georgeclerk

Introduction

Amazon.com, Inc. (NASDAQ:AMZN) has two major businesses that are responsible for the majority of the conglomerate’s revenue: Amazon.com and AWS. Amazon.com is responsible for the famous e-commerce platform, both within the U.S. and international regions, while AWS – Amazon Web Services – is responsible for Amazon’s cloud business. Unfortunately, I believe both of Amazon’s major businesses will continue to underperform in the coming months.

As many investors have already pointed out, Amazon.com is expected to continue its weakness as economic growth continues slowing as inflation and rates increase. Further, I believe that Amazon’s cash cow, AWS, will also underperform compared to expectations due to intense competition from Google (GOOG, GOOGL). Therefore, given that both Amazon.com and AWS are expected to underperform relative to expectations, I believe Amazon has more room to fall.

Amazon.com

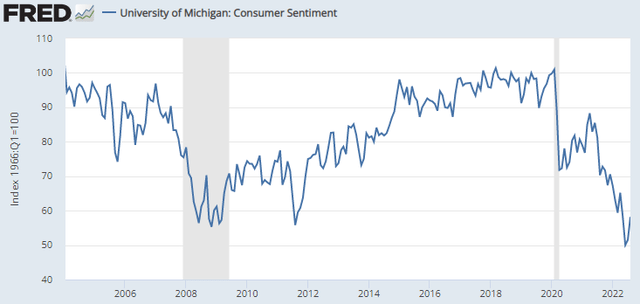

Because Amazon.com is the biggest e-commerce platform in the United States and has a formidable presence overseas, the business is heavily reliant on macroeconomic conditions and consumers’ financial health. Today, the macroeconomic health and consumers’ confidence is not in an ideal state.

As the image above shows, U.S. consumer confidence levels are near the 2008 recession-time lows due to persistently high inflation. Further, this trend may continue, as the latest CPI data shows that inflation continues to be high at 8.2% despite aggressive actions from the Federal Reserve. Thus, the consumer’s willingness to shop on Amazon.com is naturally decreasing, hurting the company’s top and bottom lines.

As a result of the macroeconomic hurdles, both Amazon.com’s North American and International businesses have reported operating losses. North American business reported a $412 million operating loss, compared to an $880 million operating profit in the prior-year quarter. Further, Amazon.com’s international business reported an operating loss of $2.466 billion for the quarter compared to $911 million in the previous year’s quarter.

Therefore, the sudden change in consumer confidence has created a strong negative trajectory for Amazon.com, and because the inflation continues to be persistent with the Federal Reserve signaling another 75 basis point increase in interest rate, this trend is expected to continue for the coming months, negatively impacting Amazon.

AWS

Although AWS continues to be the biggest and most competitive player in the market, AWS is expected to see growth and margin pressure in the near term due to both competition and market conditions.

In Amazon’s 2022Q3 earnings report, the company reported an AWS revenue of about $20.538 billion, which is about a 27.5% increase year-over-year from $16.110 billion in the previous year. The yearly number may give a positive connotation, as it includes quarters when the overall market was healthy and growing. However, looking at quarter-over-quarter growth, AWS’s growth rate decreased from an average of 8.7% quarter-over-quarter in 2021 to an average of 4.94% quarter-over-quarter growth in 2022, which is about a 56.7% decline. Further, in 2022Q3, AWS’s quarter-over-quarter growth was 4%, continuing its slowing growth trajectory.

AWS is Amazon’s most important business, as it is the only business that is returning positive operating income as of today. However, AWS’s growth is showing a significant slowdown along with the negative market sentiment.

Further, AWS may be seeing a slowdown due to competitive pressure from Google Cloud. Google Cloud has been perceived by the market as an inferior product to AWS; however, since 2019, Google has shifted its focus to enterprise cloud with the appointment of its new cloud president Thomas Kurian. As a result, Google Cloud’s growth has been stronger than Amazon’s at 9.43% sequential growth in 2022Q3, and about 163% growth since 2019Q4 compared to AWS’s 106%. Google’s enterprise-first approach is allowing the AWS customers to diversify its cloud portfolio, barring AWS’s full growth potential.

While it is true that AWS is competitive and the cloud market is expected to continue its growth at 15.7% CAGR until 2030, the current market environment where the Fed is aggressively raising rates is affecting the cloud market despite its long-term underlying trend, and Google is coming out on top during this times. Therefore, given these data points, I think it is logical to argue that AWS will not save Amazon from a significant slowdown in Amazon.com.

Valuation

AWS’s growth rate will likely stay relatively low in the near term as cloud growth is not robust due to the macroeconomic conditions and confidence. Further, Amzon.com is expected to continue struggling with low consumer demand and the Fed’s determination to aggressively raise rates no matter the cost to keep inflation low. Thus, Amazon has the potential to see a valuation dip due to multiple contractions.

The company is currently trading at about 43.4 times 2023 price-to-earnings, which is relatively low considering Amazon’s historical price-to-earnings. However, considering the near-term hurdles and Amazon’s expected 2023 growth rate of 14.6%, which is similar to other tech giants such as Microsoft (MSFT) at 13.3%, I do not see a compelling reason why Amazon is receiving about 43.4 2023 price-to-earnings while Microsoft is receiving about 24.24 2023 price-to-earnings. Therefore, given Amazon’s slowdown, I believe it is likely for Amazon’s valuation multiples to shrink.

Risk to Thesis

My bearish thesis concerning the slowdown in both Amazon.com and AWS is contingent upon the worsening macroeconomic condition as a result of the Federal Reserve raising rates aggressively. However, in the upcoming FOMC meeting on November 3rd, if Fed President Jerome Powell hints at the start of the end of the aggressive tightening cycle, investors will likely see it as a sign that the economic downturn has peaked, increasing Amazon’s valuation multiples once again. Further, the Fed’s hinting of a slowdown of raising rates in the next few months may result in the economic downturns being moderate, bringing Amazon.com and especially AWS back to its growth trajectory.

Summary

Being too early in the stock market is the same thing as being wrong. I believe investors should stay away from Amazon given the negative trajectory Amazon has shown during its 2022Q3 earnings report. Amazon.com is expected to continue reporting losses as demand significantly slows due to declining consumer confidence, with an unlikely increase in potential in the near term. Further, because AWS, Amazon’s cash cow, is also experiencing slower growth and margin concerns due to the macroeconomic conditions, I believe it is best if investors stay away from Amazon until the storm passes. Therefore, Amazon is a sell.

Be the first to comment