tumsasedgars

Introduction

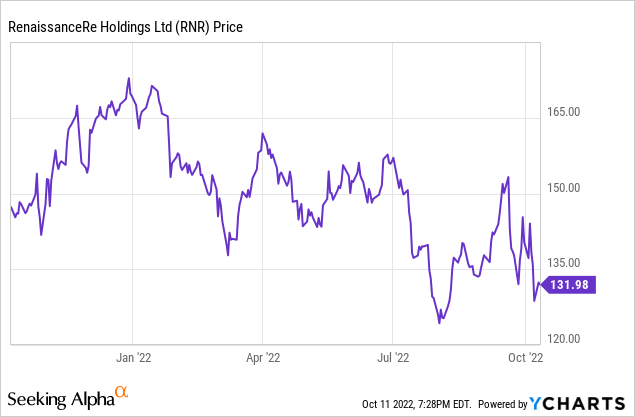

RenaissanceRe’s (NYSE:RNR) share price has been under pressure because the reinsurance company’s book value has been under pressure. Insurance and reinsurance companies take advantage of the insurance premiums they collect by investing those in (supposedly safe) securities and that’s generally how they make their money.

In this article I will mainly focus on how the interest rates are impacting Renaissance’s book value, and why this makes the preferred shares more appealing. For a more detailed overview of the business model, I’d like to refer you to Steve Evans’ article and Jared Wright’s article.

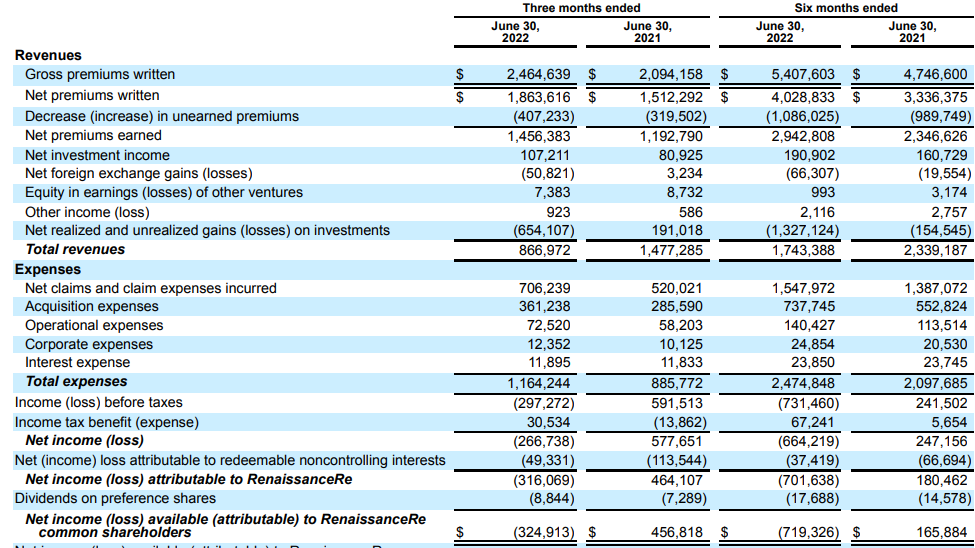

Don’t let the net loss fool you

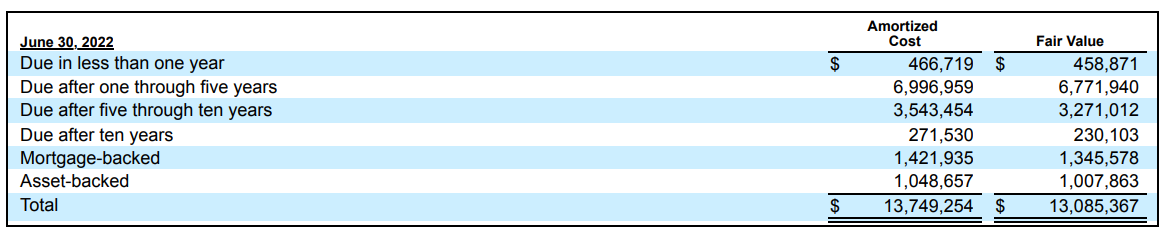

While a net loss never is a good sight, it’s also important to understand what caused a net loss. As you can see below, RNR was mainly hit by a loss on the realized and unrealized positions in its investment portfolio. The losses on investments came in at in excess of $650M in the third quarter and at almost $1.33B in the entire first semester, compared to a much more palatable loss of $155M in H1 2021.

RNR Investor Relations

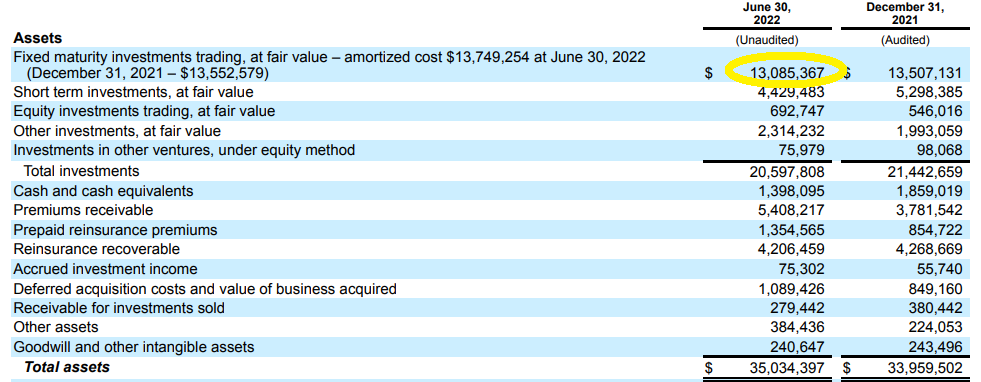

The explanation is rather simple if you look what RenaissanceRe has invested its ‘float’ in. Unlike banks which only have to mark-to-market their securities that are recorded as ‘available for sale’, RenaissanceRe sees a much bigger impact from increasing interest rates. As interest rates increase, the price of bonds goes down and that has an immediate impact on the book value of the bond portfolio. As you can see below, of the $20.6B in total investments, almost $13.1B was invested in ‘fixed maturity investments’.

RNR Investor Relations

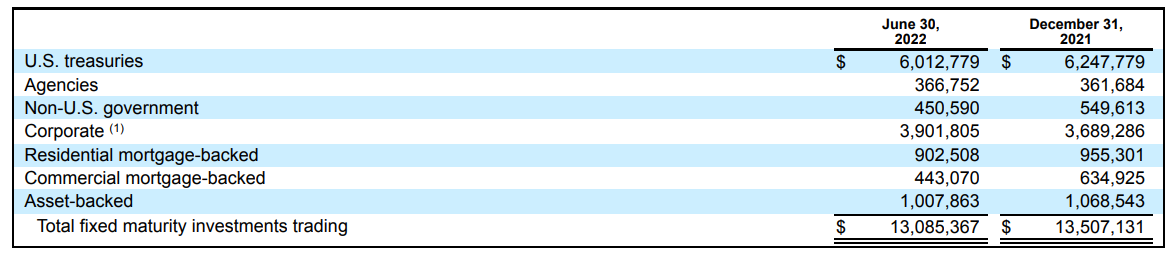

Almost half of those bonds were invested in US treasuries with an additional $3.9B invested in corporate debt securities.

RNR Investor Relations

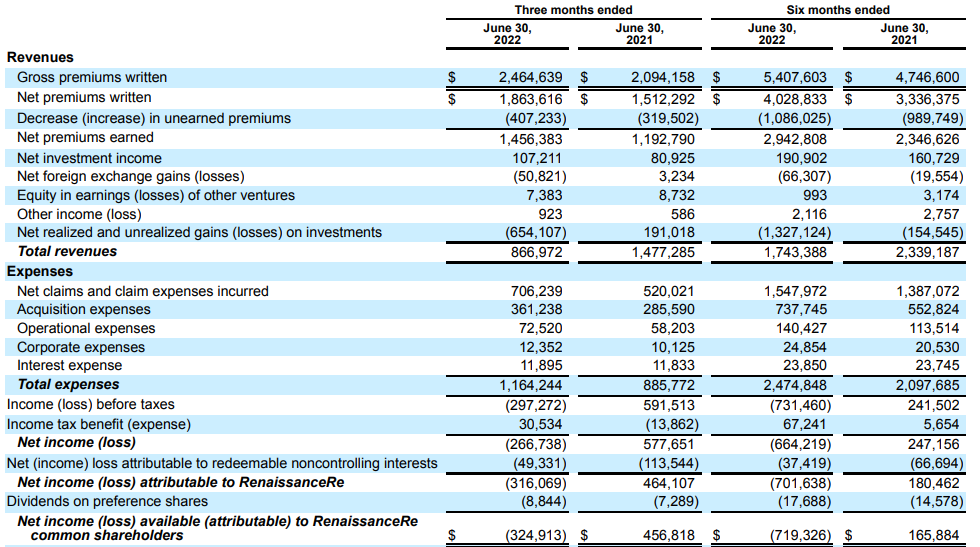

As the average yield to maturity of the US treasuries portfolio increased from 1.1% to 3% and as the average yield on the corporate debt portfolio increased from 2.6% to 5.3%, the prices of these securities went down and this caused in excess of $1B in capital to just evaporate. And as long as interest rates continue to increase, the price of these securities will decrease.

There is a silver lining though. As certain securities come close to their maturity date, the proceeds on the maturity date will likely be reinvested in higher yielding securities. Almost $0.5B of the portfolio matures before June 2022, and about 55% of the portfolio will mature by June 30 2027.

RNR Investor Relations

This means the impact of further interest rate increases will start to decrease as the required YTMs will decrease as securities get closer to their maturity date. On top of that, we should start to see a ‘tipping point’ where the investment income (interest income on securities) will start to increase. We saw the initial signs in Q2 as the investment income increased to in excess of $100M on a quarterly basis and as more low-yield investments reach their maturity date and are invested in higher yielding securities, the net investment income will increase. There will for sure be a few more quarters of tough times for the bond-heavy investment portfolio, but I think an inflection point could be reached in H1 2023.

As of the end of June, the tangible book value (defined as equity minus preferred equity minus goodwill and intangibles) was approximately $108/share, down from around $126-128/share as of the end of 2021 and almost $135 a year ago.

The preferred shares issued by RenaissanceRe

There are currently two series of preferred shares outstanding, and both issues are non-cumulative in nature. The F-shares (NYSE:RNR.PF) have a 5.75% preferred dividend yield and can be called from June 2023 on. The G shares (NYSE:RNR.PG) have a lower dividend yield of 4.20% ($1.05 per share per year paid in four quarterly installments) and can be called from July 2026 on at par but can be called before if a regulatory capital event occurs (at no premium) or if a rating agency event occurs (at a 2% premium). The latter would kick in if the rating agencies lower Renaissance’s credit rating. For the purpose of this article, I will assume the G-shares will not be called.

If we would look at the yield on cost, the F-shares are currently yielding 6.42% based on the current share price of $22.40 while the G-shares are yielding 6.19% based on the current price of $16.94/share. This means that from a yield perspective, buying the F-shares makes the most sense, not only because of the higher current yield but also because those shares can be called sooner while the higher preferred dividend makes a call more likely as RenaissanceRe will always want to retire the more expensive capital versus lower-cost capital.

Despite the net loss, which was entirely caused by the lower value of the securities portfolio, I believe the preferred dividends are very safe. Let’s pull up the income statement again. We see the pre-tax loss attributable to RNR was almost $732M but if we would add back the $1.33B in realized and unrealized losses on the investment portfolio, the normalized pre-tax income would have been approximately $600M. After deducting a (nominal) corporate tax and the net income attributable to non-controlling interests, the net income would likely have been closer to $500M if it wasn’t for the loss on the securities portfolio.

RNR Investor Relations

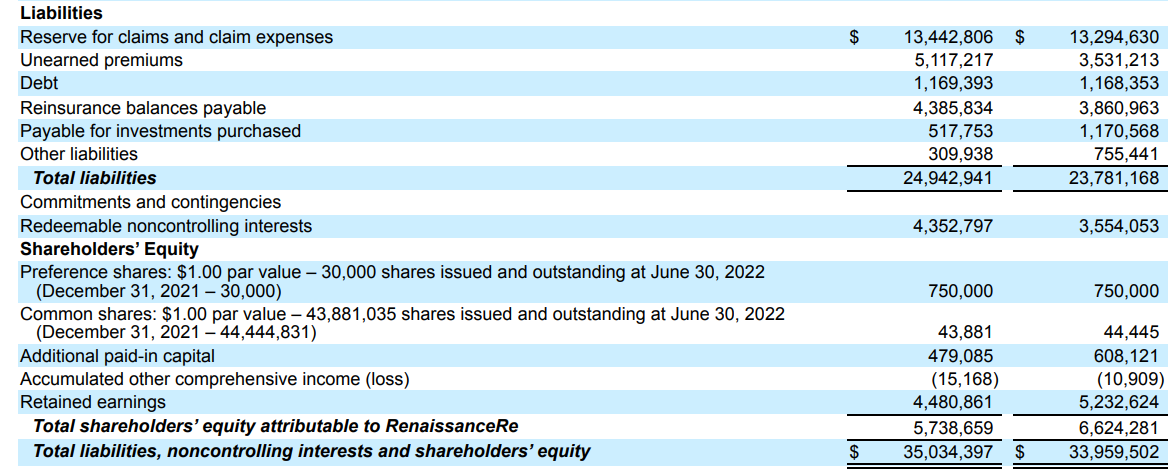

And as you can see, the total cost of the preferred dividends was just under $18M in the first semester. This means that RenaissanceRe had to spend less than 4% of its underlying normalized income on preferred dividends. A very low ratio, and that’s good news for preferred shareholders.

Looking at the balance sheet, we see an equally strong asset coverage ratio. As you can see below, the preferred equity has a value of approximately $750M which means there’s almost $5B in equity ranking junior to the preferred shares. And that already includes the impact of the $1.3B haircut on the fair value of the securities portfolio.

RNR Investor Relations

Investment thesis

I like the yields and the risk/reward ratio offered by the preferred shares of RenaissanceRe, and I have a preference towards the F-shares as they have a higher current yield and will likely be called sooner (if they get called at all). On the other hand, if you strongly believe in decreasing interest rates, the G-shares may offer more upside when it comes to capital gains.

Income-oriented investors could also be interested in the company’s debt. The April 2025 debt securities with a 3.7% coupon offer a 5.16% yield to maturity while the 3.6% April 2029 bond is trading at 88 cents on the dollar for a yield to maturity of 5.83%. As a debt investor obviously ranks senior to a shareholder, the bonds may offer an interesting possibility as well.

I currently have no position in RenaissanceRe but I could be interested in initiating a long position in the preferred shares. The F-shares make the most sense but I am also closely watching the share price evolution of the G-shares.

Be the first to comment