Koichi Kamoshida/Getty Images News

Sony (NYSE:SONY) is one of the largest corporations in Japan and is well known in its consumer electronics products like the PlayStation gaming console. It also has a strong presence in the Entertainment Industry. Despite this, SONY is currently enhancing its portfolio and shows great opportunity in its image sensing solutions. This makes the company well positioned in today’s digitalization. SONY may prosper in the EV image sensor business, which, in my opinion, will provide a long-term tailwind for the company. However, today’s sentiment from the JPY being softer than the USD makes management’s outlook unappealing, resulting in an unfavorable growth performance. Additionally, considering the slowing global video game outlook and potential recession, this makes SONY risky and provides an unfavorable long-setup opportunity as of this writing.

Company Overview

SONY operates within 6 different segments; Game & Network Services (G&NS), Music, Pictures, Entertainment, Technology & Services, Imaging & Sensing Solutions and Financial Services. SONY’s Game & Network Services remains to be the bread and butter of the company which generated ¥702,718 million or 26% of its total revenue amounting to ¥2,751,879 million this Q2 ’22.

G&NS segment. Q2 sales increased 12% year-on-year to JPY720.7 billion, primarily due to the impact of foreign exchange rates, despite a decrease in sales of third-party software. Source: Earnings Call Transcript

SONY continues to put the stronger USD to its advantage as it continues to impose higher selling prices on its gaming consoles such as the PS5. However, as mentioned below, the declining time spent on gaming due to Covid-19 restrictions relief and slower subscriber accounts may be an early signal of waning demand.

…total gameplay time spent by PlayStation users during Q2 increased slightly versus the previous quarter, it decreased 10% year-on-year, primarily due to the impact of an increase in opportunities to go outside resulting from a reduction in COVID-19 infections.

The number of PlayStation Plus subscriber accounts at the end of September decreased 4% from the end of June to 45.4 million accounts.

Source: Earnings Call Transcript

Furthermore, SONY’s year-to-date digital software and add-on content sales have slowed to 618,704 million, down from 635,294 million, signaling a reduction in user spending, which adds an added degree of uncertainty to watch.

G&NS suffered from slowing operating income amounting to ¥42,132 million, down from ¥82,679 million recorded in the same quarter last year. According to the management, this is due to non-recurring costs from its Bungie acquisition and unfavorable FX currency translation. This snowballed to a declining operating income outlook from the management of ¥255 billion in FY ’22 down from ¥346.1 billion recorded in FY ’21.

SONY’s total operating income improved to ¥344 billion, up from ¥318.5 recorded in the same quarter last year, despite the huge decline in its G&NS segment. However, considering the management outlook of ¥1,160 billion in FY ’22, it will produce a slower figure compared to its ¥1,117.5 billion recorded last year. Additionally, this will snowball to a declining operating margin of 10% in FY ’22, down from 12% in FY ’21 and down from 13% in FY ’20.

Outlier: Financial Services

SONY’s performance is being dragged down by its non-core business, Financial Services segment, which includes SONY Life.

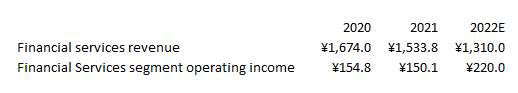

SONY: Financial Service Segment Trend (Source: Data from company filings. Prepared by the Author. Amounts are in billions)

Looking at this segment’s revenue trend, it is clear that this is not contributing positively for the company, especially considering its declining revenue which is estimated by the management to be ¥1,310 billion in FY ’22. However, despite the declining revenue trend, the management surprisingly expects an improving operating income of ¥220 billion in FY ’22. This growth, according to the management, includes a non-recurring gain from real estate amounting to ¥43 billion and recovery from unauthorized withdrawal. This is hardly reassuring, in my opinion, particularly factoring its long-term growth sustainability.

Considering SONY in US Dollars

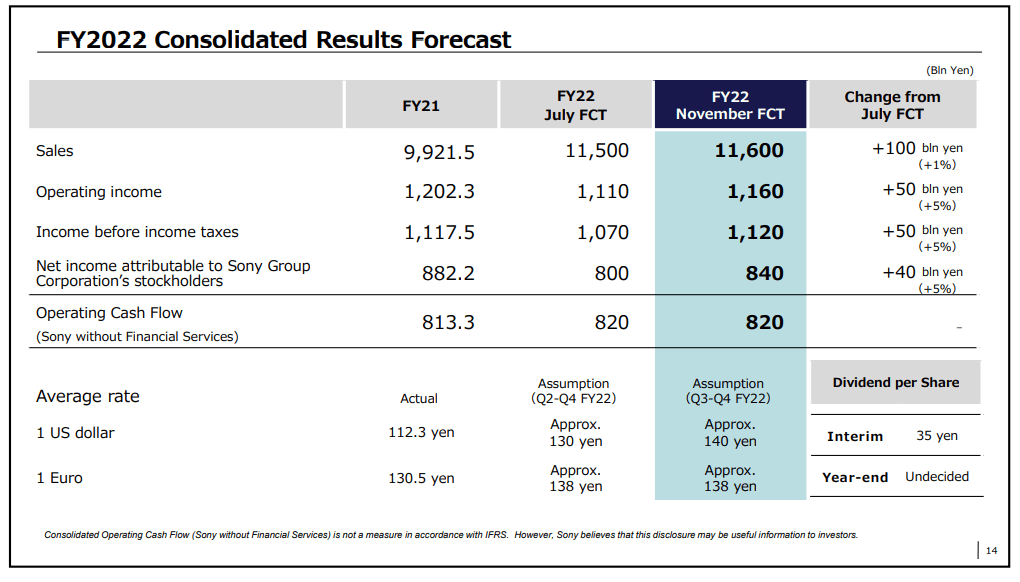

SONY: FY ’22 Outlook (Source: Q2 Earnings Call Presentation)

Using the management assumptions, and applying a translation rate of 1USD = 140JPY, SONY’s total revenue will total to $82,857.14 million in FY ’22. This will produce only 1.7% YoY growth compared to its $81,507.6 million recorded in FY ’21. The predicted YOY growth of 1.7% appears to be better than the 0.30% in FY ’21, but when compared to 5.78% in FY ’20 and its 3.86% 5-year average, the estimated growth seems to be unattractive.

Unattractive Valuation

Despite the huge price drop from last year’s high, SONY appears to be unattractive compared to its historical valuation. Its forward EV/EBITDA of 8.61x compared to its 5-year average of 8.64x provides no margin of safety as of this writing. This is especially true considering its forward EV/Sales of 1.46x compared to its 5-year average of 1.26x. Additionally, investigating its Price/Tangible book value per share of 3.80x showed some premium compared to its 5-year average of 3.73x. Hence, this sentiment allows SONY some room to fall further, before it materializes its long-term tailwinds.

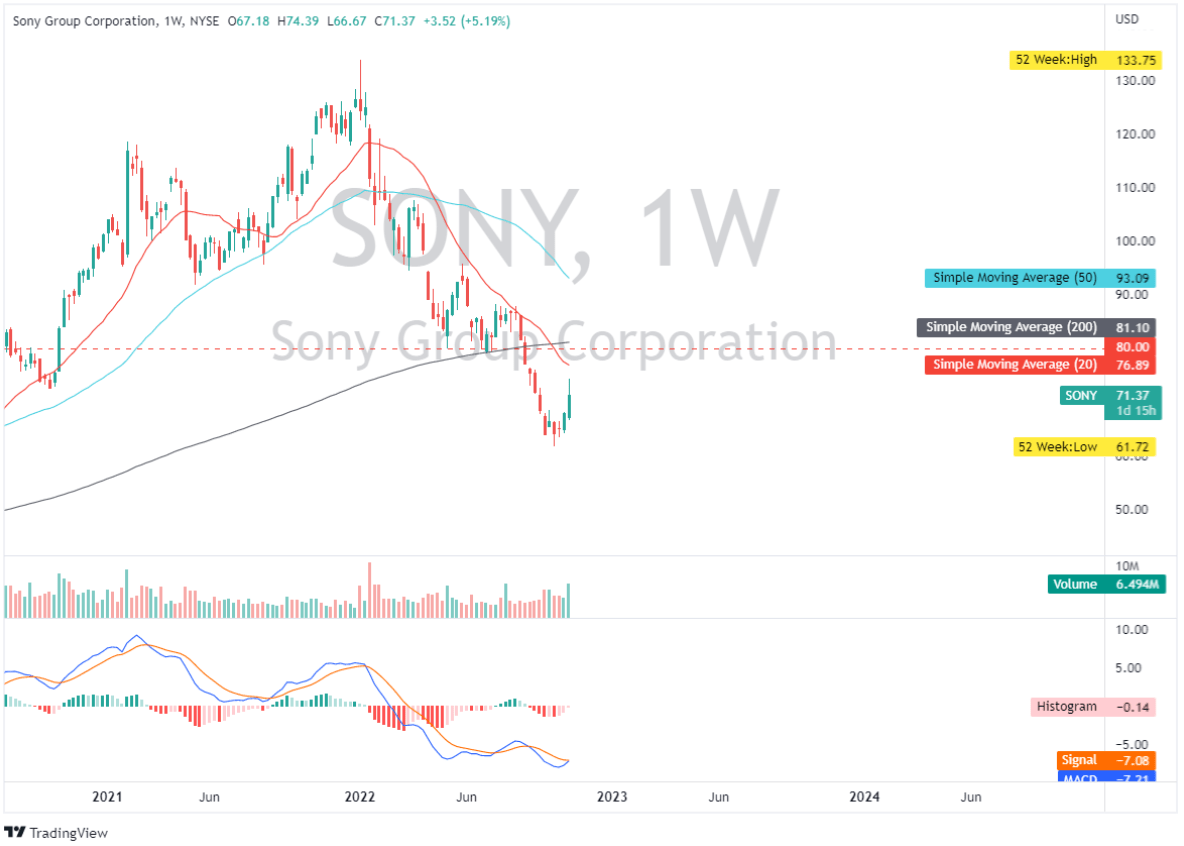

Trading Below 200-day SMA

SONY: Weekly Chart (Source: TradingView.com)

On a weekly chart, SONY is now trading below all of its simple moving averages, indicating significant negative momentum. Based on its price action, I believe $80, its old support, is now a significant resistance level to watch. If its $61 support level is breached, I anticipate the next logical support level to be around $51. Given its MACD indicator, it is forming a potential bullish crossover, which might send its price higher and re-test its $80 resistance zone.

Expanding Portfolio

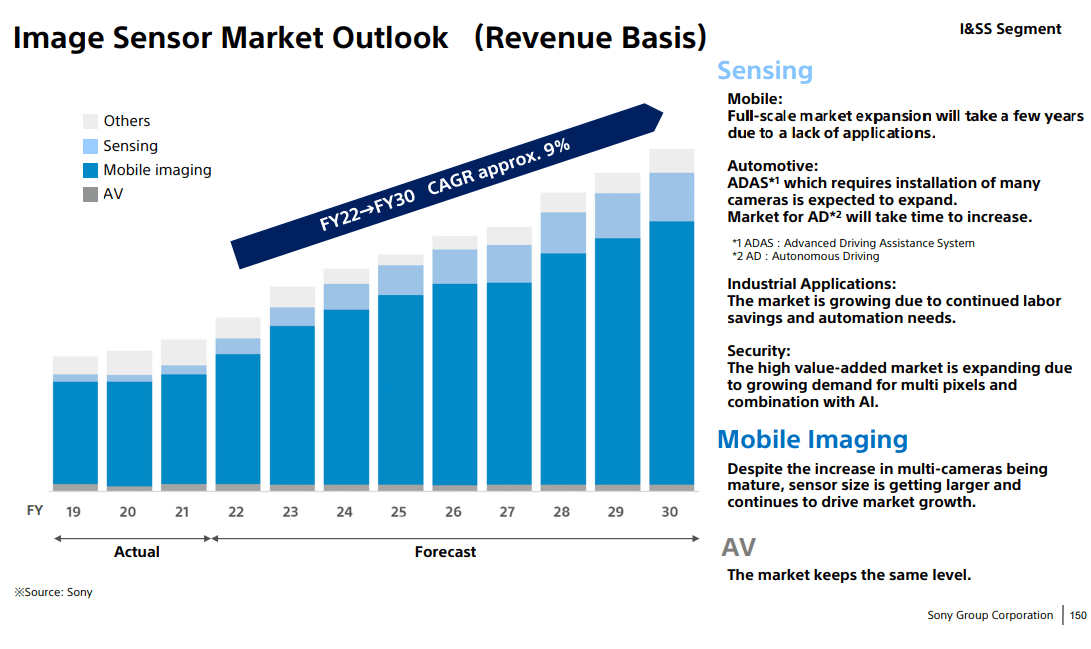

As previously mentioned, SONY is expanding its portfolio, and one interesting area that it has is its image and sensor segments, which cater to some potential in automotive image sensors and the usage of AI and clouds in mobile imaging.

SONY: High Growth Segment (Source: Investor Presentation)

In fact, Sony partnered with Honda (HMC) to deliver HMC’s EV powered by SONY’s expertise in entertainment and imaging and sensors in early 2026. The company is also investing in the STAR SPHERE project, which aims to capture the Earth’s surface. This may help boost its top line and change its current consensus revenue estimates.

Conclusive Thoughts

In addition to a slowing top line and operating margin outlook, SONY has a declining ROCE of 13.45%, down from a 5-year average of 19.29%, which contributes to my assertion that the company is still unappealing at these prices. Additionally, it reveals a deteriorating tangible book value per share of ¥3,363,229 million, down from ¥4,852,904 million recorded in FY ’21 and down from ¥4,895,107 million in FY ’20. This is due to its all-cash acquisition of Bungie Inc. on July 2022, bringing its cash level down to ¥658,560 million as of this writing. SONY’s inventory level shot up to its all-time record of ¥1,416,367 million as well as its goodwill and other intangible assets, which makes its balance sheet prone to potential impairments. Finally, it ended the quarter with a deteriorating current ratio of 0.58x vs its 5-year average of 0.79x and a deteriorating debt to equity ratio of 0.52x over its 5-year average of 0.38x. To conclude, I believe SONY offers no margin of safety as of this writing, making it unappealing.

Thank you for reading and good luck to us all this November.

Be the first to comment