer of 2021 before the current inflation scare started heating up. Put simply, the Treasury market stopped sweating about the sustained inflation threat about six months ago. While I might be willing to dismiss the significance of this reading if it was something silly like the Tesla-Bitcoin spread, the bond market is called the “smart money” for a reason.

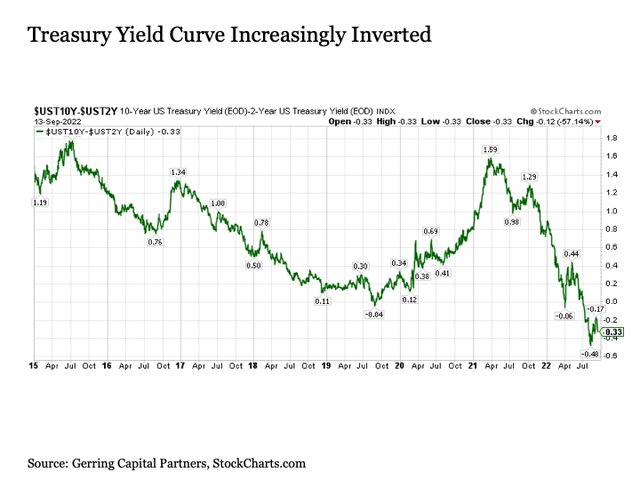

StockCharts.com

Next, consider the fact that the Treasury yield curve is becoming increasingly inverted. In other words, short-term interest rates are rising sharply, but long-term rates are not necessarily following at nearly the same pace. This only happens when investors decide that they want to lock in today’s long-term rates under the belief that rates across the curve may not be nearly as high at some point in the near future. What would cause this to happen?

This leads to my final points and conclusions on Treasuries coming out of Tuesday. Whether it makes sense or not, the Fed is likely to be even more assertive and persistent then they were previously in raising interest rates to combat inflation. They’ve already been dropping 75 basis point rate hikes bombs at recent meetings, they were already jawboning 75 basis points in September even before Tuesday’s hot inflation report (I think they stick with 75 basis points despite some speculation that 100 basis points might be on the table). And now the probability for 75 basis points or more in November has jumped to more than 70% according to the CME FedWatch Tool.

This is an awful lot of big interest rate hikes over an awfully short amount of time. This meaningfully increases the probability of a policy mistake and/or the Fed sending the U.S. economy into a hard landing in the coming months. This is essentially what the long-term U.S. Treasury market was continuing to signal with today’s move.

While I was already constructive on long-term U.S. Treasuries prior to Tuesday’s inflation report, I am even more bullish on the segment going forward in part due to the expectation that it increases pressure on monetary policy makers to act, and potentially overreact, to fight inflation.

Although it had a dismal day along with most of the rest of capital markets, I am also even more constructive on gold going forward for similar reasons. Gold is not necessarily the best inflation hedge because investors are constantly bracing for the Fed to take action by raising interest rates, which is negative for gold. But where gold performs decidedly better is during periods of economic and/of financial market uncertainty and/or instability. And such is the environment we could be heading into through the rest of 2022 and into 2023.

Bottom line

Tuesday’s inflation report was definitely attention grabbing. And while it does not necessarily change my view on the long-term performance outlook for various asset classes, it does move the needle in terms of short-term to intermediate-term perspectives on these same categories. And in the aftermath of Tuesday’s report, I am more bearish on stocks as measured by the S&P 500 with an increased expectation that June lows will eventually be retested if not broken. At the same time, I am more bullish on long-term U.S. Treasuries and gold given their safe haven characteristics given the increased probability for a harder economic landing than previously expected.

Be the first to comment