imaginima

The rotation I spoke of yesterday morning continued into the trading day with industrial stocks like Caterpillar and Honeywell at the top of the leaderboard, while Meta Platforms (Facebook) plummeted a jawdropping 25%. That’s why the Dow Jones soared nearly 200 points, as the Nasdaq Composite fell nearly as many. Again, this is a stock picker’s market. Let passive investors be warned. We are likely to have more of the same today, as Amazon stock plunged 15% after hours, following its earnings report with soft guidance. If this rotation from growth to value continues, it should solidify the recent bear market low in the S&P 500 and set the stage for a new bull market.

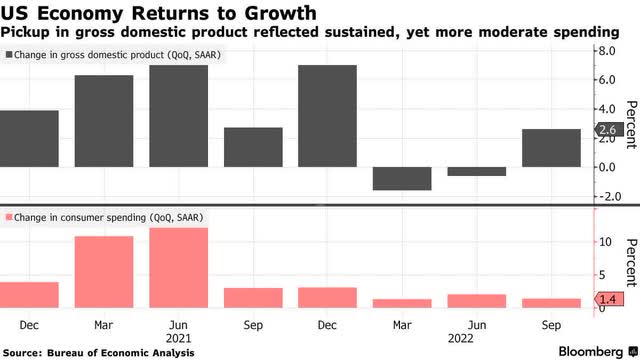

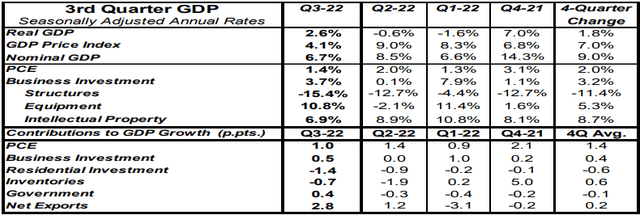

The economy expanded at a 2.6% annual pace during the third quarter, which beat consensus expectations for 2.3%, easing recession fears. Critics ignored the fact that a trade imbalance and inventory flush were the reasons the headline GDP numbers showed contraction during the first two quarters of the year. Now they are pointing to the same irregularity in trade as the only reason the economy grew in the third quarter. Give me a break. Ignore the irregularities and recognize that the engine being consumer spending has shown slowing but consistent growth, which is why this expansion continues.

While corporate leaders have said they are preparing for a recession in the coming months, they continue to invest, as business investment rose a solid 3.7% during the quarter, offsetting the slide in housing. Consumers shifted spending from goods, which fell at an annualized rate of 1.2%, to services, which rose at a 2.8% clip. That helps explain Amazon’s disappointing outlook. The most important number, which can’t be seen in the chart below, is inflation-adjusted final sales to domestic purchasers, which includes consumer, corporate, and government spending. It rose 0.5% for the quarter, which was one of the slowest rates since the pandemic, but that is the Fed’s goal and should come as no surprise.

The good news is that not only did we have better-than-expected growth, but it came with lower-than-expected inflation, as the chain-weighted price index (GDP Price Index) that adjusts for consumer behavior during the quarter fell to 4.1%, which is down from 9% in Q2 and 8.3% in Q1. The consensus was expecting a gain of 5.3%. The Fed’s preferred measure being the personal consumption expenditures price index increased 4.2% during the quarter, which was down from 7.3% in the second quarter. Sustained growth with a declining rate of inflation is what makes this a goldilocks number, and its continuation should pave the way for the soft landing that the consensus views as a pipe dream.

One development I expect to see in the coming months, which should support consumer spending growth, is a return to real wage growth as the rate of inflation falls. While the labor market is likely to weaken some, we should still see wages increase at rate of 4-5%. As the rate of inflation falls below that level, consumers will again realize an increase in real purchasing power. That should help to sustain this expansion.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment