Hispanolistic

Cosmetics and other beauty products are incredibly important in modern society. This is especially true for women. These products impact how individuals look and, in turn, can have an impact on how they feel and are perceived by others. Not only that, they also have a meaningful impact on the health of our skin, hair, etc… One company dedicated to meeting the needs in this space is e.l.f. Beauty (NYSE:ELF). Lately, fundamental performance for the business has been incredibly strong. That has been instrumental in pushing shares higher but it does not mean that shares now make sense to buy into at this moment. Given how things are looking from a share price perspective, the company does now look incredibly lofty. And absent some ramping up in profitability, any movement higher could result in shares being overpriced. For these reasons, I have decided to retain my ‘hold’ rating on the company, but I am on the edge of downgrading it to a ‘sell’.

A beauty play that’s growing nicely

The last time I wrote an article about e.l.f. Beauty was on June 1st of this year. In that article, I acknowledged that the company’s fundamental condition was improving. I said that shares didn’t look bad from a pricing perspective on a forward basis, but I ultimately concluded that the firm looks to be more or less fairly valued when taking into consideration its historical financial performance and pricing. As a result, I rated the company a ‘hold’, reflecting my belief that it would likely achieve share price upside or downside that more or less matches the market for the foreseeable future. However, things have not gone exactly as I expected. While the S&P 500 is up by 4.5%, shares of e.l.f. Beauty have jumped by 38.7%.

Although some of this movement higher is likely attributable to the broader market climbing, it’s certain that the biggest contributor was the fundamental performance the company reported for its latest fiscal quarter. You see, when I last wrote about the company, we had data covering through the end of its 2022 fiscal year. But since then, we have seen data released for the first quarter of its 2023 fiscal year. So far, the picture looks rather nice.

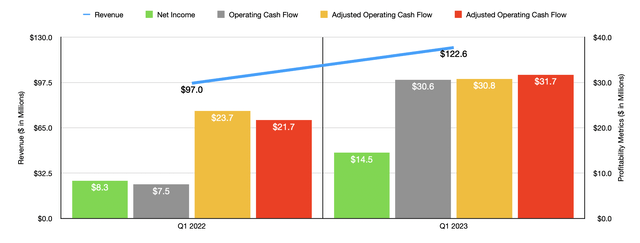

According to management, revenue for the company came in at $122.6 million for the first quarter of 2023. That represents an increase of 26.4% over the $97 million generated the same quarter one year earlier. Management attributed this upside mostly to strength in its national and international retailers. Under the retail channel category, sales grew by 26%, or $22.6 million in all. For the e-commerce portion of the business, growth was $3 million, equating to roughly 28% year over year. The company benefited to the tune of $10.9 million from an increase in sales associated with higher volume. Higher pricing, meanwhile, added $14.7 million to the company’s top line.

This strength also affected the company’s bottom line. Net income for the quarter came in strong at $14.5 million. That represents an increase of 74.7% over the $8.3 million generated one year earlier. There were two key contributors to this. The largest of these was a reduction in the company’s cost of sales relative to revenue. This number declined from 36% to 32% year over year. According to management, this improvement was driven by two different factors. The first of these, accounting for $16.3 million of improvement, was a rise in volume. This makes sense when you consider that the company is able to effectively generate more volume of products across the same value of assets. Meanwhile, price increases help to add $4.8 million to the company’s bottom line. In addition to this, the company also saw its selling, general, and administrative expenses dropped from 52% of sales to 50% of sales, driven by cost increases associated with compensation, benefits, marketing, and digital spending activities, that were smaller than the revenue increase the company experienced. Other profitability metrics followed suit. Operating cash flow rose from $7.5 million to $30.6 million. If we adjust for changes in working capital, the increase would have been smaller from $23.7 million to $30.8 million. Meanwhile, EBITDA for the company expanded from $21.7 million to $31.7 million.

For the 2022 fiscal year as a whole, management expects revenue to come in at between $448 million and $456 million. This compared to prior guidance of between $432 million and $440 million. Clearly, that played a role in the company’s share price increase. EBITDA should also be higher, coming in between $83.5 million and $85 million. Previously, management expected this to be between $80.5 million and $82 million. Management is also calling for adjusted net income of between $47 million and $48.5 million. That’s up from the prior expected range of between $43.5 million and $45.5 million. No guidance was given when it came to operating cash flow. But if that increases at the same rate that EBITDA should, we should anticipate a reading of $109.4 million on an adjusted basis.

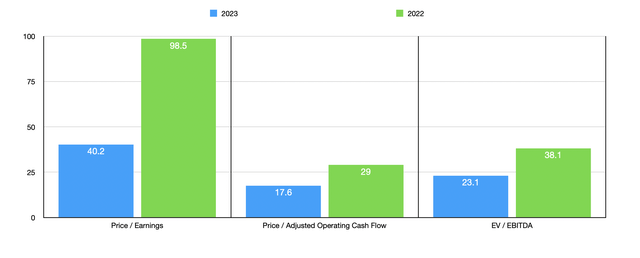

Using this data, we can calculate that the company is trading at a forward price to adjusted operating cash flow multiple of 17.6. Using 2021 figures, it was 29. Meanwhile, the EV to EBITDA multiples should drop from 38.1 using last year’s results to 23.1 using projected results for this year. To put this in perspective, I compared the company with five similar firms. On a forward price-to-operating cash flow basis, these companies ranged between a low of 7.1 and a high of 31. In this case, e.l.f. Beauty is more expensive than all but one of the firms. Using the EV to EBITDA approach, meanwhile, the range is between 7.6 and 20.1. This would make our prospect the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| e.l.f. Beauty | 17.6 | 23.1 |

| USANA Health Sciences (USNA) | 13.7 | 8.1 |

| Olaplex (OLPX) | 31.0 | 20.2 |

| Edgewell Personal Care Company (EPC) | 15.1 | 10.3 |

| Medifast (MED) | 15.7 | 7.9 |

| Herbalife Nutrition (HLF) | 7.1 | 7.6 |

Takeaway

Based on the data provided, e.l.f. Beauty seems to me to be an interesting prospect. But at the same time, the growth the company is achieving still makes it look a bit pricey. Because of how fast the company is expanding and how well it’s adding its growth to its bottom line in the form of profits and cash flows, I would be hesitant to downgrade the company. But given how lofty the shares are, I do think that upside is severely limited. In the event that the stock rises much further, I could become bearish on it entirely. But for now, I think it still warrants a ‘hold’ rating.

Be the first to comment