Marco Bello

This article is part of a series that provides an ongoing analysis of the changes made to ARK Invest’ 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 10/17/2022.

ARK Invest was founded by Cathie Wood in 2014. They manage several actively managed ETFs, index ETFs, and certain other international products. Assets Under Management (AuM) has come down from over $50B at the peak to ~$15B now. They invest in what they term “disruptive innovation” and the actively managed ETFs are ARK Innovation ETF (NYSEARCA:ARKK), ARK Autonomous Tech & Robotics ETF (BATS:ARKQ), ARK Next Generation Internet ETF (NYSEARCA:ARKW), ARK Genomic Revolution ETF (BATS:ARKG), ARK Fintech Innovation ETF (NYSEARCA:ARKF), and ARK Space Exploration & Innovation ETF (BATS:ARKX).

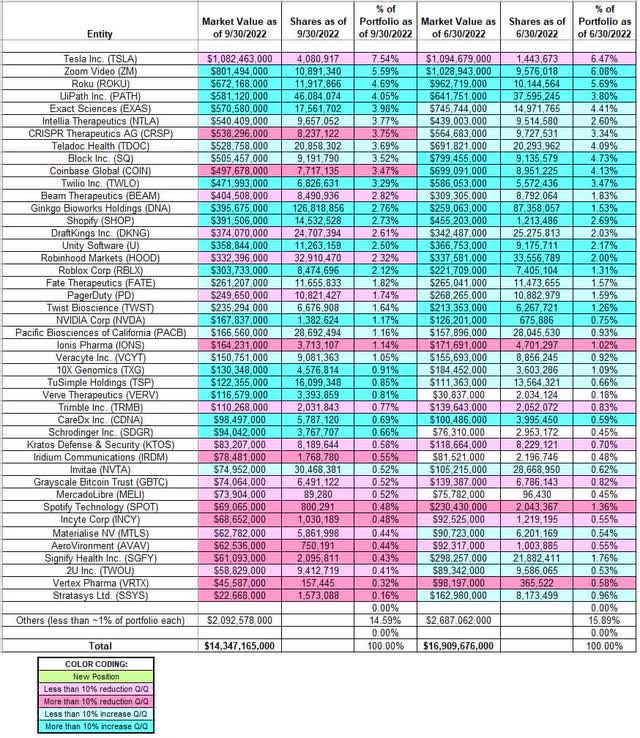

This quarter, ARK Invest’ 13F portfolio value decreased ~15% from ~$16.91B to ~$14.35B. The number of holdings decreased from 354 to 250. There are 44 securities that are significantly large, and they are the focus of this article. The top three holdings are at ~18% while the top five are at ~26% of the 13F assets: Tesla Inc., Zoom Video, Roku, UiPath, and Exact Sciences. Please visit our previous update for the fund’s moves during Q2 2022.

Note 1: Unlike other investment management businesses, ARK is pioneering an open source model of investment research through a couple of initiatives: a) Valuation models on businesses are being made available to the public through GitHub, and b) daily trades are available to anyone who signs up for it. The open source model along with the outlandish forecasts has attracted criticism as well: in April, RIA lawyers urged SEC enforcement action.

Note 2: The 13F data on which this article is based is as of 9/30/2022. Updated daily holdings data for each of their ETFs are publicly available.

Note 3: Although as a percentage of the overall portfolio the positions are very small, it is significant that they have sizable ownership stakes in the following businesses: 908 Devices (MASS), Archer Aviation (ACHR), Accolade (ACCD), Arcturus Therapeutics (ARCT), Blade Air Mobility (BLDE), Berkeley Lights (BLI), Compugen (CGEN), Codexis (CDXS), Cerus Corp. (CERS), Editas Medicine (EDIT), Markforged (MKFG), Nextdoor (KIND), Nano Dimension (NNDM), Personalis (PSNL), Quantum-Si (QSI), Repare Therapeutics (RPTX), Surface Oncology (SURF), and Vuzix Corp (VUZI).

Stake Increases:

Zoom Video (ZM): The large (top three) 5.59% of the portfolio ZM stake was built over the last two years through consistent buying every quarter at prices between ~$74 and ~$559. The stock currently trades near the low end of that range at $78.23.

Roku, Inc. (ROKU): ROKU is a top-three 4.69% of the portfolio position built in the 2019-20 timeframe at prices between ~$33 and ~$357. Last four quarters have seen another ~150% stake increase at prices between ~$56 and ~$345. The stock is now at $53.23.

Note: they have a ~9.5% ownership stake in Roku.

UiPath Inc. (PATH): PATH had an IPO in April 2021. Shares started trading at ~$72 and currently goes for $12.26. The large (top five) ~4% of the portfolio position was built in the Q2 to Q3 2021 timeframe at prices between ~$52 and ~$80. Last four quarters have seen the position almost doubled at prices between ~$12.50 and ~$56.

Note: they have a ~10.5% ownership stake in UiPath.

Exact Sciences (EXAS): The large (top five) ~4% EXAS stake was built over the last nine quarters through consistent buying every quarter at prices between ~$32 and ~$155. The stock currently trades near the low end of that range at $35.29.

Note: they have a ~10% ownership stake in Exact Sciences.

Intellia Therapeutics (NTLA): NTLA was a minutely small position in ARK’s first 13F filing in 2016. The 2017-2020 time period saw the position built to a ~11.2M share position at prices between ~$12.50 and ~$62. Since then, the stake has wavered. The first three quarters of 2021 saw a ~40% selling at prices between ~$52 and ~$177 while the last four quarters have seen a similar increase at prices between ~$38 and ~$138. The stock currently trades at $55.11, and the stake is at 3.77% of the portfolio.

Note: they have a ~13% ownership stake in Intellia Therapeutics.

Teladoc Health (TDOC): TDOC was a small stake until H2 2020 when a ~7.8M share position was purchased at prices between ~$183 and ~$238. Next quarter saw another ~85% stake increase at prices between ~$177 and ~$294. The quarters since have also seen minor buying. The stock currently trades well below their purchase price ranges at $25.45. The stake is fairly large at 3.69% of the portfolio.

Note: they have a ~13% ownership stake in Teladoc Health.

Block, Inc. (SQ): SQ was a small stake in the portfolio in their first 13F filing in 2016. The position was built during the 2018-20 timeframe at prices between ~$40 and ~$99. Last two quarters saw a ~45% stake increase at prices between ~$58 and ~$164. The stock currently trades at $57.27, and the stake is now at 3.52% of the portfolio. There was a marginal increase this quarter.

Twilio Inc. (TWLO): The 3.29% of the portfolio TWLO stake was built during the four quarters through Q2 2021 at prices between ~$224 and ~$435. Next quarter saw a ~13% trimming while the last four quarters have seen a ~110% stake increase at prices between ~$66 and ~$369. The stock currently trades near the low end of their purchase price ranges at $71.21.

Ginkgo Bioworks Holdings (DNA): The 2.76% DNA stake was built over the last four quarters at prices between ~$2.40 and ~$14. The stock is now near the low end of that range at $2.66.

Note: they have a ~11% ownership stake in Ginkgo Bioworks Holdings.

Shopify Inc. (SHOP): The bulk of the current 2.73% position in SHOP was built during the three quarters through Q2 2021 at prices between ~$92 and ~$147. The stake has since wavered. H2 2021 saw a ~40% selling at prices between ~$135 and ~$169 while the last three quarters saw a stake doubling at prices between ~$27 and ~$136. The stock is now at $28.73.

Unity Software (U): The 2.50% Unity stake was built during the four quarters through Q2 2021 at prices between ~$68 and ~$165. Q4 2021 saw a one-third reduction at prices between ~$126 and ~$197 while in the last three quarters there was a ~45% stake increase at prices between ~$32 and ~$139. The stock is now just below their purchase price ranges at $31.37.

Roblox Corp. (RBLX): The 2.12% RBLX position was built during the last four quarters at prices between ~$23 and ~$135. The stock currently trades at $43.38.

Fate Therapeutics (FATE): FATE is a 1.82% of the portfolio stake built during the seven quarters through Q3 2021 at prices between ~$19 and ~$116. Last four quarters have seen only minor adjustments. The stock is now at $21.64.

Note: they have a ~12% ownership stake in Fate Therapeutics.

10x Genomics (TXG), CareDx, Inc. (CDNA), Invitae (NVTA), NVIDIA Corp. (NVDA), Pacific Biosciences (PACB), Schrodinger, Inc. (SDGR), TuSimple Holdings (TSP), Twist Bioscience (TWST), Verve Therapeutics (VERV), and Veracyte, Inc. (VCYT): These small (less than ~2% of the portfolio each) stakes were increased during the quarter.

Note: they have significant ownership stakes in the following businesses: CareDx, Invitae, Pacific Biosciences, TuSimple, Twist Bioscience, and Veracyte.

Stake Decreases:

Tesla, Inc. (TSLA): TSLA is the top position in the portfolio at 7.54%. It was already a small position in their first 13F filing in 2016. Recent activity follows. Q1 2021 saw a ~40% stake increase at prices between ~$199 and ~$293. Last six quarters have seen the position reduced by ~80% at prices between ~$217 and ~$407. The stock currently trades at ~$220. They are harvesting gains.

CRISPR Therapeutics (CRSP): The bulk of the current 3.75% of the portfolio position in CRSP was built in 2020 at prices between ~$38 and ~$169. The stake has wavered. Q1 2021 saw a ~20% selling while in Q4 2021 there was a similar increase. The stock is now at $56.90. There was a ~15% trimming this quarter.

Note: they have a ~11% ownership stake in CRISPR Therapeutics.

Coinbase Global (COIN): COIN had an IPO in April 2021. Shares started trading at ~$290 and currently goes for $66.21. The 3.47% position was built during Q2 & Q3 2021 at prices between ~$225 and ~$342. Next quarter saw a ~22% trimming at prices between ~$231 and ~$343 while the last two quarters saw a roughly two-thirds stake increase at prices between ~$49 and ~$252. There was a ~14% trimming this quarter.

Beam Therapeutics (BEAM): BEAM is a 2.82% of the portfolio position built over the last seven quarters at prices between ~$22 and ~$130. The stock is now at ~$48. There was a minor ~3% trimming this quarter.

Note: they have a ~13% ownership stake in Beam Therapeutics.

DraftKings (DKNG): DKNG came to market through a De-SPAC transaction in Q1 2021. The 2.61% of the portfolio stake was built through consistent buying every quarter since at prices up to ~$70. The stock is now at $13.55. There was a minor ~2% trimming this quarter.

Note: they have a ~6% ownership stake in DraftKings.

Robinhood Markets (HOOD): HOOD had an IPO in August 2021. Shares started trading at ~$55 and currently goes for $10.44. The 2.32% of the portfolio position was built through consistent buying over the last four quarters at prices between ~$7 and ~$55. This quarter saw minor trimming.

Spotify Technology (SPOT): SPOT had an IPO in April 2018. Shares started trading at ~$150 and currently goes for ~$88. The bulk of the original position was built during the four quarters through Q2 2021 at prices between ~$224 and ~$365. Next two quarters saw a ~17% selling at prices between ~$210 and ~$290. That was followed with a ~82% reduction in the last two quarters at prices between ~$88 and ~$159. ARK’s stake is now very small at 0.48% of the portfolio.

Signify Health Inc. (SGFY): SGFY had an IPO in February 2021. Shares started trading at ~$39. The bulk of ARK’s stake was built in H2 2021 at prices between ~$14 and ~$30. The position was sold down this quarter and the stake is now very small at 0.48% of the portfolio.

Note: In September, CVS Health (CVS) agreed to buy Signify Health in a $30.50 per share all-cash deal. ARK had a ~13% ownership stake in Signify Health as of Q2 2022.

2U, Inc. (TWOU), AeroVironment (AVAV), Grayscale Bitcoin Trust (OTC:GBTC), Incyte Corp. (INCY), Ionis Pharma (IONS), Iridium Communications (IRDM), Kratos Defense & Security (KTOS), Materialise NV (MTLS), MercadoLibre (MELI), PagerDuty (PD), Stratasys Ltd. (SSYS), Trimble Inc. (TRMB), and Vertex Pharma (VRTX): These very small (less than ~2% of the portfolio each) positions were reduced during the quarter.

Note: they have significant ownership stakes in the following businesses: 2U Inc., Kratos Defense & Security, Materialise NV, PagerDuty, and Stratasys.

The spreadsheet below highlights changes to ARK Invest’ 13F holdings in Q3 2022:

Cathie Wood – ARK Invest’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment