jaanalisette/iStock Editorial via Getty Images

Investment Thesis

Twilio (NYSE:TWLO) positions itself for a new dawn. Twilio is a customer data and communications platform. Its whole business model is in allowing companies to interact directly with their own customers.

How do you market your brand’s message? How do you measure your brand’s communication so that you can iterate the messaging? How do you gain visibility into your messaging? How do you know what parts of your messaging are working best? Indeed, Twilio is well set up as we enter a post-cookies world.

Next, one thing that Twilio has going for it is that its growth is developer-led. Think of it as word-of-mouth. As developers move around to different jobs they quickly introduce Twilio at different businesses as a way to build a direct channel with the end customer.

However, like many businesses its stock is down more than 75% in a year.

Simply put, there’s been a dramatic reset in investors’ expectations. However, Twilio together with other tech companies, has started to realize that investors are no longer rewarding their growth at any cost strategy.

Investors want to see a clear and believable path to profitability. And yesterday’s restructuring announcement goes to the heart of this argument.

On that basis, given that there’s been such a massive sell-off in the name, it appears Twilio is now seriously reconsidering its next steps forward.

Hence, I’m asserting a tepid buy rating on this name.

The Great Restructuring Plan

Yesterday, Twilio announced that it was going to restructure its operations. Twilio’s leadership will obviously be able to look at its share price and see that it’s gone in only one direction this past year. Change is needed. And the sooner the better.

In fact, Twilio believes that the majority of its 11% workforce reduction will happen in Q3. Given that we are just weeks from the end of the quarter, it shows that Twilio means business.

Can Twilio’s Revenue Growth Rates Stay at 30%?

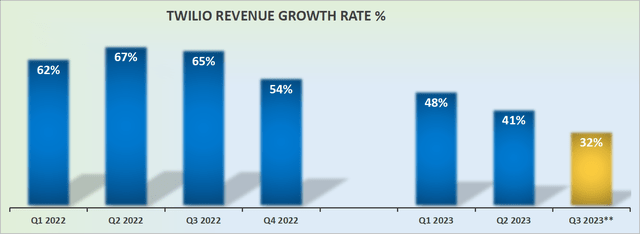

Twilio’s Q3 revenue growth rates were reiterated again yesterday. Investors were once again reminded that the business’ as-reported revenues will grow by 32% y/y.

On the one hand, this is a far cry from the confidence that investors had that Twilio could consistently grow at hypergrowth rates, meaning higher than 30% CAGR, over several years.

On the other hand, given that we can assume that Q3 is already in the bag and that Q4 is up against easier comps with the same period a year ago, this should imply that at least into Q4 Twilio ”should” see +30% y/y of revenue growth for Q4.

Can 30% CAGR be maintained? That’s obviously the big question here.

Path to Profitability in Focus

During a conference call, earlier this week co-founder and CEO Jeff Lawson said,

We have said, Hey, here’s what the carrier fees have done to our gross margin. And I think investors still have said, great, but what about profitability? And so, I think we’re in the mode where we need to show you all that we are going to be profitable in 2023 and beyond. (emphasis added)

And that comment from Lawson neatly summarizes both the bear and bull case. Twilio is far from reaching profitability on a GAAP basis. Accordingly, Twilio is likely to see around negative 6% non-GAAP operating margins for Q3 2022.

Remember, back in Q2 2022 its non-GAAP operating margin was negative 1%. While in Q3 of last year its non-GAAP operating margins were actually positive 1%.

Hence, this shows that despite all of Lawson’s proclamations, the business’ progress is not tallying up with its narrative.

And that’s why the stock has continued to slide lower post earnings, even as some pockets of tech stock have started to show a tiny bit of strength.

Further complicating the bull case here is that it’s widely acknowledged that Twilio’s core offering, its Communication Platform as a Service (”CPaaS”) platform is a very low-margin business.

The only potential for Twilio lies in its customer engagement side of the business. This is where Twilio is able to deliver higher margins, and higher value-added services to its customers, thereby improving its customer’s customer lifetime value.

However, Twilio has simply not been willing to provide investors with any granularity into Twilio’s Customer Engagement Platform. Perhaps investors will have some granularity at its upcoming investors’ day in November.

TWLO Stock Valuation – 3x Sales

Here are some back-of-envelope calculations. Let’s assume that Twilio ends 2022 with $3.8 billion in revenues. Now, let’s make a fair assumption that Twilio grows next year by approximately 27% y/y to $4.8 billion.

That would put the stock priced at approximately 3x next year’s revenues.

On the one hand, that seems like a very attractive multiple for a business with a 123% DBNER as of Q2 2022. After all, that speaks to Twilio’s power to retain and cross-sell into its user base.

On the other hand, let’s circle back to the fact that Twilio simply hasn’t figured out a way to report ”clean” post-GAAP profitability.

The Bottom Line

Investors welcomed Twilio’s much-needed changes and restructuring. With the stock down so significantly, there are probably more positives than negatives right now.

The one bearish consideration that continues to weigh on Twilio is that investors simply don’t buy into Twilio’s path to profitability. And depending on interest rate movements that may or may not be a problem.

On the other hand, bulls will be fast to retort that Twilio is already down so significantly, that the risk-reward here is obviously going to be more compelling than it was last year.

All in all, I’m tepidly bullish on this name.

Be the first to comment