Editor’s note: Seeking Alpha is proud to welcome Okky Rijanto as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto/iStock Editorial via Getty Images

As rates are going up and QE is being cut, investors are not only looking for deep value companies, but those that also have tremendous growth ahead. Wide-moat Intel (NASDAQ:INTC) is one such company that is currently undervalued with a strong cashflow and high-growth opportunities in the long term. Intel’s 12th Gen CPU is proving to be a formidable force in performance to AMD’s (AMD) Ryzen 6000 series and its Arc GPU will create new revenue streams possibly taking some market shares away from AMD and NVIDIA (NVDA). Although expensive in the short term, the planned capital expenditures to expand manufacturing capabilities in the United States will provide future growth for Intel in the long term as the company is trying to regain process leadership and expand into ARM design and manufacturing.

Intel

Intel’s 5-Year Roadmap: Growth Investor’s Dream

The Ambitious Plan

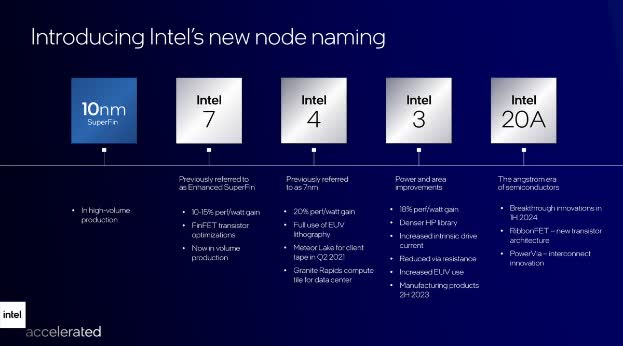

Intel unveiled an ambitious 5-year roadmap last year called “IDM 2.0 Strategy” and acknowledges that they are behind in product and process nodes and is determined to catch up. Intel is renaming its products to be based on the number of transistors instead of actual node size to bring them to equal footing with its competitors for marketing positioning. For example, Intel’s 7 is still based on 10nm node, but the number of transistors is equivalent to TSMC’s 7nm node. Intel 4 will finally be based on 7nm node and will consists of much more transistors than TSMC’s 5nm node (ie. 200-250M vs 170M). Acknowledging that its foundry is less advanced than those of TSMC (TSM), Intel will be contracting TSMC to manufacture some of its new chips and buying up the majority of TSMC’s 3nm capacities. Finally, Intel is also planning to leapfrog the competition with Intel 20A and 18A along with new foundry investments in Ohio totaling $20 billion, which could even go up to $100 billion, with advanced technologies and creating a new segment to manufacture chips for consumers, dubbed Intel Foundry Services, or IFS. It will be signing up Qualcomm (QCOM) and Amazon (AMZN) as clients, and is also in talks with 100 more potential clients.

IFS will also be creating a new revenue source for Intel, in replicating TSMC’s business model. I believe Apple’s (AAPL) foray to develop its own chips for Mac will usher a new era where Big Tech will be designing its own chips for better optimization with its software. This is where IFS will come into play and can become the contract manufacturer for Big Tech and will spell trouble for fabless competitors such as AMD and NVIDIA.

This roadmap will be one of the catalysts for Intel’s growth in the long term for investors who are patient.

Chip Shortage & Geopolitical Climate

The chip shortage is a gift to Intel as it is still selling as much as it can produce and giving more time for Intel to catch up. TSMC is having trouble keeping up with demand and consequently AMD is having supply issues for its current products and will be having issues to secure enough capacity for its new products and will also be delaying R&D and testing for its next-gen products. The current geopolitical climate is also beneficial to Intel as the need for a Western-based foundry is critical for US national security and semiconductor technological advancement. Intel’s plan to build advanced foundries suits the current climate well to ensure continuous supply of advanced chips necessary to meet growing demands.

To alleviate chip shortage issues, the Biden administration announced a $52 billion plan to boost the US chip industry. Intel will be the major beneficiary of this grant since it is the only semiconductor manufacturer in the Western hemisphere.

Looking Forward

More and more general consumer products are being digitized and embedded with chipsets and 5G connectivity. This includes IoT products for machine vision, sensors and artificial intelligence. Vehicles with the advent of digital dashboard, advanced driving assistance and autonomous capabilities require many chipsets.

On this note, Intel’s Mobileye has tremendous success, and its revenue is growing at a CAGR of 46.5% and will generate further synergies between Intel’s chipset products and Mobileye’s autonomous software technologies. Mobileye was chosen by Toyota in May 2021 for its advanced driver assistance system technology, and is also developing a Level 4 autonomous driving system with EyeQ5 Chips. Further, Mobileye is testing Level 4 Robo-taxi fleet in Germany, as regulators there allowed for Level 4 autonomous driving on public roads.

As Intel is looking to spin off its Mobileye division into its own public company, it can unlock the value of Mobileye shares in Intel’s books as the largest shareholder.

Cashflow Giant: Value Investor’s Dream

S&P Capital IQ

S&P Capital IQ

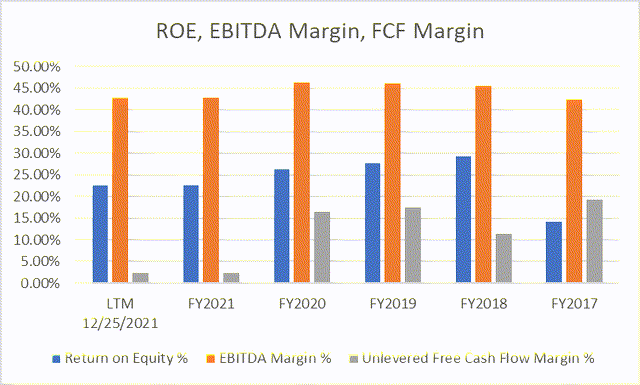

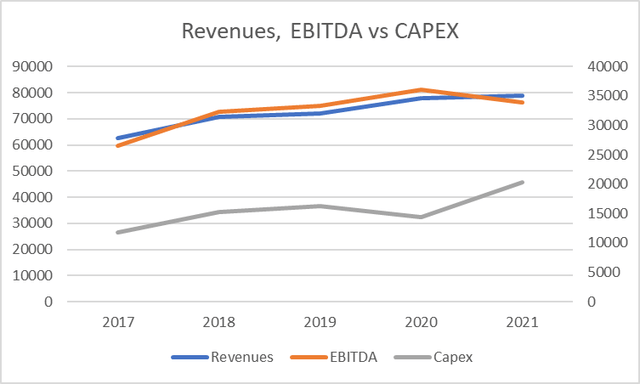

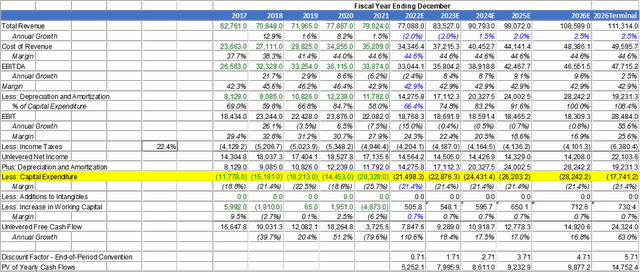

Intel was the product leader since the dawn of the semiconductor industry until 2017 when AMD challenged Intel with its superior product. However, despite losing product leadership, Intel is still growing its revenue at a 5-year CAGR of 6.51% and EBITDA at a 5-year CAGR of 8.99% and is still maintaining dominant market share as of 2022. For these reasons, Intel is still the category leader and has a wide moat in the industry.

While Intel is forced to lower the pricing of some of its products to protect market share, the company still maintains a LTM EBITDA margin 42.90%, compared to AMD at 21.75% and NVIDIA at 38.76%. Cash from operations have also been growing at a 5-year CAGR of 11.17%, generating over $30 billion in LTM 2021.

Intel has been ramping up capital expenditure which is growing at a 5-year CAGR of 17.48%. These trends indicate that the company is still growing financially and is increasing capital expenditures to regain the product leadership. The cost to this expansion however is a significantly lower unlevered free cash flow margin after deducing capex of $20 billion and a decrease in net working capital of $5 billion.

Investment Thesis: Value Inside, Growth Ahead

S&P Capital IQ

S&P Capital IQ

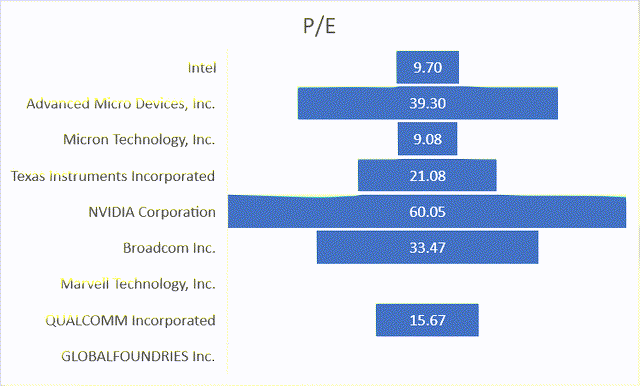

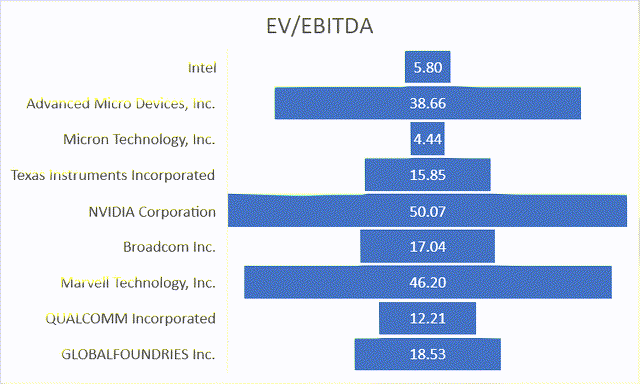

I believe that Intel is undervalued at the current P/E multiple of 9.70 and EV/EBITDA multiple of 5.80 compared to its peers, while also having tremendous growth opportunities ahead. In comparison, AMD’s P/E is at 39.30 while NVIDIA’s is at 60.05, which are looking rather expensive.

The product roadmap to Intel 20A and beyond should provide the growth drivers to Intel’s revenues and EBITDA over the next 5 years. Intel should carry a much higher multiples due to growth in ARM chips, Data Center, 5G, GPU, AI and IFS, while at the same time growing its EBITDA and free cash flow.

I believe the 3 giants – Intel, AMD, and NVIDIA – could be growing together as the semiconductor industry will still be growing due to demands from Data Centers, AI, Internet of things, Personal computing, etc.

Valuation

The world needs more and more chipsets for many more device categories beyond the traditional PC markets which Intel will be ready to supply, with its competitive advantage as the world’s only designer and manufacturer of chips. With cash from operating at $33.8 billion in LTM 2021, Intel has the capacity to outspend its rivals on innovation with over $20 billion of capex, compared to only $278 million capex spending for AMD and $620 million for NVIDIA.

Intel Fundamental Analysis, Cashflow Projection, DCF

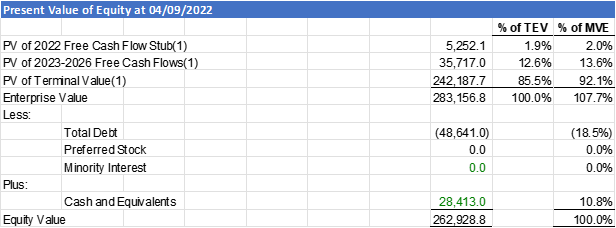

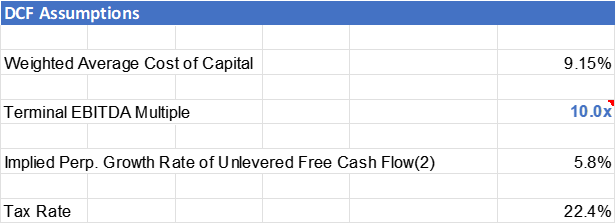

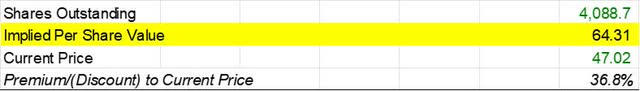

I calculate Intel’s beta of 0.90 using the Regression Beta of 0.59 for a 65% weighting and then Bottom-Up Beta of 1.48 for 35% of the weight. I believe that in the future as Intel is growing, its beta will gravitate towards its comps average beta and I incorporate 35% of the weight to reflect this. WACC is then calculated at 9.15%.

I use a constant assumption that Intel will be spending $20 billion extra for the next 5 years earmarked for the new foundries. I assume very conservatively that the expected revenue growth rate will be -2.0% in 2022, -2.0% in 2023 due to supply chain issues and lowering PC demand. With the expectation of some product launch delays, growth will pick up only slightly in 2024 at 1.5%, then 2.0% in 2025, and 2.5% in 2026. I used conservative growth rates since I expect Intel product launches will be delayed by one year from the roadmap trajectory. I used a terminal growth rate of 3.0% (FCF Perp. Growth Rate) and arrived at implied stock value of $64.31. I expect that by 2026 Intel will have its new fab operational and will be producing advanced Intel 20A chips.

The 5-year forecast free cash flow will carry a 12.6% weight and the terminal value a 85.5% weight with the enterprise value at $283 billion. Deduct debt, and I come up with an equity value of $263 billion. Intel’s current market cap is only $192.25 billion, representing a buying opportunity with a 36.8% upside potential.

S&P Capital IQ

Own Analysis

Own Analysis

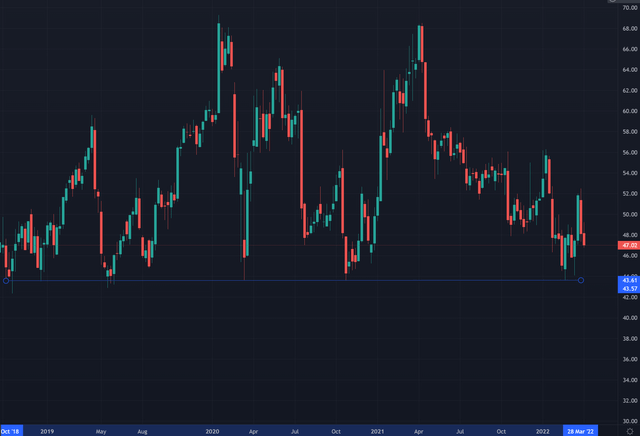

For investors who are looking for deep value companies, I recommend buying Intel at the $43-46 range. For comparison, insiders such as Intel’s CEO Pat and Chairman Ishrak Omar bought at a range of $45-50. I have noticed that the $43-46 range has been the floor for Intel stock prices for the past 4 years and I believe that the market has already priced in the costs for expansion.

TradingView

Key Risks

Having a 5-year roadmap is excellent if it is executed well with no delay. The key risk for Intel is execution. The company cannot afford to have delays in product launch or new foundry completion. Otherwise, Intel will be falling even further behind AMD and NVIDIA. Asian foundries such as TSMC and Samsung (OTC:SSNLF) also have plans to build new foundries in the United States. This means IFS will have direct competition for contract manufacturing business in its home ground. There is also a supply risk with ASML since it is the only supplier of machinery to build the new advanced foundries. Since Intel has 64% of revenues coming from Asian countries, the current geopolitical risk may impact Intel’s foreign revenues.

Final Thoughts

Just as Benjamin Graham said, “Intelligent Investors get interested in big growth stock not when its popular, but when something goes wrong,” Intel has had its mishaps in the past but is now looking to leapfrog the competition not only in process and product leadership but also in adopting ARM architecture and expanding manufacturing capabilities. This new focused direction is a great opportunity for investors to accumulate INTC shares now when the market is still overlooking them.

Be the first to comment