Olivier Le Moal

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s Not Unprofitable Dummy

Let’s deal for a moment with the world of things. Things cost money to buy. You can buy things with cash. That lands in your bank account as a result of something called cashflow. Which is not at all the same as earnings per share. Because cash flow is a thing whereas earnings per share is a mirage dreamed up to persuade you that “owner earnings” is a thing and that you as a part owner of a company have an actual claim on actual earnings.

Zscaler (NASDAQ:ZS), of course, is “unprofitable tech” with no earnings per share and is therefore cast out of polite society. Nobody is sat at a dinner party right now doling out advice on stocks where that advice includes saying, buy Zscaler. No, better to buy Exxon Mobil (XOM) or Berkshire Hathaway (BRK.A) (BRK.B) or anything except unprofitable tech. Like this turkey:

ZS EPS (Seeking Alpha.com)

Or, you could free your mind and look at actual cash flow and decide that perhaps ZS isn’t such a waste of time after all.

The company just delivered another strong quarter.

ZS Fundamentals (YCharts)

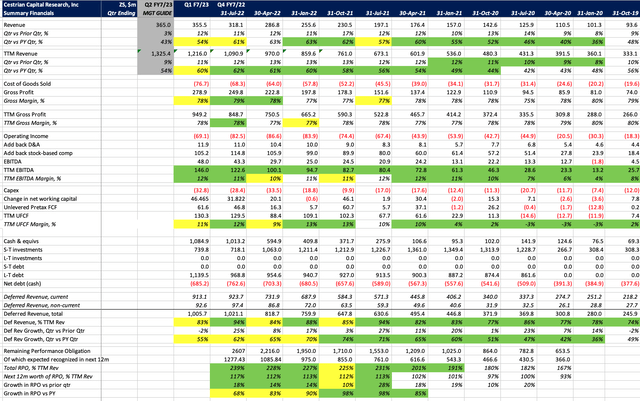

- TTM revenue growth of 54% (vs. their peak of 62%, so, holding up well even as the economy hits headwinds).

- Gross margin no change at 78% on a TTM basis.

- TTM unlevered pretax free cash flow running at 11% margins.

- Nearly $700m free cash in the bank and rising each quarter.

The management team guided to a 43% growth quarter next quarter, which would bring TTM growth down to 54%. Still not too shabby on a revenue base of $1.2bn.

Deferred revenue growing at c.55%; remaining performance obligation at greater than $2.3bn being equivalent to over 2x TTM revenue, indicate the company has plenty of visibility about how revenue will shape up in the next year or so.

All in all, a rock-solid business. Growth holding up, cash generation remaining strong, balance sheet a tower of strength. So what’s not to like?

ZS Fundamentals (Company SEC filings)

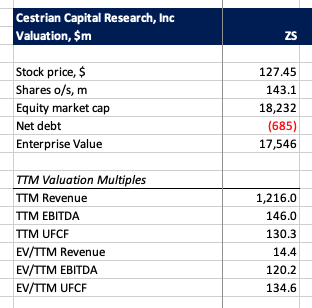

Well, that. 135x cash flow isn’t a great look these days. But that’s because the company is growing so fast so keeps its cash flow margins low to fund it. 14.4x TTM revenue is a more sensible way to look at the stock. Even then, nobody is going to be climbing over hot coals to buy this thing on that table.

Let’s consider the stock chart instead.

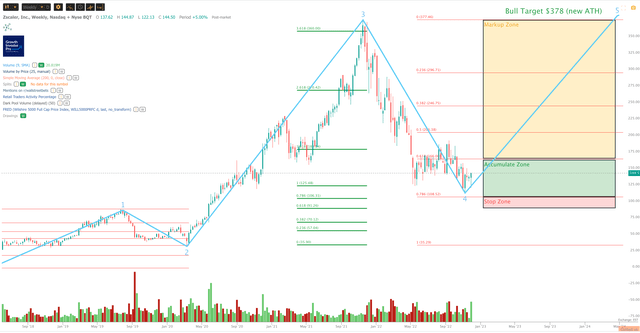

ZS Chart Outlook (TrendSpider, Cestrian Analysis)

ZS charts rather well to standard Wave and Fibonacci patterns. From the prior lows to the 2019 highs, a Wave 1. Troughs at the 61.8% retrace going into COVID. Then a huge >3.618 Wave 3; then a Wave 4 which looks to be bottoming around the 78.6% retracement of the prior Wave 3. If the chart pattern continues, we ought to see a move up toward that Wave 3 high which it may yet be able to challenge and strike out with a new high.

It’s easy to dismiss companies like this, but stocks like this at the 78.6% retrace of a prior huge move up – they can be rewarding. You need bravery, patience, and you need to assume that not all your bets made in this manner are going to pay off.

We own Zscaler in staff personal accounts and rate the name at Accumulate.

Cestrian Capital Research, Inc – 1 Dec 2022

Be the first to comment