Berkay Ataseven/iStock via Getty Images

SIGA Technologies (NASDAQ:SIGA) is a commercial-stage pharmaceutical company focused on the health security market that comprises medical countermeasures against chemical, biological, radiological, and nuclear threats, as well as emerging infectious diseases. Prior to 2022, TPOXX had been stockpiled only by the U.S. and Canadian governments and not sold commercially. This year saw approximately $100 million in additional worldwide orders. But it is doubtful that there will be repeat orders of this magnitude, given that global new weekly monkeypox cases falling 28% during Week 36 (September 5-11).

TPOXX (tecovirimat) is an antiviral drug approved by the FDA in oral and intravenous (or IV) formulations to treat smallpox but may be used for monkeypox treatment for all ages under an expanded access Investigational New Drug (EA-IND) protocol held by the Centers for Disease Control and Prevention (or CDC). TPOXX has regulatory approval with the European Medicine Agency (or EMA) for the treatment of smallpox, monkeypox, cowpox, and vaccinia complications following vaccination against smallpox. On July 8, the United Kingdom likewise approved it for a similar label, while Canada’s label only covers smallpox.

SIGA received nearly $60 million in international orders year-to-date from ten jurisdictions, of which all are new and unidentified customers except for Canada:

- The first quarter was highlighted by a country in the Asia Pacific region awarding a $2.8 million contract of oral TPOXX. They added $2 million more in June and the entire amount has been delivered in Q2.

- On June 23, $11 million from two customers (one in Europe and one in the Asia Pacific region) represented SIGA’s first orders that were in direct response to the current global monkeypox outbreak, of which $4 million have been delivered, leaving $7 million for 2023.

- In mid-July, SIGA delivered $16 million of oral TPOXX to the Public Health Agency of Canada (or PHAC). The $19 million of firm commitment orders remaining under this contract include $15 million to be delivered after March 31, 2023.

- The rest of Q2 orders comprised of around $7 million from six customers to be fulfilled between October 1 and July 31, 2023.

On the domestic front, there were three developments in 2022:

- On Aug. 09, the Department of Health and Human Services (or HHS) exercised $26 million worth of options under its 75A50118C00019 (19C) contract, with deliveries targeted for 2023. The $602.5 million 19C contract now has $285 million potential payments left in unexercised options.

- On May 12, the Department of Defense (DoD) awarded a contract for $7.5 million of oral TPOXX, of which $3.6 million worth was delivered in Q2. However, the remaining $3.8 million are exercisable options.

- During Q1, SIGA recognized revenue totaling $7.2 million for product delivery of IV TPOXX, representing the first procurements for IV TPOXX under the 19C contract.

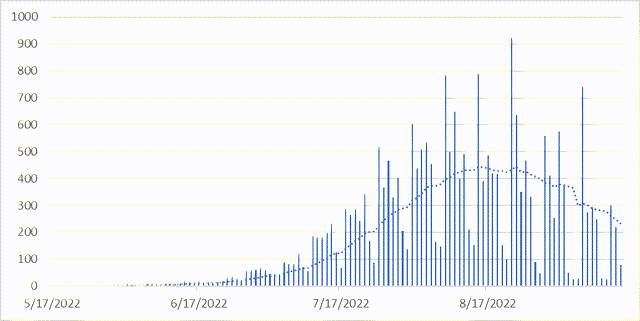

Future revenue growth is dependent on recurring orders, which in turn are necessitated by outbreaks. It is clear by eyeballing Figure 1 that the current outbreak is concentrated in the Americas (North and South) and European Regions. The rest of the world combined have only accounted for less than 1.5% of global cases.

Figure 1. Source: World Health Organization

Weekly new monkeypox cases

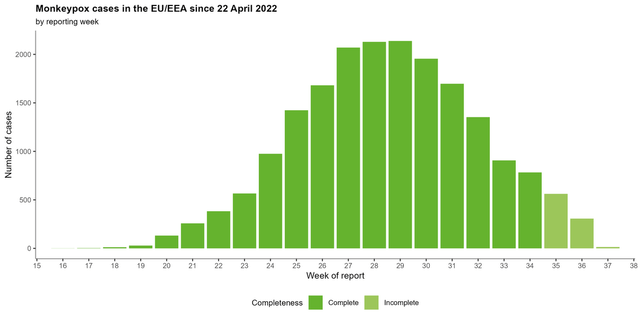

In the US, which is the leading country with 22,630 confirmed cases as of September 13, cases usually spike not on a weekend, but in the days following when people come in for testing, as seen in Figure 2. Note that the 14-day moving average following Labor Day is down to about half the peak of mid-August.

Figure 2. Source: CDC

Daily US monkeypox cases as of September 14, 14-day moving average

Centers for Disease Control and Prevention

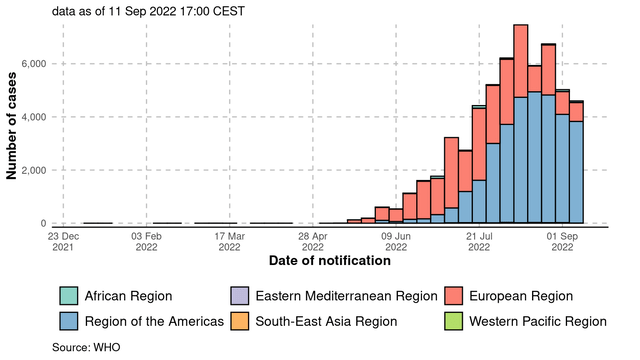

The European Union (or EU) includes the #2 country Spain, as well as 5 others in the top 10. Similar to the US, Figure 3 shows that cases in Weeks 35 and 36 (August 29 to September 11) have plummeted to less than a quarter of the July heights (Weeks 27-30).

Figure 3. Source: European Centre for Disease Prevention and Control as of September 13

European Centre for Disease Prevention and Control

Outlook

As of Sept. 2, the U.S. Strategic National Stockpile (or SNS) has shipped more than 37,000 courses of TPOXX nationwide, which is more than the number of total cases, as well as more than 800,000 vials of JYNNEOS vaccine. If efficacious, wide usage of the vaccine will obviously lessen the need for treatment. As far as the CDC’s other listed alternatives, Tembexa, the second antiviral medication approved to treat smallpox, will likely not be a competitor. According to Bloomberg, the CDC’s Media Relations Acting Deputy Branch Chief Kristen Nordlund emailed them that Tembexa could be prescribed for severe cases that don’t respond to TPOXX. Vistide is even considered worse, safety-wise. Clinical trials for TPOXX as a monkeypox treatment have begun in the U.S. and Canada, but approval doesn’t affect the bottom line. A trial for TPOXX to be used as Post Exposure Prophylaxis (or PEP) has promise, but is slow going, having been started in 2014.

SIGA revenues were $126.8 million in 2021 and $115.4 million in 2020, but may be lower in 2022 because that $100 million mentioned at beginning might be it this year. Revenues from the various government contracts usually aren’t recognized in an orderly fashion, and have included 19C procurements of $112.5 million for 363,000 TPOXX courses in each of the past two years. Since the government contract prices of the drug products are determined at inception and remain fixed unless amended, the $26 million option exercised in August comes out to almost 84,000 courses. According to Chief Executive Officer Phillip Gomez, oral TPOXX has a seven-year shelf life, and the initial U.S. government stockpile of TPOXX was comprised of drug that was manufactured in 2013, 2014, 2016 and 2017. This suggests that the 19C orders were due to mass drug expirations. Consequently, there should be no expectation of anymore replenishments this year because there is nothing expiring from 2015, and the 84,000 courses more than covers what has been distributed so far.

To conclude, revenues for this year and 2023 are likely to be in the $100-150 million range, for which SIGA was trading in the $7.50-$10 range, before the bear market of 2022. Unless monkeypox trends reverse and/or a quick indication for PEP is achieved by early 2023, current price levels in the $13s are hard to justify.

Be the first to comment