Prostock-Studio

With 15 million tons of iron ore for around 21 years, Champion Iron Limited (OTCQX:CIAFF) should be valued at much more than its current market capitalization. In my view, further exploration of the area and more acquisitions like the Pointe-Noire iron ore pelletizing facility could lead to more production than expected. Under my best DCF model, the share price could be as high as CAD7.9 per share. Yes, I also see risks from labour shortages, lack of financing, or lower ore grade than expected. However, the current price mark does seem too low.

Champion Iron

Champion Iron Limited is the owner of Bloom Lake Mining Complex in Québec. Counting the Bloom Lake Phase I and Phase II plants, Champion Iron could be producing 15 tons per year of high-grade 66.2% Fe iron ore concentrate.

With customers all over the world, Champion Iron sends concentrate to China, Japan, the Middle East, Europe, South Korea, India, and Canada. In my view, if expected production is achieved, the company will likely have a diversified list of customers to sell products.

Management also disclosed a list of exploration projects like the Kamistiatusset Project and the Consolidated Fire Lake North bot in Canada. However, I believe that the company’s valuation will likely increase soon due to the production obtained from the Bloom Lake Mining Complex. In line with my expectations, I would like to point out the recent words from management about recent record increases in the quarterly production results:

Due to the continuous dedication of our workforce and partners, our Company reached another milestone by completing Bloom Lake’s Phase II expansion project and delivering record quarterly production results, even with scheduled semi-annual maintenance. With the progress achieved since commissioning the Phase II expansion, we remain confident in meeting our target to reach commercial production by the end of the calendar year, which should positively impact operational costs per tonne as we ramp up the project. Source: Record Production

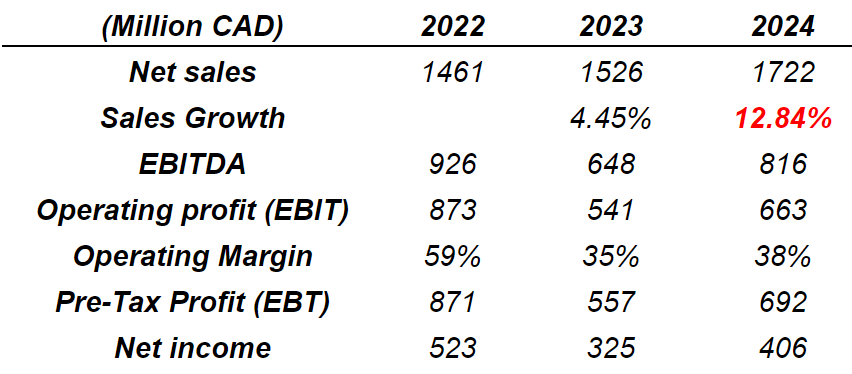

Investors out there believe that management could enjoy more than 12% sales growth in 2024, operating margin around 38%, and positive net income. I decided to have a look at the company’s project right after I saw the expectations of other analysts. So, I believe that other investors may be happy having a look at these numbers before they see mines.

Expectations Of Other Analysts

Assessment Of The Mining Plan And Valuation: Normal Conditions Lead To A Fair Price Of CAD5.09

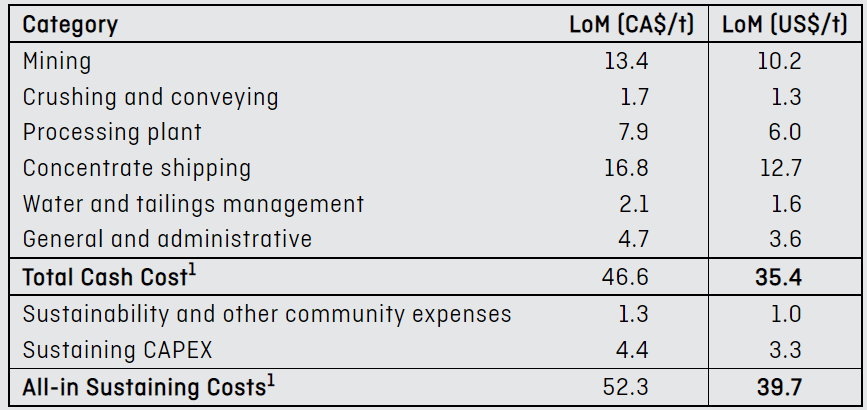

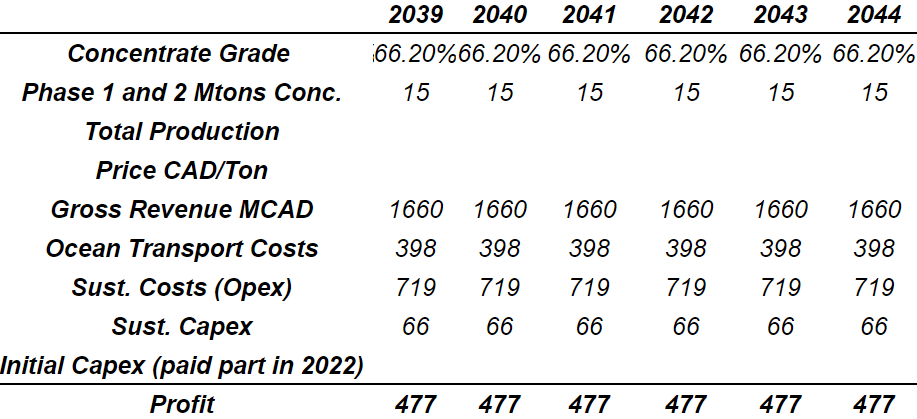

Normal conditions include cash cost close to CAD46.6 per ton, sustaining capex, and other expenses close to CAD5.7 per ton. I used these figures for my base case scenario. In my view, most market analysts will most likely start their research after understanding the assumptions offered by Champion Iron.

Technical Report

According to Champion Iron, with a long-term price close to CAD110 per ton, the after-tax net present value of the project at 8% stands at CAD2.38 billion. The company believes that production will last for close to 21 months, and average production would stay at close to 15 million tonnes with concentration of 66.2% of iron ore.

Technical Report

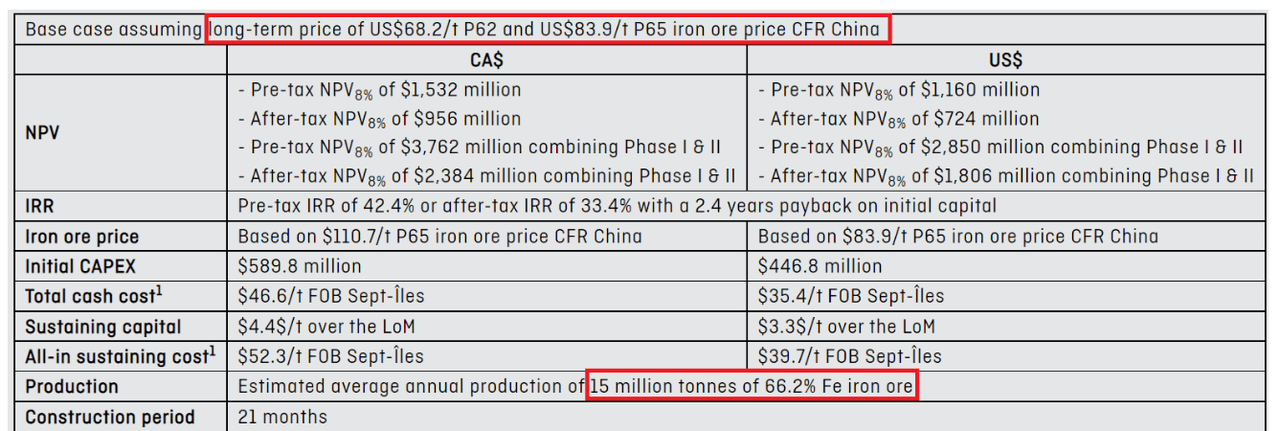

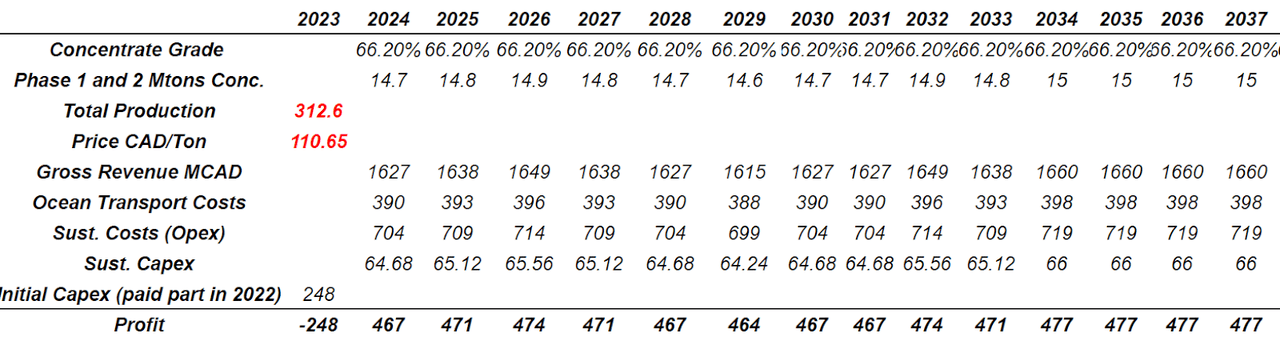

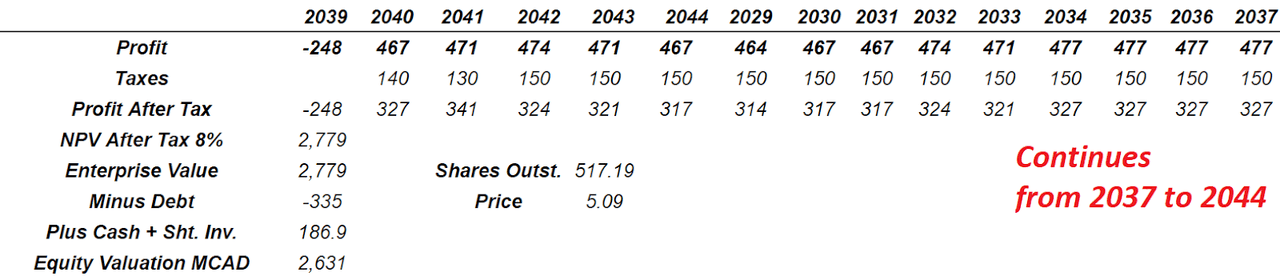

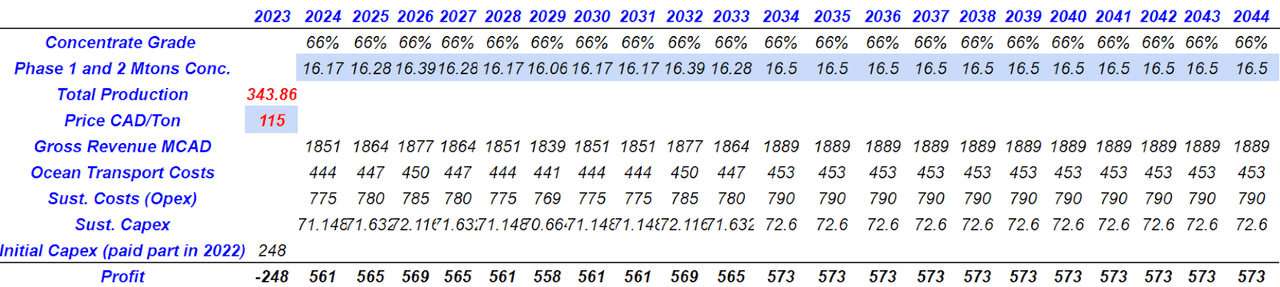

Under my base case scenario, I obtained gross revenue close to CAD1.6 billion from 2024 to 2044, transportation costs close to CAD393 million, and opex close to CAD704 million. The company already paid a significant part of the initial capital expenditures, so I assumed that management will have to pay CAD248 million more. From 2024 to 2044, sustaining capital expenditures would stand at close to CAD64 million. The results would include profit growth, from 2024 to 2044, of close to CAD467 million.

Author’s Work Author’s Work

Champion Iron reported that taxes could range from 11.5% to 28%, and depend on the profit margin. I tried to be as conservative as possible. I assumed close to CAD140-CAD150 million in taxes per year.

The federal and provincial corporate tax rates currently applicable over the Project’s operating life are 15.0% and 11.5% of taxable income, respectively. The marginal tax rates applicable under the recently adopted mining tax regulations in Québec (originally proposed as Bill 55, December 2013) are 16%, 22% and 28% of taxable income and depend on the profit margin. Source: Technical Report

By assuming a discount of 8%, I obtained a net present value of future profit after tax close to CAD2.77 million. Subtracting the debt of CAD335 million, and adding CAD186 million, I obtained an equity valuation of CAD2.63 billion. Finally, the implied fair price would be close to CAD5.09 per share.

Author’s Work

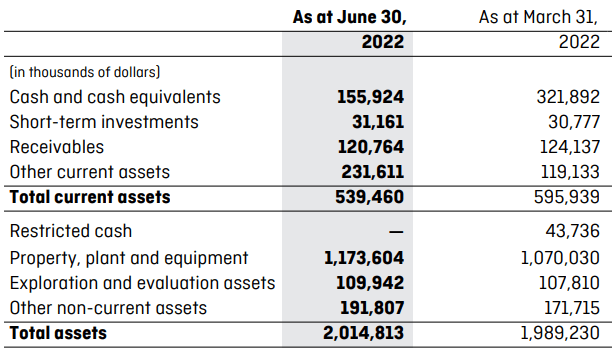

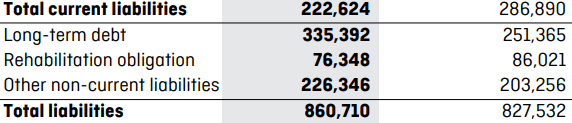

Balance Sheet

As of June 30, 2022, the company reported CAD186 million in cash and short-term investments. I believe that the company has cash in hand to pay capital expenditures for several years. As compared to March 31, 2022, the amount of exploration assets and property, plant and equipment increased quite a bit. It means that Champion’s exploratory plans are working pretty well, as they are leading to more mineral reserves. More mineral reserves usually mean more future production and revenue growth.

Quarterly Report

The long-term debt stands at CAD335 million, which doesn’t seem very worrying. Keep in mind that I am expecting to have a profit after tax of more than CAD221 million per year from 2026.

Quarterly Report

With A Decline In Concentration Grade, I Obtained A Valuation Of CAD2.21 Per Share

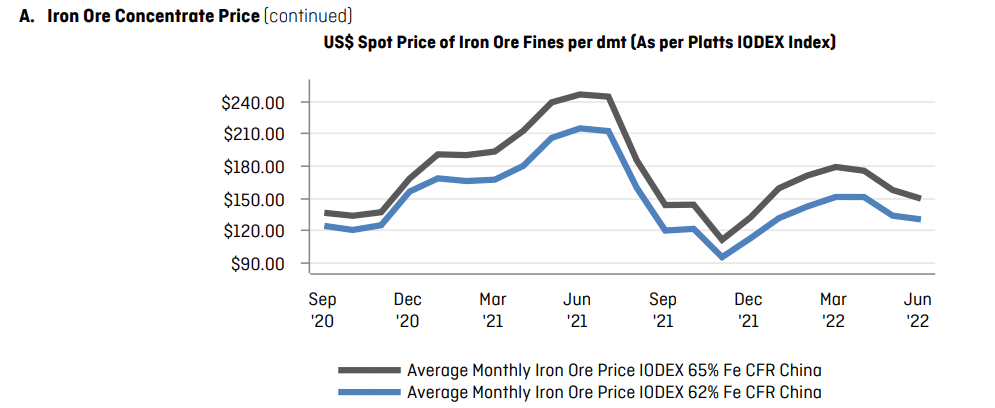

In this case, I assumed a decline in the price of iron ore. Let’s notice that the price was quite volatile in the past, so using a lower price than what Champion Iron expects makes a lot of sense. In the past, iron ore went from more than USD210 to even close to USD91.

2023 Q1 Management Report

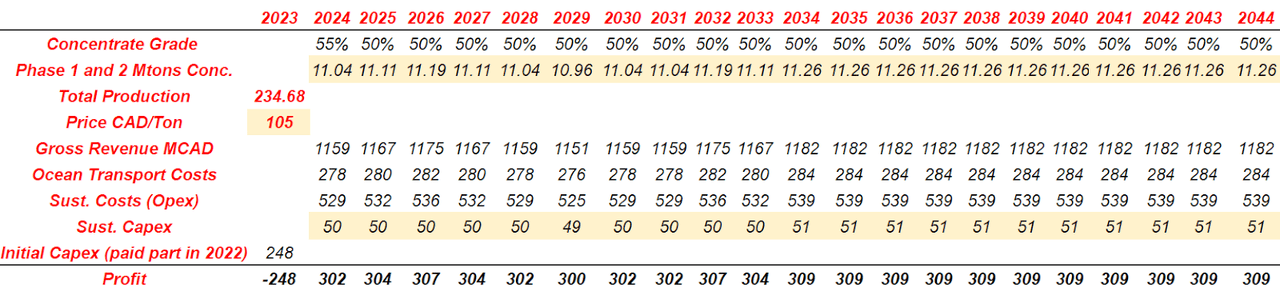

I also assumed that the concentration grade would be lower than expected. I used a concentration grade of 50%, a price of CAD105 per ton, and sustained capex close to CAD50 million per year or CAD4.5 per ton. The profit before tax would stand at close to CAD302 million per year.

Author’s Work

Assuming taxes standing at close to CAD85 million, debt of CAD335 million, and cash and short-term equivalents of CAD186 million, equity would stand at CAD1.35 billion. Finally, the implied price would stand at close to CAD2.6.

Author’s Work

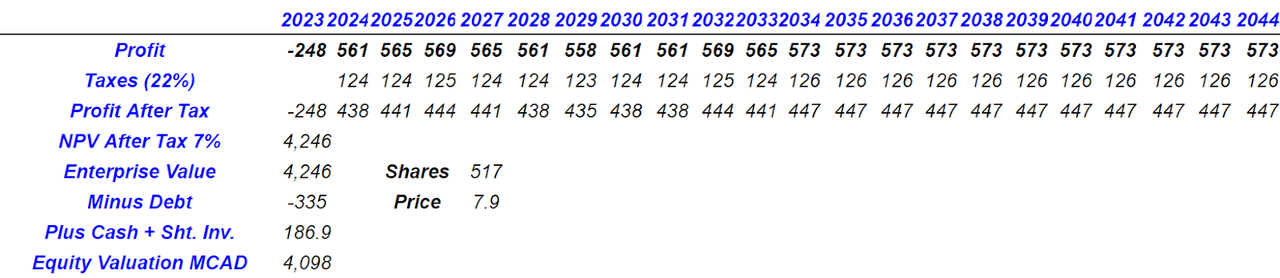

The Best-Case Scenario With Sufficient Exploration And New Feasibility Studies Would Imply A Valuation Of CAD7.9 Per Share

Under my best-case scenario, I assumed that exploration activities would lead to more resources, therefore more production. I also believe that the new feasibility studies and better machinery could, in the next twenty years, lead to higher revenue growth. The company expects to deliver new feasibility studies in 2023:

Nearing the completion of the feasibility study evaluating the reprocessing and infrastructure required to commercially produce a 69% Fe Direct Reduction (“DR”) pellet feed product, which is scaled to convert approximately half of Bloom Lake’s increased nameplate capacity of 15 Mtpa.

Advancing the Kami Project’s feasibility study, expected to be completed in the first half of calendar 2023, whereby the project is being evaluated for its capability to produce DR grade pellet feed product. Source: 2023 Q1 Management Report

I also believe that new acquisitions of new facilities will most likely lead to revenue growth. The recent acquisition of Pointe-Noire iron ore pelletizing facility is an example of the expertise of Champion Iron in the M&A markets:

On May 17, 2022, the Company entered into a definitive purchase agreement to acquire, via a wholly-owned subsidiary, the Pointe-Noire iron ore pelletizing facility located in Sept-Îles, adjacent to the port facilities. The Company also entered into a Memorandum of Understanding with a major international steelmaker to complete a feasibility study to evaluate the re-commissioning of the Pellet Plant and produce DR grade pellets. The feasibility study will evaluate the investments required to recommission the Pellet Plant while integrating up-to-date pelletizing and processing technologies. Source: 2023 Q1 Management Report

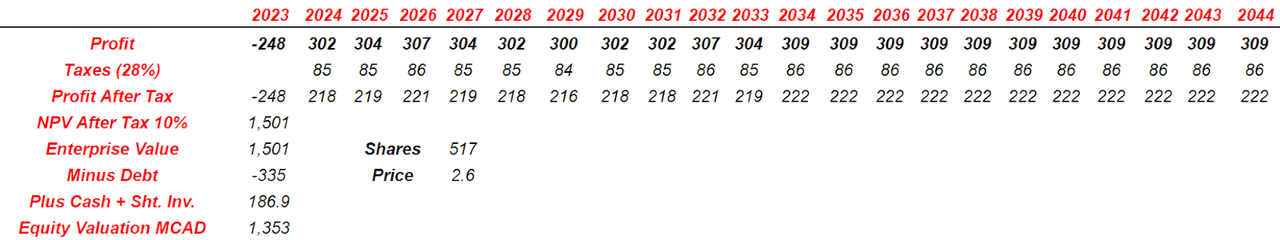

Under this case scenario, I used between 16.15 million tons to 16.5 million tons per year. Also, with a price of CAD115 per ton and capex close to CAD71.5 million, the profit before tax would be close to CAD550 million.

Author’s Work

Finally, with taxes close to CAD125 million per year and CAD335 million in debt, the implied fair price stands at CAD7.9 per share.

Author’s Work

Risks From Lower Production, Labour Shortages, Or Lower Ore Grade Than Expected

In my view, it is quite likely that costs and expected revenue have been miscalculated because of several reasons. Ore grade may be lower than expected, and actual reserves may be lower than expected, so production would be lower. Besides, labour shortages or strikes could lead to lower production, or salaries could increase. In sum, as a result, the net present value could imply a valuation lower than what I calculated. Management discussed these risks in the last annual report.

Actual iron ore production and cash operating costs may differ significantly from those the Company has anticipated for a number of reasons, including variations in the volume of ore mined and ore grade, which could occur because of changing mining rates, ore dilution, varying metallurgical and other ore characteristics and short-term mining conditions that require different sequential development of ore bodies or mining in different areas of the mine. Mining rates are impacted by various risks and hazards inherent at the operation, including natural phenomena, such as inclement weather conditions, and unexpected labour shortages or strikes or availability of mining fleet. Source: Annual Report

I also believe that lack of financing could be very detrimental for Champion Iron. The company has already paid a significant part of the initial capital expenditures for the Bloom Lake Mining Complex. However, it may happen that management does not have cash to finance future capital expenditures or opex. In the worst-case scenario, lack of financing would lead to a decline in production, and revenue growth could decline.

Conclusion

I don’t think the market is correctly assessing the valuation of Champion Iron’s flagship project. In my view, the Bloom Lake Mining Complex, valued with production over 21 months and 15 million tonnes with concentration of 66.2% of iron ore, implies a valuation of CAD5.09. However, in my view, further exploration and development could bring the stock price to up to CAD7.9 per share. With this information in mind, the new feasibility study and new acquisitions like the Pointe-Noire iron ore pelletizing facility could lead to stock price appreciation in the near future.

Be the first to comment