juliannafunk

“Irrational exuberance has unduly escalated asset values.”

Fed Chairman Alan Greenspan, 1996

“Inflation has risen, largely reflecting transitory factors.”

Fed Statement, June 2021

This is an article I have been thinking about writing for some time.

Background

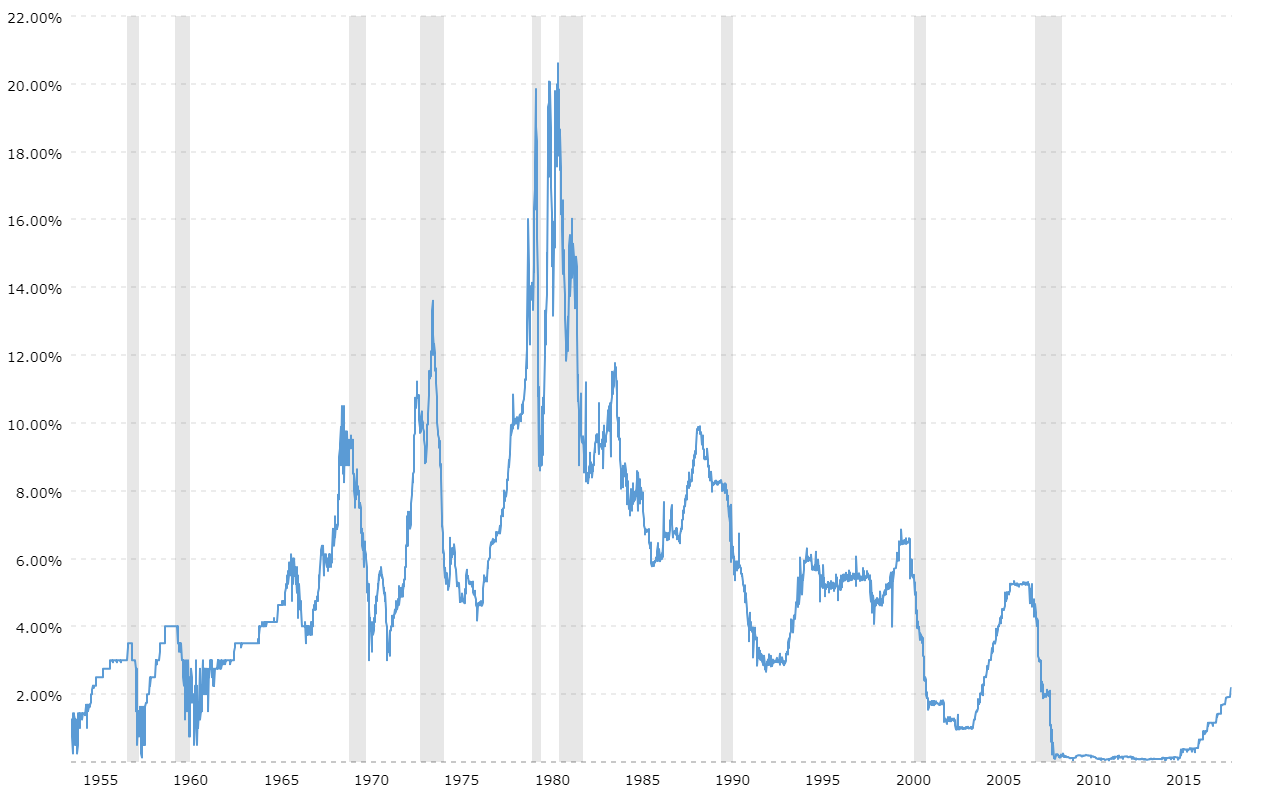

The Fed today is trying desperately to make up for lost time. Inflation is surging and it threatens to get entrenched leading to a longer term economic malaise like we had in the 1970s. It was clear a year ago that inflation was surging, but Chairman Powell dismissed it as transient. Even after the Fed acknowledged inflation was not transitory last fall, it took four months to start the tightening process.

This is just the latest in over 50 years of loose monetary policy by the Fed which has resulted in three massive asset bubbles followed by recessions. I am of course assuming a recession is coming soon this time as indicated by the negative GDP numbers released today. The result has been asset bubble after asset bubble ignored by the Fed. These bubbles included the Nifty 50 bubble of the late 1960s and early 1970s. After that burst, there was an interlude where the Fed did the right (and politically difficult) thing under Paul Volcker and tamed inflation though at the cost of a deep double dip recession. Since the mid-1990s however, it has constantly erred on the side of loose policy despite clearly evident new asset bubbles. In each case, the Fed has allowed itself to be pushed by presidential administrations only concerned about short term growth. This has resulted in short term thinking by the Fed and ignoring asset bubbles.

Those bubbles are summarized below.

1. The Nifty 50 (late 1960s early 1970s)

This was a group of some of the largest cap growth companies of the day. They included companies such as IBM, Coca Cola, Eastman Kodak, Walmart, Sears and Revlon. They often traded for 50 times earnings or more and kept going up. The thought was, these were one decision stocks and an investment in U.S. growth. Valuation no longer mattered.

The Fed Chair at the time was Arthur Burns. He was appointed by President Nixon in 1970 and served until 1978. In his book Six Crises, Nixon blamed his loss to Kennedy in 1960 in part due to tight Fed policy. He pressured Burns to keep things loose leading up to the 1972 election. Burns initially resisted. Negative stories were then planted in the papers and a threat was made to reduce the Fed’s powers. Burns and the Fed gave in. This decision had two major negative ramifications. First it led to a furthering of the Nifty 50 bubble and then a 1973 recession when oil prices rose and the Nifty 50 bubble popped. A tighter monetary policy also could have nipped inflation in the bud. But it was allowed to fester until it was out of control by the late 1970s. It took a massive recession induced by his follower, Paul Volcker to tame it.

2. The Dot.com Bubble (Mid to Late 1990s)

History is full of exciting new industries that fire imaginations of entrepreneurs and investors. These lead to massive investment followed by a large shakeout. Railroads in the 1840s and radios in the 1920s are two examples. Hundreds of new internet companies were formed in the 1990s, with almost all losing a lot of money. Many had no viable business model but still took in millions from investors. Mark Cuban is one of the few who played it right. He started Broadcast.com in 1995 and sold to Yahoo (at the peak of the craze) in 1999 for $5.7 billion. Yahoo later shut it down. Most of these companies were listed on the NASDAQ. Between 1995 and March 2000, the NASDAQ rose 400% before falling 78%. It was one of the largest U.S. stock market drops in history. While driven by internet stocks, other technology stocks in IT, software and communications went along for the ride. The result was a recession from March to November 2001.

Alan Greenspan served as the Fed Chairman for a long time, from 1987-2006. He clearly was aware of the bubble as shown by his quote at the beginning of this article about irrational exuberance in 1996. Yet from 1995 to 1999 he actually lowered the Fed Funds rate slightly. The media at the time was publishing many positive articles about Chairman Greenspan and he clearly relished the spotlight. There was even a term for his easy money policies known as the Greenspan Put. That had helped the markets quickly recover from the 1987 crash but led to two bubbles. Chairman Greenspan did not learn from the subprime bubble and continued his loose money policies which helped create another bubble, subprime in 2007-2009.

Author’s collection

3. Subprime (Mid-2000s)

After the massive stock market rout, investors decided to put their money in something historically much safer than the stock market, housing. This bubble was caused by a lot more than the Fed. I wrote an article about the causes titled The Causes And Lessons From The Financial Crises On The 10th Anniversary Of Lehman’s Bankruptcy. The reasons I listed in order of importance were

- Mortgagees not understanding or caring about their risk

- Ratings agencies rating securities loaded with subprime as investment grade

- Wall Street selling those securities to everyone

- Unscrupulous lenders selling subprime loans to mortgagees

- The Fed keeping rates low

- FLHMC and FNMA buying hundreds of billions of the subprime securities

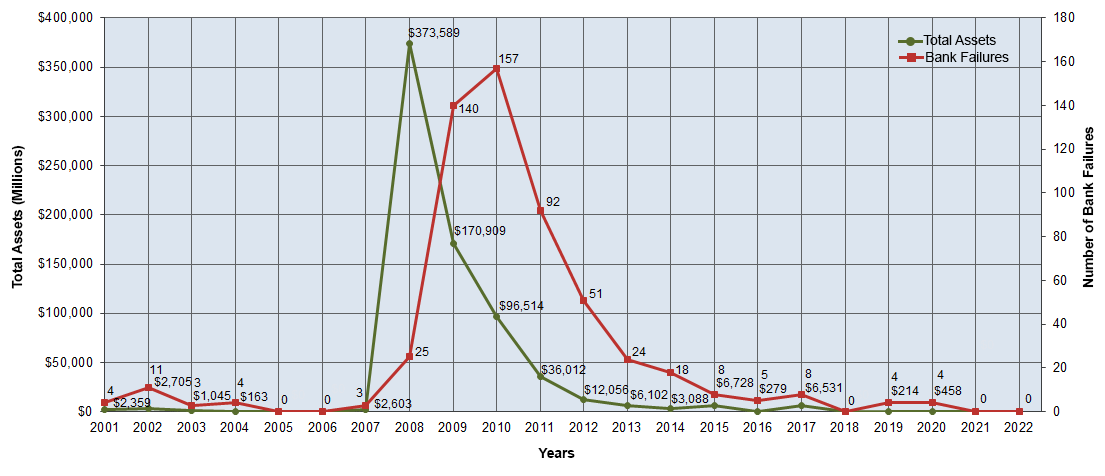

This was just the housing bubble. At the same time there was a lesser known but equally large commercial real estate bubble. Almost all of the largest banks were badly hurt by the subprime bubble. Many of the other 99% of banks also originated subprime mortgages, but almost all sold them immediately. Strangely, they understood the risk while the big banks didn’t. But they didn’t emerge unscathed. Over 400 community and regional banks failed between 2008 and 2011, almost entirely due to bad commercial real estate loans. Those failures were more tied to the Fed keeping rates too high.

Bank Failures By Year

FDIC.gov

Chairman Greenspan didn’t learn from the dot.com bubble fallout. He kept the Fed Funds rate at 1% into 2004, well after the recession. He then slowly raised rates into mid-2006 and then stopped well before a deep recession started. This allowed another full year of subprime mortgages and high risk commercial real estate loans. That vintage was also the worst of the lot. The result was a recession so deep many called it the Great Recession. I personally don’t like that term as the Volcker 1980-1982 recession was actually worse by most measures. It had higher inflation, interest rates, and unemployment.

4. Robinhood Bubbles – (Late 2010s to 2022)

Alright, so there is not an official name for the latest bubbles, so I am using Robinhood who gamified trading for the new Millennial and Gen Z investors who had not lived through the prior bubbles. It was this investor group that drove the latest bubbles. These investors also magnified their risk by using large amounts of options and leverage.

This bubble was in higher risk assets including high growth stocks, SPACs, IPOs, EVs, cryptocurrencies, and meme stocks. Many were strong established companies reflective of the Nifty 50. But valuations got so stretched that some were trading for 10, then 20 then 50 times revenue. Others especially the SPACs and IPOs were brand new money losing stocks often with long odds of success. They are reflective of the dot.com bubble.

I also wrote an article about the latest bubbles titled How The Current Stock Market Manias Took Off: The Perfect Storm in January 2021. In it I listed the causes which are listed below (for more detail see the article)

- The Fed keeping fed funds near zero for a long time

- Robinhood gamifying trading

- The advent of free trading

- Redeployment of profits into even riskier investments after successes

- FOMO

- Animal spirits (did you see wallstreetbets in its heyday?)

- A community attacking short sellers

- Large stimulus checks (free money) that was often used for investments

- People sitting at home during a lockdown with nothing to do

- A jump in earnings estimates as the economy recovered from lockdowns.

These bubbles hit a peak two months after my article and have since mostly deflated. They are not fully deflated.

Janet Yellen was the Fed Chair from 2014 to 2018. She was succeeded by Jerome Powell who was recently given a second term. Powell in particular was publicly pressured by President Trump to loosen Fed policy and he obliged by stopping a brief increase in fed funds rates. When Covid hit in 2020, the Fed unleashed everything they had at it. They quickly took Fed funds to zero and started a massive bond and mortgage securities buying program. The problem was they kept these historically loose policies in place even after it was clear the economy was booming by the Fall of 2021. What made things worse was this was on top of four massive and historically large fiscal stimulus packages. Two of those packages came after the economy was humming. The Fed not only failed to account for economic strength, and inflation, they failed to recognize the incendiary impact of trillions of extra fiscal spending.

History of Fed Funds

Macrotrends.com

Takeaway

There are two conclusions here. The first is the prior three bubbles all led to recessions and the latest one appears on the same path. The second is the Fed’s easy money contributed to each bubble and subsequent recession. The most recent bubble is now mostly deflated and an increasing amount of experts and investors expect a recession. I recently wrote two articles explaining why I expect a recession.

Get Ready A Recession Is Coming

Two Hedges And An Investment For An Increasingly Likely Recession

The Fed has clearly become addicted to easy money policies until it is overly evident the economy is overheating.

Chairman Powell should never have been given a second term. The fact he did with so little opposition shows how addicted Washington (both parties) is to a loose Fed policy. It also shows the lessons of loose Fed policy have not yet been learned. Even Janet Yellen was rewarded with a job as Treasury Secretary.

Your Portfolio

As an investor your takeaway should be we are in for a recession and it is time to allocate your portfolio accordingly. TINA is dead meaning there is a window of opportunity to buy longer term bonds. In the meantime, avoid cyclical stocks especially retailers whose demand was pulled forward by all the fiscal stimulus.

The Fed shows no signs of moving away from its addiction to easy money. It is temporarily forced to fight inflation to maintain credibility. However, once the economy moves into a recession, they are highly likely to push rates down quickly. That is because recessions usually cure or moderate inflation. It’s also because the political pressure will shift from inflation to rejuvenating the economy. The Fed has bowed to political pressure for the last 30 years. Why would they change now?

As an investor, the window of opportunity to lock in higher long term bond rates is now.

Be the first to comment