AlbertPego

Shares of AvalonBay (NYSE:AVB) have been hit hard thus far in 2022 as rising interest rates have cast a storm cloud over the REIT sector. Despite a solid operating performance year to date and a favorable set-up heading into 2023, AVB shares have fallen 30% year-to-date, leaving Avalon trading at bargain-basement levels and representing an attractive entry point for long-term, conservative investors.

Operating Trends

Avalon has more than recovered from the pandemic-driven exodus from coastal cities in 2020 which caused a significant decline in NOI and FFO. 2021 and 2022 have been fantastic years for the apartment sector, with rents soaring.

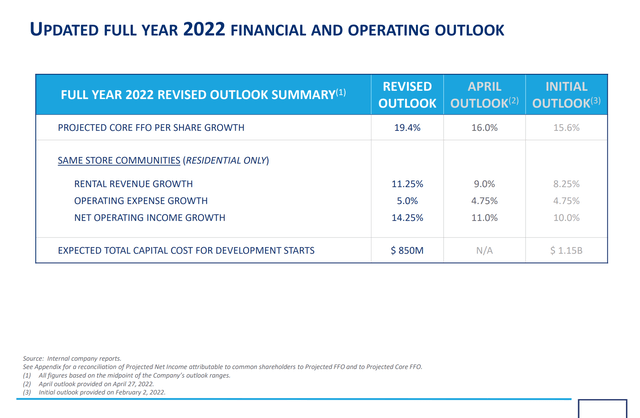

AvalonBay 2022 Outlook (Investor Presentation)

While sequential rental growth has stalled in September, AVB is set up to post record results in 2023 as 2022 rental increases have a full P&L impact in 2023. Avalon’s ended the second quarter with a 15% loss-to-lease – this means that as of the end of the second quarter, on average, the rent being charged to AvalonBay’s tenants was 15% below market rents. This loss to lease will allow Avalon to increase rents for the remainder of 2022 and into 2023 even as the economy weakens.

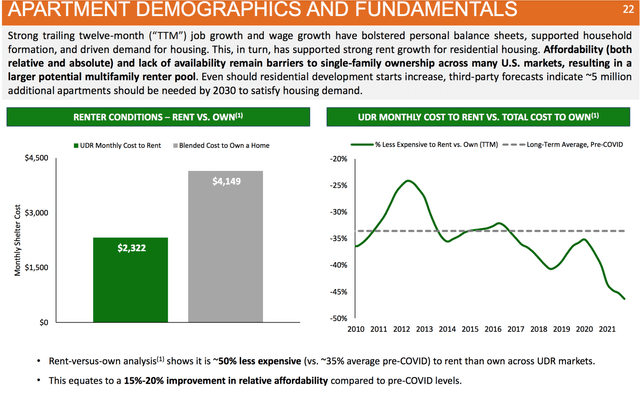

While rent growth has slowed of late, the apartment sector should experience a benefit as higher mortgage rates reduce the ability of renters to become homeowners as ownership costs have increased dramatically relative to renting as shown below.

Cost of Renting vs. Owning (UDR Investor Presentation)

Capital Market Conditions

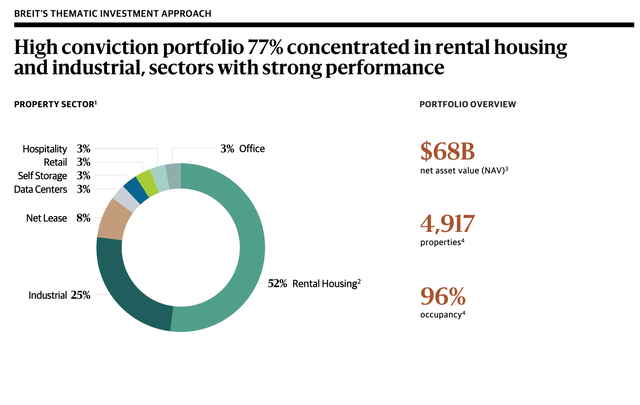

Until 2Q22, cap rates had steadily compressed as private market interest led to a bidding war for apartment buildings. Large private equity players like Blackstone (BX) have been gobbling up apartment buildings. Blackstone’s non-traded REIT BREIT has amassed a portfolio of ~$50 billion in apartment assets since its formation in 2016. Importantly, Blackstone and many other real estate firms have largely limited themselves to residential and industrial real estate, given the storm clouds facing other sectors like office and retail.

BREIT Sector Allocation (BREIT Investor Presentation)

Note: BREIT has amassed over $100 billion in real estate assets. The $68 billion in NAV deducts the debt owed.

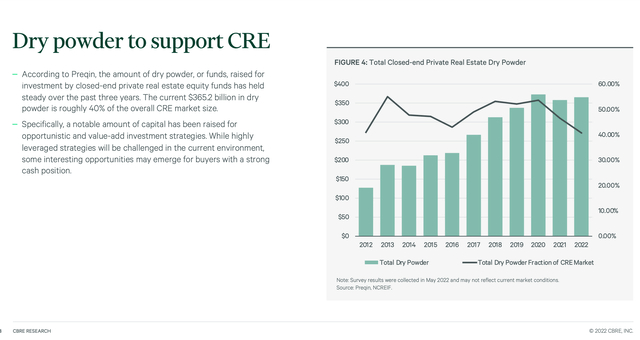

The rise in interest rates has led to a pause in private market purchases of apartment assets. While we are unlikely to see apartment assets transact at ultra-low sub 4 cap rates we saw in 2H21-1Q22, the structural increase in private equity capital being allocated to real estate is shown below:

Private Equity Dry Powder (CBRE 1H22 Cap Rate Survey)

Note the significant increase in private capital allocated for real estate investment over the past 10 years. Eventually, this capital will have to be invested to allow the private equity sponsors to earn fees. Given the turmoil in office and retail, many private equity firms are increasingly focused on apartment assets.

Valuation

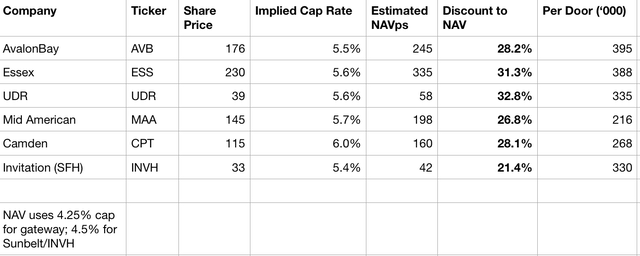

Over the past 5 years, apartment REITs have traded at implied cap rates of 4-6%. Today, AvalonBay and other apartment REITs are trading at the highest implied cap rate (cheapest prices) we’ve seen for years:

Implied Cap Rates, Per Door, NAV (Author Estimates)

Ultimately, I assume that valuations will revert back toward the higher end of their historical range. The logic underpinning this assumption is the significant amount of private capital chasing apartment assets. Further, inflation has driven up the replacement cost of apartment assets making the REITs increasingly attractive on a per-door basis (which represents an estimated 20-25% discount to replacement cost).

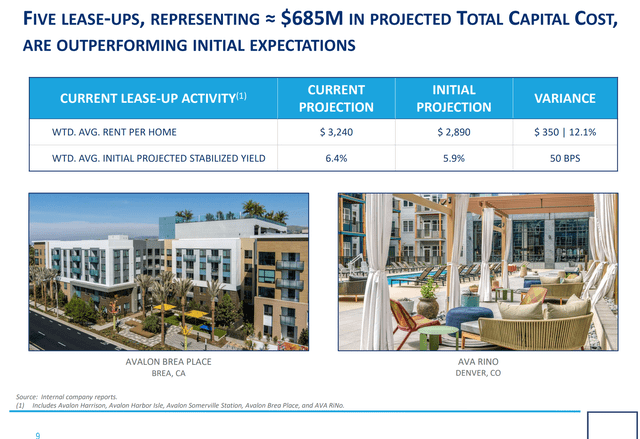

Beyond the factors cited above, Avalon has created tremendous value for shareholders over the past 10 years through successfully developing apartment communities at a yield in excess of its cost of capital. Here is a snapshot of current developments being leased:

Avalon Current Lease Ups (Investor Presentation)

Avalon’s demonstrated development prowess suggests that the shares should ultimately trade at a premium to stated NAV, as the company is likely to continue to build shareholder value through development.

Conclusion

AvalonBay owns a collection of high quality, conservatively financed apartment assets in attractive markets throughout the US. I believe the broad sell-off in REITs has created an attractive entry point for conservative long-term investors.

Risks

The main risk I see is that continued interest rate increases lead to further near-term declines in REIT prices.

Be the first to comment